Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us).

|

See at bottom of this page a listing of our many History files |

![]() The

One Bermuda Alliance’s Budget Reply ignored positive economic signs, according

to Premier David Burt. Mr Burt, speaking to The Royal Gazette this

afternoon, said: “What’s interesting was what was actually missed in the

fact that the Shadow Minister of Finance neglected to mention the fact that

Bermuda had the strongest job growth in 2019 than we have had in 13 years. We

hear this story about the economy and the challenges, of which there are some,

but we have to recognise the strengths. The most important thing to recognise is

that there was job growth — job growth overall in the economy and more

Bermudians working. There are more Bermudians working now than when we took

office. There are more people working in the Bermuda economy than when we took

office, and we are going to continue to make progress. But what we must do is

build a fairer economy.” Mr Burt also disputed the OBA’s claim that the

Progressive Labour Party has increased taxes for working Bermudians. He said:

“Nothing could be further from the truth. We have lowered payroll taxes for

workers to the lowest levels that they have been in history. The lowest payroll

tax band has never, ever been this low since payroll tax was introduced. On an

annual basis we have reduced taxes and we are going to continue to make sure

that those persons who are workers in this country who need relief will get that

relief. That is in far contrast to what happened under the former Government

when payroll tax was raised across the board.”

The

One Bermuda Alliance’s Budget Reply ignored positive economic signs, according

to Premier David Burt. Mr Burt, speaking to The Royal Gazette this

afternoon, said: “What’s interesting was what was actually missed in the

fact that the Shadow Minister of Finance neglected to mention the fact that

Bermuda had the strongest job growth in 2019 than we have had in 13 years. We

hear this story about the economy and the challenges, of which there are some,

but we have to recognise the strengths. The most important thing to recognise is

that there was job growth — job growth overall in the economy and more

Bermudians working. There are more Bermudians working now than when we took

office. There are more people working in the Bermuda economy than when we took

office, and we are going to continue to make progress. But what we must do is

build a fairer economy.” Mr Burt also disputed the OBA’s claim that the

Progressive Labour Party has increased taxes for working Bermudians. He said:

“Nothing could be further from the truth. We have lowered payroll taxes for

workers to the lowest levels that they have been in history. The lowest payroll

tax band has never, ever been this low since payroll tax was introduced. On an

annual basis we have reduced taxes and we are going to continue to make sure

that those persons who are workers in this country who need relief will get that

relief. That is in far contrast to what happened under the former Government

when payroll tax was raised across the board.”

![]() Work

permit costs could be hiked as part of a move to encourage greater Bermudian

employment, the One Bermuda Alliance proposed yesterday. Patricia

Gordon-Pamplin, the shadow finance minister, added that an OBA government would

lay the groundwork for an education authority and recommended funding for an

independent inquiry into the care of children referred for treatment overseas by

the Department of Child and Family Services. Delivering the Opposition’s

Budget Reply in the House of Assembly, she said: “The cost of work permits

could be significantly increased across the board and a tax-neutralizing

reduction benefit for payroll tax could be offered for employers. The higher

cost of permits would encourage companies to hire and train Bermudians, and this

can be reflected in opportunities for Bermudians abroad to consider returning

home. This approach could also fulfil the aim of reducing payroll tax burden on

employers while incentivising them to hire Bermudians; growing the economy;

enhancing our talent pool; encouraging the efficient processing of permits;

creating a separate revenue centre for government and creating a shift for

companies to manage expat employees as a separate cost centre rather than their

entire employee base, and could discourage employers from unfairly selecting

foreign workers over qualified and or trainable Bermudians.” Ms Gordon-Pamplin

said the OBA recommended the establishment of a Cabinet sub-committee to include

the Premier as well as ministers responsible for education, finance, health,

social services, works and engineering.

Work

permit costs could be hiked as part of a move to encourage greater Bermudian

employment, the One Bermuda Alliance proposed yesterday. Patricia

Gordon-Pamplin, the shadow finance minister, added that an OBA government would

lay the groundwork for an education authority and recommended funding for an

independent inquiry into the care of children referred for treatment overseas by

the Department of Child and Family Services. Delivering the Opposition’s

Budget Reply in the House of Assembly, she said: “The cost of work permits

could be significantly increased across the board and a tax-neutralizing

reduction benefit for payroll tax could be offered for employers. The higher

cost of permits would encourage companies to hire and train Bermudians, and this

can be reflected in opportunities for Bermudians abroad to consider returning

home. This approach could also fulfil the aim of reducing payroll tax burden on

employers while incentivising them to hire Bermudians; growing the economy;

enhancing our talent pool; encouraging the efficient processing of permits;

creating a separate revenue centre for government and creating a shift for

companies to manage expat employees as a separate cost centre rather than their

entire employee base, and could discourage employers from unfairly selecting

foreign workers over qualified and or trainable Bermudians.” Ms Gordon-Pamplin

said the OBA recommended the establishment of a Cabinet sub-committee to include

the Premier as well as ministers responsible for education, finance, health,

social services, works and engineering.

![]() Families

whose loved ones suffer from rare medical syndromes recognised their solidarity

for Rare Disease Day. Tanya Dyer, who last year called for the day to be

recognised nationally, said that she was “overwhelmed” to watch her rare

disease group grow from two families to 15. She added: “A friend of mine told

me ‘Tanya you did it, you got everyone together’, but this was a group

effort.” Rare Disease Day, which is observed in 80 countries, uses the last

day of February to recognise people living with unknown or overlooked illnesses.

Jessie and Thaddeus Murdoch, from Pembroke, said that they observed the day to

honour their four-year-old daughter, Lucy. Ms Murdoch, 33, explained that their

daughter suffered from CDKL5 Deficiency Disorder, which affects one in every

75,000 people. The disorder occurs when a protein crucial for neurological

development is not properly produced. Ms Murdoch said that Lucy’s CDD left her

with developmental challenges including epilepsy, visual impairment and an

inability to move or speak. She added: “No baby book has a chapter about what

it’s like to have a doctor tell you your infant will likely never walk, talk,

or maybe even hold her head up.” The Murdochs said that they gave Lucy

cannabidiol, which has been shown to improve CCD seizures, to help manage her

epilepsy. They added that, despite her disorder, Lucy was still a happy and

fun-loving girl. Ms Murdoch said: “She brings out the best in us, including

her baby brother, and with her we have seen some amazing acts of kindness and

met some fantastic people.” Naimah Frith, 23, said that she was one of 0.02

per cent of the global population who suffered from Marfan’s syndrome. She

explained that the genetic disorder, which targets connective tissue, made her

susceptible to complications with her eyes, lungs and heart.

Families

whose loved ones suffer from rare medical syndromes recognised their solidarity

for Rare Disease Day. Tanya Dyer, who last year called for the day to be

recognised nationally, said that she was “overwhelmed” to watch her rare

disease group grow from two families to 15. She added: “A friend of mine told

me ‘Tanya you did it, you got everyone together’, but this was a group

effort.” Rare Disease Day, which is observed in 80 countries, uses the last

day of February to recognise people living with unknown or overlooked illnesses.

Jessie and Thaddeus Murdoch, from Pembroke, said that they observed the day to

honour their four-year-old daughter, Lucy. Ms Murdoch, 33, explained that their

daughter suffered from CDKL5 Deficiency Disorder, which affects one in every

75,000 people. The disorder occurs when a protein crucial for neurological

development is not properly produced. Ms Murdoch said that Lucy’s CDD left her

with developmental challenges including epilepsy, visual impairment and an

inability to move or speak. She added: “No baby book has a chapter about what

it’s like to have a doctor tell you your infant will likely never walk, talk,

or maybe even hold her head up.” The Murdochs said that they gave Lucy

cannabidiol, which has been shown to improve CCD seizures, to help manage her

epilepsy. They added that, despite her disorder, Lucy was still a happy and

fun-loving girl. Ms Murdoch said: “She brings out the best in us, including

her baby brother, and with her we have seen some amazing acts of kindness and

met some fantastic people.” Naimah Frith, 23, said that she was one of 0.02

per cent of the global population who suffered from Marfan’s syndrome. She

explained that the genetic disorder, which targets connective tissue, made her

susceptible to complications with her eyes, lungs and heart.

