Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us).

|

See end of this file for all of our many History files |

2015. April 30. Tourism Development Minister Shawn Crockwell has insisted that he remains “very confident” that plans to build a luxury hotel on the former Club Med site will reach fruition this year. He said the developer Desarrollos would be on-Island next month to finalise arrangements and he was hopeful that excavation work on the much anticipated St George’s resort would begin by the autumn. Mr Crockwell acknowledged that the success of the One Bermuda Alliance administration, which is approaching its midterm point, was riding on making certain projects such as the St George’s hotel a reality. “I have been very pleased with the progress,” he told The Royal Gazette. “We have a very enthusiastic and eager developer. All parties have now submitted their position with regards to the lease and the developer will be here on May 6. I am hopeful to be able to give an update to the country sometime thereafter and we will be looking to seal some deals during that trip. Their financials are in a good situation and, all in all, it’s looking very good.” Government had initially hoped that work on the hotel project could begin as early as this month. But delays prompted by the developers Desarrollos deciding to change the hotel brand meant the proposed start date had to be put back until after the summer. “I am hoping that excavation of this project will begin at the end of summer or early fall, while work will begin in earnest this year,” said Mr Crockwell.

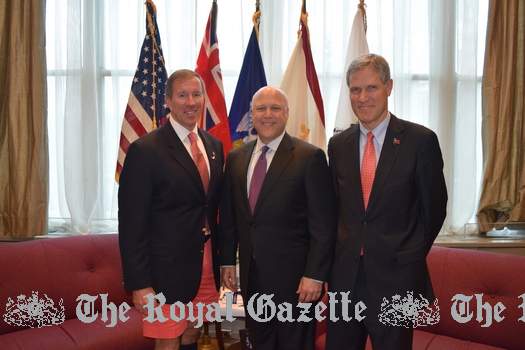

April 30. Recollections of Bermuda were shared by the mayor of New Orleans, Mitchell (Mitch) Landrieu, when he met Premier Michael Dunkley. The two men met this week as the Louisiana city hosted the Risk & Insurance Management Society’s (RIMS) annual conference. The city’s mayor celebrated his honeymoon on the Island in 1987, when he stayed for a week at the Fairmont Southampton. “I remember pink, and I remember it was spectacular,” said Mr Landrieu. Bermuda’s connection with New Orleans and the US Gulf Coast was strengthened after the devastating wreaked by hurricanes Katrina, Rita and Wilma in 2005. The Island’s reinsurers paid 30 per cent of the insured losses incurred as a result of the hurricanes. Mr Dunkley and Grant Gibbons, Economic Development Minister, visited Mr Landrieu at the city hall in New Orleans for an informal meeting where they discussed ties and commonalities between the Island and the city, including tourism, business development, and the perennial threat of hurricanes. The mayor had placed a Bermuda flag in his office ahead of welcoming the Premier and Minister on Tuesday. During the meeting the Premier told Mr Landrieu: “We all share problems in the world, and we Bermudians think of you here in New Orleans.” Mr Dunkley, Dr Gibbons and Finance Minister Bob Richards were among the Bermuda contingent at RIMS, which attracted some 10,000 risk management professionals and other senior executives and decision-makers. The Bermuda Business Development Agency, the Bermuda Monetary Authority and more than 150 executives connected with Bermuda’s insurance and reinsurance sector attended the conference, which was held in the Ernest N Morial Convention Centre, and which concluded yesterday.

April 30. A Bermuda-based fund administrator has won a top European award. Equinoxe Alternative Investment Services won ‘Best Administrator for Client Service under $30 billion’ in the HFMWeek European hedge fund services awards. Equinoxe founder and CEO Stephen Castree said: “These awards are a testament to the commitment to excellent client service and delivery that we pride ourselves on at Equinoxe. Our managed growth strategy and increasing global presence has recently seen Equinoxe surpass $20 billion in assets under administration and it is very gratifying to note that this growth has gone hand in hand with such positive client recognition for excellent client service.” Alan McKenna, global head of product development, added: “In addition to this recognition for excellent client service, we have seen our institutional asset manager services develop strongly, leading to the creation of the Equinoxe Solutions group.” Equinoxe Solutions is designed to provide an institutional technology platform in combination with back and middle office reporting. Mr Castree said: “Coming on the heels of our successful insurance-linked securities product offering with over $3 billion in assets under administration already, we believe that the immediate response to, and success of, the Equinoxe Solutions offering, which itself has swiftly garnered over $3 billion in assets under administration, clearly demonstrates our commitment to continued product innovation. We are confident that Equinoxe will be able to provide tailored solutions to some of the largest and most complex investment managers, whilst retaining the highest levels of client service and controlled growth which have been the cornerstones of our success to date.” Equinoxe was founded in 2007 and has offices in various countries.

April 30. A stunning new restaurant to be run by celebrity chef Marcus Samuelsson is to open on May 27, the Fairmont Hamilton Princess said yesterday. The new restaurant — Marcus — takes up the space once occupied by the Gazebo ballroom and features a bar, inside and terrace space and a private dining room. And Hamilton Princess director of sales and marketing, Scott Evans, said: " the new-look lobby bar, scheduled to open on May 15, will be called the Crown & Anchor in tribute to the popular Cup Match gambling game. The relationship the hotel has with the Marcus Samuelsson Group is spectacular. The hotel had been given free rein to create a restaurant that reflected Mr Samuelsson’s “sense of style”, which includes atmosphere, music and entertainment as well as fine dining. Marcus comes complete with a terrace that rings the entire restaurant, two kitchens and the private dining room. The fun thing about this place is the bar. It is a place you can come to, enjoy a drink and have a couple of starters. Marcus wants people to enjoy themselves. On the other hand, you can come with ten of your friends, have a great time and enjoy everything on the menu. I think they have a good formula here.” Marcus will initially be opening for dinner dining only before expanding to lunch and dinner from June 11. Mr Evans was speaking after a media tour of the iconic hotel to update on progress on the $90 million revamp launched after the hotel was bought by the Bermuda Green family. The new restaurant features a white tiled bar with mustard and green geometric patterns, a polished concrete banquette and is expected to seat up to 80 people in the main restaurant, around 60 outside and at least 20 in the private dining room.

April 30. The History of Policing in Bermuda is the first book documenting the evolution of policing on the Island. This is the fourth in a series of articles that will appear in The Royal Gazette in advance of the book’s sale at local stores. When the Second World War broke out in 1939, there were only 45 motor vehicles in Bermuda, none of which were police cars. By comparison, there was an estimated 20,000 pedal cycles on the roads and 550 horse-drawn carriages; today there are probably less than three dozen carriages in use. The main cause of accidents at this time was speeding … on pedal cycles! A major gripe of the cyclists themselves was that they kept getting their wheels caught in the railway lines that ran along Front Street. The effect of the war on Bermuda was immediate; tourism, and with it the economy, quickly nose-dived, and the repercussions were soon felt by everyone. Police officers for example, had their salaries cut by ten per cent. Fortunately this state of affairs did not last too long. By 1941 Britain had signed a land lease agreement with the United States, and work began on building two US bases here. The wages of officers were soon returned to their pre-war levels! A major task for officers during the war years was to keep in line several thousand American Navy Seabees, who had been brought over to the Island to construct the bases. Navy court martials were convened at Kindley Air Force Base, and officers were frequently required to testify.

The First Police Car. By mid-1942 the estimated number of motor vehicles on the Island had spiraled to over 1,000, though most were military. To keep up with developments, the police paid £375 for a Dodge sedan motor car. However it was solely for the use of the Commissioner!

