Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

![]()

By Keith Archibald Forbes (see About Us).

Bermuda-based international insurers, Bermuda Royal Gazette newspaper photos

See

Bermuda's International Business, including Insurance and Re-insurance Companies

Bermuda Online's Business and Economy Index for applicable Bermuda Business Laws

![]()

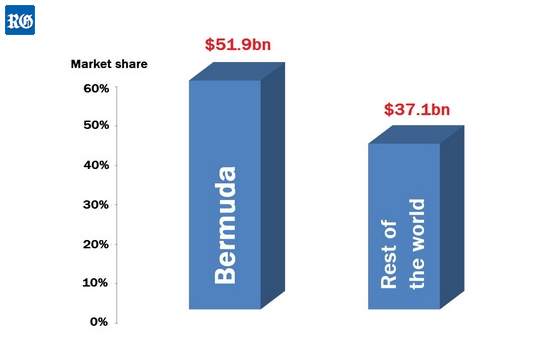

Bermuda re-insurers make up about 36 percent of the global reinsurance market based on property/casualty net premiums earned, according to the most recent report of credit rating agency AM Best Co.

2019. August 15. More than 20 per cent of the world’s top 50 largest reinsurers are based in Bermuda or have a significant presence here. In a latest rankings, PartnerRe Ltd is the highest placed Bermudian-based company, appearing at 12 on the 2018 list from ratings agency AM Best. It had $6.3 billion of unaffiliated life and non-life reinsurance gross premiums written, as measured by AM Best’s methodology. The list was released as part of a 74-page Global Reinsurance market segment report published on Thursday. One spot below PartnerRe on the list is Everest Re Group Ltd, with similarly assessed gross premiums written totaling $6.22 billion, while at 14 is XL Bermuda Ltd with $5.21 billion unaffiliated gross premiums written, according to AM Best. RenaissanceRe Holdings Ltd and Axis Capital Group Ltd, also make the top 20, while Arch Capital Group Ltd is at 21. Others on the list include Tokio Millenium Re, Aspen Insurance Holdings Ltd, Validus Reinsurance Ltd, Hiscox Ltd, Chubb Ltd, and Third Point Reinsurance Ltd. A new entry at 47 is Argo Group International Holdings Ltd, while Maiden Holdings, which had been at 40 in 2017, did not make it into the latest top 50. In its report, AM Best called the Maiden Re result the most significant drop. It added: “The drop was driven by Maiden Re’s decision to divest all of its US treaty reinsurance operations, which no longer factor into its premium revenue.” Swiss Re Ltd changed places with Munich Reinsurance Company to top the list with unaffiliated gross premiums written estimated by AM Best at $36.4 billion. AM Best noted that the year-on-year growth in the top 50s total gross premiums written was close to nil, with the 2018 total at $263 billion. There had been growth in 2017, which was driven largely by reinstatement premiums resulting from hurricane losses created by Harvey, Irma and Maria. The combined ratio of the 2018 top 50 was 100.9, reflecting the losses sustained from US hurricanes, wildfires in California and Typhoon Jebi in Japan, however it was a substantial improvement on the collective combined ratio of 109.1 seen in 2017. Bermuda-based reinsurers also dominated AM Best’s subgroup showing the top 15 global non-life reinsurance groups. Again using a measurement of unaffiliated gross premiums written, Everest Re, Partner Re and XL Bermuda were seven, eight and nine, respectively, on the list, with RenRe at 12, and Axis Capital and Arch Capital at 14 and 15 respectively. The list was led by Munich Re. In introductory remarks to the report, Matt Mosher, president and chief executive officer at AM Best, said: “In December 2018, we revised our outlook for the global reinsurance segment from negative to stable. “Reinsurers faced a challenging year in 2018 — following an even more challenging 2017. Typhoon Jebi, California wildfires, and Hurricanes Florence and Michael caused above-average insured losses even as insurers and reinsurers were hoping for a respite after 2017. At a recent panel discussion we held, reinsurance experts agreed that, after the natural disasters in 2017 and 2018, the reinsurance market would be more rational over the near term and that third-party capital investors would maintain their presence in the market owing to differing return expectations and lower interest rates.” AM Best’s market segment report on global reinsurance also features commentary on trends at Lloyd’s, the mortgage market, collateralised reinsurance, Asia-Pacific, Latin America, Middle East and North Africa and sub-Saharan Africa.

2019. July 1. Regulation poses the greatest threat to the global insurance industry due to the volume of change and associated cost, according to Bermuda-based respondents to a survey of insurance industry professionals. One survey respondent said that regulation is “strangling of our ability to operate effectively across jurisdictions and leverage our capital. [This] is a huge and expensive problem”. The Insurance Banana Skins global report, issued biennially since 2007, is published by the Centre for the Study of Financial Innovation in association with professional services firm PwC. This year’s analysis is based on 927 responses from 53 territories, including 32 Bermuda respondents. Fourteen were from the reinsurance sector, while there were nine non-life respondents, two life respondents, and one composite respondent. Six respondents identified themselves as ‘other’. While Bermuda-based respondents ranked regulation as the greatest threat, the world ranking for regulation was fourth. Technology, meanwhile, was ranked as the number one threat by respondents globally, while Bermudian-based respondents had technology at number five on their list. Bermuda also gave a higher score to political risk (sixth v eleventh in global ranking). That, the survey organisations said, was “because of the island’s vulnerability to political actions in the United States (tax), the European Union (blacklisting) and the United Kingdom (Brexit)”. Climate change was another higher-than-average scorer among Bermudian-based respondents, perhaps due to the proportionally high number of respondents from the reinsurance industry as that sector bears the brunt of catastrophic events. What follows is a selection of quotes by Bermudian-based respondents to the survey:

Bermuda produced the second-lowest score on the Banana Skins Index, implying a low level of risk anxiety. The index measures the average score given by each of the 32 countries with ten or more respondents to the 21 risks, or “banana skins”, listed in the questionnaire. The higher the score, the greater is the implied “anxiety level”. The top three scores were posted by Turkey (3.64), Malaysia (3.59) and the Philippines (3.55). Bermuda (3.19) was more anxious than only Denmark (3.15). The global score was 3.33. Meanwhile, Bermuda produced an above average score on the Preparedness Index, implying a high level of preparedness. The index measures the average response given to the question: “How well-prepared do you think the insurance industry is to handle the risks you identified?” The continuum runs from “poorly” to “well”. The higher the score, the greater is the implied level of preparedness. Bermuda was ninth of 32 countries on the preparedness index at 3.28, behind only Spain (3.47), South Africa (3.46), Switzerland (3.40), Turkey (3.35), Portugal and South Korea (3.33), Germany (3.31) and Malaysia (3.29). The global score was 3.11. The Bermuda rankings, with the corresponding ranking globally in brackets: 1, Regulation (4); 2, Cyber-risk (2); 3, Climate change (6); 4, Change management (3); 5, Technology (1); 6, Political risk (11); 7, Human talent (8); 8, Macro-economy (9); 9, Competition (7); 10, Cost reduction (12); 11, Investment performance (5); 12, Quality of management (16); 13, Reputation (13); 14, Social change (18); 15, Capital availability (20); 16, Brexit (21); 17, Guaranteed products (14); 18, Corporate governance (19); 19, Business practices (15); 20, Interest rates (10); 21, Credit risk (17).