![]() A

tribute to Bermuda’s musical greats will be held today on the steps of City

Hall in Hamilton. “Music Expressions” will feature artists such as June

Caisey, Papa D, John Burch and Cleveland Simmons. It includes a salute to the

Bermuda Entertainment Union and others who support Bermuda’s artists. Mr

Simmons said the performance, from 2pm to 4pm, was a fitting end to Black

History Month. He said: “We’re talking about musical black history. Our

musical history in Bermuda goes on and on. Ultimately we think there should be a

memorial or plaque in City Hall to recognise all the musicians and entertainers

who have done so much for the island.”

A

tribute to Bermuda’s musical greats will be held today on the steps of City

Hall in Hamilton. “Music Expressions” will feature artists such as June

Caisey, Papa D, John Burch and Cleveland Simmons. It includes a salute to the

Bermuda Entertainment Union and others who support Bermuda’s artists. Mr

Simmons said the performance, from 2pm to 4pm, was a fitting end to Black

History Month. He said: “We’re talking about musical black history. Our

musical history in Bermuda goes on and on. Ultimately we think there should be a

memorial or plaque in City Hall to recognise all the musicians and entertainers

who have done so much for the island.”

![]() A

schoolteacher and founding member of the group behind the 1959 Theatre Boycotts,

which helped destroy segregation, has died. Vera Commissiong was 87. David

Burt, the Premier, told the House of Assembly that Ms Commissiong, a social and

racial justice icon, died yesterday morning. Mr Burt paid tribute to the

“pioneering” activist. He told MPs Ms Commissiong was “unafraid to be who

she was at a time when it was unpopular for people to do it”. Ms Commissiong

and her husband, Rudolph, belonged to the Progressive Group that organised

protests against the island’s segregated movie theatres. The boycotts, which

began in June 1959, forced the six cinemas to shut due to a lack of customers.

They reopened the next month with integrated seating. The success of the

boycotts sparked a wave of desegregation as other businesses followed the

cinemas. She was the mother of Rolfe Commissiong, a Progressive Labour Party

backbencher, and was also a stalwart of the PLP.

A

schoolteacher and founding member of the group behind the 1959 Theatre Boycotts,

which helped destroy segregation, has died. Vera Commissiong was 87. David

Burt, the Premier, told the House of Assembly that Ms Commissiong, a social and

racial justice icon, died yesterday morning. Mr Burt paid tribute to the

“pioneering” activist. He told MPs Ms Commissiong was “unafraid to be who

she was at a time when it was unpopular for people to do it”. Ms Commissiong

and her husband, Rudolph, belonged to the Progressive Group that organised

protests against the island’s segregated movie theatres. The boycotts, which

began in June 1959, forced the six cinemas to shut due to a lack of customers.

They reopened the next month with integrated seating. The success of the

boycotts sparked a wave of desegregation as other businesses followed the

cinemas. She was the mother of Rolfe Commissiong, a Progressive Labour Party

backbencher, and was also a stalwart of the PLP.

![]() Bermuda’s

athletes have been urged to “continue training as planned” amid uncertainty

over the fate of the 2020 Tokyo Olympic Games due to the coronavirus outbreak. The

epidemic began in December in central China and since then has caused more than

80,000 people to become infected and killed some 2,700 worldwide, the vast

majority of them in mainland China. In Japan, officials say more than 200 people

have become infected with the coronavirus and at least five people have died

from Covid-19, the disease caused by the virus. The outbreak has disrupted

global travel and trade and also forced the cancellation or postponement of many

high-profile events, including several sporting events. Global motor sports

series Formula One and World Athletics have already called off some events. F1

cancelled its Chinese Grand Prix, which was scheduled for April 19, and World

Athletics postponed its World Athletics Indoor Championships, scheduled for

March 13-15. Earlier this week organisers of the 2020 Tokyo Olympics dismissed

speculation that the coronavirus epidemic could lead to the cancellation of the

Summer Games.

Bermuda’s

athletes have been urged to “continue training as planned” amid uncertainty

over the fate of the 2020 Tokyo Olympic Games due to the coronavirus outbreak. The

epidemic began in December in central China and since then has caused more than

80,000 people to become infected and killed some 2,700 worldwide, the vast

majority of them in mainland China. In Japan, officials say more than 200 people

have become infected with the coronavirus and at least five people have died

from Covid-19, the disease caused by the virus. The outbreak has disrupted

global travel and trade and also forced the cancellation or postponement of many

high-profile events, including several sporting events. Global motor sports

series Formula One and World Athletics have already called off some events. F1

cancelled its Chinese Grand Prix, which was scheduled for April 19, and World

Athletics postponed its World Athletics Indoor Championships, scheduled for

March 13-15. Earlier this week organisers of the 2020 Tokyo Olympics dismissed

speculation that the coronavirus epidemic could lead to the cancellation of the

Summer Games.

![]() It is not easy being born on

February 29. Lucas Amaral, a leap-year baby, is eight years old today, but it is

only the second time he has celebrated on the right day. The Warwick Academy

pupil said: “I’m a two-year-old trapped in an eight-year-old’s body.”

Carlos Amaral, Lucas’s father, said his birth date was a surprise for him and

wife Patricia as he arrived about a week ahead of schedule. Mr Amaral said: “I

never thought about it at all, until after he was born, and they said oh, there

is a Royal Gazette photographer wanting to take Lucas’s picture. It’s

a leap year. ”

It is not easy being born on

February 29. Lucas Amaral, a leap-year baby, is eight years old today, but it is

only the second time he has celebrated on the right day. The Warwick Academy

pupil said: “I’m a two-year-old trapped in an eight-year-old’s body.”

Carlos Amaral, Lucas’s father, said his birth date was a surprise for him and

wife Patricia as he arrived about a week ahead of schedule. Mr Amaral said: “I

never thought about it at all, until after he was born, and they said oh, there

is a Royal Gazette photographer wanting to take Lucas’s picture. It’s

a leap year. ”

![]()

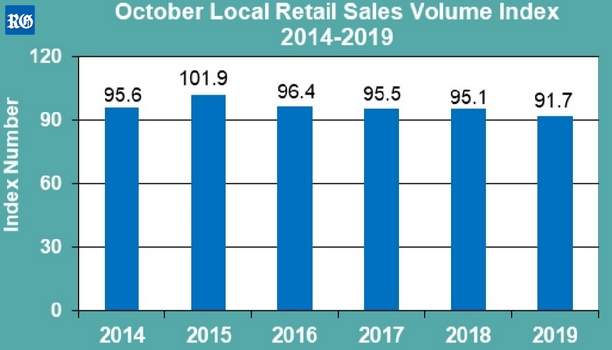

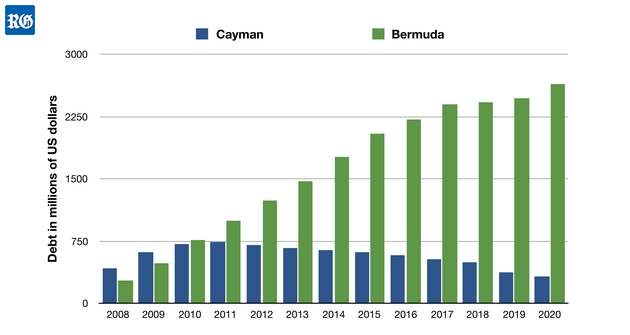

![]() A

“slash-and-burn” approach to cut the cost of the civil service is not in

Bermuda’s best interest, the finance minister said last night. Curtis

Dickinson said that such an approach would be “a mistake”. He explained:

