Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us)

![]()

![]()

Economic pillars are international business and tourism. British Bermuda is a North Atlantic business & tourism center. Not in the Caribbean, it is the only part left of British North America after the USA and Canada got their independence. There is a Bermuda Government Department of Tourism web site which includes what offices in Bermuda and overseas it operates at Bermuda taxpayers' expense.

Bermuda has a high-cost economy. The World Bank rates it as # 5 in the world in GNI - Gross National Income.. Most of its money comes from being an International Business center or offshore jurisdiction - some would say tax haven - for corporate entities (not for their employees). It is also a long-established tourism resort. It has no natural resources of its own in its 21 square miles, no oil, no gas, no heavy industry. It is one of the most isolated yet highly populated places anywhere in the world and one of the most regulated, with controls on what non-nationals cannot do that no other jurisdiction in the world imposes. Lack of citizenship to newcomers except after 10 years of continuous and living-together marriage to a Bermudian, lack of citizenship to children of non-nationals, plus their consequences of inability to vote, inability to buy property except in certain circumstances only, are merely some of them. All these mean that for most non-Bermudians including all from Britain who come to Bermuda to work in jobs Bermudians cannot or will not do or want, there can be little chance of staying beyond their Work Permit term, with no security of tenure, no prospects of citizenship, no opportunity to buy a house or condominium at the same price levels as Bermudians. But for their international business employers, it is a different story. Many were either incorporated in Bermuda or have moved their corporate headquarters to Bermuda, for international tax reasons. Why? Because Bermuda levies no taxes on their world business activities. So far, Bermuda offers them far more in assets than in liabilities. They will stay for for as long as they continue to have Bermuda's advantages as an offshore jurisdiction with advantages outweighing disadvantages. It is not true to say Bermuda has no taxes. It has no capital gains tax but the other direct and indirect taxes it levies on managements, their staff, business visitors and tourists are many and they can be so very heavy that overall Bermuda's cost of living is the highest in the world, nearly three times more than in the UK and nearly four times more than in the USA. They include a direct and hefty employment-related income tax payable by employers and employees but disguised as a Payroll tax. Bermuda Government Customs Duties averaging 36% of wholesale costs, translating into 100% or more at retail level, and annual Bermuda Government vehicle license Fees on automobiles averaging $700 per auto. These are merely a few examples of why Bermuda has an appreciably higher cost of living than direct taxed and indirect taxed jurisdictions.

Bermuda has no double taxation treaties. Nationals of countries like the United States of America and the Philippines who live and work in Bermuda are liable to taxes on their Bermuda income over a certain amount.

Bermuda's most important trading partner is the USA, by a huge margin. The Island’s trade and investment relationship with the US helped to sustain more than 300,00 jobs in the USA during 2019, with 101,000 US jobs created by annual exports to Bermuda and 200,000 derived from US majority-owned affiliates of Bermuda companies. From a re/insurance perspective, approximately 75 percent of the 500 top American companies have captives in Bermuda, while Bermuda-domiciled shipping companies provided $1.1 billion in energy-related shipping services designed to work with existing US refineries, ports and pipelines. The report said that US operating companies continued to domicile in Bermuda, with Freescale, Marvell, Contel, AOSL and Chipmos moving their corporate bases to the Island.

![]()

The USA has more visitors to Bermuda than all other countries combined, about

85 percent

in total. Next are Canada and UK, with about 5% each, then other countries.

The USA has more visitors to Bermuda than all other countries combined, about

85 percent

in total. Next are Canada and UK, with about 5% each, then other countries.

Bermuda is a quality but very high cost destination. The Bermuda Government makes no secret of the fact that it does not want low-income tourists, expects them to be earning good incomes and charges them accordingly. They are mostly 35 years old or more, 60 percent with college degrees and annual income of at least US$ 75,000 per person. A high 35% to 40% are repeat visitors earning much more each and staying an average of 6.2 nights, the majority in April through October.

As of December 31st, 2020 there were 55 licensed properties, 2,700 rooms and an estimated bed count of 5,998.

In recent years, Bermuda's tourism industry has been overtaken hugely by International Business as Bermuda's principal revenue-earner.![]()

Conducted periodically by the Bermuda Government's Department of Statistics from businesses and organizations including retail stores, hotels, guest houses, banks, utilities, schools, restaurants and sports clubs.

![]()

2019 Median average income about BD/USD 70,250

![]()

For more information see Bermuda Government's Department of Statistics.

![]()

With 47 paid legislators (36 in the House of Assembly plus 11 in the Senate), for a total of about 38,500 registered voters, a ratio of legislators to voters more than twelve times higher than the average equivalent in virtually any other country, and with in excess of 13 percent of the entire workforce working directly or indirectly by it. In February 2030, the Bermuda Government workforce - excluding the Government-owned quangos - was 6,315 - in less than 21 square miles. Thus it can be readily seen how the Bermuda Government is exceedingly expensive for Bermuda's individual taxpayers, companies both local and international, business visitors and tourists, to finance and maintain. It is Bermuda's single largest beneficiary of tourism revenue.