Nazi In Our Midst. We return to events in October 1940, when the SS Excambion berthed in Bermuda. Among the passengers on board was a German national by the name of Otto Strasser, who also happened to be travelling on a forged Swedish passport. What made Strasser so interesting to the British military and the Bermuda police was that he was a known Nazi; not just any Nazi, but a founding member of the Party together with Adolf Hitler. He had even helped to develop their platforms and policies together with such figures as Goering, Himmler and Goebbels. Strasser had allegedly broken with the Party and was on the run, and he was seeking political asylum in Canada in exchange for information that he offered to impart to British Intelligence (the United States was yet to enter the war). During his six months on the Island, Strasser was at liberty; he resided for a while in a house opposite the Cathedral in Hamilton. Once word leaked out about his existence, renowned British author and journalist, HG Wells, sailed to Bermuda specifically to interview him. He demanded to know why Strasser, “a bloodstained Nazi, was not in a concentration camp.” Wells subsequently wrote a damning article about Strasser, which later appeared in the Miami News. In 1941 Strasser was granted the asylum that he craved, and he sailed to Canada, where he took up residence in Paradise, Nova Scotia.

The Stapleton Murder. Much more shocking and of particular interest to Bermudians at the time (these were the days before television), was the murder of Margaret Stapleton. Miss Stapleton was a censorette, one of a number of young British women brought to Bermuda during the Second World War, who worked in the basement of the former Hamilton Hotel. Their job was to discreetly open and read foreign mail being sent from Europe (via Bermuda) to North America. Basically they were looking for any information whatsoever about planned enemy (Axis) activities. In July 1941, Miss Stapleton visited friends at Bleak House on Palmetto Road, Devonshire (the same residence where in September 1972, Police Commissioner George Duckett was murdered). When it came time to leave, she declined an escort and began pushing her pedal-cycle along the moonlit railway track towards the train stop at Toby’s Lane, just east of Dock Hill. However, she never caught the train, and when her flat mates telephoned to say that she had not returned home, her friends began to search for her. Miss Stapleton’s half-naked body was later found among the bushes near Prospect Railway Halt. She had been raped and beaten to death. The resultant coroner’s inquest in August 1942 named one 23-year-old Harry Sousa, a soldier in the Bermuda Volunteer Rifle Corps, as the murderer. Police knew exactly where to find Sousa; he was lodging next door in the Hamilton jail (now the site of the main post office), having recently begun serving a ten-year sentence for rape. Sousa’s trial contained a number of sensational twists and turns, and even the Commissioner was called to testify when it was claimed that he had tried to bribe a witness, which he hotly denied. Sousa was subsequently found guilty and sentenced to hang on the anniversary of Miss Stapleton’s death. But that wasn’t the end of events. Just hours before the sentence was due to be carried out, Sousa escaped under suspicious circumstances. Less than 24 hours later however, he was back in prison custody after having been flushed out of his hiding place — a cave near Black Watch Pass. He was hung on July 7, 1943, and it would be another 24 years before Bermuda’s final executions (those of Erskine Durrant “Buck” Burrows and Larry Tacklyn) took place in 1977. Next week: Read the concluding article in this series, about the first policewomen, the birth of the Marine Section, and the Belco riot from the police perspective.

April 30. The Corporation of Hamilton has launched a lawsuit against the organizers of a black mayor conference in an effort to retrieve funds spent on the event. While Conference of Black Mayors Inc had insisted that the convention would be held in the City this month, the event has yet to come to fruition. A spokeswoman for Home Affairs Minister Michael Fahy — who took stewardship of the Corporation in January — confirmed yesterday that legal actions had been launched “to retrieve monies incurred by the Corporation relating to the conference.” The full sum paid by the Corporation to the Atlanta-based organization is unknown, but documents obtained by The Royal Gazette last year said the Corporation had agreed to pay $100,000 to the organizers and had earmarked a further $250,000 for conference-related expenses. The lawsuit is the latest in a series of controversies surrounding the event. Deputy Mayor Donal Smith said in November of 2013 that the National Conference of Black Mayors (NCBM) would bring 400 to 700 people to the Island in October 2014, although it was later revealed that the Atlanta-based organization was in dire financial straits and the leadership was in question. While executive director Vanessa Williams had claimed to be in charge of the organization during talks with the Corporation, a United States judge found that Sacramento mayor Kevin Johnson was the rightful head of the group. Mr Johnson said he knew nothing of the Bermuda conference, and the event would not take place on the Island under his leadership. It was also revealed that Ms Williams was fired by the NCBM after the scale of the group’s debt under her management was exposed. Ms Williams reportedly failed to cooperate with an internal audit of the organization, which revealed that she had spent $600,000 of NCBM funds on personal expenses. However, Ms Williams continued negotiations with the Corporation for a Bermuda convention, claiming that the NCBM had changed its name to the Conference of Black Mayors (CBM) but the new body was the same organization. Documents show that the CBM was set up independently by Ms Williams. Despite the issues, Government announced last May that it would lend its support to the event. At that time, Sen Fahy said: “As the Minister responsible for municipalities I publicly advised that, before the Ministry could endorse such an event, I too had to be satisfied that all was in good order and that this event was in the best interest of the City of Hamilton and Bermuda, before we could support the Corporation’s efforts. “At my request the Mayor and his team undertook to do their due diligence to the point where I, as Minister, was content with the information provided. Today, I am satisfied with the discussions I have had with the Mayor and his team and therefore thought it was only fitting that I publicly stand in support of the Corporation’s efforts.” The event was supposed to take place in October 2014, but it was later delayed, with organizers stating it would run from April 12 to 16. In January, it was revealed that the Corporation had written to Ms Williams requesting an account of the funds paid to the organization. Sen Fahy later said it was “highly unlikely” that the event would take place.

April 30. Standard & Poor's Rating Services has downgraded Butterfield Bank as a direct result of the Bermuda Governments credit rating downgrade earlier this week. But even as it cut Butterfield's long-term issuer credit rating to BBB from BBB+, the rating agency noted that Butterfield had much less of a problem with bad loans than its Bermuda market competitors. S&P gave the bank a stable outlook. S&P also commented on the bank having a weaker capital position as a result of the deal that allowed the Canadian International Bank of Commerce (CIBC) to offload its major shareholding. Meanwhile two other rating agencies affirmed the banks ratings in the wake of the CIBC deal. Moody's confirmed its A3 issuer rating on Butterfield, but changed its outlook from stable to negative. Fitch confirmed its long-term issuer default rating at A-, also with a negative outlook. Butterfield's downgrade by S&P comes in the wake of the same rating agency cutting Bermuda's sovereign credit rating from AA- to A+. S&P's rating bakes in a moderately high likelihood of extraordinary Government support for Butterfield, should the bank need it. "Nevertheless, our downgrade of Bermuda implies a somewhat weaker credit benefit to BNTB [Butterfield] from this likelihood, which we now recognise through one notch of uplift to our stand-alone credit profile (SACP) on BNTB, rather than the two notches previously applied." The report, the lead author of which is S&P primary credit analyst Nikola Swann, added that "Butterfield's risk position had improved, as reflected by the bank's sustained outperformance of other Bermuda banks in terms of loan performance in recent years, and our expectation that this will continue. For example, BNTB's December 2014 year-end gross non-performing assets, as a share of customer loans and other real estate owned, were less than one-third of those at HSBC Bank Bermuda Ltd, Bermuda's largest bank and BNTB's primary competitor in the Bermudian loan market. Furthermore, by this measure, BNTB's asset-quality has substantially and increasingly outperformed its Bermudian peers since 2010." HSBC Bermuda's 2014 financial statements showed that more than 17 per cent of its $3 billion in loans was classified as either non-performing or impaired that is, 90 days or more past due. Mr Swann told The Royal Gazette that S&P also rates HSBC Bermuda, but that its A- issuer credit rating would be unaffected by the sovereign downgrade, as the external uplift in its ratings was based on support from the HSBC group, rather than the Government. S&P said Butterfield had cleaned up its balance sheet through significant net charge-offs made in 2010 related to hospitality and construction loans, which included the Newstead development, contributing to better loan performance than its peers. "We now expect this outperformance to continue, given what we consider a now well-established track record (implying stronger underwriting standards than at Bermudian peers, at least on loans made in recent years), even as we expect Bermudian asset quality in general to deteriorate through 2016," the report added. This week, Butterfield announced that it was paying $120 million to buy and cancel 80 million shares from CIBC for $1.50 apiece. CIBC, which helped Butterfield through a difficult time with an investment of $150 million in 2010, sold its remaining 20 million or so shares to private-equity firm Carlyle Group. Butterfield's purchase of the CIBC shares represents a substantial capital outflow for BNTB, and a deterioration in our forward-looking assessment of its capital buffers, S&P stated. "We expect this outflow to contribute to our risk-adjusted capital (RAC) estimate for BNTB falling from its year-end 2014 level of almost 12 per cent to very close to 10 per cent, where we would expect it to remain in the 2015-2016 period, absent further capital withdrawal." S&P's view tally with what Carlyle Group managing director Olivier Sarkozy, also a Butterfield director, told this newspaper five years ago that Carlyle had a five- to seven-year window for its investment in Butterfield. A Butterfield spokesperson said: "Given that S&P factors the potential for Government support of the industry into its ratings of Bermudas banks, their lowering of Butterfield's long-term Issuer Credit Rating (ICR) to BBB from BBB+ was not unexpected following their lowering of Bermudas long-term ICR from AA- to A+. We are pleased that the S&P Research Update recognized Butterfield's improved risk position and sustained outperformance of the Islands other banks in terms of both loan performance and asset quality since 2010, and that S&P changed the outlook on the Bank's ICR from negative to stable as a result." Butterfield's' short-term ICR remained unchanged at A-2. In its commentary, Moody's stated: "The rating affirmation also incorporates Moody's expectations that Butterfield's liquidity will remain strong and that asset quality will improve as Bermudas economy continues to improve." Historically, Moody's had considered Butterfield's strong capital ratio a key credit strength that helped mitigate some of the risks related to the banks concentrations specifically, its real estate concentration. In that light, the change to a negative outlook reflects the significant decline in Butterfield's capital after the buyout of CIBC's equity stake, which reduces the banks loss absorption capacity in the short term from unexpected disappointing earnings performance. The negative outlook also reflects Carlyle's ownership stake: The private-equity firms shorter-term investment horizon increases uncertainty about Butterfield's longer-term strategic direction, including the bank's capital plan. In its rating action statement, Fitch said: "Butterfield's credit performance had continued to improve and its problem loans mix had shifted from commercial to residential mortgages. Although BNTB could face some asset quality pressures, specifically in its residential loan portfolio, Fitch expects net losses to remain manageable." Fitch added that Butterfield's earnings had improved with return on assets (ROA) and net interest margins (NIM) reflecting a positive trend.