“If I was in a company, I might have a different point of view. But at the end

of the day when companies fire people willy-nilly, they end up with the

Government having to provide some sort of assistance. So the notion that I would

go slash-and-burn and I’d be taking that salary and wages line, so we could

come back in and move the Financial Assistance line, is a nonsense. It would be

the equivalent of moving money from one pocket to the other. Nothing really

changes.” Mr Dickinson added: “The way to fix this is to make it more

efficient, and to grow the economy, to create more jobs, so that when people

decide they are going to leave they have other jobs they are willing to go

to.” The comments came as Mr Dickinson gave a presentation on the 2020-21

Budget Statement at a town hall meeting. About 30 people attended the event at

the Warwick Workmen’s Club. The minister said that Government had to be

“stop borrowing and ... be more disciplined”. He added: “What I have said

to my Cabinet colleagues is we need to start emulating the behaviour of ordinary

Bermudians. Every month, or every week, you get a paycheque, you decide what

your needs are, what your wants are, and the wants get chucked off to the side

because you don’t have any money left. You can’t do that.” Mr Dickinson

said of the Government: “You can’t go borrow $1 million willy-nilly and not

have to work at paying it back, because it doesn’t work that way.” He said

that the objective of the Budget was to “strike a balance” between fiscal

and social responsibility. Mr Dickinson added: “It has been said and felt by a

number of people that the economy is not moving fast enough.” He said that the

Budget sought to provide “some level of stimulus to get the economy moving”.

Mr Dickinson said that he stood by his statement this week that it was not the

job of the Government to bail out the retail sector. He added that the

challenges faced by Bermuda retailers were no different from other retailers in

other parts of the world, and that local businesses needed to update their

models. Mr Dickinson said that the Government had provided some help in the form

of tax relief to retailers so that infrastructure upgrades could be made to

modernise businesses. He added that the relationship between himself and retail

was one of collaboration. Mr Dickinson said: “There are 4,300 people who work

in retail. If retail fails, then people are out of work. We’re going to work

together to try and figure out a way to make this work for them, but also, more

importantly, for all of us.”

A

“slash-and-burn” approach to cut the cost of the civil service is not in

Bermuda’s best interest, the finance minister said last night. Curtis

Dickinson said that such an approach would be “a mistake”. He explained:

“If I was in a company, I might have a different point of view. But at the end

of the day when companies fire people willy-nilly, they end up with the

Government having to provide some sort of assistance. So the notion that I would

go slash-and-burn and I’d be taking that salary and wages line, so we could

come back in and move the Financial Assistance line, is a nonsense. It would be

the equivalent of moving money from one pocket to the other. Nothing really

changes.” Mr Dickinson added: “The way to fix this is to make it more

efficient, and to grow the economy, to create more jobs, so that when people

decide they are going to leave they have other jobs they are willing to go

to.” The comments came as Mr Dickinson gave a presentation on the 2020-21

Budget Statement at a town hall meeting. About 30 people attended the event at

the Warwick Workmen’s Club. The minister said that Government had to be

“stop borrowing and ... be more disciplined”. He added: “What I have said

to my Cabinet colleagues is we need to start emulating the behaviour of ordinary

Bermudians. Every month, or every week, you get a paycheque, you decide what

your needs are, what your wants are, and the wants get chucked off to the side

because you don’t have any money left. You can’t do that.” Mr Dickinson

said of the Government: “You can’t go borrow $1 million willy-nilly and not

have to work at paying it back, because it doesn’t work that way.” He said

that the objective of the Budget was to “strike a balance” between fiscal

and social responsibility. Mr Dickinson added: “It has been said and felt by a

number of people that the economy is not moving fast enough.” He said that the

Budget sought to provide “some level of stimulus to get the economy moving”.

Mr Dickinson said that he stood by his statement this week that it was not the

job of the Government to bail out the retail sector. He added that the

challenges faced by Bermuda retailers were no different from other retailers in

other parts of the world, and that local businesses needed to update their

models. Mr Dickinson said that the Government had provided some help in the form

of tax relief to retailers so that infrastructure upgrades could be made to

modernise businesses. He added that the relationship between himself and retail

was one of collaboration. Mr Dickinson said: “There are 4,300 people who work

in retail. If retail fails, then people are out of work. We’re going to work

together to try and figure out a way to make this work for them, but also, more

importantly, for all of us.”

![]() The

Minister of Finance has pledged to “fix” the problem of publicly funded

organisations failing to keep up to date with their annual audits. Curtis

Dickinson told a post-Budget meeting of business leaders: “I’m not happy

about it. We have had challenges with some of the financial statements. I’ll

step out on a limb here and say: ‘we’re going to fix it’.” Heather

Thomas, the Auditor-General, said

earlier this month it was “unacceptable” that 29 publicly funded bodies had

amassed a backlog of more than 100 years of financial statements between them.

She has since revised the figure to 28 and given The Royal Gazette a list

of the organisations with outstanding audits. Ten are public fund audits,

including the Confiscated Assets Fund, which is eight years behind. The other

delayed public fund audits are for the Bermuda Tourism Pension Plan (6 years),

the Contributory Pension Fund (6 years), the Government Employee Health

Insurance (6 years), the Public Service Superannuation Fund (6 years), the

Legislature Pension Fund (5 years), the Government Borrowing Sinking Fund (4

years), the FutureCare Fund (2 years), the Health Insurance Fund (2 years) and

the Mutual Reinsurance Fund (2 years). A finance ministry spokeswoman said:

“The Accountant-General/Ministry of Finance and the Auditor-General have met

and agreed a plan to have all public funds under the responsibility of the

Accountant-General delivered to the Auditor by the end of 2020. “This is an

ongoing and longstanding matter which has plagued successive governments and it

will take time to resolve. However, the Government commits to taking the

necessary steps to remedy this situation.” A health ministry spokes-woman

said: “The Health Insurance Department (HID) manages the Health Insurance

Fund, the FutureCare Fund and the Mutual Reinsurance Fund and has been working

closely with the Office of the Auditor-General to bring the outstanding audits

up to date. The 2016-2017 audit is currently being finalised and is expected to

be tabled before the summer. The HID and OAG teams will then move on to the

2017-2018 financial statements of the three funds with the timeline for

completion subject to scheduling with the OAG. HID is collaborating closely with

the Auditor-General’s Office to get up to date. The Minister of Health is

regularly briefed on the financial position of the funds by the Health Insurance

Committee and on progress towards completion of the outstanding audits.” Ms

Thomas said last week that the 28 audits were overdue because there were “some

organisations struggling, sometimes because of limited capability or capacity to

prepare financial statements that comply with financial reporting, in accordance

with generally accepted accounting principles”. Mr Dickinson told the Chamber

of Commerce meeting: “The fix depends on a couple of things. The Office of the

Auditor-General is resource constrained. That’s part of the problem, so

we’ve provided some additional funding in the Budget this year to get that

work done. I also need some pragmatism here. We need help to get these things

done. Governments, like banks and other financial institutions, rely heavily on

this concept of confidence. Insomuch as we have to produce our financial

statements, we have to give people confidence that the Government is doing what

governments are supposed to do. So we’re looking for some help. The position

we’re in is untenable. It’s longstanding and needs to be addressed

finally.” The Ministry of Finance did not respond to a question on what

specific help was needed. The Auditor-General’s Office was allocated $4.2

million in the 2020-21 Budget, an increase of $123,000 or 3 per cent on last

year. The office has 29 employees, expected to increase to 30 in the next

financial year. Its salary bill is expected to rise by $149,000, or 4.7 per

cent, to $3.3 million. The office’s revenue from audit fees is estimated to go

up by $78,000, or 7.3 per cent, to $1.1 million in 2020-21. Ms Thomas said in

her last annual report in 2018: “I believe that, for the present, the office

is being resourced adequately.” Organizations affected include:

The

Minister of Finance has pledged to “fix” the problem of publicly funded

organisations failing to keep up to date with their annual audits. Curtis

Dickinson told a post-Budget meeting of business leaders: “I’m not happy

about it. We have had challenges with some of the financial statements. I’ll

step out on a limb here and say: ‘we’re going to fix it’.” Heather

Thomas, the Auditor-General, said

earlier this month it was “unacceptable” that 29 publicly funded bodies had

amassed a backlog of more than 100 years of financial statements between them.