2019. January 1. Some 711 captives were registered with the BMA, having total captive premiums of $40 billion.

2018. September 5. Member companies of the Association of Bermuda Insurers and Reinsurers employ nearly 16,000 people in Europe and operate in 20 EU member states. The information is highlighted in a release from Abir, based on its annual economic impact survey. The survey found that Abir re/insurers had 15,865 employees in the European region. The top five jurisdictions with the most employees were the UK, with 9,762; France, with 1,148; Ireland, with 1,123; Germany, with 814; and Poland, with 453. Additionally, in Switzerland Abir companies employ 1,011 people. “The European Union is a very important market for Bermuda re/insurers, and our members continue to take on increasing amounts of risk in EU member states,” John Huff, chief executive officer of Abir, said. “Our member companies remain strongly committed to the European market, European ceding companies, and European policyholders.” Bermuda’s regulation regime for commercial insurers was found “equivalent” by the EU to Solvency II in March 2016, one of just two non-EU jurisdictions to hold that distinction. Through equivalence, Bermuda’s commercial reinsurers and insurance groups have access to the EU market, and Bermuda’s financial regulator, the Bermuda Monetary Authority BMA, is recognized as group supervisor for its insurance groups that operate in the EU. BMA supervisors are internationally respected and regularly hold supervisory colleges with international peers, including those from EU member states and the European Insurance and Occupational Pensions Authority (Eiopa).

2017. December 21. US tax reforms approved this week by the US Congress will be “credit negative” for the Bermuda re/insurance market, Fitch Ratings says. The US credit rating agency added that it expected the tax reforms, which will take effect from January 1, to benefit US reinsurers at the expense of Bermudian and other international reinsurers serving the US. The Tax Cuts and Jobs Act will cut the US corporate tax rate to 21 per cent from 35 per cent, reducing Bermuda’s tax advantages over US rivals, and a new tax on premiums ceded by US insurers to foreign affiliated reinsurers will be levied. “We do not anticipate immediate rating implications as we expect Bermuda will largely maintain its strong position in the global reinsurance market, continuing to benefit from its underwriting expertise, strong and efficient regulatory regime and full Solvency II equivalence,” Fitch said in a statement today. “Moreover, partly in anticipation of US tax reform, Bermudian reinsurers have been adapting their businesses and increasing their geographic diversification. Nonetheless, the US continues to be their most important market. Significant declines in business or earnings could prompt negative rating actions.” The corporate tax cut and the Base Erosion and Anti-Abuse Tax will reduce the tax advantage of reinsuring US risks to Bermuda, with more reinsurance business and capital incentivised to stay in the US. Bermuda does not have a corporate income tax but most Bermuda reinsurers pay income and other taxes given their international operations. Notably, they pay a US excise tax on premium payments from the US to offshore affiliates that is currently 4 per cent on direct premiums and 1 per cent on reinsurance premiums. The added Beat will be at a significantly higher rate: 5 per cent in 2018, then 10 per cent until 2025 and 12.5 per cent thereafter. Fitch said Bermudian reinsurers’ US business is largely written in US subsidiaries and then transferred to Bermuda. “From a group perspective, the tax changes may affect the location of the business rather than the amount, with the business and associated capital more likely to be retained in the US subsidiaries,” Fitch said. "We expect most Bermudian reinsurers with US subsidiaries will take up the option to pay US corporate taxes on the subsidiaries’ profits instead of Beat. Any reduction in supply of reinsurance capacity from Bermuda following the US tax changes is likely to drive global reinsurance premium rates up. Rates in some lines of reinsurance are already on the rise following this year’s high catastrophe claims.”

2017. December 18. Bermuda-based reinsurers are weighing restructuring options in response to US tax reform legislation that could be signed by President Donald Trump as early as this week and come into effect by the start of next year. Tax expert Will McCallum said that the island’s major industry will see its cost of doing business going up when the reform takes effect and some companies will likely have to relocate hundreds of millions of dollars of capital to the US. However, judging from conversations with clients, he views a mass exodus of jobs from the island as unlikely. Mr McCallum, managing director and head of tax for KPMG in Bermuda, was speaking at a US tax reform update session hosted by the Bermuda Chamber of Commerce on Friday morning. “I don’t see how anybody can say this a good thing for Bermuda, but it doesn’t feel apocalyptic,” Mr McCallum said. Late on Friday, US Republicans put forward the latest version of the Tax Cuts and Jobs Act fashioned from the different Bills passed by the House of Representatives and by the Senate. Members of the House and Senate are expected to vote on it this week, with Republicans hoping to get it to President Trump’s desk before Christmas. The US corporate tax rate will be slashed from 35 per cent to 21 per cent, reducing Bermuda’s tax advantage over US rivals. But perhaps the biggest direct impact for the island will come from the Base Erosion and Anti-Abuse Tax, known as Beat. It will hit Bermudian insurance groups with US subsidiaries, which cede premiums to their affiliated reinsurers in Bermuda, by effectively levying a 10 per cent tax on the transaction, rising to 12.5 per cent from 2026. This will impact several major groups including XL Catlin, Arch Capital and Axis Capital. Mr McCallum told a business audience, which included John Rankin, the Governor, and Wayne Furbert, the Junior Minister of Finance, that his impacted clients in the insurance industry had been working on their restructuring options. He said Beat would effectively be a gross tax with no apparent deductibles. The Bill includes an option to be taxed as a US entity — with regard to affiliated US business — instead of paying Beat, an option that Mr McCallum believes most impacted groups will take. If the Bill becomes law before the end of the year, Beat will come into effect on January 1, 2018, meaning insurance companies face a “busy couple of weeks” preparing. For the first taxable year, the rate will be a reduced 5 per cent. Mr McCallum explained that many US subsidiaries of Bermudian insurance groups used quota-share reinsurance contracts with their parent companies, to transfer substantial amounts of risk from the US to the Bermuda balance sheet. He argued that this was “a standard way of managing risk, not a tax play”. Much of the premium goes back to the US in the form of ceding commissions and claims, Mr McCallum said. And he added that the diversification of global risk and scale of the Bermuda balance sheet was what allowed Bermudian insurance groups to take on so much American risk. He said the 10 per cent Beat tax was “not a gross tax, but it works that way” and would be so punitive to affiliated quota-share deals that most groups would take the option to file as a US taxpayer for this particular part of their business. They would effectively “draw a box around their US earnings” and pay US corporate tax on those profits. “Why would a Bermuda company opt to be a US company for tax purposes?” Mr McCallum said. “Because it’s a better outcome. The bad thing is that they will have to restructure their businesses in a way that they don’t want to, not for good business reasons. It will mean that some capital will have to be relocated to the US to satisfy the regulators. But the bottom line is that there may not be much change in Bermuda.” Bermuda reinsurers write business from all over the world that will be unaffected by the US tax changes, he said. Also, Beat would not apply to third-party business from the US. He did not expect to see mass relocation of underwriting teams to the US, but he said this would depend on each group’s circumstances and its concentration of US business. The Association of Bermuda Insurers and Reinsurers is a member of the US-based Coalition for Competitive Insurance Rates, which expressed “disappointment” over the latest version of the Tax Cuts and Jobs Act and urged a rethink. The effect of Beat would be to “unfairly slap US consumers and small businesses with higher insurance premiums — undoing potential tax relief they had hoped to get from this bill”, the CCIR stated. “The global insurance and reinsurance industry is concerned that Congress would include a provision in the Tax Cuts and Jobs Act that will serve only to ‘Americanise’ risk by decreasing capacity benefits to insurance markets globally, thus increasing US prices. This is truly a blow to consumers and business, particularly those in Florida, Texas, California, South Carolina, Louisiana and other disaster-prone states who rely on this capacity in times of catastrophe. The only winner under the double-taxation that will result from Beat is a group of highly successful domestic insurance companies who stand to benefit greatly from the market distortion this provision will trigger. CCIR welcomes continued dialogue on this issue.”

