125+ web files in a constantly

updated Gazetteer on Bermuda's accommodation, activities, airlines, apartments,

areas, art, artists, attractions, airport, aviation pioneers, banks, banking,

beaches, Bermuda as an international business centre, Bermuda books and

publications, Bermuda citizenship by Status, Bermuda Government Customs Duties

and taxes, Bermuda Government, Bermuda-incorporated international businesses,

British Army, British Overseas Territory, calypso, Canadian military, causeway,

charities, churches, City of Hamilton, commerce, community, corporate entities,

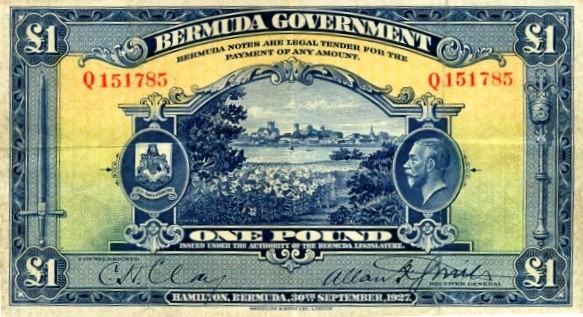

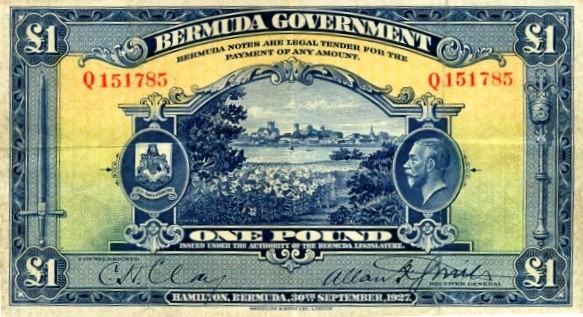

credit cards, cruise ships, culture, cuisine, currency, customs, Devonshire

Parish, disability accessibility, districts, Dockyard, economy, education and

universities abroad, employers, employment, entertainment, environment,

executorships and estates, fauna, ferries, flora, food, forts, gardens,

geography, getting around, golf, government, guest houses, Hamilton Parish,

history, homes, housing, hotels, international insurers and reinsurers, internet

access, islands, laws, legal system, legislators, local businesses and

organizations, location, main roads, media, money, motor vehicles, music,

municipalities, open spaces, organizations, Paget Parish, parishes, parish

councils, parks, Pembroke Parish, politics and political administration, postage

stamps, public holidays, public transportation, quangos, railway trail,

religions, Royal Navy, Sandy's Parish, St. David's, St. George's Parish,

shopping, Smith's Parish, Somerset village, Southampton Parish, Spanish Point,

Spittal Pond, sports, stores, telecommunications, time zone, transportation,

Town of St. George, traditions, tribe roads, tourism, United States armed

forces, utilities, vacation planning, villages, vital statistics, water sports,

weather, Warwick Parish, wildlife, work permits, etc. For tourists, business

visitors, employers, employees, newcomers, researchers, retirees, scholars.

Bermuda's

History after 2007

News and

significant events in the second third of this ninth month

By Keith

Archibald Forbes (see About

Us) at e-mail exclusively for Bermuda

Online

To refer by

email to

this web file, please use "bermuda-online.org/history2007Sept11to20.htm"

as your Subject.

2008

Early. The

face of insurance company regulation in Bermuda changed after Government passed

the Insurance Amendment Bill in the House of Assembly. The new bill made a

number of changes to the Insurance Act 1978, allowing the Bermuda Monetary

Authority (BMA) to prescribe standards for an enhanced capital requirement and a

capital and solvency return for insurers to comply with, and making new

provisions for classes of insurance companies and Special Purpose Insurers (SPIs).

It also allowed for the provision of additional financial statements prepared in

accordance with Generally Accepted Accounting Principles (GAAP) by Class 4

insurers. The changes came about through a consultation and from International

Monetary Fund Offshore Assessment recommendations carried out in 2003 and

published in January 2005 to evaluate the regulation of the banking, insurance

and securities sectors on the Island and review the financial services

legislation and identify steps to be taken to improve the country's regulatory

framework. The amendments will further enhance Bermuda's regulatory framework

and ensure that it keeps up with the evolving international standards. The

amendment to GAAP reporting for Class 4 insurers would be extended by the BMA to

Class 3 commercial sector insurance companies after a recategorisation of the

Class 3 section had been completed as per the timeline set out in the

Authority's 2009 Business Plan. The recategorisation of Class 3 insurers,

meanwhile, will separate the captive and commercial insurance firms, redefining

the Class 3 sector and forming two new sub-classes, namely Class 3A and 3B to

allow the BMA to supervise and regulate each range and type of insurer

consistently.

February 28. Government

set out its stall for tackling illegal companies trying to open up shop in

Bermuda following the passing of the Companies Amendment Act 2008. The

proposal to amend the fifth schedule of the Companies Act 1981, which lists the

annual company taxes incurred by local, exempted and permit companies, used to

help improve the Island's regulatory structure, was given the go-ahead by the

House of Assembly on Monday. Earlier this month

Finance Minister Paula Cox announced in her Budget statement that company fees

would be raised 6.5 percent, effective April 1 this year. Ms

Cox said the Act would help to recover the costs of policing international

business in Bermuda so that the Island retained its "blue chip"

reputation. She said stricter procedures were

necessary to watch for illegitimate companies setting up on the Island and to

ensure all business complied with international regulations. Shadow

Finance Minister E. T. (Bob) Richards asked Ms Cox how Bermuda compared with

other financial jurisdictions in terms of costs for companies. He

said: "We have to pay for the protection of our reputation. The Minister

has made a good case for the protection of reputation but I don't believe she

has for competitiveness." But Ms Cox said

that it was a case of "swings and roundabouts" and that in comparison

with other destinations, Bermuda offered lower work permit fees. An example of

this was the Cayman Islands, where work permit fees cost up to $15,000.

"When you look at the raft of fees in other

jurisdictions, it's swings and roundabouts. Although

in company fees we may be seen as considerably higher, and companies recognise

that in certain areas Bermuda is more costly, they also feel it's worth it

because of our reputation. We are seen as blue chip. Certainly,

I think on swings and roundabouts, Bermuda is not out of the ball park. In some

areas we're higher but in other areas, other jurisdictions are much higher.

We aren't going to tolerate abusive and sham

transactions. We are going to protect our reputation and are not going to

tolerate sham or abusive transactions. We are

serious about protecting our reputation and are not willing to be tarnished or

sullied by those wishing to use us." The

Exempted Partnerships Amendment Act 2008 and the Overseas Partnerships Amendment

Act 2008 were also passed in the House of Assembly without any objections from

the Opposition. Meanwhile,

the Bermuda Monetary Authority Amendment Act 2008 was also passed in the House

of Assembly, which includes annual fees for insurance companies such as $210,000

for Class 4 insurers and $10,000 for those in the Class 3 category.

March 30.

The

Bermuda II agreement between the UK and USA was replaced in two stages, on

this date and on June 24, 2010, by an Air Transport Agreement between the

European Union (representing 25 European countries) and the United States. This

provides for an Open Skies regime, which is more liberal even than Bermuda I and

Bermuda II.

March

30. Bermuda-registered aircraft crashes in UK. The Cessna Citation I

crash near Biggin Hill aerodrome south east of London, was attempting to

turn onto final approach having suffered engine problems. It came down on

the edge of a residential area, hitting a house, but no-one on the ground was

killed. The aircraft was VP-BGE, Bermuda-registered, that entered service in

1975, according to Flight's ACAS database. Owned by the UK division of US

fixed-base operator Ross Aviation, the aircraft was powered by a pair of Pratt

& Whitney JT15D-1 engines, and has notched up a total of 5,780h and 5,242

flight cycles. Both pilots and all three passengers died in the accident, which

occurred shortly after take-off from runway 21 bound for Pau, France. The impact

point was about 3.7km (2nm) north east of the threshold of Biggin Hill's runway

21, close to the extended centreline. Just after take-off the crew put out an

emergency call to Biggin Hill reporting engine trouble, citing severe engine

vibration. The aircraft hit a house in the village of Farnborough, Kent, [not

the town associated with the international air show], but the residents were

away.