She has since revised the figure to 28 and given The Royal Gazette a list

of the organisations with outstanding audits. Ten are public fund audits,

including the Confiscated Assets Fund, which is eight years behind. The other

delayed public fund audits are for the Bermuda Tourism Pension Plan (6 years),

the Contributory Pension Fund (6 years), the Government Employee Health

Insurance (6 years), the Public Service Superannuation Fund (6 years), the

Legislature Pension Fund (5 years), the Government Borrowing Sinking Fund (4

years), the FutureCare Fund (2 years), the Health Insurance Fund (2 years) and

the Mutual Reinsurance Fund (2 years). A finance ministry spokeswoman said:

“The Accountant-General/Ministry of Finance and the Auditor-General have met

and agreed a plan to have all public funds under the responsibility of the

Accountant-General delivered to the Auditor by the end of 2020. “This is an

ongoing and longstanding matter which has plagued successive governments and it

will take time to resolve. However, the Government commits to taking the

necessary steps to remedy this situation.” A health ministry spokes-woman

said: “The Health Insurance Department (HID) manages the Health Insurance

Fund, the FutureCare Fund and the Mutual Reinsurance Fund and has been working

closely with the Office of the Auditor-General to bring the outstanding audits

up to date. The 2016-2017 audit is currently being finalised and is expected to

be tabled before the summer. The HID and OAG teams will then move on to the

2017-2018 financial statements of the three funds with the timeline for

completion subject to scheduling with the OAG. HID is collaborating closely with

the Auditor-General’s Office to get up to date. The Minister of Health is

regularly briefed on the financial position of the funds by the Health Insurance

Committee and on progress towards completion of the outstanding audits.” Ms

Thomas said last week that the 28 audits were overdue because there were “some

organisations struggling, sometimes because of limited capability or capacity to

prepare financial statements that comply with financial reporting, in accordance

with generally accepted accounting principles”. Mr Dickinson told the Chamber

of Commerce meeting: “The fix depends on a couple of things. The Office of the

Auditor-General is resource constrained. That’s part of the problem, so

we’ve provided some additional funding in the Budget this year to get that

work done. I also need some pragmatism here. We need help to get these things

done. Governments, like banks and other financial institutions, rely heavily on

this concept of confidence. Insomuch as we have to produce our financial

statements, we have to give people confidence that the Government is doing what

governments are supposed to do. So we’re looking for some help. The position

we’re in is untenable. It’s longstanding and needs to be addressed

finally.” The Ministry of Finance did not respond to a question on what

specific help was needed. The Auditor-General’s Office was allocated $4.2

million in the 2020-21 Budget, an increase of $123,000 or 3 per cent on last

year. The office has 29 employees, expected to increase to 30 in the next

financial year. Its salary bill is expected to rise by $149,000, or 4.7 per

cent, to $3.3 million. The office’s revenue from audit fees is estimated to go

up by $78,000, or 7.3 per cent, to $1.1 million in 2020-21. Ms Thomas said in

her last annual report in 2018: “I believe that, for the present, the office

is being resourced adequately.” Organizations affected include:

![]() Bermuda

has a shortage of face masks as it continues to guard against the killer strain

of coronavirus. Health minister Kim Wilson told the House of Assembly today

that talks are under way with the government agency Public Health England to

import more masks. One centralized area will then be set up to distribute them,

Ms Wilson said. The minister told MPs Bermuda remains free of Covid-19, but

warned the world could be facing a pandemic in the coming weeks. She said it was

“likely just a matter of time before we are face to face with this new public

health threat”. Ms Wilson said: “We are in a phase of preparedness for a

potential pandemic. We must focus on preparing for this situation. According to

the WHO, we must prepare to detect cases, prepare to treat cases, prepare to

follow contacts, and prepare to put in place adequate containment measures to

control the spread.” She said the Public Health Response Team, comprising

people from 15 sectors, meets at least twice weekly to update on preparations,

discuss risks and identify vulnerabilities in the community. The minister

continued: “We are well aware of the many concerns of the public, and within

the Phert working groups we are endeavoring daily to address these concerns.”

She said Customs officers have received heightened training and must ask all

travellers where they have travelled in the past 21 days. All passengers,

Bermuda residents and visitors, must be asked this question. Depending on the

answer, travellers may be referred to a public health officer for further risk

assessment and advice,” she said. People are required to quarantine themselves

in their homes for up to 14 days, and monitor themselves for signs of illness

such as fever, cough or shortness of breath. Ms Wilson said: “The challenges

presented by individuals having to be quarantined can be quite complex, and

require co-operation of individuals, their workplaces and schools. Individuals

under self-quarantine will have to miss work or school and should avoid all

public spaces. They must avoid public transportation and places where people

gather such as faith gatherings, sports events, and concerts, for example.

Pandemic preparedness policies are required by schools, workplaces, and

employers to enable people to stay home when sick or when being quarantined,

without penalty.” The minister called on hotels and guest accommodations to

implement “robust sanitation programmes and infection prevention and control

policies”. She said: “They must be able to identify early any guest who may

be ill with a serious infectious disease so that prompt advice from medical and

public health professionals can be sought. The tourism sector is collaborating

closely with health to maintain a healthy tourism product.” Ms Wilson added:

“I am appealing for solidarity. Covid-19 prevention and control will require

nothing short of community-wide and bipartisan collaboration to keep Bermuda

safe.”

Bermuda

has a shortage of face masks as it continues to guard against the killer strain

of coronavirus. Health minister Kim Wilson told the House of Assembly today

that talks are under way with the government agency Public Health England to

import more masks. One centralized area will then be set up to distribute them,

Ms Wilson said. The minister told MPs Bermuda remains free of Covid-19, but

warned the world could be facing a pandemic in the coming weeks. She said it was

“likely just a matter of time before we are face to face with this new public

health threat”. Ms Wilson said: “We are in a phase of preparedness for a

potential pandemic. We must focus on preparing for this situation. According to

the WHO, we must prepare to detect cases, prepare to treat cases, prepare to

follow contacts, and prepare to put in place adequate containment measures to

control the spread.” She said the Public Health Response Team, comprising

people from 15 sectors, meets at least twice weekly to update on preparations,

discuss risks and identify vulnerabilities in the community. The minister

continued: “We are well aware of the many concerns of the public, and within

the Phert working groups we are endeavoring daily to address these concerns.”

She said Customs officers have received heightened training and must ask all

travellers where they have travelled in the past 21 days. All passengers,

Bermuda residents and visitors, must be asked this question. Depending on the

answer, travellers may be referred to a public health officer for further risk

assessment and advice,” she said. People are required to quarantine themselves

in their homes for up to 14 days, and monitor themselves for signs of illness

such as fever, cough or shortness of breath. Ms Wilson said: “The challenges

presented by individuals having to be quarantined can be quite complex, and

require co-operation of individuals, their workplaces and schools. Individuals

under self-quarantine will have to miss work or school and should avoid all

public spaces. They must avoid public transportation and places where people

gather such as faith gatherings, sports events, and concerts, for example.