2017. October 13. Reinsurers’ earnings for the year have probably already been wiped out by industry catastrophe losses of more than $100 billion — and their capital could also be hit. That is the view of analysts at S&P Global Ratings, who believe that an improvement in reinsurance rates may follow in the upcoming January renewals. “As reinsurers are coping with their third-quarter catastrophe-related losses, their capital could take a hit,” S&P stated in its report, released today, entitled Third-quarter catastrophe losses are becoming a capital event for reinsurers. Although our ratings are supported by robust capital adequacy levels, we would consider a reinsurer that incurs large losses that translate into capital erosion as an outlier that could be subject to a negative rating action.” Several Bermuda reinsurers have announced their preliminary loss estimates for the third quarter. Among the more notable are XL Group ($1.48 billion), Everest Re ($1.2 billion), RenaissanceRe ($625 million) and Axis Capital ($617 million). The Association of Bermuda Insurers and Reinsurers has estimated that Bermuda entities will cover at least a quarter of the estimated $100 billion in insured losses from hurricanes Harvey, Irma and Maria. S&P said global reinsurers would foot the bulk of the bill. And with capital of $605 billion, including $89 billion of alternative capital as of June 30,2017, they were well prepared to take the strain. The report described the third-quarter catastrophes as “just a speed bump” for the thriving catastrophe bond market, which is predominantly based in Bermuda. S&P has downgraded only one cat bond — the Everest Re-sponsored Kilimanjaro Re 2014-I Class B. S&P said the main reason for the lack of impact on cat bonds it rates, despite the massive economic losses caused by the string of disasters, a large proportion of the impact was not covered by private insurers. This included most of the flood damage and much of the devastation in the Caribbean. S&P saw this protection gap as an opportunity for the industry. “We think that the insurance industry and the natural catastrophe investor base have an opportunity to expand into these hitherto non-insured exposures and regions, and given the appropriate returns, can provide a new source of earnings for themselves and protection for many currently uninsured people and regions,” S&P stated. The rating agency said that “without a doubt, reinsurance pricing will increase for the affected regions and business lines”, while US national pricing was likely to move higher too. Increases in global reinsurance prices are less certain. S&P expects global prices to increase by zero to 5 per cent at January 1 renewals. “Given the magnitude of the losses, we expect reinsurers to hold flat on pricing at the very least, but most will likely demand higher risk premiums at this time,” S&P said.

2016. February 4. Changes that went into effect on January 1, 2016 applicable to Bermuda-incorporated commercial insurers registered under the Insurance Act 1978 (the Act) are now required to establish and maintain a head office in Bermuda.

This requirement means that the insurance business of commercial insurers (Classes 3A, 3B, 4, C, D and E insurers) must be directed and managed from Bermuda. At the time of licensing, the Bermuda Monetary Authority (the “BMA”) assesses the nature, scale and complexity of an insurer’s business to be conducted in accordance with the provisions of the Act, the Insurance Code of Conduct and the Insurance Statement of Principles (the insurance framework). In relation to commercial insurers, the BMA further measures compliance with the insurance framework by taking into consideration various factors to ensure that it can exercise sufficient regulatory oversight over the business to be carried on in Bermuda. In this regard, the BMA has effected the requirement for commercial insurers licensed in Bermuda to establish their head office in Bermuda. In determining whether an insurer has complied with the head office requirement, the BMA will consider, among other things, the following factors in order to ascertain whether the insurance business of the insurer is directed and managed from Bermuda:• Where the underwriting, risk management and operational decision making of the insurer occurs.

• Whether senior executives who are responsible for and involved in the decision making related to the insurance business of the insurer are located in Bermuda.

• Where meetings of the board of directors of the insurer occur.

• The location where management of the insurer meets to effect policy decisions of the insurer.

• The residence of the officers, insurance managers or employees of the insurer.

• The residence of one or more directors of the insurer in Bermuda.

The BMA will apply the proportionality principle when it considers the above factors in determining whether the insurer, based on the nature, scale and complexity of its business, has met the head office requirement.

The head office requirement does not apply to a commercial insurer that has a permit under section three of the Non-Resident Insurance Undertakings Act 1967 or a permit under section 134 of the Companies Act 1981. These provisions cover branch operations in Bermuda for foreign insurers. In addition, Bermuda captives and limited purpose insurers (Classes 1, 2, 3, A and B insurers), as well as special purpose insurers, are not required to establish a head office in Bermuda. The requirement for a head office in Bermuda has been effected as part of the BMA’s overall enhancements to its current insurance supervisory and regulatory framework in an effort to achieve Solvency II equivalence. Solvency II is a harmonized framework aimed at ensuring that there is a single market, utilizing a single set of rules for insurance services. Solvency II equivalence for Bermuda means that Bermuda’s commercial insurers will not be disadvantaged when competing for, and writing, business in the European Union. Currently, insurers licensed in Bermuda are required to have a registered office and principal office here and to appoint a principal representative resident in Bermuda. Some have queried whether an insurer’s principal office, which is already a requirement under the Act, could be regarded as its head office. The BMA has confirmed that, where the insurer’s principal office meets the standards required for the establishment of a head office, then the BMA will regard the principal office as the head office. Commercial insurers are applying the proportionality principle as they consider the above factors in order to comply with the head office requirement. The general understanding at this time is that the factors are not necessarily prescriptive and that the BMA will take a holistic approach to deciding whether the insurer has a sufficient nexus to Bermuda to allow the BMA to exercise the requisite regulatory influence over the insurer. Commercial insurers are encouraged to meet with BMA representatives if they have specific questions relating to their plans to implement the head office requirement.2014. November 13. Bermuda has been recommended for approval as a qualified jurisdiction by a working group of the US regulatory support organization the National Association of Insurance Commissioners (NAIC). If the recommendation is approved, it will reduce collateral requirements for Bermuda reinsurers who do business in the US. The NAIC is the US standard-setting organization created and governed by the country's chief insurance regulators from the 50 US States, District of Columbia and five US territories. Bermuda financial regulator the Bermuda Monetary Authority said in a statement this afternoon that the NAIC's Qualified Jurisdiction Working Group released its Summary of Findings and Determination for public consultation today. If approved by the full NAIC membership, Bermuda would be placed on the NAIC's first List of Qualified Jurisdictions effective January 1, 2015 BMA CEO Jeremy Cox said this was a considerable achievement. "The United States remains Bermuda's largest trading partner. As such, being approved as a qualified jurisdiction is highly relevant for Bermuda in terms of potentially facilitating efficiencies in the cross-border operations of Bermuda reinsurers with the US insurance market. While we recognize the process is not yet complete, we look forward to receiving the NAIC�s final approval in the coming weeks." The Working Group's recommendation went on to say that Bermuda's status as a Qualified Jurisdiction is applicable to (re)insurers licensed as Class 3A, Class 3B and Class 4, and Long-Term insurers of Class C, Class D and Class E. It also recommended that the Authority be re-evaluated every five years after 1st January 2015. "Approval under the Process for Developing and Maintaining the NAIC List of Qualified Jurisdictions (the NAIC Process) means that Bermuda-domiciled reinsurers licensed in the above classes will be eligible to be certified for reduced reinsurance collateral requirements under the NAIC's Credit for Reinsurance Model Law," the BMA stated. Up to 240 Bermuda companies may stand to benefit from the NAIC decision, including some of the Island's largest insurers and reinsurers, many of them represented by the Association of Bermuda Insurers and Reinsurers (ABIR). In August 2013, the Authority was the first insurance supervisor to agree to participate in an expedited review under the NAIC Process. In December 2013, Bermuda was granted conditional qualified jurisdiction status and the Authority continues to fully participate with the NAIC. The NAIC Process was developed to evaluate the regulatory frameworks of non-US jurisdictions for reinsurance collateral reduction purposes.