Bermuda Government-imposed methods of direct and indirect taxation and fees have become complex, bewildering - and why Bermuda is such an expensive place for locals and residents to live, companies to operate and tourists to visit. The tax structure puts a burden directly on locals, business visitors and tourists and penalizes tourism dependent industries.

In every year Government spending has increased appreciably, to the highest ever 2020 total. Since the final closure of the American, British and Canadian military bases in 1995, recouping the $60 million they yielded yearly has become a Bermuda Government priority, with a mix of tax increases and new taxes. In total employers, the Bermuda Government is now easily the island's single-biggest employer.

![]()

In general, all businesses trading in Bermuda in the local marketplace must be at least 60% Bermudian beneficially owned, controlled and managed, unlike exempted or international companies and corporations that do not trade in the local marketplace except with each other, instead trade beyond Bermuda from their corporate base or office located in or managed from Bermuda. However, some amendments have allowed some businesses to relax the 60-40 rule on foreign ownership of businesses in specific industries have been approved. The Bermuda Stock Exchange, several banks, hotels and Bermuda Electric Light Company Ltd are cases in point. In the past the blanket 60-40 rule had given protectionism to Bermudians, but it became prudent to review policies. But with controls still mostly in place there is no danger of Wal-Mart or the like being allowed in Bermuda.

![]()

Ratings agency Standard and Poor has revised its outlook on Bermuda, raising it from stable to positive. David Burt, the Premier and Minister of Finance, celebrated the announcement. “Standard and Poor’s in their overview stated Bermuda’s credit story is improving thanks to a return to positive economic growth. The agency added they view the prudent fiscal policy by the new Progressive Labour Party Government as positive. They affirmed their long-term sovereign credit and senior unsecured debt ratings as well as their short-term ratings and transfer and convertibility assessment.” Along with revising their outlook on the island, S&P affirmed Bermuda’s A+ long-term sovereign credit and senior unsecured debt ratings as well as its A-1 short-term ratings and its AA+ transfer and convertibility assessment. Mr Burt said: “The positive outlook reflects S&P’s expectations that, in the next 12 to 24 months, real GDP growth will remain moderately positive, fiscal deficits will continue to narrow approaching balance and Bermuda’s net general government creditor position will improve modestly. I am extremely pleased by this outlook which reaffirms the economic policies, stewardship and vision of this Government. We will continue our collaboration with traditional industry partners in international business and we will advance the progress made in growing and diversifying this economy. We promised the people of Bermuda that we would grow the economy and make a more inclusive Bermuda with new avenues of growth providing for more Bermudians to take advantage of economic successes. This is our focus and we are determined to build a better and fairer Bermuda.

![]()

Where it gets its revenue, alphabetically:

![]()

2020. Bermuda's international business pumped an estimated $1.97 billion into the islands economy last year. The largest single contribution was salaries, with exempt companies paying staff a total of $473 million last year pouring $47 million into Government coffers through payroll tax. Another $10 million was paid in other taxes, while rents and services amounted to more than $50 million and charities got $8 million in donations and sponsorships. A further $7.4 million was spent on entertainment in Bermuda by international business. But Association of Bermuda International Companies (ABIC) president George Hutchings said that overall spending by international business had dropped in recent years, with only training expenditure increasing.

![]()

Miami International Holdings has acquired a controlling interest in the Bermuda Stock Exchange. MIH is the parent holding company of the MIAX, MIAX Pearl and MIAX Emerald options exchanges. The US company said the stake in the BSX aligns directly with MIH’s corporate strategy and allows the company to expand its world-class technology, derivatives trading and regulatory expertise. “We are very pleased to welcome the BSX to the MIH family,” said Thomas Gallagher, chairman and chief executive officer of MIH. “As we looked to establish our international presence and address emerging markets such as digital assets, we found that the Bermuda Government’s commitment to fintech regulation, with legislation such as the Digital Asset Business Act 2018, coupled with Bermuda’s established re/insurance market, made the BSX and the country of Bermuda very attractive to us. Bermuda’s re/insurance industry and the BSX’s contribution to its products and services is strengthened by our ability to provide additional support to the evolving global re/insurance market through innovative products such as exchange traded risk. This transaction enables both MIH and the BSX the ability to offer innovative products and services on a global scale.” The BSX is a fully electronic offshore securities market regulated by the Bermuda Monetary Authority. It specializes in the listing and trading of capital market instruments such as equities, debt issues, funds, hedge funds, derivative warrants and insurance-linked securities. The BSX is a full member of the World Federation of Exchanges and an affiliate member of the International Organisation of Securities Commissions. It is recognised as a Designated Offshore Securities Market by the US Securities and Exchange Commission and a Recognised Stock Exchange by UK HM Revenue and Customs.

