Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

![]()

By Keith Archibald Forbes (see About Us).

Some lovely Bermuda homes. Bermuda Tourism photo

Bermuda has only 13,000 acres of land, with 6,000 of those for residential use.

Buying a single-family home or condominium or fractional unit in Bermuda, with its only 13,000 acres in total and an average of 3,400 people per square mile is far more costly for Bermudians and especially non-Bermudians than buying one in, say, the USA (where, according to the National Association of Realtors, the median price is currently $166,100) or anywhere in the rest of the world. The cost of living is also far higher. Nothing is cheap in Bermuda; not fuel (petrol, gas); not electricity; not automobiles or other transport; not property taxes; not alcohol, not anything. But for those who can afford it, the rewards can be many. Bermuda is in a unique mid Atlantic setting of green foliage, pink coral beaches and golf courses, less than two hours away by air from North America and seven from Europe. A Bermuda attorney (lawyer) and real estate professional will need to be consulted. An attorney will charge very expensive fees for conveyancing compared to the UK, USA, Canada and Europe. (Legal fees generally for buying and/or selling a Bermuda-based property to non-Bermudians (international buyers or sellers) are the highest in the world).

Land in Bermuda is widely defined to include land and any building erected on land and any estate, interest, right or easement in, over or under any land or building. Such extends to all residential homes and buildings, including condominiums, as well as to commercial buildings and other structures. Typically, licences are granted to an individual, an individual and spouse, or to members of an immediate family. Licences are rarely issued to trusts or to special purpose companies. The application fee for a Licence (shown below) is refunded if the application is not successful. If the Licence is granted, the full fee anticipated is from 12.5 per cent of market value for a home, or six to 8 per cent for a condo, and must be paid prior to property acquisition. For Permanent Resident Certificate (PRC) holders, the anticipated fee for condos may be less. Further, PRC holders (subject to obtaining a Licence and paying the relevant percentage fee) may purchase a home or condo with a single ARV of more than $63,600. Thus, PRC holders have a wider choice than other non-Bermudians. Overall, unlike non-Bermudians limited to the top 5%, almost a quarter of the presently available real estate market is available to holders of Permanent Resident Certificates. In the non-Bermudian market, houses start at $3,500,000 with condos from $560,000. A selling realtor agent’s particulars will always advise when a specific property is available to non-Bermudians. Property ownership does not automatically allow residence in Bermuda, however several options ensure that residence is permitted. PRC holders may reside in their acquired Bermuda home on that basis and no further permits or consents are required. Holders of a work permit may reside in their acquired Bermuda home during the currency of the work permit and no further permits or consents are required. Other purchasers may apply for a multiple re-entry permit (“Permit”), allowing re-entry on a single ticket basis on any number of occasions during its validity and with ability to remain for up to 90 days after arriving (in each case). A Permit is valid for one year. Technically, the Permit is only available after property acquisition is registered at the Office of the Registrar-General. However, the Bermuda Department of Immigration recognizes registration delays and may, at its discretion, grant the Permit on proof of purchase. If Immigration ceases to exercise discretion, a non-Bermudian purchaser may still enter Bermuda under usual tourist or visitor pre-conditions such as return air ticket etc. Plus, there are heavy Bermuda Government stamp duty charged on sale or re-sale of all homes owned by non-Bermudians; legal fees involved; and recurring real estate or property taxes, referred to as Land Taxes.

Almost uniquely in Bermuda, Land Taxes do not include Water or Waste Water/Sewage. Neither are piped in or out via a central system. Costs of water and disposal of waste water and sewage from cesspits is the separate responsibility of the home or condominium owner or tenant or both.

![]()

![]()

International/non-Bermudian buyers in both categories 1 and 2 below may not buy investment property such as land, commercial real estate or property intended mainly to earn rental income. They cannot subdivide the property. They may be granted permission to rent their property by the Immigration Department but this rarely extends to periods of more than a year and includes a tax of from 7.25 percent. They cannot purchase other properties with the same or different ARVs. They cannot lease or rent the property they have acquired without official Bermuda Government Ministerial consent and on payment of a fee or tax. They cannot use the property as a business address, even after paying so much for them, in order to recoup some of their investment, unless they get special permission. In the USA, Canada, Europe, etc it has long been accepted and even approved by their tax authorities that working from home, using computers and the internet or in other ways, is not a privilege but a right. In the USA alone, millions of employees work solely from home and at least 63 million employees do so occasionally. But not in Bermuda. Here, it is regarded legally as a privilege, not a right. Unlike in the USA, Europe and elsewhere there is no equivalent Bermuda legislation that encompasses flexible or home-working. The term “home-worker” (or similar) is not defined in Bermuda's Employment Act 2000 (“the Act”). Because of this, home working is a privilege rather than a right. Potential non-Bermudian homeowners of Bermuda property should, in their own interests, expect to be allowed to work and to have their employees do the same if they wish, from their very expensive homes without any restraint. They are advised not to seek to evade these laws by "fronting" via local or overseas law firm or attorney or Bermudian living in Bermuda or abroad. If they ignore this advice the property will be forfeited to the Bermuda Government. If a non-Bermudian owner is fully retired from all business interests, does not have more than two dependent children and wishes habitual residence in Bermuda, a residential certificate may be granted. Only in Bermuda are there so many restrictions and exclusions in what non-Bermudian can and cannot do. In contrast, in all the other tax havens - such as the Bahamas, Cayman Islands, throughout the rest of the Caribbean, etc - and international business centers, there are no such restrictions. Otherwise, what they can buy:

All types of properties available for sale or rent.

![]()

This applies to all sale and purchase agreements entered into by non-Bermudian purchasers. They must apply and pay for and obtain a license to acquire the property in which they are interested and for which they are qualified to own by ARV status. The regulatory agency concerned of the Bermuda Government is the Ministry of Labour & Home Affairs (Department of Immigration). The purchaser applies on the prescribed form, submitted by the purchaser's Bermuda-based and Bermudian law firm. The approval process can take anywhere from two to nine months.

There are no regulations limiting non-Bermudians who retire or work here to what type of property they may lease or rent. However, they will be required to pay a tax or stamp duty on their leases or rentals.

![]()

![]()

The legislation when a Bermuda property owner dies, and the procedure, formalities, executor, executrix, objections, etc.

![]()

For current charges, see under Land Evaluation

Instead of being assessed purely on present market value of a Bermuda property including its boundary and land or market value on a certain date throughout Bermuda, as most non-British overseas jurisdictions now do to help achieve fairness for comparison purposes, every residence in Bermuda is assigned an 'ARV' (see below) for the purpose of calculating the Bermuda Government's annual land tax. The ARV is not the land tax, nor is it necessarily reflective of the annual value a given home might expect to achieve on the full-time or monthly or periodic rental market. It was that once (see below), but in recent years the Government was made aware, particularly by non-Bermudian homeowners and realtors, that rents if any were no longer anywhere near the ARVs. In 2016 the cash-strapped Bermuda Government, despite rental values that fell significantly from 2009, decided to hike Land Taxes anyway, most significantly affecting those who it seemed could most afford them based on the ARV of their Bermuda homes.

A property's ARV, not the sale price, triggers the methodology employed by the Bermuda Government to determine its real estate tax (in UK, the equivalent of Council Tax). Most countries have long ago dropped the ARV system and gone for the more equitable market value of home and boundary or land system.