2014. November 12. The Bermuda insurance market writes $25 billion of business, which makes it more than half the size of the dominant London market, the latter now at a tipping point with its position under threat, according to a just-released study reported in the London Market Group's online publication LMG. The numbers were reported by LMG and The Boston Consulting Group (BCG) which have published the results of market research into commercial insurance and reinsurance. The study included more than 300 interviews with customers and market participants around the globe. It stated the competitive position of the London insurance market, addresses the current status and future prospects of the market and reveals that London's position as the undisputed global hub for commercial insurance is under threat. It reported the London Market, the largest global hub for commercial and specialty risk, reached $60 billion of gross written premium in 2013, with $45 billion of this written in London and backed by London capital. The study shows that, based on business written in London alone, the market ($45bn) is nearly double the size of Bermuda ($25bn) and Zurich ($19bn) and 11 times bigger than Singapore ($4bn). The authors warned the study's findings are also a strong reminder of the role the London Market plays in supporting the UK economy separately and distinct form the rest of the UK insurance industry. The Market contributed $30 billion to UK GDP in 2013, which is 21 per cent of the total GDP contribution of The City and eight per cent of total London GDP. It employs a collective 48,000 people throughout the UK and 34,000 in London alone. It also plays a role in supporting the broader global economy by paying large claims every year, including for specialist risks which are hard to cover elsewhere. A total of 94 FTSE 100 companies are covered by the London Market and in the last five years more than $140 billion in claims has been paid to policyholders. But the 300-year-old market is at a tipping point, warn LMG and BCG. The report states analysis reveals that London is only tracking global growth in commercial insurance, while it is losing its share in reinsurance: London's share declined from 15 percent to 13 percent between 2010 and 2013. Furthermore, London, heavily reliant on the UK, US, Australia and Canadian markets, is failing to capture the emerging market opportunity. Only 0.5 percent of the absolute growth in emerging market premiums in markets such as Latin America, Asia and Africa, was placed in London. Its share of the Asian insurance market, for example, is currently just two percent. More than half of future growth will come from emerging markets, meaning that London's global leadership will become increasingly challenged.

2013. December. Bermuda won consideration for qualified jurisdiction status from the US National Association of Insurance Commissioners (NAIC). The move means that reinsurers licensed and based in Bermuda will be eligible to be certified for reduced reinsurance collateral requirements. The Bermuda Monetary Authority (BMA) along with similar bodies in the UK, Germany and Switzerland have all been granted conditional status pending a full review next year. The NAIC is the US standard-setting and regulatory support organization created and governed by the chief insurance regulators from US states and territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer review, and coordinate their regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally. NAIC members, together with the central resources of the NAIC, form the national system of state-based insurance regulation in the U.S.

2013. November 25. Bermuda

is leading the world in the issuance of insurance-linked securities (ILS).

Today, Bermuda remains by far the largest centre for captive insurance in the world with over 1,200 captive insurance companies alone out of he 20,000 companies incorporated in Bermuda to-date, managed by numerous locally-based captive management companies. Bermuda's insurance regulation is well-designed to make it easy to create companies, while at the same time having strict controls to ensure companies have more than enough money in reserve to cover all claims. The Bermuda Monetary Authority, the Island's regulatory agency for all Bermuda-based and Bermuda-incorporated entities, strikes the right balance between maintaining an effective regulatory framework that meets relevant international standards and ensuring high standards of behaviour, while fostering an environment that remains attractive to business and enables them to grow and develop successfully.

Bermuda is the leading single top offshore risk financing center. Many Lloyds of London insurers and reinsurers have re-domiciled from London to Bermuda. More than 13 of the world’s top 40 reinsurers are based in Bermuda, and Bermuda is the fourth largest reinsurance market in the world after Germany, the US and Switzerland. Bermuda-based reinsurers’ total net written reinsurance premiums exceeds those of London-based reinsurers.

Bermuda remains

the world’s number one captive domicile overall. Captive insurers

predominantly provide insurance to their own parent corporations. The

captive insurance business played a founding role in the creation and

development of the Bermuda market and remains one of its

best-known core activities. The bulk of Bermuda’s captives are US-owned

entities, often used to insure and reinsure retentions on general liability,

auto liability, workers compensation, property and marine programs and to access

the reinsurance markets. The USA has long been the biggest single source of

captive business for Bermuda, accounting for over 60 percent of the Island’s

insurance formations. Many are single-parent captives, insuring only the risks

of their parent and affiliates. Other types are group-owned or association

captives formed by members of a common industry and agency captives, so called

because they are owned by insurance agents and often used in quota-share

arrangements to reinsure business written by the agents. But new source markets

are beginning to emerge in Africa, Australia, the Far East, the Pacific Rim and

Latin America as risk managers abandon traditional insurance buying practices

and increase their self-insured retentions. Since the early 1990’s, one of the

fastest-growing categories has been that of health-care or medical malpractice

captives. The US-based ownership of these captives is diverse, ranging from

groups to single-parent, from tax exempt hospitals to for-profit health

maintenance organizations and physician-controlled entities. Some US health-care

providers see the captive vehicle as a means of offering competitive

professional liability coverage, while others use their captives to fund for the

capitated risks they assume and for access to provider excess and HMO stop-loss

reinsurance. User applications are changing too. Increasingly, captives are

being used by larger corporations to enhance core products. They are also

playing major roles in long-range, strategic planning as more and more companies

seek optimum retentions and exert greater, in-house control over their financial

exposures.

Terrorism Risk Insurance Act of 2002 (TRIA). Bermuda's US and international insurers have a special interest — set to expire at the end of this year — is at the top of the re/insurance industry’s federal legislation priorities list. TRIA is a United States federal law creating a federal ‘backstop’ for insurance claims related to acts of terrorism, and was drafted with input from the Bermuda-based industry. Risk & Insurance Management Society Ltd (RIMS) of Bermuda is one of those trade groups with a vested interest. Since its inception, TRIA has allowed RIMS member organisations to obtain such coverage at affordable rates. Prior to that, after 9/11 Bermuda-based members were unable to obtain such coverage, which jeopardized many contracts that contained covenants to carry terrorism insurance. The availability and affordability of adequate insurance coverage for acts of terrorism is not only an insurance issue, but an economic one. By providing a backstop and assuming some of the market terrorism risk as a reinsurer, the US federal government has freed up capacity in the private market that would not otherwise exist. This capacity can then be made available to the consumer at affordable prices.

![]()

They all have "Ltd" in their official corporate name. Advantages do not include no income taxes (because there is an income tax, called a Payroll Tax, payable by employers and employees, based on employment income) but there are few restrictions as to how Bermuda companies can invest their assets and deploy capital, not to mention the island's close proximity to the largest insurance market in the world, the USA. They are presently free to accept contingent commissions, which are payments to brokers from insurers based on the volume of business steered to them. These factors, along with the current favorable market conditions, have contributed to the robust financial performance of the Bermuda insurance and reinsurance market. They are exempted from Bermuda's domestic company requirements of being at least 60% beneficially owned by Bermudians. They can trade anywhere in the world except as a local company in Bermuda (They cannot write any business for Bermuda residents, only with other international or exempted companies). The regulatory environment is exceptionally favorable to them in Bermuda - so much so that many international businesses, including insurers, from all over the world, even in places such as St. Lucia, West Indies, now have their Bermuda-incorporated and Bermuda-based companies as their registered offices and their companies beyond Bermuda as their subsidiaries. They come mostly - but not solely - from the USA. One prominent US corporation, Chevron, has over 400 Bermuda-incorporated companies and there are an equal number of Bermuda-incorporated companies beginning with the word "China." Their reasons to relocate to Bermuda as corporate inversions arise out of the USA's own tax code and/or similar taxation policies of the UK, Canada, China, Russia and other countries. The presence in Bermuda of these Bermuda-registered companies, the Bermuda Government fees they pay in return for not having any Bermuda Government taxes imposed on their income or profits and the profits they earn from their often world-wide business including acting a principal insurers in US and other jurisdictions and in major disasters such as hurricanes, typhoons and special risks, is the single-biggest reason, not tourism which lags far behind, why Bermuda, despite its tiny size of only 21 square miles or 58 kilometers, scores so highly in World Bank and related statistics in Gross National Income and other economic indicators.