April.

Norman Palmer, 57, who ran his own excavating business, died after he got

into breathing difficulties at his Paget home and was taken to King Edward VII

Memorial Hospital by ambulance. After Mr Palmer’s body was repatriated to

the UK, many of his body parts, including his brain, spleen, a kidney and

throat, were found to be missing, sparking international headlines. A UK

coroner stated he was "satisfied the body parts would have been removed in

Bermuda because of the lack of the Human Tissue Act. That meant the family were

not advised of the removal and it only came to light as a result of further

examination in this country. I have to say it is not uncommon for bodies to be

returned to this country with body parts missing.” Ms Bishop, sister of Mr

Palmer, said the harrowing mystery of what happened to her brother’s body

parts still haunted her and her sister-in-law and they had no intention of

giving up their search for them. A Bermuda Police Service investigation into the

body parts found no evidence of wrongdoing but recommended that the Island

consider introducing regulations about permission for retaining body parts. A

Bermuda Hospitals Board spokesperson said the missing organs “were not

retained by BHB. As we have previously stated, in accordance with regulations, a

small number of tissue samples were initially retained with the approval of the

coroner’s officer to ascertain cause of death, but the organs were returned

with the deceased to the funeral home in line with BHB’s policy. We have every

sympathy for the family of Mr Palmer. We have already given detailed evidence in

a public court about this matter, at which time our physicians, emergency staff

and pathologist were extensively questioned. The facts show that our staff acted

entirely appropriately.”

April. Bermuda's

insurance industry was worth a staggering $6.8 million per person, if its total

aggregated assets of $440 billion were distributed among the Island's population

of 64,000. The report by the Bermuda Monetary Authority (BMA) reveals

that the Island's insurance sector was in good shape despite a softening global

market after boosting its aggregate total assets by 33 percent, while increasing

its gross premiums written to the tune of more than $15 billion. The BMA's

findings show that the Island's insurers reported aggregate total assets of

$440.4 billion over the past year, compared to $329.9 billion the previous year.

Gross premiums written totaled $115.8 billion for the year, surpassing the

$100.7 billion written the prior year. Of these amounts, captives accounted for

$72 billion in total assets and almost $22 billion in gross premiums written. A

total of 71 new insurance and reinsurance companies were established in the

Bermuda market during 2007, compared to 82 in 2006, the BMA reported. The fall

in registrations reflected the generally softer market conditions globally,

which saw a slowing of captive incorporations. In such conditions, companies

typically are able to purchase reinsurance coverage at competitive rates in the

traditional commercial markets. According to the BMA, the majority of the new

Bermuda market entrants for 2007 were once again Class 3 insurers, a combination

of captive and commercial companies. With respect to the commercial sector, 2007

saw the formation of two Class 4 companies. This reflected the general

inactivity in the property and casualty market, and the relative lack of major

catastrophic events during the year, resulting in the likely record

profitability of existing insurers and a sufficiency of global capital in the

property/casualty sector.

August. Demolition of the old Club Med in St. George's occurred. As a direct

result, developer Carl Bazarian was later awarded a 262-year lease to build a

resort at the site of the old Club Med in St George’s. The Park Hyatt Resort

(St George’s) Act 2008 was the authority. The lease stipulated a

“construction period” mean “a period not exceeding forty-eight (48) months

commencing from the date of completion of the demolition under Article 6 of the

MDA (master development agreement)”. St George’s was still desperately

in need of an economic revival and a new hotel will definitely help change that.

But as reported in March 2012, with 42 months since the property

was imploded, the property was in breach of this deadline, Furthermore, Bermuda

was promised development would have commenced in 2011 at the latest.

The

skeleton of Governor George Bruere (Governor from 1764 to 1780) was unexpectedly

found under the floorboards of St Peter's Church in St, George's when

archaeologists from Boston University were searching for evidence of the

foundations of the original church on the site, built in 1612. His wooden coffin

had crumbled away, but a copper plate supposed to be from the top of the coffin

was found in the skeleton's chest cavity, bearing the inscription "His

Excellency / George James Bruere Esq / Governor of Bermuda /Lieut. Col. In His/

Majestys Service OB / The 10 September 1780/ AE 59 Years". The vicar of the

church commented that he had no record of the funeral. From the bones, it was

estimated that Bruere was 5 feet 4 inches (1.63 m), in height, which was about

the average for the 18th century.

Beyoncé

Knowles visited Bermuda, including a presence at the 2008 Music Festival at

the Bermuda National Stadium.

A

controversial company was set up by the Bermuda Hospitals Board (BHB). Healthcare

Partners Ltd was formed to go into business with private partners as a

subsidiary of BHB. But the scheme soon came under fire, facing allegations

that hospital staff were profiting from its activities at the expense of

home-grown medical companies.

The

Progressive Labour Party Government axed dozens of Bermudians working in the

Tourism Ministry’s New York office and replaced them with a US sales firm,

Sales Focus.

Others not available here.

2009

Celebration of the 400th

anniversary of the accidental settlement of Bermuda.

Her Majesty Queen Elizabeth

II and her husband the Duke of Edinburgh visited Bermuda.

January.

Bermuda was in the American political spotlight once again with the publication

of a report on "tax havens" which shows that the 100 largest US

corporations have a combined total of 229 subsidiaries on the Island. The

USA's Government Accountability Office (GAO), which includes the Island on its

list of tax havens, showed that 83 of the 100 companies had at least one

subsidiary in what it defined as a tax haven. Citigroup,

the recipient of some $45 billion in US Government aid during the market turmoil

since 2008, topped the list of companies with Bermuda subsidiaries, with 19.

Another banking group, Wachovia, was second on the

Bermuda list with 18 subsidiaries here. Wachovia was taken over last year by

Wells Fargo, which received $25 billion in US bailout money in 2008-2009.

Citigroup is one of several corporations with Bermuda

units to have received government bailouts, including General Motors (three

subsidiaries on the Island), Bank of America (two), American International Group

(five), Merrill Lynch (two) and Morgan Stanley (two). Two

oil company giants, ConocoPhillips and Chevron, who achieved a combined

full-year net income of more than $30 billion in 2007, take third and fourth

places on the Bermuda list, with 17 and 16 subsidiaries respectively. Pharmaceutical

giant Merck is fifth with 14, while Caterpillar, the machinery manufacturer that

stands to cash in on incoming President Obama's economic stimulus and its focus

on infrastructure spending, is equal sixth with 13. Drinks giant PepsiCo also

has 13 subsidiaries in Bermuda. AIG, an insurer which employs around 200

people on the Island and which has received some $150 billion of federal support

to enable it to survive, has five subsidiaries based on the Island of its 18 in

"tax havens" the GAO report showed. The

report was requested by US Senators Carl Levin, a Democrat from Michigan, and

Byron Dorgan, a Democrat from North Dakota, who have pushed for tougher laws to

fight offshore tax havens around the globe. Sen.

Levin, who leads the Senate Permanent Subcommittee on Investigations, has

estimated abusive tax havens and offshore accounts cost the US government at

least $100 billion a year in lost taxes.

March.

It was reported that as UK Prime Minister Gordon Brown and his fellow European

leaders prepare for the April 2009 G20 summit in London, where Bermuda and other

'tax havens' will be debated, the island's business sector is being targeted

from another direction: the state of New York.

New York Governor David Paterson has thrown his

weight behind state insurance commissioner Eric Dinallo's plan to bring

reinsurance business back from Bermuda to the US by establishing a New York

Insurance Exchange (NYIE). Mr. Dinallo intends

to have the NYIE up and running by 2010 and plans to narrow the tax gap in order

to compete with Bermuda in its most lucrative sector. Mr.