However, Bermuda properties are still always valued for tax purposes using their unique ARV. This ARV was defined in the Land Valuation Tax Act 1967 as "the rent at which a valuation unit might reasonably be expected to let from year to year if the tenant undertook to bear the cost of internal repairs, and the landlord to bear all other reasonable expenses necessary to maintain the valuation unit in a state to command that rent." In simple terms, the ARV is the amount of rent your property would attract in the open market on a yearly basis. The property's ARV is set by the Department of Land Valuation of the Bermuda Government. Once the ARV of the property is set, tax is levied on that ARV at marginal rates, which increase as the property's ARV increases. Generally speaking, the higher the ARV, the higher the sum levied in tax. The Land Valuation Tax Act 1967 required the Department to conduct a revaluation of all ARVs on the Island every five years, the last most recently. This revaluation was very significant given that rents property owners could hope to charge have declined considerably in the past few years. It was hoped that with this decline there would have been a proportionate decrease in the ARV of the vast majority of more expensive properties on the Island. Instead, needing significantly more funding to finance the expensive lifestyle of the Bermuda government and its 36 legislators in only 21 square miles, the highest ratio of legislators per square mile anywhere in the world by a huge margin, ARVs for all Bermuda's most expensive properties specifically including those purchased by non-Bermudians, have increased significantly. There has to be a good basis for challenging the ARV, an extremely costly legal process.

![]()

Buying. There is a wide choice for Bermudians who can buy any property if they can afford it. Prudence and caution are recommended. Non-Bermudians should note they are limited to the top 5%. Leasing and Renting. Providing the units have their own assessment numbers, there are no differences between what Bermudians and non-Bermudians can lease or rent.

2018. July 12. People will be able to apply for a new category of dwelling unit from Monday. The new units will have an assessment number but will be restricted from having a private car registered to the address. The change means homeowners with smaller properties will be able to get rental income, fulfilling a pledge from the Progressive Labour Party’s Throne Speech. Previously, there was no way to issue an assessment number to an address that would not automatically include the ability to register a car against the unit. That limited the creation of dwelling units to those properties that were able to provide the required car parking on their site. Home affairs minister Walton Brown said: “Many homeowners have space to create an additional unit, but are unable to create additional parking spaces. This provides a new opportunity for homeowners, who would otherwise not be able to build additional units because of parking constraints, to maximize their potential for rental income.”

![]()

Local banks use independent appraisers to establish the value of a property for mortgage, valuation and other purposes. If done at the request of a bank for a mortgage on an average Bermuda home valued at $500,000 the fee will generally be from $300-$500.

![]()

For non-Bermudians/restricted non work-permit holder persons who qualify, once a property has been selected, an application for a license to purchase is made to the Bermuda Government's Ministry of Home Affairs and Public Safety. Your realtor will assist in this. An "Acquisition of Land" advertisement issued in the Official Gazette of Bermuda will say that "Notice is hereby given that (the full name of the applicant), a citizen of (whichever applies) is applying to the Minister of Labour, Home Affairs and Public Safety for sanction to acquire a leasehold interest in or the freehold of a particular property (by name, acreage if relevant, unit number and Parish) - and if relevant, in joint tenancy with a Bermudian parent or sibling or spouse.

Agapanthus for sale for $19.5 million, left, and Chelston for sale for $45 million

For all non-Bermudians, also referred to as restricted persons - some Bermuda realtors refer to them as international buyers - a License from the Bermuda Government is required to acquire land in Bermuda unless you are on the Register of Bermudians or are a local company with Government approval to do so. They must first apply to the Minister of Labour, Home Affairs and Public Safety for a "License to Acquire" a property. Note that non-Bermudians are severely limited in what freehold properties - homes with land - in Bermuda they may buy, only the 5% top end of the market. They may select only Bermuda's 200 or so most expensive single family properties - luxury homes with an Annual Rentable Value (ARV, see below) of US$177,000 a year or more - from among the more than 20,000 residences, or from an expensive condominium - with an ARV of US$32,500 or more (Bermuda Immigration and Protection (Designation of Eligible Condominium Units) Regulations 2007). Or, instead of freehold buying a Bermuda property such as a house on land or a condominium, a practical solution for some may be to purchase a fractional unit, of which there is now a wide variety. There is a fee for the first-time sale of such a unit, more than 10 per cent. The fee for sale of a fractional unit is more than 18 per cent on the second disposition of such units. For hotel residences condos or hotel units with individual land valuation assessment numbers if they are placed on the hotel inventory it will cost a minimum of 18 percent, or a minimum of 25 percent if the property is kept for private use.

Non-Bermudians considering buying a home - whether a single family or condominium - in Bermuda should be aware that virtually all properties in Bermuda do not have a central water supply or central waste water (sewage) system, unlike in most places in Britain, Canada, Europe and USA, where these central facilities are usually included in their property taxes especially in towns or cities . Also, Bermuda charges the highest initial Government licences, buying and legal fees and annual property taxes (here, Land Taxes) in the world, by a huge margin. For example, in central London, England, where an up to $900 million home with central water and waste water pays less then $3,000 a year in property (there, described as Council) taxes), Bermuda's annual Land Tax alone could cost well over $350,000 a year for a $90 million home. Potential buyers of Bermuda homes should make a point of asking their Bermuda-based realtor for the present Land Tax of any home in which they may have an interest. Presently, no realtor does so routinely.

![]()

See under Architecture. Architects in Bermuda must be registered under the Architects Registration Act 1969. In March 2004, more than 70 architects were registered.

![]()

And their impact on parking of motor vehicles

Each single family home and/or apartment has a 9-digit number, after the owner has received a Certificate of Use and Occupancy Permit (Completion Certificate). The owner of each valuation unit - a self-contained (with its own entrance, electricity meters, permit to own a car, etc) apartment or unit in the same building and/or any other building - will also have a (separate) number. Each 9-digit number is unique, no two are the same. The digits are, in this order, Parish number (2 digits); sequential number (4 digits); Split Digit (1 digit); Re-use Digit (1 digit); Check Digit (1 digit).

Persons who do not own but rent apartments in someone's house should always be given and make a point of knowing the separate assessment number of the apartment. This is for their own protection. If it does not have its own assessment number, the person or persons renting will not be able to own a car or have a separate electricity account and may also encounter further difficulties. For example, when the owner or owners of apartments who have not bothered to arrange to have their apartments given their own assessment number, but allow their tenant or tenants to have a car anyway, both they and their tenants are breaking the law and can be prosecuted, also with the likelihood that the car will be impounded or have to be sold. All responsible home owners, owners of apartments and real estate agents know this. There are also other potential problems. For example, when an adjacent or neighboring house - which may or may not be owned by a relative or friend - is used, with permission of the homeowner, for parking of any car used illegally or moped or scooter or all of them, that person too becomes contingently liable, plus also liable themselves or via their insurance companies for any damage caused by any means whatsoever to the car or moped or scooter while parked on the property. It is not right anyway for any tenant to have to park any vehicle in an adjacent or neighboring property because the owner of the property where the tenant is living does not have space in his or her own garage or driveway for the tenant's car and/or moped or scooter. Whenever a tenant parks regularly in any adjacent or neighboring property, he or she or they should always offer in writing to indemnify the property owner fully against all damage to the vehicle or vehicle or property caused by the vehicle or vehicles. Failure to so by a quality tenant could render withdrawal of parking permission or worse.

![]()

Non-Bermudians (as well as Bermudians) are eligible, subject to government scrutiny, to buy the property mentioned. It generally means that the property, which may be a condominium or a family home is in the top 5% of both Annual Rental Value (ARV) and Land Tax. Estate agents (realtors) state this on the properties they sell. However, it can also be a property within a Bermuda Government approved-for-sale fractional ownership complex.

![]()

Provisions include clamping down on the practice of "fronting", where a Bermudian illegally fronts a trust to buy and hold land on behalf of non-Bermudians.