![]()

Hosts an annual life and annuity conference at the Fairmont Southampton Princess Hotel. Industry chiefs from Europe and North America join Bermuda-based executives. 2015's conference focused on the EU Solvency II regulations, which come in to force from 2016 and Bermuda’s ongoing work to comply with the new rules. Other highlights include a presentation by the president of the Society of Actuaries, which has more than 25,000 members in 78 countries. Special sessions will also look at “the future of living longer” and panel discussions featuring industry leaders. BILTIR was set up four years ago to serve as an advocate for the long-term insurance industry.

![]()

All in Bermuda's insurance industry are subject to the provisions of the Companies and Insurance Acts. The Companies Act regulates the activity of companies incorporated or licensed in Bermuda, including insurance-related companies. The Insurance Act is the basis for regulation of the insurance industry, both in the domestic Bermuda market and in the international arena when it affects Bermuda-based and/or Bermuda-incorporated insurance companies. It was introduced to protect Bermuda's image - and increase its world-wide credibility as an international center for insurance, captive insurance, reinsurance, and investments relating to insurance. In 2001, the new Bermuda Government position of Supervisor of Insurance was created, with full responsibility to oversee the licensing and regulation of Bermuda-based insurance companies.

Bermuda-based leading international insurer. Photo by author Keith Archibald Forbes solely for Bermuda Online.

![]()

2018. December 27. Bermuda is leading the way in the insurance sector’s growing alternative capital market. The large insurance losses sustained as a result of hurricanes in 2017 resulted in more alternative capital being placed in the Bermuda insurance market. Commenting on that trend, Craig Swan, the BMA’s managing director, supervision (insurance), said: “The steady growth of alternative capital within the Bermuda insurance market, particularly following the 2017 losses from Hurricanes Harvey, Irma and Maria, indicates that Bermuda continues to be a trusted centre for insurance risk securitisation. The aggregate exposure of non-life (re)insurers backed by alternative capital was approximately $51.9 billion at year-end 2017, while gross written premiums was $3.9 billion. Bermuda’s share of total capacity was approximately 58 per cent of the global alternative capital market.” To put the island’s share in to context, the global market in 2017 was $89 billion. Catastrophe bonds and collateralized reinsurance are the two dominant forms of alternative capital in the Bermuda market. At the end of last year, cat bonds accounted for $19 billion of the island’s alternative capital total, while collateralized reinsurance valued at $28.5 billion accounted for more than half of the total capacity. Other forms of alternative capital structures include sidecars, longevity and mortality bond/swaps and hybrid securities such as preference shares. Geographically, the assumed risks for Bermuda’s alternative capital vehicles was 40 per cent in the US. Although the risks were split across nine lines of business, property catastrophe, including property retrocession, accounted for 94 per cent of the gross written premiums to the end of 2017. Gross written premiums in 2017 totaled $3.9 billion. The information for the BMA alternative Capital Report 2018 was gathered from the alternative capital schedules and statutory financial returns submitted to the authority by June 30. The BMA has also released its annual captive report, offering year-on-year comparisons to the captive/special purpose insurers report of 2017. Mr Swan said: “Although not yet significant in premium size, the greatest year-on-year percentage increase was experienced by the cyber-risk line of business which saw an increase in premium of $26.3 million (rising to $42 million) a nearly twofold increase in premiums written.” He added: “These reports provide further insight and transparency about how Bermuda’s innovative (re)insurance market continues to evolve and develop.”

![]()

The Bermuda Monetary Authority (BMA), a separately administered division of the Bermuda Government, is the administering and regulatory authority for all Bermuda-based and Bermuda-incorporated insurance companies. Its Monthly Assessment & Licensing Committee (ALC) reviews insurance applications. Applications are accepted or declined according to their merits or demerits. The registration and licensing procedures of approved insurance entities are subsequent to the ALC application process.

Minimum paid-up capital in Bermuda is $120,000 for general (property, casualty, etc.) business; $250,000 for long-term (life) business; and $370,000 for both types (composite). General business insurers must maintain liquid assets (called relevant assets) equal to at least 75% of general business liabilities. Relevant assets exclude such assets as real estate investments, investments and advances to affiliates and unquoted equity securities. However, these assets are included in the computation of the Minimum Solvency Margin.

Insurance companies, or their agents, must file an annual Statutory Financial Return with the Registrar of Companies. This must include an Auditor's Report and in certain situations actuarial certification. For example, all companies writing life insurance business must have their reserves certified by an actuary. In addition, companies writing a significant of products or professional liability risks must have their reserves certified by a loss reserve specialist who in most cases will be a qualified actuary.

For general business, when net premium income is up to $600,000 or from $600,001-$6 million and in excess of $6 million respectively then the minimum solvency margin is, respectively, $120,000 or 20% of net income or $1,200,000 plus 10% of net premiums written greater than $6 million. There is also a loss reserve of 10%. For long-term business, it is $250,000. For composite business, it is a combination of the requirements for general business and long-term business.

Bermuda's insurers are in various classes of capital and surplus. They are mentioned in more detail below. They all have specific reporting requirements, solvency margins and actuarial certification. Insurance (and other) companies can be incorporated either by registration using the provisions of the Companies Act or by private Act of Parliament. Incorporation by registration normally takes about two weeks but in exceptional circumstances can be accomplished in a matter of days. Private Acts of Parliament usually apply when the company requires special objects, powers or abilities substantially different from the menu in the Companies Act.

The latter is responsible for processing applications and recommending to the Ministry of Finance that companies be incorporated, partnerships be formed, collective insurance schemes be established and permits be issued to effect an accredited business presence in Bermuda. When the application has been reviewed by all parties, the BMA will present the application to the Ministry of Finance with the appropriate recommendations with regard to the Minister issuing a consent to register the company. The Minister may, at his discretion, impose any terms or conditions on a consent to register a company.

More Bermuda-based international insurance companies. Photo by author Keith Archibald Forbes solely for Bermuda Online.

See Insurance Business legislation in Bermuda. The following can apply to Bermuda approved and licensed insurance companies with a physical presence and office in Bermuda and offering staff who, if not Bermudian, have an approved, current Work Permit to work (solely) for that office.

More prominent Insurance Companies domiciled and headquartered in Bermuda

![]()

A major advantage of reduced policy costs is that for fixed or guaranteed rate policies, the policyholders may be provided with an increased investment return without any additional investment risk. If operating costs are reduced by one percentage point from various sources then that reduced cost can be provided to the fixed policyholder. Passing on this benefit is one of the purposes for the creation of a Bermuda based international insurer.

![]()

Can be hugely important. Basically, it is the amount paid to the insured, usually based on the gross profit that a business would earn if trading normally, in the event of a disaster, even if it has to wait for reconstruction. In the case of law firms it covers gross fees that would have been earned. Maximum indemnity periods can vary hugely, from 3 to 36 months. Can also include Increased Costs of Working (ICW) should a business wish to continue trading from alternative premises.

![]()

Bermuda is the principal domicile of captive insurance companies. More reside here than anywhere else. There are believed to be over 10,000 captives worldwide. Other jurisdictions with industry growth include the Cayman Islands, Vermont, Guernsey and British Virgin Islands. Captives in Bermuda are 65% owned by American interests, 18% by European, 10% by British, 2% by Far Eastern, 2% by Canadian and 3% by other countries' principals.

In Bermuda, there are the following categories, all of which serve different clientele and purposes. There is also a single general class of companies dealing with captives. A summary is below.

Agency. Formed and owned by one or more independent insurance agents to write high quality risks that they control.

Association. Formed and owned by members of a common industry or trade association to share risks of that industry among its members.