April 29. The key role Bermuda’s insurance and reinsurance sector played in assisting New Orleans to rebuild and recover after the devastating damage caused by Hurricane Katrina in 2005 was recalled at this week’s RIMS event, held in the Louisiana city. Some 10,000 risk management professionals and other senior executives and decision-makers are attending the Risk & Insurance Management Society’s annual four-day conference, which concludes today. Bermuda secured a prime location in the conference exhibit hall, in the Ernest N Morial Convention Centre, with its booth styled to appear like a Bermuda home. Premier Michael Dunkley toured the event yesterday and met RIMS president Rick Roberts and chairman of Lloyd’s of London John Nelson. Later in the day, together with Minister for Economic Development Grant Gibbons, he visited New Orleans’ mayor Mitch Landrieu. Mr Dunkley said he welcomed to opportunity to meet so many people involved in the reinsurance industry, and said it was critical that Bermuda maintains a high profile at such events. “The networking opportunities do not come any stronger. It is a place where we can continue to strengthen our relationships with those who understand the Bermuda model, and a place where we have an opportunity to talk to new people about the benefits the Island offers, and to answer their questions.” According to the Association of Bermuda Insurers and Reinsurers, the Island’s reinsurers paid 30 per cent of the insured losses incurred by hurricanes Katrina, Rita and Wilma when they struck the southern US in 2005, and $22 billion to rebuild the US Gulf Coast after the 2004-2005 hurricane season. Those facts showed the tangible benefits Bermuda, through its dominant reinsurance sector, has provided to assist the region, noted Mr Dunkley. The Premier, speaking to The Royal Gazette, said there was also excitement among delegates about Bermuda hosting the America’s Cup. Finance Minister Bob Richards, who was also at RIMS, said Bermuda had strong links with the New Orleans region due of the large level of reinsurance assistance generated from the Island in the wake of Hurricane Katrina ten years ago. “Bermuda has shown that what we do is not a gimmick. It demonstrates the service and benefits that offshore centres provide,” he said. More than 150 executives connected with the Island’s insurance and reinsurance industry are attending the event. Many of them are manning their individual company kiosks, but also volunteering time to help at the Bermuda booth. Mr Richards said: “It is heartening that we have encountered a number of companies that want to come to Bermuda because things have not been working out well in the places where they are.” He added: “The industry is still in a consolidation phase and the important thing for Bermuda is that companies remain in Bermuda and are stronger because of consolidation.” Shelby Weldon, director of licensing and authorizations for the Bermuda Monetary Authority (BMA), was another of the Bermuda officials at RIMS. He was interviewed by AM Best and Captive Review about developments within Bermuda, particularly regarding mergers and acquisitions, regulatory changes and Solvency 2. Those were also topics that came up during conversations with fellow delegates inquiring about Bermuda. “There have been a number of questions about changes to regulations and there have been questions about increased competition in the captive markets. The BMA’s role is to support the market, to answer questions about day to day supervision and regulations. Some people have questions about our regulatory framework. We are here to show that the BMA is accessible. It has been an excellent place to network and talk about what we are doing over the next few months and the next few years. There is a great spirit of collaboration. The Bermuda booth is popular, and we also have representatives from the Department of Tourism, which is excellent to see.” The Bermuda Business Development Agency (BDA) was at the forefront of efforts to promote the Island as an ideal place for new businesses to locate, or for existing business to redomicile. Last night Bermuda hosted its popular networking cocktail reception at Club XLIV, in New Orleans’ Mercedes Benz Superdome. Award-winning Bermudian band Mohawk Radio were due to provide live music and pay tribute to Bermuda’s late songwriter Hubert Smith Sr, who wrote the ballad Bermuda is Another World.

See above article.

April 29. Bermuda’s credit rating took a hit yesterday after analysts lowered the Island’s ratings. Ratings agency Standard & Poors (S&P) reduced Bermuda’s long term issuer credit and senior unsecured debt ratings to A+ from AA-, and said continued weak economic performance, persistent Government deficits and increased debt burden were to blame. The short term rating of Bermuda also decreased — from A-1+ to A-1 and S&P predicted that weakness in the economy and public finances would continue through its two year outlook window. But the outlook of “stable” is up from the “negative” view previously expressed by the ratings agency. S&P’s report said: “Bermuda’s six-year recession has resulted in declining revenues which has led in turn to fiscal deficits of five per cent of GDP in fiscal years 2013 and 2014. The debt financing of deficits will increase gross interest costs to more than 11 per cent of Government revenues for fiscal years 2015-17. The stable outlook reflects our expectations that positive economic growth will return in the next two years, fiscal deficits will get smaller as revenue growth returns and Government debt will stabilize at slightly more than ten per cent of projected GDP. The Ministry of Finance believes that the contraction in real GDP could be as much as 1.5 per cent in 2014. Real GDP fell 18 per cent by 2014 from the 2008 peak and nominal GDP declined eight per cent. Labour market results were also weak in 2014. Bermuda’s unemployment rate rose to nine per cent in 2014 from seven per cent in 2013, compared with eight per cent in 2012. Employment fell in both 2013 and 2014, as it has each year since 2009. By 2014, employment had fallen 16 per cent from its 2008 peak. Despite the poor economic performance of recent years, GDP per capita remains what we consider very strong, at about $88,000. We believe that real GDP growth will be flat in 2015 but increasing to about one per cent growth in 2016. The current governing party and its predecessors have made some progress toward reducing expenditures in the past five years. However, declining revenues have undone efforts to achieve balance. Should the economy continue to contract and Government revenues in tandem, downward pressure on the ratings could emerge. On the other hand, should Government measures, including holding hosting of the America’s Cup, place Bermuda back on a higher plane that resulted in a steady decline in the Government debt burden, we could consider a positive outlook revision or upgrade.” Between 2009 and 2014, Government revenue dropped by seven per cent. The 2015 budget imposed small increases in payroll, air passenger, commercial property, corporate services and fuel taxes. Government predicts its fiscal deficit will improve to 3.9 per cent of projected GDP in this financial year and to 2.1 per cent by 2017-18, while the annual change in Government debt should be 1.8 per cent of GDP between 2015 and 2017. And the S&P report said the America’s Cup competition would “help increase growth in the latter years of the forecast horizon. However our forecasters do not incorporate a direct boost to Government net revenue from the race.” Finance Minister Bob Richards yesterday put a brave face on the downgrade news — and said that the ratings drop was “not surprising” given problems in the economy and public sector finances. “We are pleased, however, that S&P has attached a stable outlook to the rating,” he said. Mr Richards added that the lower rating was still in the upper medium investment grade with a stable outlook. “S&P continues to endorse the Government’s effective policymaking and political stability.” And he said it was good news that S&P recognized that America’s Cup would boost the Island’s profile as an upscale tourism spot and kick-start investment in the hospitality sector. Mr Richards added: “The Government will continue to press ahead with our two track strategy that strikes a balance between responsible growth and disciplined financial management. We will continue work to restore investor confidence to attract foreign dollars back to our shores, opening the Island to job and revenue-creating activities, creating new possibilities for Bermudians to make a living. As the Minister of Finance, I remain committed to creating an economy that works for everyone and returning our public finances to a sustainable position.”