![]()

2019. December 31. One in nearly four jobs on the Island are held by non-Bermudians.

![]()

Casual upscale sportswear is acceptable in restaurants for lunch but many restaurants and night clubs require a gentleman's ensemble to include a pair of long trousers and jacket and tie in the evenings, or official dress Bermuda shorts with full jacket and tie and long knee length hose ensemble. Formal dress attire is not required. Swimsuits, abbreviated tops and short shorts should be used only at beaches and pools. There are no nude or semi nude beaches in Bermuda and indecent exposure is an indictable offense. Bare feet and hair curlers are not acceptable anywhere in public. If you jog, wear standard running shorts and shirts.

![]()

![]()

![]()

The total actual number of companies registered in Bermuda is about 18,700, with more than 15,300 Bermuda based international companies, 2650 local companies, 430 overseas partnerships and 940 other non residents. They include subsidiaries of 75% of the Fortune 100 and their European equivalents. Only 235 or 3.4% of the internationals have local offices, yet account for 75% of internationals' spending. In insurance and reinsurance, Bermuda has an industry capital base exceeding US$ 35 billion and gross premiums of US$ 24 billion. It ranks with Lloyds of London and New York as a global leader.

Exempted companies, or international companies. Most focus on international activity. To protect local business interests, the Bermuda Government will not normally allow the formation of an exempted company in banking. However, some quality international banking organizations may, under certain circumstances, apply to form an exempted company for international or multinational general trust, investment and executorship activities. By qualifying as exempted companies, these corporate entities are not subject to any restrictions on foreign ownership. They can be either 100% owned by non-Bermudian interests or anywhere from 100% to 80%. Bermudians cannot hold more than a combined 20% interest in any one exempted company or partnership.

Continuation or Permit Companies. Also Exempted Companies. These are incorporated outside Bermuda but are permitted to operate from Bermuda in the same way as exempted companies. They evolved originally to meet certain special situations, for example when the United Kingdom's exchange control restrictions once prevented incorporation in Bermuda, or where tax treaties made it disadvantageous to incorporate in Bermuda. Others are encouraged to do so, for strategic reasons.

Local Companies. Beneficially owned by Bermudians and operating in the local marketplace, they are NOT "exempted" companies. The legal requirement that they must be at least 60 percent beneficially owned by Bermudians goes further. To avoid non Bermudians controlling local companies through pyramiding or secret agreements, corporate shareholders of local companies must themselves be at least 60 percent owned by Bermudians to qualify as Bermudian owners and with at least 60 percent Bermudians as directors. They provide support services. They include local accounting, banking and legal firms.

![]()

See Cost of Living Guide in Bermuda. Bermuda is the most expensive place in the world to live, work and retire in and to visit as a tourist. Bermuda's retail prices are high mostly because of the Bermuda Government duty rates on imports, the Government's single biggest source of revenue - and the Government law requiring all local companies except hotels to be at least 60 percent Bermudian owned. So non-Bermudian companies with substantial bulk purchasing power cannot enter the local market as investors and part owners to give much needed economies of scale in local costs of goods to businesses, residents and visitors in the same unrestricted way they can do so elsewhere. Despite these drawbacks, Bermuda's overall economy remains good, even if it is artificially so. Except that export earnings from international company businesses based in Bermuda now greatly exceed tourism earnings from people who visit Bermuda on vacation.

![]()

| Total working population (excludes juveniles, retirees and those unable to work) | 39,457 |

| Hotels, restaurants and clubs | 5,607 |

| Public Administration (excludes employees in Bermuda Government-owned hospitals and quangos | 4,054 |

| Banks, insurance and real estate | 3,359 |

| Business services | 3,330 |

| International entities | 3,201 |

| Hours worked per week | 33.3 |

| Unemployment - among Bermudians allowed to work | estimated 3 percent |

| Male employees | 50 percent |

| Female employees | 50 percent |

| Bermudian employees | 70 percent |

| Expatriate employees (on Work Permits) | 30 percent |

Overall, women outnumber men in population (32,019 compared to 30,258 men) in the community services, education, financial sector, retail and wholesale trades. Men outnumber women in the transport sector. Nearly 75 percent of the new jobs created in 1999 were in professional and managerial posts. Non Bermudians number 7,521 persons. Work Permits (see separate file) are required to be applied for by all employers (except the Bermuda Government) of non Bermudians without local spouses. The Bermuda Government reaps a healthy annual revenue benefit from the desire of employers to employ non Bermudians.