Pandemic preparedness policies are required by schools, workplaces, and

employers to enable people to stay home when sick or when being quarantined,

without penalty.” The minister called on hotels and guest accommodations to

implement “robust sanitation programmes and infection prevention and control

policies”. She said: “They must be able to identify early any guest who may

be ill with a serious infectious disease so that prompt advice from medical and

public health professionals can be sought. The tourism sector is collaborating

closely with health to maintain a healthy tourism product.” Ms Wilson added:

“I am appealing for solidarity. Covid-19 prevention and control will require

nothing short of community-wide and bipartisan collaboration to keep Bermuda

safe.”

![]() An

Opposition politician claimed that the “wheels are off” the island’s

tourism organisation after its chief executive quit the job. Leah Scott

added that the results produced by the Bermuda Tourism Authority proved Kevin

Dallas had the expertise to boost visitor numbers. She was speaking after the

BTA board said on Wednesday that Mr Dallas would leave his post today after

three years in the job. Ms Scott, the One Bermuda Alliance deputy leader,

highlighted a House of Assembly sitting 15 months ago when MPs debated the

Bermuda Tourism Authority Amendment Act 2018. She said that Zane DeSilva, the

Minister of Tourism and Transport, referred to the former OBA finance minister

Bob Richards, who said that the party’s first job was “to find out what’s

under the hood” after it won power in 2012. Mr DeSilva told MPs in November

2018: “This minister turns over stones. Bob Richards who lifted up the hood

... I’m pulling the car apart. I am going to tear that engine apart.” Ms

Scott, the shadow tourism, transport and regulatory affairs minister, said:

“Well, the car is up on blocks and the wheels have been taken off. Let’s see

how far the BTA rolls now. I have stated previously that, in my opinion,

interference with the administration of the BTA will counteract economic and

social enhancement. Just look at what happened when the then Minister of

Tourism, Jamahl Simmons, spearheaded the legislation that compromised the

independence of the Casino Gaming Commission. We now have a behemoth that we,

the taxpayers, continue to fund, to the tune of millions of dollars, while the

chance of a qualified executive director being hired or of having gaming

proceeds administered by any banking institution is slim to none. The model of a

tourism department being used as an extension of the whims and desires of the

minister of the day failed in years gone by. It is for this very reason that the

BTA was established as an independent body.” Ms Scott added: “Let those who

have the skills and expertise in the area of tourism, do what they do. Kevin

Dallas did it well and Bermuda has the statistics and the revenue to prove

it.” The BTA board said that the authority’s chief executive would step down

to “pursue opportunities in the private sector”.

An

Opposition politician claimed that the “wheels are off” the island’s

tourism organisation after its chief executive quit the job. Leah Scott

added that the results produced by the Bermuda Tourism Authority proved Kevin

Dallas had the expertise to boost visitor numbers. She was speaking after the

BTA board said on Wednesday that Mr Dallas would leave his post today after

three years in the job. Ms Scott, the One Bermuda Alliance deputy leader,

highlighted a House of Assembly sitting 15 months ago when MPs debated the

Bermuda Tourism Authority Amendment Act 2018. She said that Zane DeSilva, the

Minister of Tourism and Transport, referred to the former OBA finance minister

Bob Richards, who said that the party’s first job was “to find out what’s

under the hood” after it won power in 2012. Mr DeSilva told MPs in November

2018: “This minister turns over stones. Bob Richards who lifted up the hood

... I’m pulling the car apart. I am going to tear that engine apart.” Ms

Scott, the shadow tourism, transport and regulatory affairs minister, said:

“Well, the car is up on blocks and the wheels have been taken off. Let’s see

how far the BTA rolls now. I have stated previously that, in my opinion,

interference with the administration of the BTA will counteract economic and

social enhancement. Just look at what happened when the then Minister of

Tourism, Jamahl Simmons, spearheaded the legislation that compromised the

independence of the Casino Gaming Commission. We now have a behemoth that we,

the taxpayers, continue to fund, to the tune of millions of dollars, while the

chance of a qualified executive director being hired or of having gaming

proceeds administered by any banking institution is slim to none. The model of a

tourism department being used as an extension of the whims and desires of the

minister of the day failed in years gone by. It is for this very reason that the

BTA was established as an independent body.” Ms Scott added: “Let those who

have the skills and expertise in the area of tourism, do what they do. Kevin

Dallas did it well and Bermuda has the statistics and the revenue to prove

it.” The BTA board said that the authority’s chief executive would step down

to “pursue opportunities in the private sector”.

![]() Transport

Control Department officers have received “verbal confrontations and

unpleasant exchanges” from drivers, the House of Assembly heard today.

Zane DeSilva, the Minister of Tourism and Transport, spoke in support of TCD

officers, who he said have identical powers to police to issue parking and

moving offence tickets. Mr DeSilva said TCD had recently changed its mission

statement to include assuring “the safety of all road users”.

Transport

Control Department officers have received “verbal confrontations and

unpleasant exchanges” from drivers, the House of Assembly heard today.

Zane DeSilva, the Minister of Tourism and Transport, spoke in support of TCD

officers, who he said have identical powers to police to issue parking and

moving offence tickets. Mr DeSilva said TCD had recently changed its mission

statement to include assuring “the safety of all road users”.

![]() Sports

minister Lovitta Foggo spoke at the House of Assembly today about the upcoming

Carifta Games which Bermuda will host at the National Sports Centre.

Sports

minister Lovitta Foggo spoke at the House of Assembly today about the upcoming

Carifta Games which Bermuda will host at the National Sports Centre.

![]() People

with evidence over historic land grabs have been invited to make submissions to

a Commission of Inquiry. The inquiry, to be headed by retired Puisne Judge

Norma Wade-Miller, will investigate property thefts at a series of public

hearings to be scheduled later this year. The commission said in an

advertisement in The Royal Gazette on Wednesday that it wanted evidence

or information on “historic losses of citizens’ property in Bermuda through

theft of property, dispossession of property, adverse possession claims and/or

such other unlawful or irregular means by which land was lost in Bermuda”.

Anyone who wants to give evidence to the commission, or present relevant

information, should make an application to the Secretary of the Commission at

Sofia House on Church Street by March 16. A planning hearing, where the commission will then decide on how it

will proceed, will be held at the Cricket Pavilion on the National Sports Centre

North Field on March 19. A motion by the late Progressive Labour Party MP Walton

Brown, for a Commission of Inquiry into all known claims of property loss or

dispossession, was passed by the House of Assembly in 2014. Mrs Justice

Wade-Miller will be joined by lawyers Lynda Milligan-Whyte and Maxine Binns,

business manager Frederica Forth, Wayne Perinchief, a former PLP MP,

environmentalist Jonathan Starling and Quinton Stovell Jr, a land surveyor. The

inquiry was designed to collect evidence on the extent of historic property

losses. The commission will draw up a list of all land connected to historic

losses and identify the people or corporate bodies responsible.

People

with evidence over historic land grabs have been invited to make submissions to

a Commission of Inquiry. The inquiry, to be headed by retired Puisne Judge

Norma Wade-Miller, will investigate property thefts at a series of public

hearings to be scheduled later this year. The commission said in an

advertisement in The Royal Gazette on Wednesday that it wanted evidence

or information on “historic losses of citizens’ property in Bermuda through

theft of property, dispossession of property, adverse possession claims and/or

such other unlawful or irregular means by which land was lost in Bermuda”.

Anyone who wants to give evidence to the commission, or present relevant

information, should make an application to the Secretary of the Commission at

Sofia House on Church Street by March 16. A planning hearing, where the commission will then decide on how it

will proceed, will be held at the Cricket Pavilion on the National Sports Centre

North Field on March 19. A motion by the late Progressive Labour Party MP Walton

Brown, for a Commission of Inquiry into all known claims of property loss or

dispossession, was passed by the House of Assembly in 2014. Mrs Justice

Wade-Miller will be joined by lawyers Lynda Milligan-Whyte and Maxine Binns,

business manager Frederica Forth, Wayne Perinchief, a former PLP MP,

environmentalist Jonathan Starling and Quinton Stovell Jr, a land surveyor. The

inquiry was designed to collect evidence on the extent of historic property

losses. The commission will draw up a list of all land connected to historic

losses and identify the people or corporate bodies responsible.