April 29. Minister of Home Affairs Senator Michael Fahy has issued the following statement with regards to Par-la-Ville car park: "Over two weeks ago I gave a press conference where I advised the public that the Par-la-Ville car park was in receivership. At that press conference I also laid out a number of issues that were a cause of grave concern to me and the Government of Bermuda in connection with issues surrounding the governance of the Corporation of Hamilton, the placing of the Par-la-Ville car park into receivership and the use of funds that were secured by way of a loan from Mexico Infrastructure Finance, LLC. I undertook at that press conference to update the public when I deemed it appropriate given the sensitivity of the issues involved. To be absolutely clear, I was first made aware of these issues during a meeting with the Corporation on January 22nd, 2015 and since that time I have been diligently making enquiries into the issues in the hope that I could ascertain all of the facts and, more importantly, rectify the situation by identifying the whereabouts of the funds with the obvious aim of retrieving them. As a result of my enquiries, which are ongoing, in all the circumstances I thought it prudent on 12th March 2015 to advise the Bermuda Police Service of my immediate findings. Whilst I do not wish to in any way impede or prejudice the work of the Bermuda Police Service in the light of the way in which some have sought to characterize matters generally, I think it important that the public be aware of the following facts so as to put matters in perspective. As stated above, it was not until January 22nd, 2015 that I was made aware of serious concerns that existed on the part of certain members of the Corporation’s Council that the proceeds of the loan by Mexico Infrastructure Finance, LLC to Par-la-Ville Hotel & Residences, Ltd. had been withdrawn from an escrow account and paid over to the principal of Par-la-Ville Hotel & Residences, Ltd., Mr. Michael MacLean. I was also informed that many of the Corporation’s Council members were unaware of the transactions at the time that they were entered into and concerns were raised that there was no resolution of the Corporation that authorized the transactions. As a result of receiving this very concerning information, and for other reasons that I have previously articulated, on January 26th 2015, I again assumed Stewardship of the Corporation’s affairs. I then embarked upon a series of meetings with both the Corporation’s attorneys and the attorneys for Mexico Infrastructure Finance, LLC to obtain a better understanding of the facts. The first meeting took place on February 5th, 2015 and there have been a number of subsequent meetings between myself, the Ministry’s attorney, Mexico Infrastructure Finance, LLC and their attorneys, the Receivers, the attorneys for Par-la-Ville Hotel & Residences, Ltd., Mr. MacLean and the Corporation’s Mayor and Secretary. I am thus now able to confirm the following facts:

(1) On July 9th, 2014 Par-la-Ville Hotel & Residences, Ltd. entered into a Credit Agreement with Mexico Infrastructure Finance, LLC whereby it borrowed the sum of US$18 million. The loan was described as a “discount loan” with the result that all interest that was to accrue during the term of the loan would be paid when the loan proceeds were dispersed by deduction from the proceeds of the loan. The same was true with respect to the negotiation fees relating to the loan. The purpose of the loan was to provide funds for the payment of expenses associated with a permanent loan which was to be negotiated for the funding of the future hotel development. The loan was to be repaid on December 30th, 2014.

(2) On the same date, the Corporation entered into a guarantee of the loan and, as security for that guarantee, it provided Mexico Infrastructure Finance, LLC with a first mortgage over the land comprising the Par-la-Ville parking lot. At the same time, Par-la-Ville Hotel & Residences, Ltd. executed a Deed of Surrender of the lease that it had over the Par-la-Ville parking lot. This Deed of Surrender was to be held in escrow and would be triggered into effect in circumstances where Par-la-Ville and Residences Ltd. defaulted on the loan.

(3) Also on July 9th, 2014 an Escrow Agreement was entered into between the Bank of New York Mellon, Mexico Infrastructure Finance, LLC, Par-la-Ville Hotel & Residences, Ltd. and the Corporation whereby the net proceeds of the loan after deduction of fees and interest, being an amount of $15,449,858.00, was deposited into an escrow account with the Bank of New York Mellon pursuant to a detailed escrow agreement. These funds were to remain in escrow until such time as Par-la-Ville Hotel & Residences, Ltd. could deliver documentation verifying that it had secured funding for the development of the intended hotel, that funding to comprise a loan of $225 million and an equity investment of $100 million. The funds in escrow were not to be released until copies of the permanent loan funding documents were delivered to the Bank of New York Mellon, as escrow agent, as well as Mexico Infrastructure Finance, LLC. It was an express term of the escrow agreement that the $15.5 million held in the escrow account was to be used only “for the purpose of paying expenses associated with the Permanent Loan”.

(4) On or about October 16th, 2014 a meeting was held in London between Mr. Michael MacLean, the Mayor and the Corporation’s Secretary with Mr. Robert McKellar, the principal of a Gibraltar company known as Argyle Limited.

(5) As a result of that meeting, on October 20th, 2014 Argyle Limited entered into a Co-Venture Trade and Profit Share Agreement with Messrs. Shane Mora and Matthew Hollis in their capacity as trustees of a Bermuda trust known as the Skyline Trust in Devonshire, Bermuda. Under the terms of that agreement, Argyle was to be paid a one-time irrevocable payment, referred to as a “fee payment”, in exchange for which Argyle extended a line of credit to the Skyline Trust. The beneficiaries of the Skyline Trust are understood to be Michael and Yasmin MacLean. The fee payment was to be not less than US$12,500,000 and the line of credit was to a maximum amount of US$125 million. The line of credit was to be used by Argyle to operate a co-venture business arrangement between the parties whereby Argyle would arrange for the purchase and resale of “instruments” for profit. The line of credit was for a period of one year.

(6) On the same day, Par-la-Ville Hotel & Residences, Ltd. wrote a letter to the Corporation certifying that the conditions for the release of the escrow funds held by the Bank of New York Mellon had been fulfilled by virtue of entering into the Argyle agreement and, as a consequence, Par-la-Ville Hotel & Residences, Ltd. requested that the Corporation execute and forward a release notice to the Bank of New York Mellon authorizing the release of the escrow funds. This letter was signed by Mr. Michael MacLean. Par-la-Ville Hotel & Residences, Ltd. provided the Corporation with the requested form of letter to be sent to the Bank of New York Mellon and this letter, signed by the Mayor and the Secretary, was sent on October 24th, 2014. Also on that date, Par-la-Ville Hotel & Residences, Ltd. similarly wrote authorizing the disbursement of the escrow funds to the personal bank account of Michael and Yasmin MacLean maintained at Clarien Bank Limited. It remains unclear as to the basis upon which it could be said that the Argyle agreement fulfilled the necessary conditions of the Escrow Agreement. Certainly, I have seen nothing that could support any contention that there now exists a Permanent Loan Funding Agreement and that a Permanent Lender has been secured for the Par-la-Ville Hotel project.