Captive of insurer. Single parent captive by a professional insurer or reinsurer.

Captive writing 3rd Party business. Captive writing a portion of its net premium from risks unrelated to the business of its owners and/or affiliates.

Composites. Insurance company writing a composition of life and general business.

Finite Insurer and/or Reinsurer. Company writing unrelated risks where there are (a) clearly defined aggregate limits and (b) premiums that reflect the underwriter's anticipated investment income.

Health Care Captive. Owned by a hospital or health maintenance organization (HM0) and writing the risks of its owners and/or affiliates.

Long Term (or Life) Insurer and/or Reinsurer. Insurance company writing life risks as a direct writer and/or insurer.

Multi Owner Captive. Owned by two or more unrelated persons or organizations and writing the risks of its owners and/or affiliates.

Professional Insurer and/or Reinsurer. Insurance company writing unrelated risks as a direct writer and/or insurer.

Pure Captive. Single parent captive writing only the risks of its owner and/or affiliates.

Rent-a-Captive. Owned by unrelated persons or organizations and providing captive facilities to others for a fee. Contract documentation is usually detailed and voluminous and there is substantial work in maintaining individual program funds in segregated accounts, etc.

![]()

|

First, the policyholder does not need to disclose the existence of the policy to any entity. Many onshore jurisdictions require their residents and citizens to report the existence of any bank, financial, securities or investment accounts held in foreign jurisdictions or any interest in a foreign trust. The invasiveness of these requirements is obvious as is their potential for use as evidence. Failure to report, even unintentionally, is a crime with significant penalties. Generally, most jurisdictions do not view insurance policies as financial assets, but as contracts under statutory law. |

Therefore, insurance policies are generally exempt from disclosure because they are recognized as a contractually based agreement between the individual and an insurance company and not as a financial account. An appropriate insurance policy can give the policyholder additional confidentiality and privacy through a "Private Act" Confidentiality clause. Unless directed by the Bermuda government, it is required by Bermuda law to withhold all information relating to any policyholder or policy regardless of the stature of the person doing the questioning, All disputes over disclosure will be physically adjudicated in Bermuda under Bermuda law.

![]()

|

Many countries and their regulators require extensive filing of policies, policy forms, actuarial documentation, and regulatory compliance which can reduce the ability of an insurer to respond to the needs of policyholders. Many insurance regulators also limit the number of policy types. Standardization suggests all policyholders have the same needs, timing, risk and return requirements. This is a mass market approach where large groups of policyholders are assumed to have identical needs and requirements. But a good Bermuda company may provide customized and personalized policies to its policyholders. Ask if your insurer can offer policy design and elements imaginative policyholders may need. |

Bermuda insurance provisions and a Private Bill statute can provide significant protection to policyholders along with annual actuarial and audit requirements, yet without a regulatory bureaucracy that significantly constrains the quality and increases the costs of policies to its policyholders.

![]()

|

Insurance policies offer better advantages than a trust and are superior to drafting a will. The death benefits may avoid the process of probate and help ward off potential lawsuits from dissatisfied heirs. Drafting an insurance policy can also be cheaper than a trust or a complicated will. Insurance is an element of estate planning. But many advisors may not have explored the global advantages available to their clients and accepted the constraints associated with many onshore jurisdictions. |

The insurance policies of a good Bermuda company can allow a policyholder to avoid problems.

![]()

|

Third world countries enforce various types. Their residents are constrained from moving certain types of assets outside. Select where you have freedom. Recognize that insurance policies are based on contracts between the insurance company and the policyholder. Many domestic regulations do not recognize life insurance as a financial asset. Policyholders resident in jurisdictions that do not impose exchange controls may benefit appreciably. Cross border relocation with the use of global insurance products allow such individuals to optimize their insurance coverage internationally. Do present Foreign Exchange rates based on where you live have a good or bad impact on your Bermuda insurance premiums and insurance-covered assets? It could be a key question. Bermuda is tied to the US Dollar. |

|

Some onshore and offshore jurisdictions or states or provinces or parts of countries may have forced heirship laws in whole or in part, such as Scotland, Quebec, etc. See http://en.wikipedia.org/wiki/Forced_heirship. They may not permit a person to disinherit certain family members regardless of the wishes of an insurer. Some of the estate may have to be allocated to a spouse and/or heir. However, these laws do not always consider an insurance policy to be part of the estate (unless the estate is designated as beneficiary). Thus the policyholder may bequest the proceeds of an insurance policy based on the owner's wishes. |

Only Bermuda laws apply. UK laws do not apply in any way to the operations in Bermuda of any Bermuda-registered companies. Nor do the laws of the USA or Canada or any other foreign jurisdiction apply in Bermuda. As a result, a high number of UK, USA, Canadian and other foreign-headquartered companies, including many with considerable market activity abroad, were incorporated in Bermuda. Unlike in the USA from where the vast majority of companies come for corporate inversions in Bermuda, there is no legal requirement in Bermuda for their CEOs to personally certify their company's financial results if of the requisite size, but some of the better ones do so on a voluntary basis

However, Bermuda-based but USA-owned or USA-operated companies can sue or be sued in the USA following a US Supreme Court ruling. Also, from 2003, if relocating to Bermuda from the USA or owned by US investors, they may have to tell shareholders they may face capital gains taxes in the USA.

![]()

|

Insurers in most countries cannot accept premium payments other than in local currency. Under certain circumstances, a good Bermuda company can structure a policy which will allow the contribution of premiums to be made in kind. This means assets other than cash. This offers significant flexibility for clients who have the need for the advantages of various types of insurance policies yet choose not to liquidate significant assets to acquire insurance benefits. Payment in kind can take the form of securities, business interests, real estate - both earning and not earning. |

A Bermuda insurance company's ability to comply with insurance and tax regulation in the policyholder's country can provide significant advantages. For example, it is possible for a USA domiciled policyholder to be provided with a policy that is federal tax compliant yet not subject to individual state regulatory perfidy. Likewise, in Switzerland, Swiss companies do not offer unit linked, indexed, or variable type products. But they can be acquired through a good Bermuda based international company. To varying degrees, many countries offer benefits for the owners and beneficiaries of insurance policies. In certain countries, premiums themselves are deductible for tax purposes and, in others, policies wrap investment oriented products that expand the tax deductibility of premiums paid which can include dividends, capital gains, and total investment return. Another major advantage is the deductibility or exclusion from estate taxes when benefits are paid.

![]()

|

Many countries and/or their regional jurisdictions require payment of premium taxes by insurers on and/or policyholders. A glaring example is the United Kingdom's Insurance Premium Tax. For details see For basic details, see https://www.gov.uk/government/publications/insurance-premium-tax-increase-to-standard-rate/insurance-premium-tax-increase-to-standard-rate and https://www.gov.uk/government/publications/notice-ipt-1-insurance-premium-tax/notice-ipt1-insurance-premium-tax. This insurance tax affects the cost of car, home and all other insurances. It is calculated as a percentage of each premium, with those who pay the highest prices for insurance suffering the most. Bermuda-based and Bermuda-incorporated companies with a marketing presence in the UK are required under UK law to make their UK-based policy holders pay the UK Insurance Premium tax. These taxes do not benefit the policyholder. All thus incur higher costs for the insurer and policyholder, making some jurisdictions uncompetitive. In some countries, such as the USA, the purchase of a non American insurance policy outside the USA by an American requires the payment of a federal excise tax equal to 1% of the premium paid. It is not clear if this tax is tax- deductible for Americans. |

![]()

2016: Legislation, drawing upon Delaware law, has been approved by MPs in Bermuda to introduce limited liability companies (LLCs). Such vehicles would be broadly similar to Delaware LLCs.

|

Many countries restrict access to investment alternatives that, when properly structured, can offer significant diversification, return, and risk reduction characteristics. Switzerland does not by regulation allow variable or unit linked products to be offered by its domestic insurance companies. It restricts investment opportunities available to Swiss nationals. In the USA, variable products are available only to the extent they are invested in registered mutual funds with the Securities & Exchange Commission which invokes additional investment restrictions. Other countries require that investments of the insurance companies be restricted by regulation of quality, type, country, region and even government. But Bermuda insurance law and a good Bermuda based international insurer can provide a degree of flexibility not available in most other countries. |

For some beneficiaries, location of benefit payment can also be of great interest. Because these issues vary significantly from country to country and region to region, the efficient global structuring of the affairs of the client to maximize such benefits can provide strategic advantages. Recent innovations by issuing companies, supportive domicile insurance regulation and country specific statutory legislation have also been provided to enhance the benefits of insurance.