![]()

![]()

Both a guide and specification document for contractors and home owners alike on all matters concerning traditional residential construction. Rigidly enforced, partially to ensure homes can withstand major storms. Individuals and entities wishing to bring new building products into Bermuda must first contact the Senior Building Inspector of the Department of Planning of the Bermuda Government to determine if the product meets local standards. Recently, innovative construction alternatives have included faux roof slate - imported - to replace or repair Bermuda slate and known as Dura Slate - steel frame dwellings and faux lumber (PVC) to replace or improve or with a better price than the local product.

![]()

Boundary Survey. If you are buying or selling a single family home, make sure the boundaries are staked and the stakes can be identified. If they are not staked, a surveyor should be consulted to do so. The vendor should either be asked or should volunteer to re-stake the property to confirm there are no encroachments on the property.

Structural Survey. While not yet common in Bermuda, the requirement for a structural survey is a prudent step in older properties that have not been rewired or re-plumbed for many years, and/or where termite damage is evident and/or or where the site may be steeply sloped.

![]()

The Bermuda Police Service issues reminders to the public to be sure to lock their homes before they leave for any length of time. There are numerous reports of break-ins at homes after they are left unlocked. Police tell the public to secure all windows and doors before leaving to prevent being victims of burglary. Thieves needing to fuel their drug habits are some of the nastiest and often the most violent or destructive burglars.

![]()

Based upon April 2019 market rates the cost of building a home with traditional residential Bermuda construction is over $410 per square foot. This excludes the cost of the land. The standard Bermuda price now for real estate is now a standard $1.5 million an acre, for undeveloped or re-developed land, without a house or utilities. For Bermudians, the average price of a single family detached home without water views is now over $1.2 million, of average size 0.25 acre. In Bermuda, condominiums now have about 62% of the total 2013 housing market. The average price of a condo in August 2013 was about $800,000. In comparison, in the USA in April 2013 the median price of an existing single-family home is $185,300.

Housing is on average about four hundred percent more than in the USA, and Canada, 220% more than in the UK.

Bermudian home. July 2009 Photo by author exclusively for Bermuda Online. Has "location, location, location."

Bermudian home. July 2009 Photo by author exclusively for Bermuda Online.

![]()

See Bermuda Immigration and Protection Acts. Some non-Bermudian residents with unblemished continuous residence have been in Bermuda for periods exceeding 20 and 30 years yet have not been given citizenship. It means they are not not allowed to vote, or to register to vote, in any election after they become 18 years old, even when they have been model residents for years. Those in this category are mostly from the USA, Britain, Canada, Caribbean and Europe, but some are from Africa, Asia, Australia, New Zealand, Philippines and elsewhere. Without citizenship, persons also cannot buy any real estate as Bermudians can if they can afford it; are limited to the top 5 percent of property in assessed value and a particular kind and type of property only and must pay a substantial purchase tax on top of other taxes; cannot obtain any local scholarships from any organization; if of employable age are not allowed to take any employment but are limited to the kind of employment on a Work Permit approved by the Immigration authority of the Bermuda Government; and may not under any circumstances be an executor or executrix of any Bermudian-owned property not in the top 5% of Annual Rental Value. Their attorneys are required to tell them this and would-be executors are expected to know this. They should also check with the Bermuda Government to see if it is permitted or not for them to benefit in any way financially from any Bermudian-held estate. They may only be executors of Bermuda property which is presently in non-Bermudian hands and as such is in the top 5% in Annual Rental Value. Nor are they - or any other non-Bermudian - allowed to be sole owners of a business in the local marketplace. They are limited to a maximum 40% holding in shares and management and are prohibited from employing any ruse that will enable them to overcome this restriction.

![]()

Condominiums located within the City of Hamilton are the easiest and quickest to buy and sell. Rental agents do not keep them on their books very long. They are in high demand and often come inclusive of high-quality, tasteful furnishings. They have all modern conveniences including full-size appliances, washers and dryers and basement storage units; some even come with such amenities as a roof terrace, pool or gym. Always in demand by renters, they are also popular with buyers and most are available to permanent resident certificate holders (PRCs) and overseas buyers. In April 2018, one-bedroom units in the city are listed for sale at between $525,000 and $675,000 and two bedrooms are asking $575,000 to $695,000. Rents for a one-bedroom start at about $2,900 per month; the price goes up to $4,500 for a two-bedroom. City units have held their value in the sales market much better than condominiums located outside of the city, and are likely to be a good investment for many years to come; because they tend to attract high-caliber young professionals or companies, rent is almost guaranteed. Most people find it easier to use a rental agent as they often have a list of people wanting to rent these type of units on their books already. They also know the real estate laws and have legally approved leases already made up at no additional cost to the landlord and are able to do credit checks on potential tenants. With city units, there is not necessarily the need for a car, although some do offer parking facilities. The units are on one level, with elevator access. They are safe, as security is often monitored with CCTV throughout the complex. None allow pets, the condominium owners’ association does not allow Airbnb rentals, and rentals should be for six months or longer. City complexes are convenient to almost everything within the city. Most have a full-time management company to take care of painting and other maintenance items, but with upkeep of the interior of the unit the responsibility of the leaseholder or tenant.

![]()

They include a Stamp Duty charged on a sliding scale. It is is usually payable by the Vendor and the Purchaser in equal shares.

Stamp Duties (tax) for property conveyance and transfer. From up to $100,000 in property value, 2%; $100,000-$500,000, 3%; $500,000 to $1 million, 4%; $1 million to $1,500 million 6%; over $1.5 million 7%.

For non-Bermudians, the length of time will be determined by how long it takes the Department of Immigration to process an application for a License to Acquire Property. This can range from 6 weeks to nine months. Sales contracts usually specify that the closing take place within a set time from the date of the grant of the License. A License to Acquire Property is required for non-Bermudians wishing to buy a home in Bermuda. The government charges a fee of 22% of the price of a house (or 15% if you are buying a condo) for this license, if it is granted. The review process is designed to determine that you are financially independent and not an 'undesirable.' Personal and financial references are required and will involve some research. Your local lawyer will guide you.

![]()

![]()

Some are available to overseas nationals, others are not.

Left, Condos, Convict Bay

Condominium ownership in Bermuda has become increasingly popular over the last 15 years partly because it requires a lower initial cash outlay and presents fewer responsibilities than for a traditional householder. Generally, a condominium owner is only responsible for the interior. External repairs, redecoration, grounds maintenance and insurance are shifted away from each owner, to condominium management. However, some homework is required before purchasing a condominium. Prospective buyers should determine to their satisfaction, by visiting each unit in which they may be interested, how much privacy and freedom there is, compared to and generally less than a traditional house. Rules and regulations written into condominium terms and conditions can seem restrictive. However, they can encourage good standards, for the benefit of all condominium owners. For example, noise can be reduced by requiring condominium owners to fit carpets and comply with auditory restrictions during defined night hours.

Often, businesses and trades are prohibited from operating from a condominium. On-going contributions towards maintenance expenses can seem burdensome, especially as development buildings age and require more upkeep. However, the owner of a traditional house is solely responsible for the costs of upkeep, whereas condominium owners share responsibility for costs and can together accumulate a specific reserve over time. Such an accumulated reserve is known as a “sinking fund”, which spreads out payment for expenses over time and between all owners in a development. If a development is extravagantly maintained, ongoing fees may be too high; but if poorly maintained, the development may be a less desirable place to live.