![]() Police

and fire services along with other Government bodies now have a “state of the

art” public safety radio system. Wayne Caines, the Minister of National

Security, said the digital system worked better and would cut radio costs by 60

per cent over its 15-year life span. Mr Caines told the House of Assembly the

Government normally paid at least $2 million each year. His ministry signed a

$4.17 million contract with a local firm, Electronic Communications Limited,

last year. Every radio on the system is able to communicate with each other, and

the handsets have “a high level of encryption”, Mr Caines said. He added:

“This new radio platform will enable public safety agencies to coordinate more

efficiently than in past days.” Its implementation is to continue over the

next several weeks.

Police

and fire services along with other Government bodies now have a “state of the

art” public safety radio system. Wayne Caines, the Minister of National

Security, said the digital system worked better and would cut radio costs by 60

per cent over its 15-year life span. Mr Caines told the House of Assembly the

Government normally paid at least $2 million each year. His ministry signed a

$4.17 million contract with a local firm, Electronic Communications Limited,

last year. Every radio on the system is able to communicate with each other, and

the handsets have “a high level of encryption”, Mr Caines said. He added:

“This new radio platform will enable public safety agencies to coordinate more

efficiently than in past days.” Its implementation is to continue over the

next several weeks.

![]() Residents

of the Town of St George selected Zindziswa Swan to fill a vacant seat on the

corporation last night. Ms Swan, 25, took 170, or 57 per cent, of the 298

overall votes. She was elected over Colin Campbell, 62, who earned 128 votes. A

government spokeswoman said: “An extraordinary municipal election was held at

Penno’s Wharf Cruise Ship Terminal in St George, to return the seat of

Municipal Residents’ Councillor, to the Corporation of St George. “At the

end of polls, Zindziswa Swan was declared the winner.” The seat was left

vacant after Lloyd Van Putten resigned.

Residents

of the Town of St George selected Zindziswa Swan to fill a vacant seat on the

corporation last night. Ms Swan, 25, took 170, or 57 per cent, of the 298

overall votes. She was elected over Colin Campbell, 62, who earned 128 votes. A

government spokeswoman said: “An extraordinary municipal election was held at

Penno’s Wharf Cruise Ship Terminal in St George, to return the seat of

Municipal Residents’ Councillor, to the Corporation of St George. “At the

end of polls, Zindziswa Swan was declared the winner.” The seat was left

vacant after Lloyd Van Putten resigned.

![]() Increases

in valuation and a stronger British pound and Australian dollar helped Somers

Limited to a $74.6 million profit in its first quarter, which ended on December

31. The financial services investment holding company has reported its

results, only days after it was announced that regulatory and government

approvals have been received for the sale of Bermuda Commercial Bank Ltd, which

it owns. Alisdair Younie, director of ICM Ltd, Somers’ investment advisor,

said: “Post the quarter end we were delighted to announce that all material

regulatory and government approvals had been received for the sale of BCB. We

expect the sale to complete shortly and will advise shareholders of the

anticipated use of the proceeds upon completion.” Somers’ net income of

$74.6 million, or $3.61 per share, compares to a loss of $16.8 million for the

same period in 2018. The company said the improvement was primarily due to

valuation increases at Resimac and PCF, and the strengthening of sterling and

the Australian dollar against the US dollar. About 80 per cent of Somers’

investment portfolio is exposed to foreign currencies, mostly British and

Australian. Warren McLeland, chairman of Somers, said: “The first quarter of

the year included buoyant global stock markets, clarity on Brexit and an

agreement on phase one of the US/China trade war. This had a positive impact on

Somers’ two main foreign currency exposures, sterling and the Australian

Dollar. On top of this, Resimac announced strong financial results during the

quarter providing a significant increase to the valuation. This gain at Resimac,

the positive move in the global markets and stronger foreign currencies enabled

Somers to announce a record profit for the quarter of $74.6 million and an

increase in the company’s net asset value to $20.41. Importantly, our

underlying investments continue to perform strongly with their core fundamentals

continuing to provide excellent growth.” Resimac Group Holdings is Somers’

largest investment with a value of $227.8 million and assets under management of

A$14.2 billion ($9.3 million) at the end of December. Other investment

highlights for Somers during its first quarter was Waverton Investment

Management Ltd completing the acquisition of Timothy James & Partners, and

MJ Hudson Group plc completing its initial public offering on the London

Alternative Investment Market, raising $30 million and valuing Somers;

investment at $10.4 million. Somers’ total borrowings at December 31 were

$73.6 million, up from $67.9 million three months earlier due to increased

shareholder loans to fund investments.

Increases

in valuation and a stronger British pound and Australian dollar helped Somers

Limited to a $74.6 million profit in its first quarter, which ended on December

31. The financial services investment holding company has reported its

results, only days after it was announced that regulatory and government

approvals have been received for the sale of Bermuda Commercial Bank Ltd, which

it owns. Alisdair Younie, director of ICM Ltd, Somers’ investment advisor,

said: “Post the quarter end we were delighted to announce that all material

regulatory and government approvals had been received for the sale of BCB. We

expect the sale to complete shortly and will advise shareholders of the

anticipated use of the proceeds upon completion.” Somers’ net income of

$74.6 million, or $3.61 per share, compares to a loss of $16.8 million for the

same period in 2018. The company said the improvement was primarily due to

valuation increases at Resimac and PCF, and the strengthening of sterling and

the Australian dollar against the US dollar. About 80 per cent of Somers’

investment portfolio is exposed to foreign currencies, mostly British and

Australian. Warren McLeland, chairman of Somers, said: “The first quarter of

the year included buoyant global stock markets, clarity on Brexit and an

agreement on phase one of the US/China trade war. This had a positive impact on

Somers’ two main foreign currency exposures, sterling and the Australian

Dollar. On top of this, Resimac announced strong financial results during the

quarter providing a significant increase to the valuation. This gain at Resimac,

the positive move in the global markets and stronger foreign currencies enabled

Somers to announce a record profit for the quarter of $74.6 million and an

increase in the company’s net asset value to $20.41. Importantly, our

underlying investments continue to perform strongly with their core fundamentals

continuing to provide excellent growth.” Resimac Group Holdings is Somers’

largest investment with a value of $227.8 million and assets under management of

A$14.2 billion ($9.3 million) at the end of December. Other investment

highlights for Somers during its first quarter was Waverton Investment

Management Ltd completing the acquisition of Timothy James & Partners, and

MJ Hudson Group plc completing its initial public offering on the London

Alternative Investment Market, raising $30 million and valuing Somers;

investment at $10.4 million. Somers’ total borrowings at December 31 were

$73.6 million, up from $67.9 million three months earlier due to increased

shareholder loans to fund investments.

![]() A free, twice-a-year newspaper

to promote Hamilton, its people, attractions and businesses has hit the streets.

It is called City Limits, and has been produced by Jarae Thompson, who

launched The St George’s Crown, its sister paper, three years ago. The

first edition of the paper has a print run of 6,000 and is being snapped up by

visitors and locals looking for information about the city and the people who

help make it tick. Business owners Mstira Weeks, Glen Wilks, and David Hamshere

are among those profiled in City Limits, which also features places of

interest in the city, the work of the City of Hamilton, and a section focused on

North Hamilton. Both papers are a hit with visitors who enjoy reading them and

often take copies home as a vacation keepsake of their time in Bermuda. Copies

are distributed through visitor information centres, hotels, cafés, and Airbnb

properties. Mr Thompson studied graphic design and digital media at universities

in England, and is responsible for the design and layout of the newspapers, as

well as illustrations and most of the photographs. He was inspired to launch The

St George’s Crown in 2017 after seeing the success of the Dockyard Times,

a free newspaper that he is not connected with, in the West End. The Crown

is also a twice-a-year publication. It started with a print run of 3,000 per

edition, but is now at 6,000. “It grew with every passing newspaper that came

out. We started really enjoying it and getting into it,” Mr Thompson said.