Dinallo believes his plan will see insurance jobs move back to New York, which

he recently described as a reinsurance "vacuum." While

the last incarnation of the NYIE folded in 1987 after losses mounted, those

working on the 2010 version believe the current state of the economy will work

in New York's favour. "The US currently

gets none of the tax revenue from this activity because all of this is in

Bermuda, so if we can capture some tax revenue from the business that comes to

NYIE, that would be a big benefit," the New York State Insurance

Department's Mr. Mais said. "This is

particularly important, given the hits that employment in the financial markets

has taken recently. The NYIE itself would be a new employer and presumably

numerous insurance companies, capital providers, syndicates and brokers would

have to hire more people here in New York to work on the exchange. We

hope to get favorable tax treatment and a relatively small amount of initial

capital committed and the exchange set up, so that as the economy begins to turn

around, the facility is available and New York will enjoy the benefits of

drawing new sources of capital to our financial markets. There is also the

probability that there will be a shortage of reinsurance capital, particularly

catastrophe coverage, over the next few years, which will create an opportunity

for the NYIE."

April 17. Tucker's Point Hotel

and Spa opened, at 60 Tuckers Point Drive, Hamilton Parish, Harrington

Sound, Bermuda, HS 02, as a reincarnation of the old Castle Harbour then

Marriott's Castle Harbour Hotel. Performing the opening ceremony were

Michael Douglas and his wife Catherine Zeta-Jones and Premier Ewart

Brown. It had been 37 years since Bermuda had last constructed a new

luxury hotel.

April. The Lamb Foggo Urgent Care

Centre opened to much fanfare in Southside, St. David's. It was built

on the site of the former US military hospital.

May. The Bermuda

Government's application was approved to become a contributory member of the

University of the West Indies (UWI). Bermuda's membership was slated to

allow Bermudian students to enter the University at an agreed upon

subsidized rate possibly as early as the 2009/2010 school year. UWI also

agreed that their Open Campus (online degree courses) would become open to

Bermudian students in the future, with Bermuda becoming the 13th country to

have access to the Open Campus.

May 16. Roy

Talbot, the last surviving member of Bermuda's famed Talbot Brothers band, has

died. The 94-year-old, who with his talented

family helped popularize calypso music in the wider world, was yesterday

remembered as a skilled bass player, "a gentleman and a fine

Bermudian" and an early promoter of the Island as a tourist destination.

The Talbots were hugely popular here, in the

United States and the United Kingdom in the 1950s and 1960s. The group released

four albums and were known for such songs as 'She Has Freckles On Her Butt',

'Bermuda Buggy Ride' and 'Yellow Bird'. Mr.

Talbot played the bass fiddle and actually created his own instrument, a double

bass known officially as "the doghouse", and affectionately as

"Bermudavarius" a nod to the Stradivarius violin. The

group's accomplishments were never forgotten. VSB radio and television station

manager Mike Bishop recently produced a documentary. Last

month, the 94-year-old was presented with a lifetime achievement award and a

book, CD and DVD collections compiled by Mr. Talbot's nephew Clement were

released. Mr. Talbot's health quickly

deteriorated soon after, however. "It's a

real loss," said his nephew, who started the Ross (Blackie) Talbot

Foundation, named eponymously after his father, another band member. "I

spoke to (his wife of 22 years), my aunt Mary this morning. It

was a shock. She knew his time was running to the end but wasn't anticipating it

would end as abruptly as it did. Obviously it has an emotional impact but I

think the family is holding up well although we're all saddened by the loss.

" Several tributes were paid to the

legendary musician in the House of Assembly yesterday. Said

Environment and Sports Minister Glenn Blakeney: "The Talbot Brothers were a

national treasure, known not just here on these 22 square miles, but around the

world as they traveled bringing incredible joy to communities with their unique

style of performing original and classic calypso songs. Roy

Talbot was the bass player and actually invented an upright bass made of one

string, he hit all the right notes." Several

MPs added their comments to his, among them former Premier Dame Jennifer Smith:

"I was glad he was around to see the book his nephew published."

Culture and Social Rehabilitation Minister Dale Butler

described Mr. Talbot as a "gentleman and fine Bermudian". However

one of those who best knew him was his nephew, who spent three years trying to

convince him to agree to the special project he had in mind. Mr.

Talbot said he persisted because he saw his relatives as being "the last of

what you call the almost-forgotten." Roy

Talbot also enjoyed the production of a new book and DVD on the Talbot Brothers.

"He

and his brothers made a significant contribution to Bermuda's hospitality

industry. They broke down a number of barriers and were able to climb a number

of barriers (which existed) because of their skin colour."

May 27.

Visitor arrivals and spending plummeted by more than a quarter in the first

three months of this year, according to figures released yesterday.

Announcing the Department of Tourism's 2009 First

Quarter figures, Premier Ewart Brown said: "It should be abundantly

clear to everyone that Bermuda Tourism is not immune to the regional and

global trends of an economy in dramatic downturn." Shadow

Tourism Minister Michael Dunkley however, dismissed this as

"spin". "No amount of

recession, no amount of words, aka 'spin', can cover over the fact that the

Government's tourism woes are self-inflicted," he said. Senator

Dunkley said what was needed now was a Tourism Authority, to put "the

management of tourism into the hands of hospitality professionals and out of

the hands of politicians". Dr. Brown,

Tourism Minister, yesterday revealed air arrivals have dropped by more than

a fifth and occupancy of hospitality properties declined 28 percent. Government

statistics for the first quarter of 2009 show visitor spending also fell.

The figures show visitors spent between $734 and $922, compared to

$1,013-$1,216 per person in January to March 2008. Total

visitor arrivals for the opening quarter of 2009 fell by 27.84 percent year

over year, with 32,361 tourists during this period, compared to 44,845 last

year. Air arrivals fell 22.75 percent, with

32,235 visitors 9,500 less than the first quarter of 2008. The

statistics also point to a steady decline in 'all arrivals' as the year

progresses, with 17.3 percent fewer arrivals in January, 26.1 percent less

in February, and 33.4 percent <\!m> a third less in the total number

of visitors for March. The number of people

travelling to Bermuda for a vacation dropped by 29.1 percent in the first

quarter, year over year. Business visitors declined by 10.5 percent and

convention visitors were down by more than half compared to 2008, with a

53.6 percent drop. Yesterday however, Dr.

Brown said he was optimistic things would pick up in the summer. Commenting

on future hospitality bookings, he said: "The rest of May and going

into June have been better than anticipated." He

added the opening of Tucker's Point had created "a buzz in the

industry", and that hoteliers would succeed by showing

"creativity". But Dr. Brown added

that for some visitors, the Island was perhaps too expensive. He said:

"There is something about the Bermuda price point which didn't sit well

with visitors. I don't know that it wasn't acceptable value for money but it

didn't sit well with some." Announcing

a raft of measures to attract more tourists, he said: "I feel good

about all the good things that are happening. In spite of the tendency of

some of the media to paint a miserable picture, we believe there are some

good things happening, but they must do what they do." Dr.

Brown said the opening of the new Heritage Pier in Dockyard would also buoy

up cruise visitation figures. He said that

once global tourism recovered from the economic downturn, people "would

start travelling again. And when they travel again, we believe they will be

more likely to visit or re-visit those destinations where the tourism

product is fresh and buzz-worthy. With the new Port Royal and the

revitalised Dockyard, with the new Tucker's Point Hotel and the

crowd-pleasing Newstead, with the soon-coming Park Hyatt, Four Seasons and

Grand Atlantic we think Bermuda Tourism is in a position to capitalise on

the comeback. I trust all of our local

Tourism partners will be ready." Yesterday

however, Sen. Dunkley said: "We need a new approach to tourism and new

leadership. The best thing the Premier can do today to improve tourism is to

begin the transition to a Tourism Authority." The

Opposition Senator said Government had failed to provide a "dedicated

cruise ship for Hamilton this year" and "did not vote extra

marketing dollars this winter to pump up Bermuda's market profile, as did

our competitors to the south". He

added: "We don't have a working sales force in the United States as a

result of the Minister's destruction last year of the New York sales office.