An acceptable balance is required. Watch for expensive upcoming costs, for example with the elevator, roof and other structural repairs as owners must contribute toward those costs unless an adequate sinking fund has accumulated. In this regard, a professional buildings survey may assist you to determine what any upcoming costs may be. Investigate the condominium company’s accounts for the last three years for a sinking fund, for any non-contributions and for financial health generally. Missing contributions may indicate vacant units, or discord among existing owners and such could affect the desirability of the development. Non-contributions may have to be made good by those that do contribute; this is unfair, but may be the only practical solution for essential works. If owners have a shareholding (and so a say) in the management company, expenses may be kept to an acceptable level.

Understand how and when maintenance charges can be increased, and determine the percentage contribution to ensure that the charges for the chosen condominium are fair. Check that the buildings insurance is at a reasonable premium, for an adequate sum, and covers the unit — and be aware of any unreasonable exclusions. In case of a catastrophe, management should be obliged to reinstate the development (and so each condominium), within a reasonable period of time, using insurance proceeds.

Most condominiums are leasehold. A monthly condo fee will apply. A leasehold property is a depreciating asset, however many leaseholds are for around 999 years. Leases with fewer than 70 years left are unlikely to prove a good investment. Finance is unlikely to be available for a short-term lease, and the property itself represents less value to pass on to children. In 2011 the Bermuda Government announced that more than 500 condominiums across the Island, including The Waterfront in town and Mizzentop in Warwick, can now be sold to non-Bermudians (restricted persons). Earlier, non-Bermudians could only buy condominiums with an ARV of $32,400 or higher. Government amended a section of the Bermuda Immigration and Protection Regulations Act and added 521 condominiums to the list of units that can be bought by expatriates. These amendments were made through a notice in the Official Gazette. Forty-three of the units are on former tourist properties. The Government notice stated the following condominium units are eligible to be held or acquired by restricted persons, namely non-Bermudians.

The list includes:

50 units at Manor House, Smith's

48 units at Mizzentop, Warwick

44 units at Southdown Farm, Southampton

43 units at Landmark, Southampton

40 units at Mount Wyndham, Hamilton

36 units at Inwood, Paget

30 units at Roxdene Apartments, Pembroke

30 units at The Waterfront, Pembroke

30 units at Cloverdale Apartments, Devonshire

26 units at Warwick Villas, Warwick

21 units at Panorama Apartments, Paget

19 units at Pink Beach/Hidden Cove, Smith's

18 units at Grosvenor Apartments, Pembroke,

18 units at Queen's Cove Apartments, Pembroke,

16 units at Mount Langton, Pembroke

12 units at Grove Apartments, Smith's

12 units at St James Village, Flatts, Hamilton

12 units at former Mermaid Beach Club/Breakers.

6 units at Palmetto Hotel and Cottages

6 units at former Surfside, now Cliffside.

4 units at Pomander Gate, Pembroke.

Units at Convict Bay, St. George's.

![]()

A conveyance deed is a document, with considerable stamp duties involved, that in Bermuda conveys legal title to the owner, if mortgage-free, or if with a mortgage, to the lender with whom the deed is lodged and with the mortgage recorded in the Book of Mortgages at the Registrar General's Office. When a mortgage is repaid, a re-conveyance deed certifies that the property is no longer encumbered, with the bank asking the owner for the name of his or her attorney. The re-conveyance makes it clear that the debt is repaid. The legal cost of a re-conveyance is less than the cost of a conveyance, with stamp duty payable by the owner based on the original mortgage loan amount. The attorney will also arrange for the mortgage to be marked as satisfied in the Registrar Genera's Office. Those who do not get a re-conveyance risk having major problems when they decide to sell.

Stamp Duties (tax) for property conveyance and transfer. From up to $100,000 in property value, 2%; $100,000-$500,000, 3%; $500,000 to $1 million, 4%; $1 million to $1,500 million 6%; over $1.5 million 7%.

![]()

There are strict development guidelines and rules. Development & Planning changes must be publicized before approval or otherwise. Bermuda's Department of Planning ultimately determines what can and cannot be done by way of development. Guidelines and specifications are set out in written form. Permission is routinely denied for anything which falls within these specifications and with the right guidance may well be permitted to do certain projects which fall beyond that scope, if in the public interest to make such exceptions. Those considering any development should consult an architect experienced and successful in dealing with the Planning Department.

All additions, alterations, conversions, conversions, extensions, improvements, etc, must be made to the Bermuda Government's Department of Planning, 3rd Floor, Government Administration Building, 30 Parliament Street, Hamilton. The applied-for changes will be advertised in the Official Gazette by Parish with the full name and address of the applicant in each Parish and the changes sought, with a Plan Reference number. Any person wishing to object must do so within 14 days of the date of publication of the relevant notice. Objections must be written, in letter format, stating any interest which the objector may have, with names and full addresses and with a concise statement of the grounds of the objection. For further details, see the Development and Planning (Applications Procedure) Rules 1997.

![]()

Everything depends on the reliability of this. When outages occur from gale force winds because only relatively few homes and streets have underground electricity, electric water pumps do not work and consumers cannot access the water. Some homes have - and many more need - portable generators (see separate heading). A serious disadvantage is if the property needs major electrical work. It could involve months of stress and strain in high humidity. All this is at a very high local cost compared to North America and Britain.

![]() .

.

Applies when boat-friendly or any other relevant water front property in any Bermuda parish is acquired by anyone, Bermudian or non-Bermudian. It will have to have a foreshore lease or licence. Most such places need one, especially those with their own dock. Why? It is a peculiarly British requirement. The Bermuda Government in this British Overseas Territory has freehold title to all of the foreshore and seabed from the mean high water mark and extending 12 nautical miles off shore (known as the Queen’s Bottom). When waterfront landowners construct docks or jetties (whether concrete or wooden) from their properties to gain access to the water and parts of that dock or jetty that project beyond their lot line and over the foreshore, it is classified as an encroachment. The Ministry of Works and Engineering, on behalf of the Bermuda Government, rectifies or regularizes these encroachments by issuing a foreshore lease for a term of 21 years. If, however, the dock has been in existence and unchanged for a period of over 60 years, which must be proven with affidavits, official plans etc, then it is deemed to be “regularised” and exempt from a lease. Most reliable sales agents will guide their sellers who have waterfront property through this process when securing the listing as it can take some time and it makes for a cleaner sale if this paperwork has been sorted out before the property goes on to the market. Sellers of applicable Bermuda property may wish to consult an attorney.

![]()

Fairly new, relates to private membership property developments and hotels. Now a popular form of property ownership in Bermuda by non-Bermudians. Fractional ownership offers the purchaser a deeded real estate interest in a Bermuda residence but they do not confer any permanent residency or work permit rights (they have to be applied for separately and are based on merit or appropriate employment opportunities, in both cases needing approval from the Bermuda Government. But for regular visitors who do not seek permanent residence or to work in Bermuda, these developments offer many amenities such as swimming pools, tennis courts, golf course/club, beach clubs etc. The purchase licensing fee is a percentage of the purchase price. Some are being sold by hotels, others by realtors.

![]()

2018 Garbage collection days, according to the Bermuda Government are:

Mondays: All of Sandys Parish. Western Southampton Parish down to and including Church Road. Tuesdays: East of Church Road, Southampton, to and including Cobbs Hill Road, Warwick.

Wednesdays: East of Cobbs Hill to Trimingham Hill and Crow Lane, Paget. Pembroke — west of Blackwatch Pass, Barnard’s Park, the junction of Court Street and North Street and Woodbourne Avenue.

Thursdays: Pembroke — east of Blackwatch Pass, Bernard Park, the junction of Court Street and North Street. East Paget from Trimingham Hill. All of Devonshire Parish. Smith’s Parish up to Devil’s Hole Hill. Western end of Hamilton Parish up to and including Flatts. Fridays: Hamilton Parish from Flatts to the Causeway. Smith’s Parish from Devil’s Hole to Pink Beach. All of St George’s Parish.