When asked what led him to do a Hamilton paper, he said: “City Limits

started when one of our friends said we should produce a paper for Hamilton. We

got right on to it. We got in touch with the Mayor of Hamilton, along with the

BEDC. They were very keen and right on board with it.” Kelli Thompson, the

mother of Mr Thompson, is the manager of the papers. She said the City of

Hamilton has been a major supporter of City Limits. “Great thanks to

the Mayor of Hamilton, Mr [Charles] Gosling. We gave him a call and he directed

us to his team, Jessica Astwood, Sideya Dill, and Zoe Mulholland,” she said.

Ms Thompson added that the BEDC had supported the entrepreneurial endeavours of

her son, and thanked Erica Smith, Ray Lambert, William Spriggs, and Jamillah

Lodge. “It was really a great effort by everyone to get the first edition out.

It was a lot of fun. And a big thank you to George Frost and professor Calvin

Shabazz, they were instrumental to helping us push it forward,” she said. Also

involved in the newspaper production team are Alison Outerbridge and Cris

Valdes-Dapena. The newspapers have allowed Mr Thompson to hone his graphic

design skills and his expertise with software programmes Adobe InDesign,

Photoshop and Illustrator. He is looking to grow City Limits, and said:

“Hopefully, we can get more in it, and more support.” The papers include

some local business adverts. Ms Thompson, who owns Saltwater Jewellery Design,

on Water Street, St George, said the Corporation of St George had been the

biggest supporter of the Crown, and Skyport had also been a major supporter

since the first edition in the summer of 2017. “We’ve had a good feedback

from visitors that pop in here, on the St George’s side, and say how wonderful

the newspaper is. The majority of them take it back with them, off our shores,

as a keepsake because of the historic content and the information that is in

there,” she said. Visitor Information Centres have copies of the paper, as do

hotels and Airbnb rentals. Ms Thompson said: “There has been good feedback

from Airbnbs, who pick up copies from distribution spots and ask if there are

any more. A lot of morning/breakfast eateries and cafés have them as well, as

does Miles grocery store, the pharmacies, the aquarium and Crystal Caves — all

those hotspots for visitors.” The current winter editions of both papers have

16 pages. Asked if things have become harder now there are two publications to

prepare and distribute, Mr Thompson said: “It’s not very difficult. It can

get daunting at times, but it depends on how you manage your time.” Mr

Thompson can be contacted at 705-1714.

A free, twice-a-year newspaper

to promote Hamilton, its people, attractions and businesses has hit the streets.

It is called City Limits, and has been produced by Jarae Thompson, who

launched The St George’s Crown, its sister paper, three years ago. The

first edition of the paper has a print run of 6,000 and is being snapped up by

visitors and locals looking for information about the city and the people who

help make it tick. Business owners Mstira Weeks, Glen Wilks, and David Hamshere

are among those profiled in City Limits, which also features places of

interest in the city, the work of the City of Hamilton, and a section focused on

North Hamilton. Both papers are a hit with visitors who enjoy reading them and

often take copies home as a vacation keepsake of their time in Bermuda. Copies

are distributed through visitor information centres, hotels, cafés, and Airbnb

properties. Mr Thompson studied graphic design and digital media at universities

in England, and is responsible for the design and layout of the newspapers, as

well as illustrations and most of the photographs. He was inspired to launch The

St George’s Crown in 2017 after seeing the success of the Dockyard Times,

a free newspaper that he is not connected with, in the West End. The Crown

is also a twice-a-year publication. It started with a print run of 3,000 per

edition, but is now at 6,000. “It grew with every passing newspaper that came

out. We started really enjoying it and getting into it,” Mr Thompson said.

When asked what led him to do a Hamilton paper, he said: “City Limits

started when one of our friends said we should produce a paper for Hamilton. We

got right on to it. We got in touch with the Mayor of Hamilton, along with the

BEDC. They were very keen and right on board with it.” Kelli Thompson, the

mother of Mr Thompson, is the manager of the papers. She said the City of

Hamilton has been a major supporter of City Limits. “Great thanks to

the Mayor of Hamilton, Mr [Charles] Gosling. We gave him a call and he directed

us to his team, Jessica Astwood, Sideya Dill, and Zoe Mulholland,” she said.

Ms Thompson added that the BEDC had supported the entrepreneurial endeavours of

her son, and thanked Erica Smith, Ray Lambert, William Spriggs, and Jamillah

Lodge. “It was really a great effort by everyone to get the first edition out.

It was a lot of fun. And a big thank you to George Frost and professor Calvin

Shabazz, they were instrumental to helping us push it forward,” she said. Also

involved in the newspaper production team are Alison Outerbridge and Cris

Valdes-Dapena. The newspapers have allowed Mr Thompson to hone his graphic

design skills and his expertise with software programmes Adobe InDesign,

Photoshop and Illustrator. He is looking to grow City Limits, and said:

“Hopefully, we can get more in it, and more support.” The papers include

some local business adverts. Ms Thompson, who owns Saltwater Jewellery Design,

on Water Street, St George, said the Corporation of St George had been the

biggest supporter of the Crown, and Skyport had also been a major supporter

since the first edition in the summer of 2017. “We’ve had a good feedback

from visitors that pop in here, on the St George’s side, and say how wonderful

the newspaper is. The majority of them take it back with them, off our shores,

as a keepsake because of the historic content and the information that is in

there,” she said. Visitor Information Centres have copies of the paper, as do

hotels and Airbnb rentals. Ms Thompson said: “There has been good feedback

from Airbnbs, who pick up copies from distribution spots and ask if there are

any more. A lot of morning/breakfast eateries and cafés have them as well, as

does Miles grocery store, the pharmacies, the aquarium and Crystal Caves — all

those hotspots for visitors.” The current winter editions of both papers have

16 pages. Asked if things have become harder now there are two publications to

prepare and distribute, Mr Thompson said: “It’s not very difficult. It can

get daunting at times, but it depends on how you manage your time.” Mr

Thompson can be contacted at 705-1714.

A new coffee shop opens its doors inside the Hamilton Princess & Beach Club on Monday. It is called The Duchess, and it has created four new jobs for Bermudians. The café will offer a range of teas and coffees, pastries, cakes, homemade gelatos, and lunch options. It will be open from 6am until 3pm, with extended opening until 5pm from April through October. The café has been designed by BotelhoWood Architects with support from Bermuda Interiors, P&M, BAC and SoundDecision. It features the hotel’s signature pink in ceiling stripes, the banquette seating and piping on the chairs. The space also has a retro twist. The café, like the hotel, takes its name from Princess Louise, Duchess of Argyll. With sustainability in mind, the café will offer customers hay straws, bamboo cup holders, wooden cutlery and stirrers. Locally sourced ingredients continue to be a priority for the hotel, with the locally made baked goods and salads made with produce from Wadson’s farm and J&J Produce, and roasted coffee from Devil’s Isle. “We are incredibly excited to be opening The Duchess Café and Gelateria at Hamilton Princess & Beach Club,” Tim Morrison, general manager at Hamilton Princess & Beach Club, said. “We have something for everybody: freshly made pastries, delicious coffees, breakfast and lunch for those on the go and fun milkshakes — made with our very own house made gelato. It’s the perfect place for the whole family and we look forward to welcoming our guests and community to The Duchess.” Examples of offerings include savoury breakfast sandwiches, Italian Prosciutto Baguette, Pressed Pulled Chicken Focaccia, Low Carb Grilled Salmon Salad, as well as the signature Duchess Cake (funfetti with strawberry buttercream), Bailey’s Chocolate Cake, Marcus’ Carrot Cake and Guava Cheesecake. The Duchess’ website will go live on Monday at website thehamiltonprincess.com/dining/duchess/ and it can be followed on social media at @DuchessBermuda on Instagram.