The so-called 'reorganisation' fired its Bermudian

sales force in favour of a US company that was dumped just a few weeks ago

by the Minister. As we said last week in an editorial: The upshot is that

Bermuda Tourism's marketing organisation is in a shambles; with the Minister

supervising the meltdown of our North American operations. In

the midst of a worldwide economic crisis, when Bermuda needs its strongest

sales effort against intense competition, we are without a dedicated sales

force in our most important market." Last

night Stephen Todd, President of the Bermuda Chamber of Commerce, said

hoteliers and hospitality partners, retailers and restaurateurs had

anticipated a fall in visitor numbers. "They

are concerned, as we all are, but also guardedly optimistic," he said.

"We are all looking at the manner in which we

deliver our products and services, and the restaurant and retail sector are

looking to provide value to their customers, and also the way they deliver

those products and services. While we can't

control the ability to get people to come to Bermuda and to travel in this

current global economic climate, we need to encourage visitors who do come

here to return. We've seen a number

of initiatives the Department of Tourism has and will be moving forward,

some of which the Premier indicated in his speech today, but the true test

will be if we see an increase in visitor numbers in the coming months.

This is really something we can't predict."

Premier Dr. Ewart Brown outlined a number of

initiatives to encourage visitors to the Island as the tourism industry is

hit by recession and the global economic downturn. The

measures announced yesterday at a Ministry of Tourism and Transport press

conference, include Partnership with the Bermuda Hotel Association (BHA) in

the 'Compliments of Bermuda' $200/$300/$400 promotion, from November 2008 to

March. The Department of Tourism provided $650,000 in subsidised funding to

hotels for the hotel package promotion. Government

contributed a total $900,000 to hotels for joint promotions with Bermuda

Tourism in the fall and winter of 2008-9. This resulted in 5,031 bookings,

or 10,062 passengers. A 'Sizzling Summer

400 Program' to mark Bermuda's 400th anniversary of permanent settlement,

will provide a credit of $400 to visitors spending four nights of more on

the Island. The Department of Tourism

executive team completed a 2009/2010 sales and marketing plan in

mid-February. Dr. Brown, Tourism Minister, said this was "designed

specifically to address the current challenges faced by Bermuda in the face

of the current economic downturn". This

includes more emphasis on digital (Internet) marketing. $2.5 million has

been allocated to digital and interactive marketing, with a revamped Bermuda

Tourism website and more marketing on social networking sites. Marketing

efforts will also focus on the "core northeast market with secondary

attention to the UK, Canada and Europe". The

Premier, the Director of Tourism and the director of Global Operations, have

given presentations to industry partners in Philadelphia, New York and

Boston. Dr. Brown said: "Approximately 25 percent of Bermuda's business

is attributed to retail travel agents and we will continue that commensurate

level of support to this distribution channel." Speaking

engagements. Dr. Brown said this was a means for Bermuda "to get word

out on the street about our outstanding tourism product". He

cited a speech to the Young Presidents' Organisation at a regional function

in Miami as an example, and said the aim was to get business leaders

inspired to visit Bermuda for a retreat. New

marketing partnerships with the Boston Red Sox and the Deutsche Bank Golf

Championship. A Red Sox Bermuda Night is to take place at Fenway Park on

June 19. The course renovations are now

complete for the new Port Royal Golf Course and the Premier said Tourism has

"big plans for Port Royal" in its strategy, with plans to focus on

New England in marketing. The Bermuda

International Love Festival. Dr. Brown said this year's sponsors included:

Elle, W, and Departures magazines, Golf World, Robb Report, Veranda, Chopard

Jewellers and JetBlue. The partnerships would lead to more "editorial

coverage of Bermuda". Dr. Brown said

that while this year's Love Festival attracted 160 people, next year the

target would be 300. Salsa dancing and

street festivals could feature among the activities on offer this summer.

The Department of Tourism is sponsoring free events around the Island, which

include: an increased schedule for the 'St. George's Historical Reenactment;

storytelling in Bob Burns Park; 'Gombey Saturdays' at Par-la-Ville Park; a

'Taste of Bermuda Calypso Sundays' at Royal Naval Dockyard; and the return

of Movies on the Beach.,Whenever

cruise ships are berthed at Dockyard on a Saturday, the ferry service will

operate to St. George's with four round trips a day. Dr. Brown said:

"We are providing this service in response to input received from

residents and businesses in St. George's."

June 11. Four Uyghurs who

had been held in extra-judicial detention in the United States Guantánamo

Bay detention camp, in Cuba were deported secretly to Bermuda under a

conniving deal reached solely between the-then Premier of Bermuda, Dr. Ewart

Brown, United States Consul General in

Bermuda and the United States government - and in violation of Bermuda's

Constitution. The four men were among 22 Uyghurs who claimed to be

refugees, who were captured in 2001 in Pakistan after fleeing the American

aerial bombardment of Afghanistan. They were suspected of training to assist

the Taliban's military. They were cleared as safe for release from Guantánamo

in 2005 or 2006. But U.S. domestic law prohibited deporting them back to

China, their country of citizenship, because the U.S. government determined

that China was likely to abuse their human rights. In September 2008 the men

were cleared of all suspicion, and Judge Ricardo Urbina in Washington

ordered their release. However domestic opposition to their admittance to

the United States was very strong and until Bermuda and Palau agreed to

accept them, the U.S. had failed to find a home for them. The Uighurs

concerned were banned from ever going back to the USA for having

accepted training from al Qaeda and taken part in terrorism.

The secret, sneaky and illegal bilateral discussions that led to

prisoner transfers between the U.S. and the devolved Bermuda government

sparked diplomatic ire from the United Kingdom, which was not consulted on

the move despite Bermuda being a British territory. Tensions between Bermuda and Whitehall reached fever pitch with

then-Governor Richard Gozney calling the move 'invalid' and 'unacceptable.'

The British Foreign Office issued the following statement: "We've

underlined to the Bermuda Government that they should have consulted with

the United Kingdom as to whether this falls within their competence or is a

security issue, for which the Bermuda Government do not have delegated

responsibility. We have made clear to the Bermuda Government the need for a

security assessment, which we are now helping them to carry out, and we will

decide on further steps as appropriate."

June

12-15. Bermuda participated in the international event linking

Europe and North America also part of the 400th anniversary celebrations of

Bermuda’s permanent settlement after the wrecking of the Sea Venture.

Bermuda was named one of the host ports for

the Tall Ships Atlantic Challenge along with Vigo on Spain, Tenerife in the

Canary Islands, Halifax, Canada, and Belfast in Northern Ireland. Young Bermudians

were given the opportunity to be

placed as trainees on some of the international ships as they sailed from port

to port. The Spirit of Bermuda took part in some stages

of the event. Between 30 and 40 tall ships

were on hand for the festival, which got a

boost in 2009 as it coincided with the 100th anniversary of the Royal

Canadian Navy, also bringing a number of military tall ships. A

fleet of ships from Europe raced to Bermuda and gather back in Halifax

for another leg of the race. This

leg ended in Belfast, Northern Ireland.

August

18. A new digital marketing campaign has proven extremely successful for the

Department of Tourism, Premier Ewart Brown said yesterday.

The Department released the second quarterly

bulletin which showed that despite arrivals being down between April and

June visits to BermudaTourism.com

were up 81 percent compared to the same period in 2008. Dr. Brown, who is

also Minister of Tourism, said several high impact promotions on the site in

the second quarter attracted approximately 301,000 visits. Page views were

also up 49.9 percent to 2.7 million. The

results mean potential tourists are now spending more time while viewing

more pages and sections of the website. Dr.