![]()

And alternatives if you don't have one.

Whether buying or renting, an apartment of any size or house with a garage is essential for a car (only one per household is allowed) or moped or scooter. Those without one should be avoided because vehicles not stored in them just do not stand up to Bermuda's salt-laden air, constant winter gales and periodic hurricanes. Do not leave your vehicle outside at night without being securely garaged (in a garage with four solid walls, not a flimsy carport). Even rust-proofing is only partly effective for garaged vehicles. Be aware that Bermuda can often have hurricanes or storms or gales and plenty of rain.

Left out in the driveway or under a flimsy car port, many vehicles in Bermuda could suffer damage. In the aftermath of recent hurricanes many people returned to their vehicles only to find them damaged or destroyed as a result of flooding and fallen debris. If you cannot garage your car, park in a public car park such as Bull’s Head, Hamilton. The cement structure may keep your vehicle safe in a severe storm. Or park away from land which is liable to flooding and try to locate a lee, such as a wall or a rock face for your vehicle to keep it safe from high winds. Don't park near trees or electricity poles. Casuarinas are shallow-rooted trees, which can be easily uprooted during a storm. Norfolk Pines have branches that can break easily and can damage your vehicle. If your car is exposed to wind and rain, try to park the car with its rear-end to the wind. This prevents salt, sand and debris from getting under the hood and into your engine.

![]()

For home owners who do not wish to do this themselves, they can employ a gardener or gardening contractor.

![]()

Especially after hurricane scares when virtually all Bermuda homes can be without electricity for periods ranging from days to three weeks, portable generators are an absolute "must" for all who own homes and many who rent apartments. There is a very high Bermuda Government Customs Duty rate on them, exceeding 30%. If bought locally, they can retail for over $2,000. If bought and imported privately, from places such as Home Depot in Florida or New York, they will still cost more than $950 after transportation delivery and Customs duty. As most homes in Bermuda are of limited acreage (one third or less) and are close together, the noise of a generator can be very stressful, so should be plugged in only during the day.

![]()

But not be employed, for which a separate Work Permit is required by any non-Bermudian.

![]()

If living close to a neighbor, hedges and trees are often a nice screen and help maintain privacy. If you decide to cut your side of the hedge between you and your neighbor you are entitled to cut any branches or roots that cross over the property boundary onto your land. You can also trim parts of your neighbor’s tree that may hang over your property line. However, the branches and roots still technically belong to your neighbor, so you should speak to him or her first to see if they would prefer to trim it themselves or if they want to keep the branches. You cannot go on the tree owner’s property without their permission, unless a branch poses immediate potential harm. You may be liable for costs if you cause the structural integrity of the tree to be harmed. You should also check that that particular tree is not subject to a preservation order with the Department of Agriculture. You are responsible for maintaining any trees growing on your own property. Regular hedge and tree maintenance is the best way to avoid problems. Trees that do not receive regular pruning may become weak, and are more vulnerable to high winds and other extreme weather events. Removing dead or diseased limbs seasonally is beneficial because high winds can rip trees out of the ground. Because this is referred to as an act of God, tree owners are not responsible for damage caused to neighboring properties unless it has previously been reported that the tree is unsafe and requests to correct the problem have been ignored by the applicable parties. A fallen tree in your yard, whether it is yours or not, is your responsibility to remove; your neighbour may be willing to help out. If you are on friendly terms it may be possible to split the cost of having a downed tree removed, however if you and your neighbour are on poor terms it may be difficult. If a tree from your neighbor’s yard damages your home or garage, will your homeowner’s insurance pay for the structural repairs? Or will your neighbor? If the tree damages your car, your comprehensive coverage should offer to pay for repairs.

The growth habit of trees can create complications between neighbors. The canopy of a tree may extend over the adjacent lot and if a young tree is planted near the boundary, the trunk may grow large enough to cross the property line. A tree usually belongs to the property where its trunk stands however when the tree trunk overlaps the property line, it can become unclear who owns it. Maintenance of a boundary tree is up to the affected property owner, but both owners must agree to any work that affects the whole tree. The owner of the tree, or part thereof, has a legal responsibility to prevent it from causing harm to any other property. That may include cutting back branches or roots if they have the potential to cause injury or damage or if the tree is shown to have harmed the adjacent property. If a tree or tree limb falls and damages the property, the tree owner may be liable for damages if it can be proved that the damage was caused due to the owner’s neglect of the tree’s maintenance. Hedge and boundary issues can be very emotive and in all cases, communication with your neighbour is important and can help alleviate contentious situations.

Homes with their own lawns will keep their homeowners or renters busy. In drought conditions, which can be frequent in the summer months, it is not advisable to use chemicals to control weeds or even pest and diseases unless the plants are well irrigated and then only in the cool of the day. A "good" lawn should be virtually weed-free, of good colour with little or no thatch and of one grass type. Selecting the right grass type for the specific area will save future headaches with less maintenance problems to deal with. Mixed type lawns can be troublesome not only from a patchwork appearance but also with weed control as chemical control for one type of grass may adversely affect another type. Common Bermuda grass seed is sown at a rate of two to three pounds per thousand square feet, sow in two directions to obtain a more equal coverage. St. Augustine plugs are planted at four inches to six inches apart and are best installed in spring. As temperatures rise, they will, when maintained properly, in-fill quickly. Warm season grasses are St. Augustine and variety Floratem, a chinch bug resistant strain; Bermuda grasses and their hybrids and Zoysia. St. Augustine grass is not always advisable as it is subject to attack by chinch bug which will devastate a lawn in a short period of time given the right conditions. Many homeowners prefer to let landscaping companies handle their lawn mowing and maintenance.

![]()

![]()

Home owners have accountability and responsibility when facing and after hurricanes. They must address the curb appeal (ie fixing broken screen doors, clearing out clutter, freshening up paint, etc) and be sure the property is hurricane-ready. The checklist includes making sure shutters are intact and close securely; fixing cracks in the roof and loose tiles; securing pergolas and balconies; for those with boats, strengthening moorings; installing a generator or having one in the garage that could be included with a sale. Prospective purchasers definitely look more at features that will help protect homes and their investment in the event of storms. Even the neighborhood comes under scrutiny. Areas which have been diligent in burying cables underground and trimming large trees are advantaged. Minimizing homeowner responsibilities via good property maintenance is essential, especially for those who travel often or are elderly or have little time to attend to repairs and maintenance. They will benefit from owning a condominium in an established development.

Condominium complexes have protocols and resources in place particularly for hurricane-preparedness which are invaluable for those off Island or unable to perform the work themselves. Property managers and on-site caretakers may assist or get help with closing shutters; cutting back foliage from power cables; inspecting loose debris; stowing garden furniture and outdoor items especially barbecues; turning off major appliances; plugging gutters; establishing contact information for neighbors. Property managers are also key to record damage assessments while the boards file collective insurance claims as per condominium policies. There are no guarantees that residents will have power throughout or immediately after a storm, but it helps to live in a community that is designed to reduce the exposure. Many modern condominium complexes have buried cables underground which provided for power continuity throughout the recent storms. For those who live in rented single family houses or duplexes or apartment blocks, expect the landlord to take all the necessary actions.

![]()

Especially relevant for non-Bermudians working in Bermuda on Work Permits. These should be avoided as they are a potential source of trouble and expense.