The majority of employees in Bermuda work for a relatively small number of businesses. Some 113 companies, representing just over 3 percent of the total number of locally based business organizations, employ 18,517 people, 54 percent of the entire work force. In the international sector, 262 non-Bermudian companies with an active physical presence employ an average of 8.7 persons each. By contrast, some 2,741 organizations, nearly 75 percent of all employers, provide a total of 4,422 jobs, representing 22 percent of the work force. Most employers in this category employ five or fewer people.

Employment Rights. Under the Employment Act 2000, employees are entitled to legislated benefits from employers. They include two weeks holiday (vacation) after one year; no unauthorized docking of salaries or wages; a written contract after one week's employment; a 40-hour week; time and a half, or time off, after 40 hours, with possible exemptions; paid Public Holidays; a rest period of at least 24 consecutive hours each week; 8 days paid sick leave per year; unlimited time off to attend ante-natal classes for pregnant employees; 8 weeks paid and 4 weeks unpaid maternity leave after one year; statutory notice period; bereavement leave of 3 days unpaid or 5 days unpaid if traveling abroad; disciplinary procedure; time off for court duty, voting, meeting of Government Boards, Bermuda Regiment, Reserve Police, Senate or House of Assembly; notice of 1 week if weekly paid, 2 weeks if bi-weekly paid, 1 month in any other case; employers cannot sack employees for complaining about their treatment; an employees can take an employer to the Employment Tribunal for unfair or constructive dismissal.

![]()

The Bermuda Government's Payroll Tax, an income tax on all employers and employees, is the government's single-biggest source of income.

Extends a guarantee that the

Bermuda Government will not charge exempt companies any taxes on profits, income

or capital gains. The amendment prolongs that guarantee until 2035. Those affected in Bermuda include US citizens and green card holders resident in the US and living

abroad. They include Bermudians and non-Bermudians who have US and foreign financial bank accounts, financial

interests and other holdings; US residents for income tax purposes (those who do

not have a US passport or citizenship but have resided in the US long enough to

meet the substantial presence test), and others with US connections such US

owned foreign entities. Also liable are US-classified foreign financial

institutions and non-financial foreign entities including all those with US

proprietary investments, US account holders, or other US financial dealings.

FATCA cooperation is both encouraged and enforceable in Bermuda because Bermuda

has signed Tax Information Exchange Agreements (TIEAs) in the last few years

with the United States and other countries. TIEAs, tax treaties, and

Intergovernmental Agreements all aid in mutual information exchange cooperation.

In cases where tax evasion, etc, is suspected or determined, the US Internal

Revenue Service has profound regulatory powers (agreed on by the TIEAs and tax

treaties) to request detailed significant confidential information on specified

US individuals and related parties. 2014.

August 19. Bermuda, like many other areas in the world, became a signatory to

the USA's Foreign Account Tax Compliant Act (FATCA). It was enacted

in 2010 by Congress to target non-compliance by U.S. taxpayers using foreign

accounts. FATCA requires foreign financial institutions (FFIs) to report to the

IRS information about financial accounts held by U.S. taxpayers, or by foreign

entities in which U.S. taxpayers hold a substantial ownership interest. FFIs are

encouraged to either directly register with the IRS to comply with the FATCA

regulations (and FFI agreement, if applicable) or comply with the FATCA

Intergovernmental Agreements (IGA) treated as in effect in their jurisdictions. Since 2015 when the-then Bermuda Government announced the first three members of

the Casino Gaming Commission following legislation enacted in late 2014,

there has been much discussion and millions of dollars spent, but no concrete

action. The commission was tasked with regulating the

casino gaming industry on the Island, which has not yet been introduced when it is

finally introduced and is the only entity which will determine who receives a casino licence.

Present legislation allows only three casino licenses to be

in effect at any given time. The transfer of a casino licence without a

fresh application to the commission will be prohibited, and

licence-holders will be required to report any material changes in their

circumstances. The commission will also have the power to approve the

layout of a casino, gaming equipment and hand out licenses for key

casino employees. GDP is the market value of all the

goods and services produced and in Bermuda has mainly due to the impetus of the international

business sector. 2019. December 13. Bermuda’s

gross domestic product increased by 0.1 per cent to $6.5 billion in 2018, the

Government announced today. GDP is a measure of economic activity that

captures the value of goods and services produced within a country during a

given period. Including inflation, GDP in current prices increased by 1.7 per

cent in relation to 2017. Overall, eight of 18 industry groups contributed

positive growth to the real GDP, the report compiled by the Government

Department of Statistics reveals. The largest increases in absolute real terms

were recorded for the construction and quarrying industry, which grew by $33.9

million and international business, which grew by $24.7 million. The

international business industry was the largest contributor to GDP, representing

25.2 per cent of total GDP, the report shows. In contrast, value added in the

arts, entertainment and recreation industry fell by $36.6 million and the

wholesale and retail trade industry decreased by $15.5 million. Compensation of

employees accounted for 55.7 per cent of the total cost of producing the GDP at

current purchasers’ prices in 2018. Operating surplus/mixed income and

combined taxes less subsidies (on production and products) represented 28.7 per

cent and 11.5 per cent of the GDP at current purchasers’ prices, respectively.