Brown said he believes the increase is due to the website's new look as well

as an increased amount of new information being posted. Data also shows that

people are staying on the website longer as the "bounce rate" is

down 48.5 percent. "We believe this

trend will continue which is important because search is a cost effective

way of touching our target audience and we will continue to increase

investment not only with our own website development but also with our

online distribution partners. Increased traffic to the website, despite

fewer visitors, is an extremely encouraging indicator that our goal to

increase destination awareness is definitely working and this augurs well

for the future." News is also good

from online booking agencies. Dr. Brown said in 2007 they realised more

effort needed to be put in online tourism sites as 57 percent of North

American consumers booked vacations online. Online

bookings on Expedia were up 33 percent year to date, compared to the first

six months of 2008, while Orbitz bookings were up 45 percent, Travelocity

bookings up 35 percent and Purely Bermuda, a key UK online operator, up 36

percent. No actual numbers were provided. He

added that in key markets BermudaTourism.com

is the first site located by a Google search, previously the site ranked

third or fourth. "These numbers are

very encouraging," Dr. Brown said. "In fact they are exciting. I

have supreme confidence we are moving in the right direction on our digital

marketing strategy and I will be compelling our Internet group to keep their

foot on the gas pedal." Tourism stats for the second quarter of 2009,

compated to the same period in 2008, showed Air

arrivals were down 14.2 percent, brining 74,979 visitors to the Island this

year; Air arrivals for people coming on vacation were down 12.4 percent; Air

arrivals for people coming for business were down 16.4 percent; Air arrivals

for people coming for a convention were down 41.9 percent; Air arrivals for

people coming to visit friends or family were down 0.8 percent; Air arrivals

from the core US market were down 12 percent; Air arrivals from the rest of

the US market were down 13 percent; Air arrivals from Canada were down 10.8

percent; Air arrivals from the UK were down 19 percent; Air arrivals from

Europe were down 28 percent; Cruise arrivals were down 3.7 percent, bringing

124,553 visitors to the Island this year; Yacht arrivals were down 7.98

percent, bringing 3,529 visitors to the Island this year. For the year to

date the number of total visitors was 235,525, down 11.28 percent. In the

past 30 years the total visitor number has surpassed 200,000 only eight

times. This year's total visitor number is the fifth best since the modern

recording system was implemented. 201,565 visitors came to the Island in

1982. 213,931 visitors came to the Island in 1987. 200,607 visitors came to

the Island in 1994. 200,676 visitors came to the Island in 1996.

228,768 visitors came to the Island in 2006. 232,806 visitors came to the

Island in 2007. 220,634 visitors came to the Island in 2008. 203,061

visitors came to the Island in 2009.

September. What for

centuries in Bermuda used to be known as Spanish Rock formally renamed

Portuguese Rock in a ceremony attended by dignitaries from Bermuda and

Portugal. The ceremony

was held at the rock, which was engraved here almost 500 years ago.

Portuguese Rock is a poignant reminder that Bermuda has and will continue to

have strong cultural connections with Portugal and a shared maritime and

international commercial history that built the foundations of the modern

Atlantic world. Antonio

Nunes de Carvalho Santana Carlos, Ambassador of Portugal, flew in from

London for the ceremony and made a short speech. Once the new sign was

unveiled, Bishop Robert Kurtz and Father Julio Blazejewski both said

prayers. The Portuguese

national anthem was performed on the accordion by Antonio Araujo and Wendell

"Shine" Hayward played Bermuda's official national anthem God Save

the Queen, on his saxophone. It

was thought that the inscription 'RP 1543' was made by the Spanish who

roamed the seas in the 1500s and hence it was called 'Spanish Rock.'

But subsequent research indicated that the inscription was made by a

Portuguese sailor who was wrecked off Bermuda's reefs in 1543.

September. Government’s

Washington office opened, on 7th Street in the US capital. The-then

Progressive Labour Party administration said that its core functions were to

maintain open channels of communication with US policymakers and their

advisers while also facilitating business development opportunities for

Bermuda. Opposition MPs branded the initiative extravagant — it is

understood that the Government signed a ten-year lease on the office, paying

$180,000-a-year to rent the space.

October.

Bermuda's honey bees were badly hit when the varroa mite hit the

Island, causing thousands of local bees to die. The mite infected

most of the bee hives in Bermuda. There was a knock-on effect on agriculture

as bees are needed to pollinate crops.

October

26. With the closure of Elbow Beach Hotel's main building for the next

several years, many people have been left wondering what does this mean for

much touted hotel developments across the Island.

Last Wednesday, when the announcement was made

that 160 people would loose their job as a result of Elbow's

partial-closure, Premier Ewart Brown said he was saddened by the news but

optimistic. A press statement indicated

that the Premier believed the hotel was in "dire need of

upgrading" and added that he was "expressing optimism on the

future. The rooms that will replace the old-style accommodations in the old

building will make a welcome addition to the improved product that will come

when other hotels are developed," he said. "Elbow Beach will then

be able to compete with brands like Park Hyatt, Four Seasons and St.

Regis." The press statement added that

Elbow Beach will neighbour the proposed Four Seasons to be developed at the

site of Coral Beach/Horizons. Here's a look

at the progress of the hotel developments Dr. Brown mentioned as well as six

other properties across the Island: Ariel

Sands, Devonshire. After closing its doors indefinitely in January, the

owners attempted to find an investor to redevelop the property. In March

executive director John T. O' Brien said its original investor had backed

out of the deal because of the deteriorating financial climate and the

company was looking for new investors. Since then no new investors have been

publicly named. Grand Atlantic Resort

and Residents, South Shore, Warwick. In

2007 it was announced that a nine-storey, 706-bed hotel would be built at

the former Golden Hind site. A

Special Development Order was passed outlining that Government and

landowners Atlantic Development were to build a 100-room hotel and 125

affordable homes in a public-private partnership. It

added that the 125 two and three-bedroom condos would be built in four

phases, while the hotel was constructed on a neighbouring site, with a

projected completion date by 2013. St.

Regis. Hamilton. In November 2007 the Corporation of Hamilton signed a

deal to develop a five-star Ritz Carlton on the site of the Par-La-Ville car

park. However, in June Premier Ewart Brown

announced the exclusive five-star hotel and residence development would now

be a St. Regis. The St. Regis Bermuda will

feature 140 rooms and suites and 80 serviced residences, and will be located

on the corner of Par-la-Ville Road and Church Street, overlooking the park.

A spokeswoman for the overseas developers said the

ground breaking will take place between July and December next year and the

foundation will be laid sometime in 2011. The hotel will be opened by

September 30, 2013, at the latest. She added that they were confident with

their financing. Coral Beach Club and

Horizons, South Shore, Paget. Owners are waiting for the Draft Plan

Tribunal to decide on an appeal against the Development Applications Board's

refusal of planning permission for the Four Seasons Hotel in Paget. The

plans include a 150-room hotel, 60 fractional ownership villas, 20

residential units, a spa, fitness centre, tennis courts, pools and

conference centre to be located at the properties. The developers did not

respond to a request for comment. Former

Wyndham/Sonesta property, Southampton. In January 2008, developers Scout

Real Estate Capital announced plans for a $300 million resort called

Southampton Beach Resort. Last week the

company declined to comment on rumours it was looking for a quick sell-off

of the property and did not respond to a request for an update. Coco

Reef Hotel, South Shore. In January 2008 Coco Reefs Hotel was granted a

Special Development Order to build 66 apartments on Government owned

property. In March this year Coco Reef

Resorts Ltd. owner John Jefferis said he planned to break ground on the 66

new lease back Coca Villas cottages in December. Mr.

Jefferis did not respond to a request for an update. Stonehaven

Development Condominium Hotel, Hamilton. The 81-unit apart-hotel at the

corner of Court Street and Reid Street will house 42 'hotel condominiums',

39 'residences', plus a restaurant and spa. The

development, on the site of the former Canadian Hotel, was granted a Special

Development Order in 2008. Owner Ted Powell

said they were still working on financing the project and talking with

prospective hotel brands. There is no date in place for breaking ground on

the project. Former Club Med, St.