An illegal apartment is one that has not passed the tests of the Bermuda Plan 1992 Planning statement and has one or more of the following faults:

![]()

When property - houses and/or condominiums and/or land - is passed on by a parent or parents to their children or relatives, they become owners and/or co-owners. There are two kinds of co-ownership, one known as "joint tenancy" and the other as "tenants in common." There are significant differences between the two. It's also a legal oddity that despite a person or persons concerned being owners or co-owners they are legally joint tenants or tenants in common as the case may be.

A house and land held in a joint tenancy results in each co-owner having an unascertained share. That share cannot be sold separately; if a co-owner dies, the deceased's share automatically goes to the other co-owners whether or not there is a will. A joint tenancy is usually most appropriate for a husband and wife, who remain married and wish the surviving partner to automatically own the marital home in full after the death of one spouse. For a joint tenancy, "four unities" must exist - those of possession, interest, title and time. Unity of possession means that each co-owner is as much entitled to possession of any part of the land as the others; unity of interest means that the interest of each joint tenant is the same in extent, nature and duration; unity of title means that each joint tenant must claim their title to the land under the same act or document; and unity of time means that the interest of each tenant must vest at the same time. The four unities are often present in a tenancy or voluntary conveyance of land to two or more individuals, without any further reference regarding the kind of ownership. However, the four unities can be displaced by "words of severance", which if used indicate co-ownership by way of a tenancy in common. Additionally, the four unities can be displaced if there is evidence of an intention contrary to creation of a joint tenancy. For example, if business partners acquire land as co-owners, the established rule is that ownership automatically passing to the other co-owners has no place in business. Business partners usually, therefore, have a tenancy in common unless specific wording is found creating a joint tenancy. A joint tenancy can become a tenancy in common by a process known as "severance", which occurs by the action of one or more co-owners, or by a course of transactions, indicating a tenancy in common. After severance, each co-owner usually has an equal share in the newly created tenancy in common.

In a tenancy in common, where each owner has a specific share, for example 25% each in a family of four children, or 50% each with two children, or by arrangement each co-owner can hold an agreed proportion of the property. This form of co-ownership also enables all the parties concerned to transfer their shares during their lifetime if they wish, without any legal requirement to notify any other party beforehand and bequeath their shares entirely as they wish in their will, a process which will ensure their shares continue to be protected. This means that on the death of any of the co-owners in a tenancy-in-common, their shares do not pass to other co-owners (as it does in a joint tenancy) but to a spouse or another or others designated in a will. One characteristic of a tenancy in common is that a co-owner can transfer his or her interest to a third party. However, such a transfer could result in a new and undesirable co-owner. To avoid such a possibility, co-owners may wish to enter into a scheme requiring a selling co-owner to give a right of first refusal to the other co-owners. If a co-owner of either a joint tenancy or tenancy in common desires to sell without the agreement of the other co-owners, the Partition Act 1855 provides a potential remedy. The co-owner desiring sale may apply to the Supreme Court for an order, which could result in a sale of the land, as directed. After sale, proceeds are allocated to the co-owners in accordance with the court order.

An attorney expert in the area can assist with:

advising if land to be acquired should be held as a joint tenancy, or as tenants in common;

finding out if land already acquired is held as a joint tenancy, or as a tenancy in common;

transferring a joint tenancy to a tenancy in common;

arranging a scheme for co-owners to have first refusal against a selling co-owner;

transferring a tenancy in common to a joint tenancy; or

attempting to force the sale of co-owned land.

When a will does not specify that co-ownership of a property goes to specific individuals in joint tenancy or as tenants in common, a lawyer may suggest a Declaration of Trust be signed, to record the respective shares. If the property is sold in the future the amount of equity distributed to each owner will reflect the terms of the Declaration of Trust. A lawyer should be consulted for more details, terms and conditions, changing from joint tenants to tenants in common, etc. and to inform clients of any problems.

![]()

Land taxes in

Bermuda are property (or Council if in the UK) taxes elsewhere. Land taxes in

Bermuda do not include access to a municipal or local water supply or sewage

disposal. Land

Taxes are a property tax charged on all developed land throughout Bermuda with

some minor exceptions. Bermudian home owners over 65 qualify for exemption

or a rebate (a) when the property is registered in their own names, not in the

name(s) of their child(ren) and, since early 2012 (b) if the ARV is less than

$50,000 The expression "land" is used in its broadest

sense to include land, buildings and structures attached to land. Undeveloped

land is not liable to tax, though developed land that is merely unoccupied is

still liable. Each piece of property that is liable to tax is known as a

"valuation unit" and details describing it and its assessed annual

rental value (ARV) are entered in the Valuation List. This List is prepared and

maintained by the Land Valuation Officer under the authority of the Land

Valuation and Tax Act 1967 as amended. A printed copy of the Valuation List is

available for public inspection at the Land Valuation Department. Note that The Land Valuation Department just deals with the property and

its assessment. The Tax

Commissioner's Land Tax Officer calculates the amount of land tax chargeable on

all valuation units and demand notes are issued to taxpayers half-yearly. The

amount of tax for each property is determined by multiplying the ARV by the appropriate tax rates.

Bermuda's Land Valuation and Tax

Act 1967 as amended requires all properties on the Island be revalued every five

years, at the same time. See the Land Valuation website www.landvaluation.bm.

Land taxes are payable

to the Bermuda Government by all

Bermudian and non-Bermudian property owners. It is based upon

the Assessed Rental Value (ARV) for each private dwelling (apartments, condominiums and

single-family detached homes) and commercial buildings with the ARV determined by the Bermuda Government's Land

Valuation Officer.

Land taxes in

Bermuda are property (or Council if in the UK) taxes elsewhere. Land taxes in

Bermuda do not include access to a municipal or local water supply or sewage

disposal. Land

Taxes are a property tax charged on all developed land throughout Bermuda with

some minor exceptions. Bermudian home owners over 65 qualify for exemption

or a rebate (a) when the property is registered in their own names, not in the

name(s) of their child(ren) and, since early 2012 (b) if the ARV is less than

$50,000 The expression "land" is used in its broadest

sense to include land, buildings and structures attached to land. Undeveloped

land is not liable to tax, though developed land that is merely unoccupied is

still liable. Each piece of property that is liable to tax is known as a

"valuation unit" and details describing it and its assessed annual

rental value (ARV) are entered in the Valuation List. This List is prepared and

maintained by the Land Valuation Officer under the authority of the Land

Valuation and Tax Act 1967 as amended. A printed copy of the Valuation List is

available for public inspection at the Land Valuation Department. Note that The Land Valuation Department just deals with the property and

its assessment. The Tax

Commissioner's Land Tax Officer calculates the amount of land tax chargeable on

all valuation units and demand notes are issued to taxpayers half-yearly. The

amount of tax for each property is determined by multiplying the ARV by the appropriate tax rates.

Bermuda's Land Valuation and Tax

Act 1967 as amended requires all properties on the Island be revalued every five

years, at the same time. See the Land Valuation website www.landvaluation.bm.

Land taxes are payable

to the Bermuda Government by all

Bermudian and non-Bermudian property owners. It is based upon

the Assessed Rental Value (ARV) for each private dwelling (apartments, condominiums and

single-family detached homes) and commercial buildings with the ARV determined by the Bermuda Government's Land

Valuation Officer.

By American and Canadian standards, Land Taxes, paid on homes and condominiums twice a year, are not too onerous for most middle-income Bermudians but for non-Bermudian owners of local properties are extraordinarily high, the highest in the world by far. They cannot be compared to Council Taxes in the UK because the Bermuda annual land taxes are hugely more than any UK council taxes. (For example, in 2016 in Westminster, London, $950+million Buckingham Palace and all other London millions-of-pounds properties pay less than £1500 a year in total Council Taxes (the equivalent of land taxes) but in Bermuda a much smaller $20 million property owned by a non-Bermudian, depending on its ARV, could easily cost the owner an outrageous more than $85,000 a year in annual Land Tax, for nothing more than periodic outdoor removal. Far more so than in any other country, Bermuda's land taxes on non-Bermudian owned property have been increased hugely in recent years.