![]()

|

The costs of providing efficient insurance products is constrained by insurance regulation, administrative expense, capital reserve costs and company taxes controlled by the insurance company's domicile, tax and regulatory environment. These vary. While they may provide protections, they may also produce significant costs and efficiencies. Consider the economies of scale. Some Bermuda based international insurance companies are structured accordingly. Additionally, capital reserve costs in many established domiciles also lead to increased costs. The use of separate accounts by a particular Bermuda based international insurance company can isolate policyholders from creditors and litigants. |

This can provide lower capital requirements for the company and higher returns or better protection or both to the policyholder.

![]()

All the world's major oil companies and other multi-nationals too have discovered Bermuda is a suitable corporate base for their specialized captive insurance operations. As at January 2015, at least 8,200 multinationals have their own insurance offices, managing and controlling from their offshore base their onshore insurance operations in other parts of the world. In many respects, an internal or captive insurance company operates just like an ordinary insurance company. If a company wants to insure its aircraft, cars, cranes, buildings, employees, loans, ships, etc. its subsidiaries abroad pay their premiums to the principal's Bermuda insurance company. Whenever damage occurs, the principal's own private insurance company pays it out of the big money jar founded by these premiums. Doing it this way means huge savings by not using commercial insurers. It is by no means the only advantage. The key advantage is that insurance premiums can be deducted from the revenues. Doing so means the companies pay less tax in the countries in which they operate. And from Bermuda, the profit can be sent back, untaxed, to the corporate Head Offices abroad. In Bermuda, profits and of all Bermuda-incorporated, Bermuda-based but not Bermuda-market companies remain secret, unlike in most European and other onshore countries where they are published.

![]()

There is a so-called Public Register of Companies in Bermuda but all it provides for free, via a computer or in person, is the name of the company, when incorporated and a number. For a fee, one can find out its office address in Bermuda, perhaps its Bermuda-based directors and corporate secretary, but not much else; not who owns or directs or manages it, not from where its money comes and goes, not any profits or losses.

![]()

|

Get a unique combination of benefits when a Bermuda insurer is enacted by Private Act of Parliament. The provisions provide more guarantees and benefits to policyholders and are protected by Bermuda law. A good Bermuda insurer can amend its Private Act to provide additional benefits deemed desirable in the future. Bermuda's common law system, based on British law, combined with a record of legal precedence, supports and ensures the legality of an insurer's Private Act. Within Bermuda, litigants may initiate a first tier appeal. A second tier appeal is accorded by the Privy Council, the highest court in the United Kingdom. Thus, policyholders can rely on the sovereign law of Bermuda to protect their rights and benefits from claimants of other jurisdictions. |

![]()

![]()

Effective March 24, 2016. This means the European Union considers the standard of the island’s insurance regulation to be equivalent to its own. In November last year, the European Commission recommended that Bermuda should be considered as in line with the tough new insurance rules being adopted across the 28-country bloc. A 90-day consultation period that gave member countries and the European Parliament the chance to have their say has now passed. On March 4, the EC’s delegated decision on Bermuda’s equivalence with Solvency II was laid out in detail in the Official Journal of the European Union. Now that 20 days have passed since the date of publication in the Journal, confirmation of Bermuda’s new status is complete. Solvency II equivalence means that commercial insurers and reinsurers based in Bermuda will not be competitively disadvantaged when they do business in the European Union. The news represents a significant achievement for Bermuda’s financial-services regulator, the Bermuda Monetary Authority, which has worked and lobbied for more than six years to achieve the goal. In an interview today, Jeremy Cox, chief executive officer of the BMA, paid tribute to his “tenacious team”, as well as the industry leaders and politicians who had helped to make it happen. A full story on the interview will appear in Monday’s Business section of The Royal Gazette. The BMA also released its 2016 Business Plan today. In his introduction, Mr Cox stressed that equivalence confirmation did not mean the BMA would suddenly have a lot of spare time on its hands. “Securing equivalence was clearly a major achievement, a powerful example of what can be accomplished with a strong, tenacious team that embarked on the road to equivalence in 2010,” Mr Cox said. But equivalence is an interim objective, rather than an end in itself, and should be viewed in the wider context of our vision and strategic goals.”

Bermuda complies and benefits. Solvency II refers to a European Union Directive (2009/138/EC) relating to insurance regulation. Solvency II became effective on 1 January 2016 and provides new rules with respect to capital requirements, governance, risk management, and disclosure in relation to insurers and reinsurers. The regulatory changes resulting from the implementation of Solvency II include, but are not limited to, the following three pillars:

• How insurers quantify their liabilities and assets, including the way a company reserves funds to satisfy policyholder claims.

• How the structure and management of insurance businesses are governed, enabling insurers to identify, quantify, monitor, successfully manage and report risks to which they are exposed.

• Ensuring that robust reporting and disclosure rules are in place to foster transparency for insurers reporting on their business.

Following a demonstration of interest from the Bermuda Monetary Authority (BMA), the Bermuda Government's regulatory agency for Bermuda-registered insurance companies, the European Commission tasked the European Insurance and Occupational Pensions Authority (EIOPA) in 2010 to provide a preliminary assessment of the BMA’s supervisory regime. The goal was to have EIOPA determine whether the BMA’s supervisory regime satisfied the general criteria for third-country equivalence (i.e. non-EU member state equivalence). In an effort to gain equivalence, the BMA has, over a period of six years, fortified and revised its approach to insurance regulation in such a way as to bring the regulation of Bermuda’s commercial insurers (ie those registered as Class 3A, 3B or 4, C, D or E) in line with Solvency II. In several follow-up reports, EIOPA advised that Bermuda’s regulatory framework for commercial insurers was broadly equivalent with the Directive, paving the way for formalization of equivalence. This came in the form of a delegated act adopted by the European Commission on November 26, 2015 (Delegated Act). The Delegated Act came into force on 1 January 2016 (subject to a three-month review period by the European Parliament and European Council), and grants full equivalence to Bermuda for an unlimited period. In summary, the Delegated Act is essentially the EU conveying that they acknowledge the Bermuda commercial (re)insurance and group supervisory regimes to be equivalent to that of the EU, and on that basis, Bermuda (re)insurers and groups are free to conduct business in the EU without additional regulatory requirements/burdens. The BMA’s approach to insurance regulation is not strictly EU-centric. International regulatory input is derived, in part, through membership in various international standard setting bodies relating to insurance regulation such as the International Association of Insurance Supervisors (IAIS), the International Organisation of Securities Commissions (IOSCO), and the Group of International Insurance Centre Supervisors (GIICS). The BMA has also entered into a multilateral memorandum of understanding with, and is a charter member of, the International Association of Insurance Supervisors (IAIS). Locally, the BMA is able to derive input from a variety of sources including insurance and reinsurance companies, law firms and other organisations such as the Association of Bermuda Insurers and Reinsurers (ABIR), the Bermuda International Long-Term Insurance and Reinsurance Association (BILTIR), and the Bermuda Insurance Management Association (BIMA) to name a few. With the Delegated Act passed and in-force wef January 1, 2016, Bermuda registered (re)insurance companies and groups are able to conduct business freely within the EU, and on an even playing field with existing EU insurance companies. As the economic output of the EU represents a quarter of the global economy (measured in terms of GDP), ease of operations for our (re)insurers and groups in the EU is an important asset, one that many competing offshore jurisdictions are without.