George's. In June Dr. Brown told a PLP

Town Hall meeting in St. George's financing for the five-star Park Hyatt

hotel at the former Club Med site would be signed in July. Financing

is at an advanced stage. Final documents are to be signed in July. That

will secure all of the funding both from the investment side and the debt

side. These documents will be signed next month. Developer

Carl Bazarian did not respond to a request for an update as to whether

financing had been secured or a start date for the project. Morgan's

Point, Southampton. Government

agreed to a land-swap with developers to swap Southlands for the Morgan's

Point property in April 2008. Originally

the Jumeirah hotel group was attached to the project. In

March, a Jumeirah spokeswoman said the ultra-luxury Dubai-based chain had

signed an agreement to manage a new hotel in the US Virgin Islands, but not

in Bermuda. But she added: "Jumeirah

was appointed in 2007 to manage the first five-star resort to be built in

Bermuda in 35 years. Since then, the developers, along with the Government

authorities, have been looking at a new opportunity on a different site. We

continue to be committed to Jumeirah's resort in Bermuda." Attempts

to reach developer Craig Christensen for an update were unsuccessful.

November. Establishment of the

Bermuda Government's Energy Commission. The mission is to assist in the

development and maintenance of affordable, clean and sustainable energy, for

the economic, social and environmental well-being of residents and

businesses in Bermuda. As required by the Energy Act 2009, appointed by the

Minister of Energy, Telecommunications and E-Commerce in November 2009. The

Commission consists of a chairman and four other members, though an

additional member may be appointed to assist in an inquiry by the Commission

if their expertise/experience is required. Members are appointed for a

period of three years. Meets twice a month and primary duties are to Review,

and subsequently approve or disallow variations to the price or charge for

electrical power submitted to the Commission by a specified businesses;

Set out the terms and conditions

under which a specified business may make a variation to the price or charge

for electrical power; Conduct

inquiries into the price or charge made for any energy-related commodity;

Conduct inquiries into other

matters concerning the cost or supply of any energy-related commodity;

Conduct inquiries into any

matter which may affect the exercise of the Minister's powers under the

Energy Act 2009; and Advise

the Minister in the discharge of the Minister's functions under the Energy

Act 2009.

2009. John Barritt & Son Ltd

began importing Coca-Cola and other soft drinks from overseas, rather

than bottling them locally, to cut costs amid falling sales.

2009. Gosling’s joined with

Polar Beverages of Massachusetts to create, package and distribute its

own ginger beer soft drink.

2009. Plans to develop the South

Shore, Warwick homes were announced by Premier Ewart Brown. He promised

a combination of 125 housing units and a 100-room hotel would be built on

the site of the former Golden Hind resort and before that, in the 1960s, the

Bermudiana Beach Club premises fronting one of Bermuda's loveliest beaches.

2009. The government of

Bermuda transferred Casemates Barracks and its adjacent Ordnance buildings and

fortifications into the existing Bermuda Maritime Museum and the

combination, involving a total of 16 acres of land and buildings, became the National

Museum of Bermuda.

2009. The

Bermuda Chamber of Commerce, Real Estate Division, published its 2009

Handbook on buying and selling Bermuda Homes, see

2009 Bermuda Real Estate Handbook.pdf

2009.

Death

of Bermuda war veteran David Lindsay. Born in Bermuda on March 4, 1920,

he was the son of Walter and Mary Lindsay, formerly of Kirkaldy, Fifeshire,

Scotland. Walter had come to Bermuda to be chief electrical engineer at the

Hamilton Hotel, then the largest in Bermuda, where city hall now stands.

David attended Saltus Grammar School until he was

16, when he went to Scotland to complete his education. He remained

in Scotland after leaving school. He wrote a vivid

account of his experiences as a soldier overseas in World War Two. It was

originally published in the Bermuda Mid-Ocean News of October 20, 2000,

under the headline "My 6 ˝ years as an anti-aircraft gunner". At

the outbreak of the Second World War, he was 19 and an apprentice insurance

actuary. He had not long to wait before

being called up for the Royal Scots, the oldest regiment in the British

Army. Following 12 weeks of basic training, a special course and a lance

corporal's stripe, he qualified as an instructor. He could really shout in

those days! His platoon was in dawn-to-dusk

stand-to duty. He decided it was time to

move on and, along with three others, answered a call for volunteers to

become Lewis gunners on trawlers. He trained in everything from basic .303

ammunition to six-inch naval guns. On completion, we were posted to the

3/2nd Maritime Anti-Aircraft Regiment in Middlesborough.mA

further call for volunteers for training on 40mm Bofors guns saw him posted

to a troop ship leaving Gourock in Scotland for South Africa. He was

sea-sick for days. After a stop at

Freetown, Sierra Leone, he reached South Africa. He spent three glorious

days there, and a further nine at Durban, where people were wonderfully

hospitable. He still had his Glengarry (the special Scottish cap worn by the

Royal Scots) which was a great passport abroad. Eventually,

he returned to Glasgow where he went to Sheerness to join a tanker bound for

the United States. It had been refitted at Mobile, Alabama. On

the way to Halifax to join a convoy for Britain, he eas torpedoed. He got

off safely, was picked up and taken to Norfolk, Virginia. He ended up in a

convoy named Operation Pedestal with 14 merchantmen and 50 escort ships

bound for Malta. He hardly got through the Straits of Gibraltar when the

aircraft carrier Eagle, at the rear of the convoy was torpedoed and sunk. He

fired so many rounds he had to change gun barrels twice as they became too

hot. After two days of chaos, the two

battleships and the aircraft carriers departed, leaving him to get on with

it. He was the loader on top of the gun and at dusk someone handed him an

ammunition clip the wrong way round. The gun jammed just as German Stuka

dive bombers were attacking him and his party. "I

looked up and saw a Stuka coming straight down. Its bombs went diagonally

across the aft part of the ship, just below us. The blast blew me off the

gun against the parapet. All I got was an injured knee. Another guy broke

his wrist. We were lucky. Next day we came

upon the convoy's only tanker, which had been torpedoed. Another destroyer

was standing by. The two destroyers (HMS Penn and HMS Braham. I was on the

Penn) got ropes aboard the tanker. But the dive bombers appeared and the

destroyers had to let go of the ropes. Eventually,

they lashed the destroyers to the tanker, one on each side and, in spite of

further attacks, we got into Malta's Grand Harbour where, later, the tanker

sank. They gave the tanker's captain the George Cross. They

should have given our destroyer's captain a medal. I don't know how or when

he could have slept. When we got him ashore, they had to cut his boots off,

his feet were so swollen. Things were so

bad that each gun crew had been on a ration of only four rounds of

ammunition a day. That took two seconds to fire off. We

were kept in Malta. We thought we would be there until the war ended.

However, Allied victories in North Africa and Sicily changed things. I

was put on a trooper and a guard to prisoners-of-war going to Egypt and

Palestine. It had been a hard year in Malta. We had dysentery and sores

which wouldn't heal due to shortage of rations and Vitamin C. After

four months on a tanker plying between Haifa and Egypt, I got shipped to

Scotland, and my fortunes improved. I went to a new regiment in Bristol, and

was placed on a small Dutch coastal ship loaded with coal. I

was waiting to go on a sergeant's course when D Day intervened. I was

assigned to a top-heavy American vessel, taking supplies to Utah and Omaha

Beach Heads in Normandy. We ran the ship up on the beach at high tide and

waited for low tide to unload . Later, we twice went up the River Seine to

Rouen. After a course at the Royal

Artillery School of Survey, I went to Hanover, Germany, and Osnabruck,

Austria, and ended up in charge of a 25-pounder team in Dortmund before

demobilisation after six and a half years of service. Looking

back, it didn't seem that long." During

David's post-War period of duty in Germany, he met and married Maria. They

were married for 54 years before Maria died following a serous illness.

They

are survived by a daughter, Elinore Thomson, and a son Robert. Elinore and

Robert are now retired but still live in their ancestral home city of

Kirkaldy in Scotland.

2009.

British American Insurance Company (BAICO) was wound up after its collapse.