(7) As a result of receiving these letters, on October 31st, 2014 the Bank of New York Mellon deposited into the account of Michael and Yasmin MacLean the sum of $13,749,858, this being the amount of the escrow funds net of a $500,000 retention and the payment of agreed expenses already incurred in relation to the Par-la-Ville project in a total amount of $1,173,684. Again, I have seen no documents nor received any evidence that support the view that the Bank of New York Mellon was in a position to comply with the request to release the escrow funds. However, it did so.

(8) On the same day, October 31st, 2014 the sum of $499,999.99 was wired transferred out of the MacLeans’ account to an entity called Rational Foreign Exchange Ltd. This was followed by a wire transfer to Argyle UAE Limited in an amount of $11,500,000 on November 5th, 2014 and a further wire transfer of $500,000 to Rational Foreign Exchange Ltd. on November 7th, 2014.

(9) Subsequently, on December 31st, 2014 an amount of $869,748.00 was transferred to Par-la-Ville Hotel & Residences, Ltd.

It remains unclear as to how the remaining balance of the escrow funds has been dealt with. Neither the OBA, the Government, nor myself as Minister were aware of any of these transactions until after January 22nd, 2015. The Corporation did not seek or obtain my approval or consent to the entering into or the execution of the documentation that resulted in the escrow funds being released. Neither did the Corporation inform me at any time of the intended arrangement to be entered into with Argyle Limited. It is clear that notwithstanding the Financial Instructions and the good governance procedures that I caused to be put in place in March 2014, the instructions and procedures were not followed by the Corporation and the Government of Bermuda was kept uninformed. It is highly regrettable that having afforded the Corporation the opportunity to enter into guarantees in order to facilitate a much needed, approved hotel project in the City of Hamilton, the Government was then kept in the dark as to these unfortunate arrangements which, on their face, appear to be very unwise. However, the Government was entitled to assume that the elected and unselected officials of the Corporation would have conducted the Corporation’s affairs properly and in the best interests of the Corporation. Clearly this has not happened here. In the meantime, Mexico Infrastructure Finance, LLC has commenced proceedings in the Commercial Court against Par-la-Ville Hotel & Residences, Ltd., together with Michael and Yasmin MacLean, and those proceedings are ongoing with a summary judgment application scheduled to be heard on May 26th, 2015. As part of those proceedings, the Commercial Court has issued an injunction freezing the assets of Par-la-Ville Hotel & Residences, Ltd. and the MacLeans up to an amount of $15,449,858. I have been assured by Mr. MacLean that the full amount of $18 million exists and is available to be paid over to the rightful parties. Whilst I have seen no tangible evidence of this, I am in ongoing discussions with Mr. MacLean with a view to the Government’s concerns in this regard being alleviated. I have been made aware that both Argyle Limited and Mr. MacLean have sought assistance from local lawyers to have the monies moved to a local escrow account and I believe progress can be made here. I am also in discussions with Mexico Infrastructure Finance, LLC and KPMG in relation to achieving repayment of the $18 million loan and the release of the Par-la-Ville parking lot from receivership. Finally, whilst the issue is of no relevance whatsoever to the $18 million loan arrangements and the Par-la-Ville parking lot, in response to questions from the press as to whether I have had any discussions involving a guarantee for the Par-la-Ville Hotel project with Mr. Steven DaCosta, the answer is yes. In fact I and other members of Government were lobbied by a number of people, including Mr. DaCosta and Mr. MacLean to try and find a way to get the project up and running, including the provision of either a Bermuda Government guarantee or a guarantee by the Corporation of Hamilton. This was all in the context of the Government and myself endeavoring to ascertain the then current state of play insofar as both the Par-la-Ville and Hamilton waterfront projects were concerned, bearing in mind these were issues left over from the previous Government. I am at a loss to understand how we can be criticised for entertaining such discussions in circumstances where we were simply endeavoring to assist a developer realize an important project. Finally, let me make it clear again so there is no doubt in anyone’s mind. I had stewardship of the Corporation of Hamilton from December 2013 to mid-March 2014. The Corporation of Hamilton was responsible for its own affairs from mid-March 2014 until I assumed stewardship again in late January 2015. The most recent Stewardship Order was confirmed by the Bermuda Supreme Court in March 2015 as valid. The funds were removed from escrow and various agreements were signed relating to the Mexico Infrastructure Finance LLC loan when the Corporation of Hamilton managed its own affairs. Checks and balances were put in place by the Government in March 2014 which appears to have been ignored. This is partly why a bill was laid in the last sitting of the Senate to further strengthen the Government’s oversight abilities and to ensure something like this does not occur again. We will continue to work on a resolution of this matter, but “trial by press” is not the way to handle this delicate situation. When my discussions and enquiries are fully exhausted, I will give the public a further update. I remain hopeful that this matter can be resolved satisfactorily to all concerned parties."

April 29. Senator Michael Fahy moved to quiet the growing unease surrounding the Par-la-Ville car park fiasco with the release of a seven-page statement yesterday that laid bare the details of an $18 million loan deal gone bad. The Minister of Home Affairs, who took over stewardship of the Corporation of Hamilton in January when confidence in its elected officials was lost, included in his missive the revelation that the $12.5 million that went directly or indirectly to Argyle UAE Ltd was in exchange for an open line of credit for as much as $125 million. He also admitted having had talks over the Par-la-Ville hotel project with Steven DaCosta, the business partner of former Premier Craig Cannonier, but, in dismissing concerns from the Progressive Labour Party that there was anything untoward, added that this had nothing to do with the loan or the car park ultimately falling into receivership. “In fact, I and other members of Government were lobbied by a number of people, including Mr DaCosta and Mr [Michael] MacLean, to try and find a way to get the project up and running, including the provision of either a Bermuda Government guarantee or a guarantee by the Corporation of Hamilton,” Sen Fahy said in his statement. “I am at a loss to understand how we can be criticised for entertaining such discussions in circumstances where we were simply endeavoring to assist a developer realize an important project.” David Burt, the Deputy Leader of the Opposition, had also posed a number of open questions to Sen Fahy — and also to Premier Michael Dunkley in advance of his national address on Monday. Prominent among them was a question to Mr Dunkley that said: “Let the people know what has happened to the money that you assured Parliament and the taxpayers there were appropriate checks and balances in place.” Mr Burt also posed specific questions on the Par-la-Ville hotel project: “As part of your due diligence, did you seek assurances from the branded partner for the Par-la-Ville development Starwood? Did you have knowledge of the intent of the Corporation of Hamilton to release the funds in escrow to Argyle Ltd before they were released? Are you aware that no resolution was passed by the Corporation of Hamilton to release funds to Argyle Ltd? Given that is the case, why and how exactly were these funds released? What did the developer show to the Cabinet that satisfied the ministers that the developer was worthy of a change of legislation and gained government support for their plans to use the Par-la-Ville car park as collateral for a bridging loan? There must have been something that was shown to Government in order for them to change the law and say that you can use the Par-la-Ville car park to obtain financing for your project,” he said. Sen Fahy’s statement chronicles the Par-la-Ville Hotel and Residences Ltd debacle from July 9, 2014, when the company entered into a Credit Agreement with Mexico Infrastructure Finance LLC to borrow $18 million, to his meeting with the Corporation on January 22, during which he said he learnt that the principal, which had been sitting in an escrow account in the Bank of New York Mellon, had been paid into the developer’s bank account. He said certain members of the Corporation had “serious concerns” about the transaction and that there was no resolution that it had been authorized. Sen Fahy, who also revealed that he referred the case to the Bermuda Police Service last month, said: “The funds were removed from escrow and various agreements were signed relating to the Mexico Infrastructure Finance LLC loan when the Corporation of Hamilton managed its own affairs. “Checks and balances were put in place by the Government in March 2014 which appear to have been ignored.”