Land Evaluation Appeals Tribunal. Those who complain about their taxes can try complaining to this Bermuda Government body, appointed under the Land Valuation & Tax Act 1967 and shown in alphabetical order in Bermuda Government Boards.

Who pays Land Tax? Usually, the Land Tax on Private Dwellings on rented properties is paid by landlords, not tenants. But it is not uncommon for many local landlords to include the Land Tax in the sum they ask for rentals.

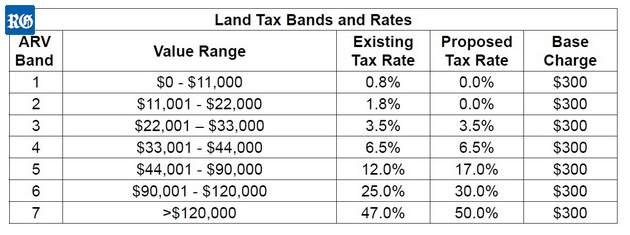

Present land tax bands and rates with effect from July 1, 2019 under Land Tax Amendment Act 2019

Aimed at tourist units such as hotels, cottage colonies and guesthouses, but excludes vacation rental units. On top of a base charge of $300, the Act imposes charges based on the property’s annual rental value, with a special rate for properties inside Economic Empowerment Zones. However, additional landholding charges that had been scheduled to take effect on March 31 this year have been deferred another two years, under the Bermuda Immigration and Protection (Landholding Charges) Amendments Regulations 2019. Also tabled was the amendment to hike the foreign currency purchase tax from 1 per cent to 1.25 per cent, and Bills extending customs duty relief to hotels and restaurants to 2024.

Earlier Property tax, based on ARV of each property band, payable twice a year, and how they increased:

| Up to – US$11,000 | from 0.60% to 0.8% |

| US$11,001 – US$22,000 | from 1.20% to 1.8% |

| US$22,001 – US$33,000 | from 2.40% to 3,5% |

| US$33,001 – S$44,000 | from 4.80% to 6.5% |

| US$44,001 – US90,000 | from 9.60% to 12% |

| US$ 90,000-$120,000 | new rate, 25% |

| Over US$120,000 | was 18.23% now 47% |

How these property taxes compare internationally

In UK. For £950 million 830,000 square feet Buckingham Palace, London, including staff accommodation. Band H. £1,639.04 (about $2504) annually.

In UK. For a £170K 1,750 square feet 3 bedroom house in Scotland, Band F. £1,672.67 (about $2592) annually.

In Miami, Florida and most US places including Puerto Rico, average property taxes on a $20 million 11,500 square feet house are $25,000 a year.

In Bermuda. For a $20 million 11,500 square feet house with ARV of $564,000 plus staff apartment with ARV of $48,000. $92,292 plus $1,374 (total $93,666) annually. Highest property or land tax in the world, by a huge margin.

Presently, when offering Bermuda Homes for sale of a type that may be sold to non-Bermudians, most Bermudian realtors do not list the land taxes relevant to each property. It is particularly recommended that before buying any Bermuda property, prospective owners ask their Bermuda realtor to ascertain what the ARV and annual land tax on that property will be.

![]()

Land

Title Registry Office, Milner Place, 32 Victoria Street, Hamilton HM11.

Mailing Address: PO Box HM 2587,

2018. July. Implementation of the Land Title Registration Act. The Land Title and Registration Office is responsible for registering land and property ownership in Bermuda. Its duty is to record any legal right or interest affecting parcels of land and to provide an up-to-date report of the evidence of land ownership. Individuals, businesses or organisations who become land owners or own interests in land must apply to the LTRO to: register unregistered land, register a new owner of a registered property following a sale; and register an interest affecting registered land, such as a mortgage, lease or a right of way. Once the information is recorded, the LTRO will provide an accurate, accessible and comprehensive record about land and property ownership and any interests affecting land as well as provide land owners with a land title certificate/registered title.

2018. June 16. A new register of land ownership will crack down on people who try to cheat vulnerable owners out of their property, MPs heard yesterday. Lieutenant-Colonel David Burch, the Minister of Public Works, said the new land title registry would end a “sorry and deplorable” history of real estate agents and lawyers swindling clients. Colonel Burch explained: “This system will provide for the guarantee of legal ownership of land and the simplification of conveyancing transactions.” He added the register would become “the definitive record of title” and that any further transactions could be carried out quickly and at low cost. Further, once a title is registered, title to that land is guaranteed, and cannot be lost or stolen.” He said that land exchange on the island came with a “long and sad history”, in which many had been cheated by “unscrupulous professionals, and even at times by family members. Landowners who opt to register their deeds would obtain absolute title. Property owners would finally be able to secure their real estate, and the land that they worked so hard to obtain, their piece of the rock that they want their children and grandchildren to inherit and maintain after they are gone, their legacy, will for ever be safe. It is unconscionable to this Government that landowners would have to pay lawyers’ fees for this service, so we will amend the Act to remove the requirement for a lawyer to examine the deeds.” Staff at Government’s Land Title Registration Office will instead carry out searches and grant registered titles. The modernized system will come into force at the start of next month. Colonel Burch said the change will complete the move from a deeds-based registration system that dated back to 1999. Shady practices in the real estate market sparked a debate in the House of Assembly in 2014, when the Progressive Labour Party was in Opposition. A Commission of Inquiry was approved by Parliament, but it was never authorized by the Governor. Colonel Burch predicted “great interest” from the public and that voluntary registration would start by appointment only to allow the office to handle the workload.

![]()

If you lease instead of own an apartment or condominium or home, you will not rent by the month but will lease for a specific, mutually-agreed time. Leases are legal and breakage of a lease should not be attempted without risk of a severe penalty. If an employer, not a professional newcomer employee, signs a lease, great care should be taken by the employee not to put the employer at risk. The employee will still be liable to the employer for payment of utilities, conduct and care and interior maintenance of the leased property.

There is a leasing stamp duty (tax), based on monthly rent. It will cost for rents up to $1,200 (most working non-Bermudians will pay far more) $75; up to $1500, $100; from £1,500 to $2500, $150; from $2500-$3,500, $200; from $3,500-$5,000, $300; and over $5,000, $400.

A lease is a contract requiring a landlord to provide accommodation and the tenant to pay a rent for use of the accommodation for a fixed time period. Normally, many other conditions are included in a lease, such as who is to pay the land tax etc. As the contract is for a fixed period, any party breaking early is in default and may be liable to compensate the non-defaulting party. Often, a lease is for a foreseeable time period, such that neither party requires the contractual ability to terminate early due to a change in circumstances. If a lease is for a longer period, a landlord and tenant may agree contractual circumstances when one or both may require early termination without liability for loss. As expatriates - newcomers from abroad - constitute a significant portion of the Bermuda residential lettings market, residential leases usually allow a tenant to terminate early in the event that a work permit is withdrawn or not renewed. In such circumstances, the tenant is able to serve notice and the landlord can look for an alternative tenant during the notice period. In the commercial market, landlords and tenants generally look for longer term arrangements but with some added flexibility. A landlord ideally requires a long lease period but a tenant often prefers a shorter period. Both can be accommodated by a longer lease period but with the tenant afforded the ability to surrender (also known as a break clause), for example, halfway through the period. Tenants are often also given an option to call for a new lease period, which is often known as renewal. A tenant that can pay the rent is likely to want to stay at the end of a lease period as moving out can lead to significant expense and business interruption costs. Consequently, landlords are often flexible when negotiating lease periods. Generally, there are three options for a tenant wanting to move out before the end of a lease period: surrendering, transferring, or subletting. Unless contractually available, surrender cannot be forced on a landlord. Logically, unless the landlord has a replacement tenant, at an equal or higher rent, a landlord might refuse to accept surrender. Ordinarily, after surrender, neither the landlord nor the tenant has any liability or obligation to the other. For this reason, the landlord should ensure that all the tenant’s obligations under the lease have been complied with and rents paid, before signing or accepting the surrender. If a landlord is unwilling to accept surrender, a tenant might next consider transferring also known as assigning the lease to a third party assignee. After such a transfer, the assignee “stands in the shoes of the tenant” and is liable to the landlord as the tenant would otherwise be. A disadvantage to transfer is that the tenant remains liable to the landlord for default by the assignee. A tenant may request a release after transfer but there may be no obligation for the landlord to give such a release. If either surrender or transfer is unavailable, a tenant should consider subletting. When a tenant sublets, the tenant remains liable to the landlord under the lease as before. A wise subletting tenant shall ensure, as far as possible, that all lease obligations are passed to the sub-tenant. However, even in those cases, the tenant can remain ultimately responsible to the landlord. A lease often states the circumstances under which a tenant may sublet. A landlord shall be interested to make sure that the sublet contains acceptable conditions because for practical reasons, the sub-tenant can become the landlord’s immediate tenant. This can happen, for example, if a tenant becomes bankrupt. Subletting or sharing by a non-Bermudian company may require a license from Government under section 123A of the Companies Act 1981. There is no such thing as a “standard lease” and so it is important to obtain legal advice and know the contractual conditions before signing a lease, whether landlord or tenant."

![]()

The Waste and Litter Control Act 1987and its penalties may apply, but only if the litter from yours or another person's rented or leased or owned apartment or condominium or house is visible from a public place, for example, from a main road or estate road, park, etc. This type of litter should always be reported first to the Bermuda Government's Department of Works and Engineering for investigation.

![]()

The Book of Mortgages at the Registrar General's Office will have details of all conveyances where mortgages are involved and all re-conveyances satisfying the mortgage. Bermuda banks are willing to lend approved buyers up to 80 percent of the appraised value of a house or property when the applicant has the appropriate means. With an average mortgage of 20 years, persons who are given a mortgage should expect to pay a variable rate from 7.25 percent plus fees. A household would need to earn at least $7,000 a month to qualify. Organizations that provide mortgages include banks, savings and loan entities, possibly some local (Bermudian) insurance companies; some law firm's trust department. Some will lend to non-Bermudians. Terms range from 5-20 years.

![]()

Bermuda largely follows the UK system, except that the UK system has been amended recently, unlike in Bermuda. Technically, a neighbor can object to an owner or new owner's application to Planning for amendments, upgrades, improvements and renovations. Anyone contemplating buying a house that has been noted or described by a realtor or neighbors as needing fixing up or extended or improved or in any modified in a way that needs Planning approval and wanting to make any such alterations now or in the future should make a special point of first asking the selling agent for details and also neighbours of that property if they are likely to object. In theory, if not in practice too, a house clearly in need of an extension or other modification should have had planning permission in principle granted, after an appropriate plan has been submitted. It may reduce the prospective value of a house if this has not been done. A potential seller should also compare the asking price with an competent and reasonably timely market-price evaluation by a qualified surveyor. You are advised not to buy the house if a planning application is likely to be rejected. It's been claimed, but this is arguable, that no purchaser is likely to pay to have plans drawn up and neither would he be able to submit them, until after he/she is the owner and the old owner has received his payment. Any objections a new owner may or may not make to plans a new owner of a house may produce in the future would be the business of the neighbor or neighbors entirely, after considering whether there would be any point under the planning and zoning laws.

![]()

See under Land Valuation and Land Taxes.

![]()

Are required to have a valid license for the current financial year, under the Real Estate Brokers’ Licensing Act.

![]()

Applies to all who deal in Bermuda real estate.

![]()

![]()

See under Land Valuation & Land Taxes.

![]()

Beware of possible water tank contamination. All who seek to rent a Bermuda home, whether on a short term holiday (vacation) basis or on a monthly lease or rental agreement, are strongly advised, before the rental period occurs, to get it in writing that the owner or owners have had the property and in particular its water tank both examined and certified by a competent Bermuda authority such as the Department of Health, as free from any water contamination that could cause potentially very serious health problems. Most folk who are not Bermudians or long-term residents don't know that Bermuda has absolutely no standard piped-in underground fresh water supply and no piped-out underground waste water and sewage system. It also has rivers or a rainy season, no fresh water lakes. It has to be said publicly that many Bermuda home owners and landlords do not comply with nearly 65 year old Bermuda Government regulations - Public Health (Water Storage) Regulations 1951, which require all household water tanks to be professionally cleaned every six years, as a result of which unsuspecting tenants could be unwittingly exposing themselves, their children and their pets to dangerous drinking and bathing water. It also has to be said that these regulations, which in any event are too old to comply with international current standards, have not been enforced in Bermuda and that many properties have not had their tanks professionally cleaned for possibly as long as 30 years. Many water tanks located in homes rented to non-Bermudians do not meet American, Canadian and other international hygiene standards and prospective renters should make a special point of asking for appropriate certification that water tanks have been cleaned recently before they rent. If they cannot be supplied with such certification they should not rent the property, period.

![]()

Rents for non-Bermudian employees. Some non-Bermudian newcomers may be receiving a housing allowance from their employers. It can pay all or some of the rental costs. Utilities are always extra. Newcomers are advised not to pay any more than 28% of their salary on accommodation if they do not receive a partially compensatory housing allowance.

Rent Control. Applicable to Bermudians. Homes with a low annual rental value are regulated by the Rent Commission to give tenants in lower-value properties security of tenure and prevent landlords from increasing rent arbitrarily and unfairly.. A Bermuda Government spokeswoman said the change was being made on the basis of information provided by the Department of Land Valuation from its latest draft valuation list. Rent control has been in place in Bermuda since the late 1970s and is enforced by the Rent Commission.

Landlords and tenants should be aware that a court action may result if the landlord of a rent-controlled property (house or apartment) shows a disregard for the rights of a tenant. A common example of this is physical removal of the tenant or his possessions to re-let at a higher rent. Landlords should know that an order of a court is always required before a tenant may be lawfully dispossessed.

![]()

Owners of roadside properties are responsible for trimming back overhanging trees and hedges. They must cut back vegetation which has encroached onto public roads. Overhanging vegetation can cause safety hazards to road users including obstructed visibility, damage to bus and truck windscreens, and injury to pedestrians, cycle riders and waste collection personnel. Vegetation needs to be kept clear at least 4.9 metres (16ft 1in) above the road surface, or 3 metres (9ft 10in) above the surface of a pedestrian walkway or verge. If property owners do not heed requests to trim back their vegetation in reported problem areas, a statutory nuisance abatement notice will be served on owners.

![]()

With drug addition rife and burglary and other anti-social crimes common, Bermuda is not a low-risk area.

![]()

Vendors are usually responsible for paying 50% of the stamp duties (see below) on a conveyance. Sellers of properties in Bermuda need to produce title deeds going back at least 20 years. Title deeds must be kept in a safe place known to the owner at all times. Those who have a mortgage should expect the mortgage holder to retain possession until it is satisfied. Possession of a deed is required to mortgage or sell a property.

![]()