Later, its distinctive blue

building was listed with agents Coldwell Banker, initially for $3.6 million,

then $2.7 million, most recently for far less than that, $1.95 million. In

October 2012 it still had not sold. The building was home to BAICO. The drop

in asking price means the final distribution to be divided among creditors

or policyholders still awaiting a final cheque will be less than hoped. In a

statement sent out in October 2012, KPMG Advisory Ltd, agents to the

Official Receiver, said: “Creditors should be aware that it remains the

objective of the Official Receiver to execute a sale as soon as possible,

and that notwithstanding the significant reduction in price aimed at

attracting a buyer, no one has yet been identified with the ability to

finance the building’s purchase. As such, in order to assist those

purchasers who are finding it difficult to obtain financing in the

prevailing economic environment, the Official Receiver has further reduced

the asking price to $1.95 million.” BAICO owns 40 percent of the building

with the other 60 percent belonging to the BAICO Bermuda pension scheme.

There are approximately 3,800 BAICO policyholders and 6,000 policies.

2009.

The Bermuda

Housing Corporation (BHC) warned Cabinet against building the Grand Atlantic

development in Warwick. BHC was informed of the plan for a hotel and

housing development on the South Shore in 2009. The Grand Atlantic project

was a Cabinet directive, which the Corporation cautioned against. At that

time, the data regarding the real estate market supported the case that the

cost of housing was falling and the demand was not there. It was agreed that

BHC would buy 78 of the 125 units and offer them for resale, with an option

to buy the additional 47 units “if the market supported the purchase.”

2009.

The controversial Heritage Wharf cruise ship terminal at Dockyard was opened

at a Bermuda taxpayer cost of $60 million — a huge increase on the

original estimated cost price of $35 million.

2009.

November. The Energy Commission,

a regulatory body, was empowered by the Energy Act 2009. It does not

release its annual reports to the public — nor does it have to. The Energy

Act requires only that it provides the relevant Minister with a report on its

activities, not taxpayers. Visit www.energy.gov.bm for more information on the

Commission and the Department of Energy.

2009.

Revision of the original Grand Atlantic Resort and Residences (Warwick

Parish) Special Development Order 2007, which specified that the site

was to contain a nine storey, 220 room ‘five star’ hotel, 20 luxury

fractional suites, five luxury villas and 52 luxury condominiums. The

revision announced that the project would be a hybrid project consisting of

125 affordable housing units and a 100-room hotel.

2010

January 2. The

2009 draft valuation list is now ready for publication in 2010, according to the

Land Valuation department. The Draft

Valuation List is a list of all properties on the Island assessed for land tax

purposes and according to a press release, the Land Valuation and Tax Act 1967

requires all properties on the Island be revalued every five years, with the

last revaluation carried out in December 2004. All

properties are revalued at the same time to maintain fairness in the Valuation

List. Property values change over time with some property types and areas going

up in value while others in some cases may go down. The

revaluation re-levels the playing field by reflecting these relative changes in

value. Copies of the draft valuation list will

be available in the post offices throughout the Island. The information will

also be accessible on the Land Valuation website www.landvaluation.bm.

If

anyone believes the information is wrong, contact the Land Valuation Department

until June 29 to make an objection.

January

2. A compendium of Government statistics has revealed more than a third of hotel

rooms and guest houses lay empty in 2008.

The latest Environment Statistics Compendium says the

2008 tourism occupancy rate was only 59.1 percent. This is a drop of eight

percent on the previous year. Tourism arrivals

fell by 17 percent to 550,021 visitors, and total expenditure dropped from $513

million to $402 million from 2007 to 2008. Visitor

expenditure includes hotel accommodation, meals and drinks, shopping,

entertainment, transport and sightseeing. Government

recorded 18 percent fewer visitors from the US in 2008, and an overall decrease

in air arrivals of 14 percent. Cruise ship passengers reduced in numbers by 19

percent. The first Environment Statistics

Compendium was released recently, providing a comprehensive overview of land

use, population, energy, transportation, environmental health and the natural

environment. The latest figures, for 2008, will

assist in guiding Government's Sustainable Development Strategy and

Implementation Plan, particularly in 'Protecting and Enhancing Our Environment

and Natural Resources'. In the foreword to the

new report, Chief Statistician Valerie Robinson-James says: "The thrust of

this project is to ensure that environmental considerations are integrated

within social and economic planning contexts." The

compendium includes data on the number of vehicles on our roads; fishing catch;

electricity consumption; and the growth in fertilizers and pesticides. It

is broken down into nine sections: Agriculture and Land Use; Biodiversity;

Coastal and Marine Resources; Energy, Minerals and Transport; Environmental

Health; Natural and Environmental Disasters; Population and Households; Tourism;

and Water. The report reveals registered

vehicles on our roads rose from 48,054 to 48,571 in 2008, however, less gasoline

was imported. A total of 34 million liters was brought to Bermuda, a tenth less

than the 37.3 million liters in 2007. The

population of Bermuda only officially grew by 200 people in 2008 to 64,209. This

gives a population density of 1,181 people per square kilometer. Electricity

consumption also only increased marginally, from 644 million kilowatt-hour (kWh)

in 2007 to 645 million kWh last year. Copies

of the 2009 Environment Statistics Compendium are available from the Department

of Statistics, 3rd floor, Cedar Park Centre Building, 48 Cedar Avenue, Hamilton,

or can be downloaded from: www.statistics.gov.bm.

January

8. The bad news is air arrivals have dwindled

to a few hundred thousand a year, another of Bermuda's hotels closed down, and

no ground was broken last year on any of at least ten proposed new resorts.

But the good news is developers behind most of the

highly publicized hotel developments announced in 2009 remarkably are pushing

on. Despite the economic uncertainty,

construction could finally begin this year on at least three, and possibly four,

new hotels. Some of the proposed developments, including the St. George's Park

Hyatt, appear to have been scaled back. However,

2010 may finally see at least a dawning of Government's much-touted and badly

needed "platinum period" of tourism revitalization. Last

year two new, or rather, redeveloped hotels opened, Tucker's Point and Newstead

Belmont, while Elbow Beach made the shock announcement it was closing its main

hotel in order to upgrade the rooms. In the

past decade the number of tourists flying to Bermuda has dropped from close to

400,000 to just 264,000 in 2009. But that's not

putting off developers. U.S. hotel developer Carl Bazarian says he now has full

financing in place and could finally break ground on the planned Park Hyatt at

the old Club Med site in St. George's possibly "at the end of the

year" once the design is finalized and approved. Mr.

Bazarian told The Royal Gazette: "We have received a commitment on rounding

out the equity from a London-based investor well known to HSBC and Credit

Suisse." Officials with Ariel Sands hotel,

closed for a year, say they are close to a redevelopment deal with a Canadian

developer and high-end hotel operator, which could see ground broken this year.

"Feasibility studies are currently underway and

will be completed within three months," said Trevor Boyce,

accountant-consultant to Ariel Sands. "If

successful Ariel could well see ground broken this year." He said the

Canadian developers view the site as "absolutely unique" and were very

serious about proceeding once the studies are done, if there are no major red

flags. Officials with the planned Par-La-Ville

Hotel and Residences says the project is "on track" and the

development is now featured on the St. Regis Residences website, which has begun

taking names of people interested in buying one of the 80 private residences.

Detailed plans for developing Morgan's Point into

"a five star luxury hotel resort with full amenities" were shown to

Government at a meeting in early December. A

spokesperson for Premier Ewart Brown said the proposal was still being reviewed

by the various Government agencies involved. "Southlands

Ltd made a presentation to the Cabinet Committee on Special Hotel

Development," the Premier's spokesperson said. "The developer's

proposal continues to emphasize tourism use for the land at Morgan's

Point." Government has held off completing

a planned swap of the Southlands site for Morgan's Point land until the plan for

the entire development is revealed. A

spokesperson for Southlands Ltd., said "(Earlier in December) the

principals of Southlands Ltd made a presentation to Bermuda Government

representatives at a recent Tourism Cabinet committee meeting. There,

they presented their proposal for developing Morgan's Point into a five star

luxury hotel resort with full amenities. At this point they are waiting for a

response from Government on the success of that proposal." Plans

for a Four Seasons 150-room hotel and residences at the Coral Beach Club are

proceeding. The project, which will include a pedestrian tunnel, won

in-principle approval upon appeal and owner George Wardman said "a new

slower approach" was being taken with U.S. partners Brickman. He said the

hotel remains open, having never actually closed down in November as originally

planned. "I believe something is going to happen soon," Mr. Wardman

said. Brickman officials did not return phone calls.