![]()

![]() Cannabis

use, cultivation and sale will be legalized if legislation tabled in May is

passed, the Attorney-General said yesterday. Kathy Lynn Simmons told the

Senate that the consumption of cannabis at home or in licensed premises would be

permitted, as well as cannabis sales, under a “simplified regulated

framework”. She said that the Cannabis (Licensing and Control) Act 2020 was

the outcome of “reassessed” policies based on public feedback. Ms Simmons

said the proposals were in line with the liberal stance taken in Canada, where

marijuana is legal for recreational and medical use, as well as in parts of the

United States. She added: “In time, we can envisage a Bermuda-branded cannabis

strain being developed for export, and expansions in our tourism offerings to

include cannabis-driven marketing, events and dedicated public spaces for safe

cannabis use.” She said consultation would include governmental bodies such as

the Department of Public Prosecutions, as well as town hall meetings, to develop

regulations on age restrictions and exclusion zones. Ms Simmons added that a

consultative draft Bill on medical cannabis was tabled last December, but

provoked an “unexpectedly low” public response, which sparked Cabinet

discussions on wider legislation. Ms Simmons said: “The framework will include

regulating cannabis use and consumption, permitting personal cultivation and

commercial cultivation. It is intended that corresponding economic benefits will

be directly available to individuals with respect to commercial cultivation.”

Kyjuan Brown, a physician and campaigner for medical cannabis, said the move was

“smart — it's what the populace wants, and I have no problem with that”.

However, he criticized more delay on the introduction of medical cannabis and

said he wanted the Government to understand “the urgency of now. Dr Brown

added: “I have a patient, Natasha York, still having uncontrollable seizures.

I put her on two medications which worked for a few weeks and are not working

now. Cannabis helps with her seizures. I have patients dying of cancer who want

pain relief. They don't have time for a consultative process that goes on for

six months to a year.” Dr Brown said he had been “talking to every minister

responsible for the past four or five years”. He added: “I will restate my

case again.” A spokesman for the Opposition One Bermuda Alliance said the move

appeared to be “a very wide-reaching policy”. He added: “We will await the

legislation with interest as there are areas where we need to know more

details.” Legalisation of cannabis was hinted at in 2014 under the previous

One Bermuda Alliance government, with cannabis-derived medicines such as the

anti-nausea drug Marinol approved later that year. The Progressive Labour Party

decriminalised possession of seven grams or less of the drug in December 2017.

However, Ms Simmons said the Government had decided to go further after the PLP

caucus backed “a regulated cannabis market”. She added that the five-strong

Cannabis Authority envisaged in the December legislation would remain “much

the same”. She said consultation would also be used to help draw a draft

licensing and control Bill for cannabis, as well as regulations on the sale of

cannabis.

Cannabis

use, cultivation and sale will be legalized if legislation tabled in May is

passed, the Attorney-General said yesterday. Kathy Lynn Simmons told the

Senate that the consumption of cannabis at home or in licensed premises would be

permitted, as well as cannabis sales, under a “simplified regulated

framework”. She said that the Cannabis (Licensing and Control) Act 2020 was

the outcome of “reassessed” policies based on public feedback. Ms Simmons

said the proposals were in line with the liberal stance taken in Canada, where

marijuana is legal for recreational and medical use, as well as in parts of the

United States. She added: “In time, we can envisage a Bermuda-branded cannabis

strain being developed for export, and expansions in our tourism offerings to

include cannabis-driven marketing, events and dedicated public spaces for safe

cannabis use.” She said consultation would include governmental bodies such as

the Department of Public Prosecutions, as well as town hall meetings, to develop

regulations on age restrictions and exclusion zones. Ms Simmons added that a

consultative draft Bill on medical cannabis was tabled last December, but

provoked an “unexpectedly low” public response, which sparked Cabinet

discussions on wider legislation. Ms Simmons said: “The framework will include

regulating cannabis use and consumption, permitting personal cultivation and

commercial cultivation. It is intended that corresponding economic benefits will

be directly available to individuals with respect to commercial cultivation.”

Kyjuan Brown, a physician and campaigner for medical cannabis, said the move was

“smart — it's what the populace wants, and I have no problem with that”.

However, he criticized more delay on the introduction of medical cannabis and

said he wanted the Government to understand “the urgency of now. Dr Brown

added: “I have a patient, Natasha York, still having uncontrollable seizures.

I put her on two medications which worked for a few weeks and are not working

now. Cannabis helps with her seizures. I have patients dying of cancer who want

pain relief. They don't have time for a consultative process that goes on for

six months to a year.” Dr Brown said he had been “talking to every minister

responsible for the past four or five years”. He added: “I will restate my

case again.” A spokesman for the Opposition One Bermuda Alliance said the move

appeared to be “a very wide-reaching policy”. He added: “We will await the

legislation with interest as there are areas where we need to know more

details.” Legalisation of cannabis was hinted at in 2014 under the previous

One Bermuda Alliance government, with cannabis-derived medicines such as the

anti-nausea drug Marinol approved later that year. The Progressive Labour Party

decriminalised possession of seven grams or less of the drug in December 2017.

However, Ms Simmons said the Government had decided to go further after the PLP

caucus backed “a regulated cannabis market”. She added that the five-strong

Cannabis Authority envisaged in the December legislation would remain “much

the same”. She said consultation would also be used to help draw a draft

licensing and control Bill for cannabis, as well as regulations on the sale of

cannabis.

![]() The

chief executive of the Bermuda Tourism Authority is to quit the job tomorrow, it

was announced yesterday. Kevin Dallas will step down after three years in

the post — over which the island notched up record numbers of visitors.

However, the move was said to have no “direct relevance” to plans for a

restructure at the public-private authority or the tourism minister’s forecast

of “changes” less than two weeks ago. Mr Dallas said yesterday: “It has

been a true privilege to serve as the BTA’s CEO. I am incredibly proud of what

our team and industry stakeholders have accomplished collaboratively and in a

relatively short period. I remain very positive about the growth potential of

Bermuda tourism with the investment we have stimulated. Personally, I’m now

looking forward to new opportunities and challenges and am confident this is the

right decision. The BTA is in a strong position with a superb team of

hard-working people dedicated to the industry’s future.” The BTA said

yesterday that Mr Dallas would step down “to pursue opportunities in the

private sector”. The other members of the senior executive team will take over

the leadership on a temporary basis as the authority’s board searches for a

replacement. Curtis Dickinson, the Minister of Finance, signaled in the Budget

Statement last Friday that a restructure of the BTA “to focus more directly on

its sales and marketing role” was on the cards. He told MPs: “BTA data for

2018 versus 2019 indicate that cruise visitors are up 14 per cent while air

arrivals are down 6 per cent.” Mr Dickinson added: “Bermuda tourism works

best for Bermudians and Bermudian businesses when air arrivals are up and hotels

are full.” Zane DeSilva, the Minister of Tourism and Transport, said a week

earlier that he was unhappy with the 2019 statistics. He added then: “Some

changes are coming. I want to lay down a marker tonight.” Mr DeSilva said the

independent authority’s founding legislation, drawn up by the former One

Bermuda Alliance government, meant “the minister can only do so much”.

Stephen Todd, the BTA board’s deputy chairman, insisted that Mr Dallas’s

departure did not have “any direct relevance” to the ministers’

statements. He added: “I believe what needs to take place now is a discussion

and we have not as yet had the benefit, as a board, to sit down with the