April 29. The Public Accounts Committee is set to hold a public hearing tomorrow on the Port Royal Golf Course project. The project ran up a bill of more than $24 million between 2007 and 2011, despite initially being budgeted at $4.5 million. During tomorrow’s meeting, the PAC is expected to deliberate on the golf course renovation and facility improvement work, which was the subject of a recent special report by Auditor General Heather Matthews. While Ms Matthews said the project should have been left in the hands of the Department of Public Works, it was delegated to the Cabinet Office from 2007 to 2010, and the Ministry of Tourism and Transport from 2010 to 2012, while Port Royal’s board of trustees managed the project. None had the capacity for the oversight or management of such a project, Ms Matthews said, nor did financial instructions permit the management of capital development projects to be delegated. The PAC is comprised of Members of Parliament and is authorized by the House of Assembly to closely examine and report on matters relating to the accounts, showing the appropriation of the sums granted by the Legislature to meet the public expenditure of Bermuda. The committee also investigates findings reported by the Auditor General. The hearing is scheduled to take place inside the House of Assembly library, starting at 2.30pm.

April 29. Tourism ambassadors, school volunteers and “heroes of hospitality” received recognition last weekend for their contributions from the Bermuda Tourism Authority, in tandem with the Bermuda Hospitality Institute. More than 150 members of the hospitality industry were commended at The Fairmont Hamilton Princess as the Island nears 400 people who have attended status as certified tourism ambassadors. The hospitality and friendliness of Bermudians stood out in visitor surveys as the most memorable aspect of their trips, with tourists relying on the recommendations of locals for where to go and what to see and do. According to a BTA statement, the data shows that “positive engagement with residents leads visitors to feel their vacation exceeded expectations”. Karla Lacey, chief operating officer of the BTA, said the ambassadors’ knowledge of Bermuda’s history and its present-day offerings are what drive the Island’s success as a destination. The Bermuda Hospitality Institute’s “Hospitality Skills — Life Skills” school programme, offered to children at P4, P6 and M2 levels, was also recognized, along with the START programme — a “skills, tasks and results training” certificate programme through the American Hotel and Lodging Educational Institute, which is aimed at high school students aged 16 to 18. In addition, the community group Imagine Bermuda was commended for taking the nomination of April as hospitality month to champion local “heroes of hospitality.”

Tourism ambassadors, see above story

April 29. “Your wallet is likely to take a small hit this year and next — but it could see some improvement by 2017.” Even so, the Island stands to lose hundreds more jobs this year. Offering the “brutal facts” from the 2015-16 Budget — plus some tentative projections of moderate growth — statistician Cordell Riley gave a guarded economic forecast for the years ahead. However, several audience members last night at the Bermuda College bemoaned the Island’s lack of fresh ideas when it came to economic recovery. Businessmen spoke out against local banking practices and bureaucracy, with one lamenting that he considered himself middle class as someone who runs businesses — “but it’s all eaten up by taxes. What we have got to do is put pressure on the elected people that are supposed to be working for us,” added businessman Nelson Hunt. “This is no longer a popularity contest. We’re all broke.” The Island has heard several references lately to “green shoots” in the local economy, Mr Riley observed. Premier Michael Dunkley recently used the term, along with several local business and finance heads in the past six months. “The real question is whether that’s enough,” Mr Riley said. “Sometimes you see shoots coming up and they die; they don’t grow. I think from a political perspective, you want to see these green shoots. But when you start to pull back the data and have a clear look, you start is ask the question — is that really going to happen?” Bermuda’s population is ageing even as it declines: Mr Riley suggested the Island’s numbers could be down to 61,500 come 2020 — a four per cent drop from 64,130 in 2010. “Some are estimating that it’s already there,” he added, pointing out that the Island doesn’t keep net migration figures. Without knowing how many have chosen to try their fortunes elsewhere, Mr Riley said, “the truth is we really don’t know”. Either way, the stakes are high: 2017 is likely to mark the year that the senior population overtakes the Island’s youth population of age 17 and younger, thus increasing the pressure on those of us with jobs. Mr Riley said local jobs had peaked at 40,213 in 2008 and fallen to 33,487 last year. Jobs could fall to 32,800 this year before Bermuda starts into recovery in 2016, he said: “We could bottom out in 2015” — but still lose another 700 jobs. Mr Riley told the audience he preferred the term “rebalancing” rather than cutting when it came to the civil service. Pointing out that all those on the Government payroll are not civil servants, he gave a figure of about 4,200 in that category as of last year. “It’s a fact that as overall jobs declined, the civil service jobs haven’t declined at the same pace. If they did, we would be at about 3,400 civil servants. But we can’t say let’s cut the civil service — that’s a lesson the Government learnt very recently.” The decision not to renew temporary positions when contracts ran out had seen many reversals, he said. Even as jobs continue to fall, retail sales have staged a recent comeback, suggesting a resurgence in customer confidence. It is also possible that the Island has reached the bottom and is starting to climb back out when it comes to air arrivals, which last year stood at 229,484 — a plunge from the 305,548 in 2010. While the Island is down again for the first quarter of this year, Mr Riley said there was a fair chance that Bermuda could hit 250,000 air arrivals in 2016. As for debt, the end is still far: by 2017-18, the Island will reach just under $2.5 billion — although that figure could dip to $2.1 billion come 2019-20. “The operative word is ‘could’,” Mr Riley added. New taxes in services, as yet unspecified by Finance Minister Bob Richards, remain ahead. Several speakers voiced their frustration at the Island’s lumbering bureaucracy. Investor confidence is creeping back, one said, but “they’re not going to wait around for a third bite of the cherry.” Bermuda has been complacent over embracing money makers like cannabis and casinos, others said. “It’s always been said that we’re in this together,” Mr Riley observed. “I think this is one time it’s proving that we are.”

April 28. Plans for the proposed redevelopment of the Ariel Sands property have been placed online. The project will include 26 villas, along with a 20-room hotel building, two restaurants, a spa, gym, salon and children’s entertainment zone. The villas will be a mix of two and three-bedroom self-contained apartments with facilities such as washer/dryers, bathrooms for each bed and kitchens. They will be available for sale to Bermudians and non-Bermudians, who can then rent them out through an international reservation and marketing group. Celebrated actor Michael Douglas, whose family have owned the Devonshire property since the 1840s, formally announced the redevelopment project last year. Last week, Mr Douglas told The Royal Gazette: “The plans have been refined substantially since we made our initial announcement and we have spent an exorbitant amount of time to get it right. Sometimes plans are submitted in part, but this is complete.” The Environmental Impact Statement and Environmental Scoping Report for the project have been made publicly available through the Department of Planning website.