Developer Gilbert Lopes said plans for a 100-room hotel and 125 affordable homes

for Bermudians on South Shore, Warwick, are on track and he is involved in

"almost daily" talks with Government, the Housing Corporation and

lenders to finalize the details and the financing. Mr. Lopes said he and Larry

Swenson, of Atlantic Development, hope to have a building permit by this summer

and to break ground right after. Coco Reef

Resorts Ltd. owner John Jefferis announced plans to break ground next year on 66

serviced villas, to initially be leased back to the hotel for six months a year.

He said financing is in place. A second phase at the

South Shore, Paget site will include a six-storey hotel. It's

unclear whether Bermuda's foreign home ownership rules will have to be revised

in any way to accommodate the new kinds of residential components of some of the

proposed resorts, such as the St. Regis Residences. Bermuda

laws right now allow foreigners only to purchase certain houses and condos, and

they must have certain high annual rental values. Fees up to 22 percent to

acquire a property are also charged by Government. Plans,

meanwhile, look uncertain for the former Wyndham/Sonesta prime beachfront

property that now sits derelict in Southampton. In

January 2008, developers Scout Real Estate Capital announced plans for a $300

million resort called Southampton Beach Resort to open in 2011. The hotel was

demolished and Lehman Brothers was supposed to finance the new resort, but went

bankrupt. Last October Scout declined to

comment on reports it was looking for a quick sell-off of the property and that

it had been newly appraised. Scout CEO Alan

Worden did not return repeated phone calls seeking an update. Plans

for an 81-unit hotel and residences at the corner of Court Street and Reid

Street also seem to have gone cold. The

development on the site of the former Canadian Hotel was granted a Special

Development Order in 2008. But owner Ted Powell said last year financing was

still not in place. Also

stalled, are plans by Lawrence and James Doyle, of New York, to create a $145

million "ultra-luxury resort" on the site of the old Lantana cottage

colony.

January 13. Bermuda's

rental market has picked up considerably over the past year, with total closed

units increasing by 18 percent versus 2008, according to the latest report

released by Coldwell Banker Bermuda Realty. The

Real Estate Sales Update, which is complied by Coldwell Banker's agency manager

Susan Thompson based on company data, revealed that despite the number of closed

units rising year over year, the overall average price per unit was down by 15

percent as a result of lower rental prices or fewer high end properties for

rent. Furthermore, there was a 32 percent

reduction in the volume of properties renting for $9,000 and above from 2008 to

2009, but those that were rented were approximately 14 percent higher than the

same category in 2008 and average days on the market was up 25 percent. The

average price for a one-bedroom apartment was $2,378, two-bedroom was $3,576 and

three-bedroom $5,514, equating to a rental reduction of around 25 percent from

2008 as a whole. The report also found that

rental prices began to fall at the end of 2008 through March 2009, before

levelling off as landlords placed their properties on the market at competitive

prices. Information compiled by Coldwell Banker

which was gathered from Government's Registrars Office records, while at least

three months behind actual closing dates, showed that the figures for 2008

compared to 2009 were little changed, with the average price of a single family

home in 2008 at $1,415,003 versus $1,422,169 for 2009. The

data also revealed that condo/townhouse prices were basically unchanged, with

$803,271 reflecting the 2008 average price and $807,274 in 2009. Vacant land was

again almost the same, with $644,136 (2008) compared to $624,447 (2009) once the

$10,000,000 South Shore Road (2008) sale and Loughlands (2009) land sale at

$11,864,000 were removed as anomalies. "Because

all 2009 figures are unaccounted, it is difficult to reconcile the overall

strength of the Bermuda housing market," the report read. We

suspect that even though the average price per unit has not varied greatly that

the overall volume of properties sold has diminished. We

can report that 40 percent of the recorded inventory for 2009 that successfully

closed were condos, followed by 25 percent being single family homes. Only nine

properties thus far have been recorded as selling at $3,000,000+. Available

inventory is still at an all time high with 56 percent of the inventory

condos."

March 12.

- School

principals reassigned. Three

school principals are being reassigned and another is to retire, the

Ministry of Education announced this morning. Commissioner of Education,

Wendy McDonell

announced it.

- British

Airways cabin crew to strike

.

BA

plans to operate all Gatwick long-haul flights. British

Airways cabin crew plan to strike for a total of seven days this month after

talks with management over changes to pay and working conditions broke down.

- Top

hotel confirms its plans for Coral Beach. Four

Seasons Resort and Hotel gave its name publicly to the redevelopment of

Coral Beach Club for the first time last night.

- BEC

voices Budget concerns, Cox says common sense will prevail.

Finance

Minister Paula Cox said last night there was "nothing unique"

about the heavy criticisms of this year's Budget. And she will "rely on

the residual goodwill" within the business community.

- Questions

are asked about cost of KEMH project.

It's

time the public was informed of the total cost of the redevelopment of King

Edward VII Memorial Hospital (KEMH), said Opposition MP Grant Gibbons.

- Witnesses

are accused of lying in murder trial.

The

prosecution accused two defence witnesses of lying yesterday as they took

the stand in the Kellon Hill murder trial. Lewis

denies kicking victim as he lay on the ground. Murder-accused

Kellan Lewis stabbed and punched victim Kellon Hill, then kicked him as he

lay on the ground.

- Southlands

property could be developed on if land swap doesn't happen, warn owners.

The

owners of Southlands warned yesterday they would have "no

alternative" but to reconsider developing the estate if Government

reneges on a promised land swap deal, says Brian Duperreault.

- Government

set to collect $51m as land tax and stamp duty rises are approved.

Land

tax increases on high end of the market properties reaping Government $50

million were passed through the House of Assembly on Wednesday night.

- Grants are

cut as Health Ministry reallocates funds.

The

Ministry of Health has cut grants to its charities and organizations

by more than $250,000.

- Election

funding rises 50 percent, Barritt wonders why. The

funding in the Budget for general elections and by-elections has increased

by 50 percent.

- MPs back

doubling of foreign currency purchase tax. MPs

backed legislation doubling foreign currency purchase tax, creating extra

costs for customers in Bermuda, according to local businesses.

- Taxis

to get limited period tax rebate.

Taxi

drivers will pick up an estimated $490 tax relief each after legislation

passed through the House of Assembly on Wednesday.

- Roban:

Hospital changes will improve patient satisfaction. The

King Edward VII Memorial Hospital is making positive changes to increase

patient satisfaction, according to the Minister of Health.

- Four invited

onto Corporation's pedestrianization committee. The

Corporation of Hamilton yesterday announced that four members of the public

have joined it, making good on an election promise to invite public

participation in the city's decision-making processes.

- Public-private

plan for hospital redevelopment. Government

has said the redevelopment of King Edward VII Memorial Hospital will be

financed through Bermuda's first public-private partnership. A

public-private partnership (PPP) is a contractual agreement between

Government and a private sector entity to deliver a facility for the use of

the general public.

- Tourism will

be a major debate topic in the House today, with

or without Premier Ewart Brown.

- Parliament

to get a Hansard reporting system and website. A

Hansard system of reporting and a Parliamentary website are to go live this

year, as Government tries to improve public access to information.

- Premier says

Bermuda is ready to host global economic forum. Bermuda

will be able to beat the drum for Caribbean countries when it hosts a global

economic forum, Premier Ewart Brown said yesterday.

- Gay cruise

ship plans a visit to Bermuda. A

gay cruise ship is due to swing by Bermuda in June says Pied

Piper Travel.

- Nursing

aides at MWI graduate with City & Guilds.