![]()

![]()

All classes have minimum capital, surplus and more.

Class 3A - Small commercial insurers whose percentage of unrelated business represents 50 percent or more of net premiums written or loss and loss expense provisions and where the unrelated business net premiums are less than $50 million.

Class 3B - Large commercial insurers whose percentage of unrelated business represents 50 percent or more of net premiums written or loss and loss expense provisions and where the unrelated business net premiums are more than $50 million.

Insurers writing long-term (or life) business. The minimum capital and surplus requirement is $125,000,000 and the actuarial certification requirement is yearly.

Since late 2009. Focuses on fully collateralized SPVs that are set up to carry out specific insurance transactions. Effective April 1, 2012, all new SPIs licensed in Bermuda pay $6,000 for annual registration, compared to the earlier registration fee of $11,600. The move was seen as a boost to Bermuda’s competitiveness in the global insurance-linked securities (ILS) market, which has flourished on the Island over the past two years. SPIs are often used as vehicles for ILS, such as catastrophe bonds and industry loss warranties. Since the new classification of SPI was introduced by the BMA, the value of ILS listed on the Bermuda Stock Exchange has gone from zero to $3.5 billion. An SPI assumes insurance or reinsurance risks and typically fully funds its exposure to such risks through debt issuance or some other financing. Since SPIs are fully funded, the Bermuda Monetary Authority (BMA), the Bermuda Government's regulatory agency, also applies a proportionate level of supervision to such entities which is different from what it would apply to say, a large Class 4 commercial insurer. This fee adjustment also recognizes that distinction, since the BMA's fees are directly related to the cost of supervision, further reinforcing Bermuda’s competitive position to support SPIs

![]()

![]()

![]()

![]()

1903, a group of Bermudians formed Bermuda Fire and

Marine Insurance Company for the sole purpose of insuring fire and marine risks

within Bermuda.

1947. Not until after the Second World War was the next insurance company

started, Kitson Insurance.

1950. Argus Insurance was established through a need for medical insurance

and formed the Somers Isles Insurance Company.

1958. Colonial Insurance Company was founded, developed from The Gibbons

Company car dealership. Directors deemed it logical and profitable to insure the

cars they sold.

1962. The international insurance sector in Bermuda began when the idea of

captive insurance companies was born.

1978.

As the insurance industry started to grow, Bermudians realized that it needed

to be regulated properly and in 1978 the Insurance Act was passed by

Parliament. Following this, the Insurance Advisory Committee

(IAC) was established, made

up of people representing insurance companies, legal firms and Government

regulatory agencies such as the Bermuda Monetary Authority.

1985. ACE was formed by a group of 34 US companies to provide third-party

liability coverage to protect them against the risk of lawsuits.

They were unable to buy this type of coverage elsewhere because of the very

large awards being handed out by the US legal system - people slipping on

supermarket floors; suing fast-food restaurants for their coffee being too hot,

etc.

1986. XL Capital was formed, based on the same principles as ACE.

This was the beginning of the next stage of Bermuda's development as an

insurance centre.

1990's. Bermuda-based

international insurance and Bermudian insurance companies found that there were not enough insurance companies

to insure everything they wanted risk coverage for, so once again Bermuda

provided the infrastructure necessary to allow new property catastrophe

reinsurance companies to form. Mid Ocean Reinsurance was the first property catastrophe reinsurance company

formed in response to this severe lack of capacity. Bermuda authorities knew that with the increasing amount of insurance and

reinsurance capital on the Island, there needed to be strong rules for

conducting business, so the IAC continued to update the Bermuda laws.

From 2000. The Bermuda insurance marketplace

began to build a reputation for being innovative.

2007. March 27. It was reported Bermuda has lost out to the likes of Guernsey and Ireland when it comes to attracting captives linked to UK companies. A survey showed Bermuda’s share of the UK-generated captive market declined from 19 percent to 15 percent, while Guernsey and Ireland increased their share of the market significantly. The reason for the changing fortunes appears to be down to the ability to secure the same benefits in offshore jurisdictions much closer to mainland UK. Also, Malta is expected to increase its number of captive formations as it benefits from its membership of the European Union. The report on the growing popularity of captives with UK companies surveyed 94 of 350 identifiable captives owned by UK companies. In the 11-year period used for comparison Guernsey’s share of the market increased from 42 percent to 50 percent and the Republic of Ireland’s from two percent to eight, by contrast Bermuda’s decreased by four percent, the Isle of Man’s share dropped from 31 to 21 percent and Jersey and Gibraltar remained on one percent. The two other significant jurisdictions of Vermont and Cayman both dropped from two percent to one percent in the survey.

2007. July 20. Bermuda's leading role in providing reinsurance cover to the USA was underlined by the latest-to-date report from the Washington DC-based Reinsurance Association of America (RAA). It reported the US ceded $54.7 billion in premiums to offshore reinsurers in 2006 and ceded recoverables of $114.2bn. The largest markets for unaffiliated premiums ceded and recoverables due were Bermuda, the United Kingdom and Ireland, Germany, Cayman Islands, Switzerland and Barbados. One concern raised by the RAA was the possibility that US companies may be at risk because of offshore reinsurance deals. "It is especially important in light of the current public policy debate regarding the reduction in collateral requirements for unlicensed, unauthorized reinsurers that are not subject to US regulatory and solvency requirements," states the RAA. "The outcome of this policy debate could have significant implications to the solvency of US companies, as reinsurance recoverable from offshore companies continue to increase." The RAA prepared a comprehensive report, entitled the Offshore Reinsurance in the US Market: 2006 Data, which tracks trends in the buying of reinsurance as it impacts the US and aims to provide policymakers and the public with data and analysis about the US reinsurance market. Figures show there has been a 11.9 percent decrease in the level of premiums ceded from the US to offshore reinsurers between 2005 and 2006, and a 7.8 percent decline in recoverables. "Offshore companies' share of US unaffiliated reinsurance premium increased to 53.1 percent from 51.8 percent, while the market share of offshore companies and US subsidiaries of offshore companies decreased to 84.5 percent of US unaffiliated reinsurance premium from 85.4 percent," said the RAA. The organisation notes that total US premiums ceded to affiliated offshore reinsurers decreased by 16.3 percent to $32.5m while net recoverables due from affiliated offshore reinsurers increased 2.8 percent to $70.8bn. The RAA warns: "Data suggests the current US regulatory environment and 100 percent collateral requirements for unauthorized reinsurers is not a significant barrier for offshore companies as they account for more than half of the US unaffiliated reinsurance market. "An offshore company can participate in the US market by becoming licensed in the states in which it does business, by establishing a US affiliate licensed in the states in which it does business or by posting collateral in the US. In 2006, offshore companies and US subsidiaries of offshore companies accounted for 84.5 percent of the US reinsurance market."

2007.

October.

The

capitalization of Bermuda's reinsurance industry rose more than 20 percent to

reach $129 billion by the end of the third quarter of 2007.

That was greater than the 2006 gross domestic product

of many countries, including Pakistan and New Zealand and oil-producing Nigeria,

according to International Monetary Fund (IMF) figures. In

2007 lack of catastrophes enabled the Island's reinsurers to pay out less in

claims and retain more of their earnings. Reinsurers

managed to return $9.4 billion to shareholders in 2007, a 200 percent increase

over 2006. In addition, more than $2 billion in share repurchases were executed.

Reinsurance