April 28. Premier Michael Dunkley issued a rallying call to Bermudians last night urging everyone to work together to overcome the challenges faced by the Island. During a televised speech, he detailed Government’s accomplishments since the OBA came to power in December 2012, but cautioned: “There is much more to do.” Mr Dunkley hailed the America’s Cup and casino gaming legislation as initiatives that would stimulate the economy and rebuild tourism. He also maintained that efforts to reduce Government spending were beginning to bear fruit. “We are confident the recovery is taking hold, but we cannot do it alone,” said Mr Dunkley. “So I appeal to you to think about what you can do to help your Island home. It could be mentoring a child, donating to a charity or helping people in need. Once you decide what you can do, then commit to doing it, commit to the life of the community, extend a helping hand wherever possible. Bermuda, we are a good people being tested in big ways. Let’s use this time to come together, to work together, exercising tolerance and respect. Let’s use these testing times as an opportunity to make Bermuda better, to make it more open, fair and inclusive.” Mr Dunkley insisted that public service reform remained a priority, while he pointed to the new Public Access to Information Act as proof of Government’s commitment to transparency and accountability. “By the end of this fiscal year we will have reduced Government’s annual deficit by approximately $110 million,” said Mr Dunkley. “We will have moved the Current Account, before debt service payments, to a surplus position — the first time in more than seven years. The steps we’ve taken so far are steps to grow the economy — cutting red tape, passing legislation, adjusting regulations and reaching beyond our shores to create new channels of investment in Bermuda; investment that builds hotels, creates new businesses and sets the stage for making the America’s Cup in Bermuda one of the greatest sporting spectacles of all time.” During the speech, which aired at 6.50pm, Mr Dunkley praised the work of the Bermuda Police Service and the Department of Corrections, and highlighted the success of projects including the anti-gang GREAT programme, as well as outreach and educational programmes in prison. “With several hundred million dollars in projects lined up over the next three years I am very optimistic about our future,” he said. “These projects reflect rising confidence in Bermuda, confidence that translates into jobs, career and business opportunities for Bermudians. The America’s Cup will generate fantastic levels of activity and excitement, making Bermuda one of the hot spots on the planet when the racing gets under way.”

April 28. Royal Gazette Editorial. John F Kennedy was the consummate helmsman, figuratively and literally. His long political career, first as a Congressman and US Senator, then as America’s President, was a case study in steering and trimming his sails to take maximum advantage of constantly changing conditions. He had the instinctive ability to read the ever-shifting public mood, to gauge fluctuating political realities, and to react to them immediately. When his intuition occasionally failed him, as in the disastrous 1961 US-backed Bay of Pigs invasion intended to oust the Soviet Union’s puppet regime in Cuba, Kennedy learned from his humiliating experience. He accepted full responsibility for the fiasco, made sweeping changes in the upper echelons of the US national security apparatus and, a year later when confronted by the Cuban Missile Crisis, steered a calm, resolute and successful course through that harrowing exercise in nuclear brinkmanship. Perhaps not surprisingly, he often credited his lifelong love of the sea for the skilled, steady and largely unshowy helmsmanship he brought to public life. Kennedy grew up on the water. The greatest love of his life was arguably the 26-foot sailboat Victura he owned from the age of 15 and he was decorated for gallantry as a result of his military service in the US Navy during the Second World War. So trust Kennedy to invoke the almost mystical connection which exists between all of us and the ocean during some otherwise dry, largely business-like remarks to a dinner for 1962 America’s Cup crews. “I really don’t know why it is that all of us are so committed to the sea, except I think it’s because in addition to the fact that the sea changes, and the light changes, and ships change, it’s because we all came from the sea,” he said. “And it is an interesting biological fact that all of us have in our veins the exact same percentage of salt in our blood that exists in the ocean and, therefore, we have salt in our blood, in our sweat, in our tears. We are tied to the ocean. And when we go back to the sea — whether it is to sail or to watch it — we are going back from whence we came.” He ended by reminding the American and Australian sailors and organizers competing for the Auld Mug in Newport, Rhode Island, in 1962 they might be racing against one other, but they were also racing with one another against the always changing wind and sea, against always unpredictable conditions. He hardly needed to add that much the same applies in other areas of life. The fact we in Bermuda may be in competition against one another in politics, business or some other area does not mean our roles are not actually complementary. We have common goals in mind and common hazards to overcome. The slain President’s words should still resonate in modern Bermuda, now to host both the 2017 edition of the America’s Cup as well as the qualifying regattas. Every Bermudian, being born within a mile of the water, is bred amphibious, a distinguished chronicler of our people and folkways once famously observed. So we all know that surpassing tie to the sea Kennedy described as well as we know our own names. But whether we spend much time on the water or not, most of us understand the broader meaning of what he was saying — the need for all of us to steer and trim our sails so as to take maximum advantage of constantly changing conditions, the need to demonstrate adroit helmsmanship to reach the most desirable destination. The America’s Cup and its Qualifiers present Bermudians with an enviable, world-class opportunity to pursue the common cause, to overcome common obstacles. It is an opportunity for us to put aside the fractiousness and disunity which so often characterizes Bermudian public affairs and so often results in each side pressing its own end to the neglect of the common good — and achieving precisely nothing whatsoever. It is an opportunity to tighten our community bonds by embracing what could be a genuine community-building exercise and then to move Bermuda forward with that renewed sense of confidence and purpose which comes from success. And it is up to all of us to be helmsmen in this undertaking. As someone once said, the pessimist complains about the wind while the optimist simply expects it to change. The genuine leaders adjust the sails and steer windward.

April 28. There is a large question mark hanging over the whereabouts of nearly $400,000 of an $18 million loan made to the Par-la-Ville Hotel and Residences Ltd development company. Documents show that Mexico Infrastructure Finance made a claim against the mortgage on the Par-la-Ville car park, when Par-la-Ville Hotel and Residences apparently failed to repay its debt on December 30. According to an accountant who went through several documents and letters that were also seen by this newspaper, while most of the funds received by Par-la-Ville Hotel and Residences Ltd can be roughly accounted for, the whereabouts of some of that money is still not clear. The accountant explained that about $2.5 million of the original $18 million sum was withheld by Mexico Infrastructure Finance to pay fees and interest. The remaining $15.5 million was then deposited into an escrow account by Mexico Infrastructure Finance at the Bank of New York Mellon, specifically to be used to pay the costs and fees associated with entering into a binding agreement for the permanent financing for the hotel project. The terms of the escrow agreement allowed for a distribution of up to $1.2 million to pay various legal and professional fees that were detailed in the Credit Agreement, a document which clearly states the conditions which had to be met to distribute funds from the escrow account. Additionally, it was stated that $500,000 must remain in the escrow account after the Corporation of Hamilton and Par-la-Ville Hotel and Residences Ltd released the funds from escrow to secure the permanent financing for the hotel and residences project. It appears that $1.2 million was dispersed from escrow to pay legal and professional fees that were detailed in the Credit Agreement, $500,000 was held back in the escrow account, and approximately $13.8 million was dispersed from the escrow account to the Clarien Bank account of Michael and Yasmin MacLean. Correspondence shows that Par-la-Ville Hotels and Residences Ltd were the party that instructed the escrow agent, the Bank of New York Mellon, to release the full balance in the escrow account to the MacLeans’ account with Clarien Bank. Further correspondence shows that the Corporation of Hamilton approved the release of the money to the personal account of the MacLeans. It is signed by Mayor Graeme Outerbridge and Corporation secretary Ed Benevides. Sources have confirmed $12.5 million was sent directly or indirectly from the MacLeans’ account to a company called Argyle UAE Ltd, a Dubai entity. It is believed that the transfer to Argyle UAE Ltd is directly connected to an agreement with Argyle Ltd, a Gibraltar entity, which received the $12.5 million in the form of a one-time irrevocable fee payment in exchange for a one-year credit facility in the amount of $125 million. The exact whereabouts or use of approximately $400,000 remains a mystery. The Corporation of Hamilton was entitled to a $900,000 fee for guaranteeing the credit agreement using the PLV property, but sources have confirmed that the Corporation of Hamilton has not been paid this fee.