Depreciation accounted for 4.1 per cent. In 2018, non-financial corporations

contributed 43.6 per cent of the total GDP at current basic prices mostly

concentrated in real estate activities, professional, scientific and technical

activities, and wholesale and retail trade, the report said. Financial

corporations contributed 37.7 per cent of total GDP at current basic prices with

general government contributing 10.8 per cent and households contributing 7.9

per cent. Gross national disposable income reached $7.3 billion at the end of

2018, up 1.2 per cent from 2017. After adjusting GNDI for consumption

expenditure, gross national savings was measured at $2.9 billion, the report

said, which represented a 3.4 per cent increase year-over-year. Of the total

savings, Government said, $1 billion was spent on gross capital formation

(investment in capital goods) which positioned the Bermuda economy as a net

lender to the rest of the world in the amount of $1.9 billion. Government said

that it has re-based the island’s GDP from 2006 to 2013 in order to keep up

with the evolution of prices and capture more current economic conditions. The

re-basing exercise was completed with the assistance of the Caribbean Regional

Technical Assistance Centre. The 2018 GDP publication reflects changes to the

industry structure and levels of the annual GDP estimates, Government said.

These changes are the result of an updated Supply and Use Table for Bermuda as

part of the implementation of the 2008 System of National Accounts, which serves

as the international statistical standard for the production of statistics on

GDP. Wayne Furbert, Minister for the Cabinet Office, said: “The exercise to

update the SUT and the GDP base year was a collaborative process between the

Caribbean Technical Assistance Centre and the Department of Statistics over a

five-year period ending in August 2019. “The DOS finalised an SUT with 2013

data as this was the most recent year with supporting data from the Household

Expenditure Survey. The finalised SUT allowed for replacing the outdated 2006

base year for estimating GDP in constant prices which is used to measure real

growth rates in the Bermuda economy. The updated GDP estimates will give a

realistic and integrated view of the economy that is more suitable for policy

and analytical use and reflects more closely the current economic dynamics.”

Based on the balanced SUT, the GDP level in current prices for the base year

2013 has been revised up by 14.5 per cent, Government said, adding that the

increase in the re-based GDP series is not uncommon, as other countries which

implemented recent re-basing and application of the 2008 SNA showed the

following increases in GDP in current prices: Cayman Islands +27.5 per cent in

2015 GDP; Maldives +19.5 per cent in 2014 GDP; Tanzania +27.8 per cent in 2013

GDP; Kenya +25.3 per cent in 2013 GDP; Bahamas +27.6 per cent in 2012 GDP; and

Zambia +25.2 per cent in 2010 GDP. Bermuda’s GDP series, Government said, now

reflects a more accurate picture of the size and structure of the economy and

incorporates new activities that were previously not captured in the

computational framework. The relevance of the GDP series has been enhanced and

is now more internationally comparable with other jurisdictions, it said. The

2013 base year series features 18 industry groupings versus the previous 15

industry groupings. In support of evidence-based decision making, the re-based

GDP provides a better understanding of which industries are driving growth since

emerging industries such as the Information and Communication industry are now

explicitly featured, Government said. The year-over-year GDP breakdown by

industry is: 2019. August 28. First-quarter

gross domestic product (GDP) rose 3.7 per cent, after being adjusted for

inflation, in the first quarter of this year. It was the fastest growth in

quarterly GDP since the third quarter of 2015 and was helped by strong growth in

construction work done. GDP reflects the monetary value of the island’s goods

and services over a period in time and is regarded as an indication of economic

health. A report issued this evening by the Department of Statistics showed that

GDP at constant prices in the first three months of the year was estimated at

$1,339.5 million, 3.7 per cent up from the same period in 2018. The main driver

was a $30.9 million increase in gross capital formation, or fixed assets. The

construction element of these assets saw a 15.6 per cent increase during the

period. The report cited Belco’s new North Power Station and ongoing work on

the new airport terminal, as well as new residential construction, road and

bridge refurbishments and hotel development. After adjusting for inflation,

household final consumption increased 0.5 per cent year over year to $624

million. During the period, households spent more on services such as

accommodation services, catering services and insurance but less on durable

goods such as motor vehicles. Government final consumption rose 1.2 per cent,

due to higher wages and salaries, offset by a reduction in spending on goods and

services. The net surplus on trade in goods and services increased $11.7

million, or 3.8 per cent, mostly because of a rise in services exports, which

rose 5 per cent during the period. There were increased earnings from the export

of travel services, legal and accounting services. Goods imports, which have a

downward effect on GDP growth, grew 10.7 per cent due mostly to imports of

machinery, fuel and finished equipment. Payments for the imports of services

rose 1.3 per cent due to construction and engineering services. GDP in current

prices, which does not adjust for inflation, rose 4.8 per cent to $1,816.2

million, up 4.8 per cent year over year. The World Bank rates Bermuda as one of the top

six jurisdictions in

Gross National Income per capita. How they compare, according to

the World Bank: Hugely expensive in Bermuda,

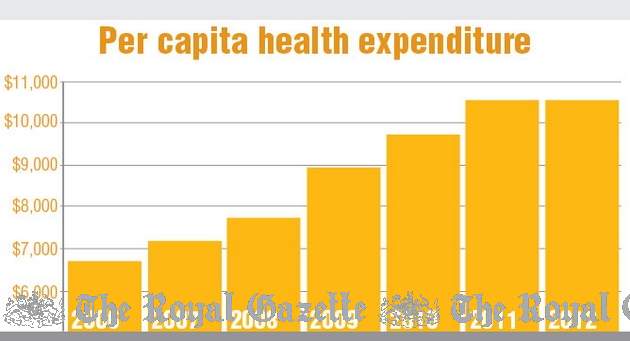

$11,962 per capita in 2020, 14.2% of GDP in 2019. These

statistics place Bermuda significantly ahead of virtually all other

countries in the Organization for Cooperation and Development (OECD) on health

care spending, more so than in the USA. In Bermuda, prices have risen by nearly 180% since 2000 and in

2013 to date are at least $990,000 for a house with an apartment ($540,000 in 2000) and $1 million - $995,000 ($545,000 in 2000) for an average 2/3 bedroom

median single dwelling house. These figures are obtained from current Coldwell

Banker JW Bermuda Realty statistics. Housing costs are on average 400% more than

similar properties and plots in the USA and Canada - about US $160,000 and

280% more than in UK. Small periodic increases in social security

pensions and salaries have lagged far behind the overall rate of inflation of

housing. In the USA, according to CNN on May 8, 2005, a 30-year mortgage can be

obtained at an interest rate of 5.6% but in Bermuda it is 9%.![]()

Exempted Undertakings Tax

Protection Amendment Act 2011

![]()

Foreign Account Tax Compliant

Act (FACTA)

![]()

Gambling and Gaming

![]()

Gross Domestic Product (GDP)

![]()

Gross National Income per Capita

(GNI)

![]()

Health Care

![]()

Home ownership

30-year mortgages are now available to qualified persons from the local banks at interest rates totaling about 9 percent per annum (7 percent plus finder's fee). The required monthly payment of a 30 year mortgage of an average $975,000 Bermuda property is $6,090 but the average monthly Bermudian take home pay is $3,569. Bermuda banks require a household to make in excess of $12,000 a month to meet average 30 year mortgage payments. Plus, they need a $250,000 down payment, as a bank will not lend more than 85% of the appraised value of the property. Thus a far greater number of Bermudians than non-Bermudians in other countries are denied the opportunity of home ownership. The number of households that can afford to buy the average Bermuda property is 5,064 of the 19,505 households in Bermuda making over $108,000 a year.

The Bermuda Housing Corporation has built several thousand properties which it has sold to Bermudian families. The original idea was to provide subsidized housing to Bermuda's lower income families. But by international standards of subsidized housing costs, these are extremely expensive.

![]()

2019. December 31. Median average income is about BD/US$ 72,000

![]()

Practically everything in Bermuda is imported, except for what is generated by the secondary industries shown below. In 1999, Bermuda imported $620 million worth of goods, more than at any time earlier. By far and away the greatest portion came from the USA, despite the odd fact that shipping costs from Britain and Europe are not more expensive than from the USA.

Residents alone - not companies - spent $460 million in 2011 on overseas travel and purchases. In Bermuda, the average duty rate for dutiable goods exceeds 30 percent. 85% of all visitors are from the USA and assume, incorrectly, that in Customs exemption of duties for visitors - from wherever they may be - and returning residents, Bermuda has the same very generous laws as the USA. Unfortunately, this is not the case. By comparison with the USA, Britain and Europe, in this regard Bermuda treats its visitors very severely and its returning residents with laws and regulations the democratic countries would not dare impose.

Produce receipts from a retail store satisfactory to the Customs Department of actual purchase price of the items or be prepared for the Customs Department to assess items for your payment of duty at much higher Bermuda prices. This is applied vigorously. To avoid being arrested and having goods confiscated, do not try to import goods into Bermuda without paying the duty.

Only Bermudian legislators consider themselves exempt from laws affecting other people, like Customs inspection and payment of duty. It was reported in The Royal Gazette on page 9 of Thursday, September 13, 2001 that Bermuda Customs and Immigration have a long-standing practice of giving preferential treatment to local legislators returning from abroad. Other Members of Parliament have confirmed to this author that they too - not just the Premier and Ministers - do not pay any Customs duties unless they wish to do so voluntarily. Most don't wish to, so will not. Nor are they searched. It is not a policy, technically payment of Customs duty applies to everyone, but individual Customs Officers have the authority to use their discretion and not levy duty in the case of legislators.

![]()

See under Unemployed

![]()

None, unlike in the UK, USA and elsewhere. However, this is planned for 2020 and could be $15 or more per hour.

![]()

See the Bermuda Government's The Pension Commission. Not Social Security (see separately), but private pension plans. The National Pension Scheme Act 1999 became effective on 1st January 2000. All employers, whether local or international or exempted must comply, for every employee whether Bermudian or a non-Bermudian spouse of a Bermudian of from 23 years of age who works a minimum of 720 hours per calendar year. Employers may, however, offer more generous eligibility provisions to employees by allowing them to become members of their pension plan at an earlier age and with fewer numbers of hours worked. While 65 for men and women is when those eligible in Bermuda will get Social Security, private pension plans can be more generous and in lesser age as well. Note that the Act specifies private pensions only for Bermudian and international or exempted company employers employing Bermudians or non-Bermudian spouses of Bermudians. There is no requirement to establish pension plans for guest workers, which may come as a shock to the latter. Non-Bermudian employees should ask local and international companies and or the Bermuda Government employing them what, if anything, they offer as private pension plans or equivalent, so they know where they stand and what they can expect to take with them when they leave Bermuda.

For those who qualify under the Act for pension eligibility, the pension scheme (plan) can be offered only by approved local insurance companies, not the "exempted" or "international" variety registered in Bermuda but not "corporate citizens" as they are often referred to, inaccurately.

The Act removed many of the anomalies and restrictions that since the 1970s for "approved private pension plans" had existed in some with 15 or more years service but had severely restricted or totally excluded others, for example all those with say 12 years service with the same employer by retirement age. The current Act creates some portability for plans of all employers and employees. But for some people close to retirement age when it came into effect, it was far too late to ensure that once they become senior citizens and retire from working, they will have an adequate income without hardship.

Minimum contribution rates are based on pensionable earnings per year. At January 14, 2012 Approved Pension Plan Administrators under the Act include

BF&M

Life Insurance Company Ltd.

Bermuda

Life Insurance Company Ltd (Argus).

Bermuda

Investment Advisory Services Ltd.

Colonial

Pension Services Ltd.

Freisenbruch-Meyer

Insurance Services Ltd.

![]()

![]()

There is some poverty. Some Bermudians are less affluent than others, mostly those who cannot make ends meet, including many single parent families and those who have a permanent disability of one kind which overseas would give them some disability allowance and other concessions but which in Bermuda do not. Some Government financial assistance, via the Ministry of Health and Social Services, is given to Bermudians only who are pensioners, or not pensioned by former long term employers, who don't own and have to pay to rent a home and don't have a job or any private income and have virtually no savings; or are qualifying single parent families; or certain others (on a discretionary basis) who are permanently mentally or physically handicapped; and certain able-bodied but unemployed or under-employed individuals not earning sufficient income to live on; and those who are born locally or overseas and are twins or triplets or higher. There is also a housing allowance program for Bermudians only with temporary rent payment difficulties because 99 percent of all Bermuda properties are hugely over-priced to rent or buy.

In the last reported (some years ago) Bermuda Government low income study, 'Low Income Thresholds for Bermuda Households in Need' which pitches the poverty line at incomes of less than $27,000 per annum for a single person and $76,000 for a two-parent family with two children under 16.

(It also shows the huge difference in the cost of living between Bermuda and the USA, see figures below) The study found 11 percent of households fell below the new threshold, which equates to 3,050 homes. The study found that the highest incidence of low income households occurred for single and two parent households with young children and in elderly adult households. The Department of Statistics spent just under two years researching poverty and low income models from different countries, getting feedback from local groups and consulting with international academia and organizations.Compare the Bermuda latest available) poverty line figures with the United States' Government's 2013 figures:

| Persons in family | Poverty guideline |

|---|---|

| 1 | $10,830 |

| 2 | 14,570 |

| 3 | 18,310 |

| 4 | 22,050 |

| 5 | 25,790 |

| 6 | 29,530 |

| 7 | 33,270 |

| 8 | 37,010 |

| For families with more than 8 persons, add $3,740 for each additional person. | |

Poverty is a very complex concept to define and measure, particularly in affluent and wealthy countries such as Bermuda. So 'Low Income Thresholds' or LIT measures were developed as indicators to identify and assist Bermuda households that are economically disadvantaged or simply less well off. The latest LIT study revealed that in 2012 there were 3,600 households in Bermuda currently living below established low income thresholds which range from $27,000 per year for a single adult household to $76,000 a year for a family of two parents and two children younger than 16 years old. LIT measures were derived from a nutritious low-cost food basket as approved by the Government Nutritionist combined with essential services that families need such as education, health and transportation. They show that in 2012, the minimum expenditure a single parent household with one child needed to ensure a nutritional diet of food was $4,471 per year or over $12 per day; housing cost averaged roughly $65 per day or $1,993 per month, the cost of fuel and power totalled close to $9 per day while health care costs averaged $7.80 per day. The LIT measures will be used by the Department of Financial Assistance to make annual adjustments to help paid to families and the new figures have already helped work out a threshold for free child care assistance. Other programs such as free public transportation, an affordable health care system and subsidies for the elderly will certainly help to alleviate the financial burden that some households face. Government will track the long-term impact of Government spending on the economic and financial positions of families in need. Families struggling to make ends meet are urged to contact the Department of Financial Assistance.

![]()

Issued by the Department of Statistics of the Bermuda Government.

![]()

All homes and apartments (flats) with an annual rental value (ARV) of less than a certain amount are subject to rent control. This has applied anew since August, 2000 with the Rent Increases (Domestic Premises) Control Amendment Act 2000. It updated the Rent Increases Domestic Premises) Control Act 1978. Before then, only homes built before 1983 and with an ARV of less than $9,900 were subject to the controls. The legislation increased the number of rental units affected by rent control from 3,600 to 13,300 or 48 percent of Bermuda's residential units. This is a good benefit for people who do not live in up-market houses or apartments and do not own their own homes. But it means that the minimum rent for a 2-bedroom apartment is now at least $1,400 a month and often much higher.

![]()

Other secondary industries include artistic works; beer brewing; carbonated beverages bottling; cedar wood souvenirs; condiments; concrete block and related products for building purposes; diary products such as cream and ice cream; glass-blowing; ornamental iron working; paint manufacture; and perfumes and toiletries preparation. But these are mostly only specialty items with very small export markets.

![]()

To see how their status and benefits compare to other countries overseas, see Senior Citizens in Bermuda.

![]()

Bermudians resident in the UK and UK nationals also living there who once worked in Bermuda and while working in Bermuda paid individually and through their employers enough contributions from 1972 to qualify presently receive their payments via the UK's Crown Agents, who charge both a commission to recipients and require them, at their additional expense, to obtain certified confirmation from a notary public or similar of where they live. The Crown Agents state, wrongly, this can be obtained from a local Police station or council office.

However, the system below will be changing, most likely to take effect in /2020. In the 2018 Throne Speech, the Government announced that Bermuda’s social insurance system will be changed from a fixed-rate contribution to one based on a percentage of income. Contribution increases will be delayed until the actuary completes the modelling to effect this policy objective.

| Category of insured person | Payable weekly by Employee in BD$ | Payable weekly by Employer in BD$ | Total |

| Employed person over school leaving age and under 65 | $35.92 | $35.92 | $71.84 |

| Employed persons over 65 | - | $35.92 | |

| Self-employed persons over school leaving age and under 65 | $71.84 | - | $71.84 |

| Self-employed persons over 65 | $35.92 | - | $35.92 |

There is a Contributory Pensions Appeal Tribunal. .

NB: When private corporate pensions are offered, they are in addition to the Government administered Contributory Pensions plan shown above.

![]()

The Bermuda Government has agreed this with many countries in compliance with international financial regulations.

They

include Aruba, Australia, Bahrain, Belgium, Brazil,

Canada, Czech Republic, Denmark, Faroe Islands, Finland, France, Germany,

They

include Aruba, Australia, Bahrain, Belgium, Brazil,

Canada, Czech Republic, Denmark, Faroe Islands, Finland, France, Germany,

The agreement is a reciprocal arrangement between the country concerned and Bermuda not to tax the repatriated income that a firm or a national of the parties domiciled in one country earned (and paid taxes on) in the other country.

In 1988 Bermuda and USA signed the US-Bermuda tax treaty in Washington DC, shortly after Premier Sir John Swan met with President Ronald Reagan. It began the international business boom for Bermuda that continues to this day. It is so favorable to Bermuda that all conferences and conventions involving American businesses meeting in Bermuda end up being borne entirely by American taxpayers. Since then, Bermuda also has a Tax Information Exchange (TIEA) in force with the US and a Mutual Legal Assistance Treaty (MLAT) with the US.

![]()

2019. December 31. About 8 percent. Unemployment benefits in Bermuda are far tighter to obtain in Bermuda compared to the USA, Canada, UK, etc. Also, non-Bermudians don't generally qualify.

![]()

See details in Non-Bermudians Working in Bermuda.

![]()

![]()

Authored,

researched, compiled and website-managed by Keith A. Forbes.

Multi-national © 2020. All Rights Reserved