April 28. Corporation of Hamilton Mayor Graeme Outerbridge and chief operating officer and secretary Ed Benevides approved the disbursement of the “full balance” of the Par-la-Ville Hotel and Residences Ltd’s multimillion dollar escrow account at the Bank of New York Mellon, according to a letter signed by both men on Corporation letterhead. The New York bank was told to place the funds in the private bank account of Michael and Yasmin MacLean at Clarien Bank Limited in Bermuda, via intermediary bank Wells Fargo Bank in New York. Documents and letters relating to the $18 million bridging loan made to Par-la-Ville Hotel and Residences Ltd and its disbursement have been seen by The Royal Gazette. Mr MacLean has stated in an affidavit that he is the president of Par-la-Ville Hotel and Residences Ltd (St Regis Bermuda). That affidavit was filed for a legal action for $90 million in losses the plaintiffs are claiming was incurred by the voiding of the Hamilton Waterfront development agreement. The money, which is believed to have totaled approximately $13.8 million of the $18 million loan, was deposited in the developer’s private bank account. Some $12.5 million of that money is now thought to be held by a United Arab Emirates entity called Argyle UAE Ltd. According to Minister of Home Affairs Michael Fahy, the money had been traced to a Gibraltar company called Argyle Ltd. He said two weeks ago: “It appears that a substantial sum of the bridging loan was at some point paid to a company registered in Gibraltar called Argyle Ltd as a fee to get access to a large line of credit to develop the financing for the hotel and residences development. Both the Corporation of Hamilton, me as steward and the mortgage holder are doing everything possible to obtain further details as to the whereabouts of the bridging loan money.” The Royal Gazette reported on April 16 that documents show that Argyle Ltd had declared just £1,000 ($1,486) in assets in December 2013. Its website has been closed down. Very little information about Argyle Ltd is easily available, although the company appears to remain active. It was started in December 2006 by a Robert McKellar, whose residence is stated to be Malaga area, Spain. However, further investigation reveals a seemingly more active entity under the Argyle brand, Argyle UAE Ltd, whose address is listed as Dubai, United Arab Emirates, and whose website describes Robert McKeller as its chairman. A telephone call to Argyle UAE was answered by an automatic paging service asking callers to select either Argyle UAE or Argyle Ltd. Sources now confirm that the money went to the UAE entity. The Argyle UAE website states that the company was formed in 2012. It says: “We invest in fixed income and zero coupon investment grade products and receivables to generate income streams and profits for projects for our own account. We invest globally and have investment opportunities in London, Zurich, Gibraltar, Channel Islands and Singapore. We are particularly interested in clients with cash or near cash assets where we can match these to investments, the profits from which are applied to the client’s own projects to increase available equity, or to fund research and development projects where such funding is difficult to raise from traditional sources.” The letter from the Mayor and Corporation Secretary supporting Par-la-Ville Hotel and Residences Ltd instructions to the US bank to make the disbursement to the MacLeans’ personal bank account in Bermuda has been seen by this newspaper. The day and month that the letter was written have been obscured and only the year, 2014, is legible. Sources put the month as October. The lender of the funds was a company called Mexico Infrastructure Finance LLC. Documents show that the money was to be loaned for a 180-day period, and the Credit Agreement, dated July 9 and signed by the parties to the loan, states repayment was due on December 30 last year. Par-la-Ville car park was put up by the Corporation of Hamilton as collateral for the $18 million loan, but after the failure to repay this, the approximately 79,000 square foot site of prime Hamilton real estate is now in the hands of KPMG receivers. In that Credit Agreement, dated July 9, a condition of loan states the lender should receive “an appraisal addressed to Lender, issued by CBRE Inc, appraising the Land at $29,900,000 or more, as of a date no earlier than April 18, 2013. Documents also show that the borrowed funds were specifically for the purposes of paying expenses associated with securing a “permanent loan” along with fees and costs. The need for the loan is spelled out in the Credit Agreement between Par-la-Ville Hotel and Residences Ltd and Mexico Infrastructure Finance, which states: “Borrower represents to Lender that its agreement with Starwood Hotels and Resorts Worldwide Inc and Sheraton Overseas Management Corporation (Starwood) to develop the project (the Starwood agreements) are not in good standing because Borrower failed to obtain the Permanent Loan at the time required by the Starwood Agreements. Borrower shall use commercially reasonable efforts to (a) bring the Starwood Agreement into good standing, subject to obtaining the Permanent Loan, or (b) enter into a similar development and operation agreement with a hotel company comparable to Starwood.” The proposed project is also spelled out in the Credit Agreement. Under “Definitions”. It states: “‘Project’ means the Starwood branded St Regis Hotel and Residences, consisting of a 137-room hotel, 82 residences, retail space and three-level parking garage, planned to be constructed by Borrower on the Land.” According to the Escrow Agreement (see below), Par-la-Ville Hotel and Residences was looking for about $334 million. Although the bridging loan was specifically to enable Par-la-Ville Hotel and Residences to secure financing for the project, there was no information about who that lender was to be. A letter from law firm Wakefield Quin, dated December 29, 2014, responding for Par-la-Ville Hotel and Residences to correspondence from the lenders’ lawyers, Shutts & Bowen LLP, stated: “PLV (Par-la-Ville Hotel and Residences) is not in a position to supply the Lender with a copy of the Permanent Loan Funding Agreement and that PLV is permitted to withhold same in accordance with section 3.3(c) of the Lender Escrow on the basis of it being subject to strict confidentiality owed to the Permanent Lender. Also, the formation of the Senior Escrow and the terms governing the transfer of the Escrow Property ... are recorded in and form part of the Permanent Loan Funding Agreement and is therefore subject to similar restrictions and exceptions on the basis of confidentiality. Although the specific provisions of the Permanent Loan Funding Agreement cannot be disclosed, PLV wishes to advise the Lender that (i) the Senior Escrow was established in accordance with the definitions set out in section 3.8 of the Lender Escrow and (ii) that the proceeds of the Loan were deposited in the Senior Escrow in accordance with section 3.4 of the Lender Escrow and (iii) that the escrow agent appointed pursuant to the Senior Escrow ... was duly approved by the Corporation of Hamilton.” The Royal Gazette has not seen documents showing Corporation approval of a permanent lender or senior escrow. However, it is understood that the transfer of funds to Argyle UAE Ltd is directly connected to an agreement with Argyle Ltd, the Gibraltar entity, which was to provide the funding in the form of a one-time irrevocable payment in exchange for a one-year credit facility of $125 million. The letter from Shutts & Bowen to Mr MacLean and Mr Outerbridge, dated December 15 last year, argues why they believed Par-la-Ville Hotel and Residences was in default. It states that, among other things: “The Borrower’s failure to (a) use the proceeds of the Loan only for the purposes of obtaining the Permanent Loan or paying expenses related thereto ... (b) obtain and deliver, to the Lender, the certification and other documents specified by Section 3.3 of the Lender Escrow Agreement as a condition precedent to obtaining a distribution of the Escrow Property, (c) transfer the Escrow property into the Senior Escrow, as required by section 3.4 of the Escrow Agreement, and (d) comply with Section 10 of the Credit Agreement”, which lists the reasons that would constitute a default of the loan. The letter ends with a sentence entirely written in capital letters, which states: “The Lender is attempting to collect the indebtedness evidenced by the loan documents and any information obtained by the lender or its representatives will be used for that purpose. “Govern yourself accordingly”, it concludes. Documents show that the Corporation voted to approve the loan and guarantee, but there are no documents that this newspaper has seen that showed the Corporation approved the removal of the funds from the Bank of New York Mellon escrow account and the deposit of that money into the MacLeans’ bank account. Corporation Councillor Carlton Simmons said last week: “It is important for the public to know that based on the assurances given by our attorneys to the board, $15 million of the $18 million was never supposed to leave a joint account held by the Corporation of Hamilton and the developer. The legal conditions under which the money could have been released were never met. The Corporation of Hamilton’s lawyers and the Council were never consulted and therefore did not advise the release of millions of dollars to a third party.” Mr Simmons said that if rules and guidelines had been followed then “this tragedy would have never occurred. Someone has to be held responsible." Home Affairs Minister Michael Fahy said last week: “This whole debate is the reason we stepped in. I attended a meeting on January 22 with the entire Council of the Corporation of Hamilton, including the Mayor, and at that meeting, a number of concerns were brought to my attention in relation to the transaction, in respect to the guarantee and the loan.” Sen Fahy said that he then took control of the Corporation on January 25, and that between March 2014 and the end of January this year “we had no running of the Corporation”.

• Section 3.3 of Lender Escrow Agreement states:

To obtain a distribution of the Escrow Property into the Senior Escrow, the parties shall, subject to section (d) below, comply with the following: