Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us).

Benefit of website linkage to Bermuda Online while traveling

|

See at end of this file all our many History files |

![]() Visitors to Bermuda can now

complete an immigration arrival card online before they fly, saving time and

making their experience through the airport

more frictionless, the Bermuda Tourism Authority said today. “Meantime,

the move improves business intelligence gathering for marketers and could result

in greater visitor spending by alerting travelers to events, activities and

experiences while they’re on the island,” the BTA said. “The digital

Visitor Arrival Card launched with a test phase in mid-December of 2018. So far

almost 500 travelers have taken advantage of the new option – about one-third

of those have already travelled to Bermuda. From visitors and airport officials

the feedback is positive. Making it easier to get out here and get around the

island is a major part of the new National Tourism Plan,” said Bermuda Tourism

Authority Chief Executive Kevin Dallas. “Our objective in the infrastructure

section of the plan is to work closely with partners to encourage the use of

technology in a way that improves the visitor experience. Bermuda’s Minister

of National Security Wayne Caines and the team at the Department of Immigration

have embraced the idea of frictionless and have our sincere thanks for a

successful phase one launch.”

Visitors to Bermuda can now

complete an immigration arrival card online before they fly, saving time and

making their experience through the airport

more frictionless, the Bermuda Tourism Authority said today. “Meantime,

the move improves business intelligence gathering for marketers and could result

in greater visitor spending by alerting travelers to events, activities and

experiences while they’re on the island,” the BTA said. “The digital

Visitor Arrival Card launched with a test phase in mid-December of 2018. So far

almost 500 travelers have taken advantage of the new option – about one-third

of those have already travelled to Bermuda. From visitors and airport officials

the feedback is positive. Making it easier to get out here and get around the

island is a major part of the new National Tourism Plan,” said Bermuda Tourism

Authority Chief Executive Kevin Dallas. “Our objective in the infrastructure

section of the plan is to work closely with partners to encourage the use of

technology in a way that improves the visitor experience. Bermuda’s Minister

of National Security Wayne Caines and the team at the Department of Immigration

have embraced the idea of frictionless and have our sincere thanks for a

successful phase one launch.”

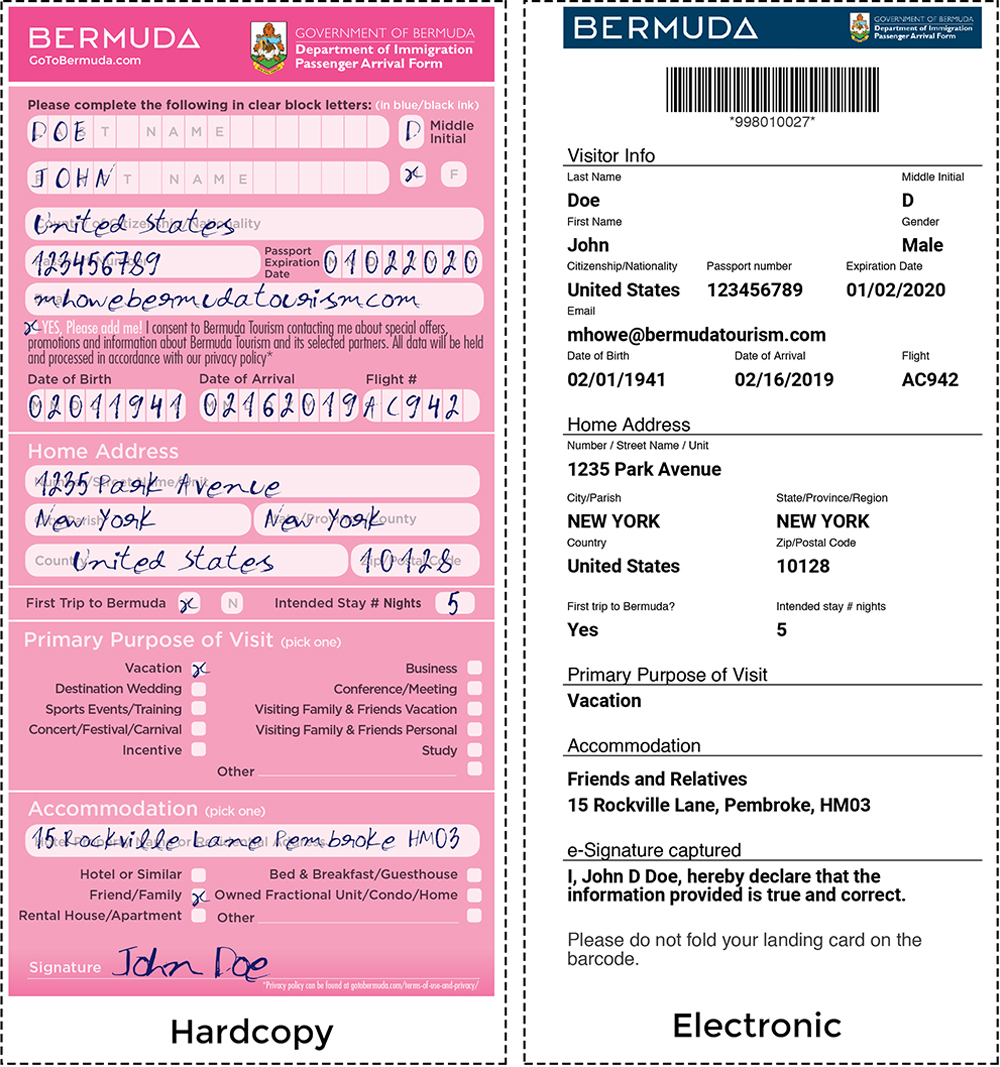

Specimen of hardcopy and electronic Visitor Arrival Card

The BTA explained, “Currently visitors who fill out the Visitor Arrival Card online at BermudaArrivalCard.com must print it and bring the document with them when they travel. In the next phase, the process will be paperless, allowing travelers to show their completed form on a smartphone.Tourism marketers see the move to a digital airport arrival as a big win for the industry. It’s the first time the Bermuda Tourism Authority has access to detailed information about specific visitors before they arrive. Currently, with a handwritten form, the information isn’t physically entered into a database until days after the visitor has left. And sometimes there are data entry errors due to illegible handwriting. Now, with accurate information from visitors in advance, tourism officials can send pre-arrival marketing messages via email, if the visitor has opted in. In the future, travelers can receive topical messages on where to eat and which events to attend while they’re out here. The potential positive impact on visitor spend and experience is substantial. Hoteliers, event planners, business meeting planners and other tourism stakeholders are encouraged to include a link to the arrival card in their email communications to visitors. Newstead is one local hotel already advising their guests of a more frictionless Bermuda travel experience.” Newstead General Manager Bushara Bushara said: “A smooth pre-arrival process is a critical part of a successful stay. That’s the reason we added the digital Visitor Arrival Card to our pre-arrival communications with guests. It lessens travel stress for them and fits neatly with the airport transfers, Island Tour Centre experiences and other things we encourage guests to set-up before their trip.” The Bermuda Tourism Authority notified its database of visitors about BermudaArrivalCard.com and will be working with hotels, airline partners and tour operators to request travelers receive a link to the online card when they make their reservations. Meantime, the existing hardcopy form is still available to travelers to fill out on the plane or when they land at L F Wade International Airport. Bermuda residents do not need to present a Visitor Arrival Card when arriving at the airport.

![]() The

Bermuda Civil Aviation Authority (BCAA) this week hosted members of the UK Air

Accident Investigation Branch who facilitated a workshop offering guidelines to

the local aviation community on what to do in the event of an aviation accident

or serious incident occurring in Bermuda. Representatives from BCAA were

joined by Skyport, the Bermuda Airport Authority, Airlines, CI2, Bermuda Police

Service, HM Customs, Bermuda Hospitals Board, the Bermuda Red Cross and several

other organizations and spent two days learning the latest techniques in

uncovering the causes of accidents - including those of illegal drone flying.

The AAIB is the organization appointed by the Governor of Bermuda, who is

responsible for carrying out air accident investigations, to perform these

services. Under the International Civil Aviation Organization (ICAO) Convention

on Civil Aviation, States must establish and appoint an organization responsible

for air accident investigations, which is separate and independent from the

Civil Aviation regulator, which in Bermuda is the BCAA. The aim of any air

accident investigation organization is not to apportion blame but to uncover the

root cause of any accident so lessons may be learned and improvements can be

made to prevent similar issues from recurring. The presentations invoked much

discussion and were followed by practical exercises of various scenarios in the

local area.

The

Bermuda Civil Aviation Authority (BCAA) this week hosted members of the UK Air

Accident Investigation Branch who facilitated a workshop offering guidelines to

the local aviation community on what to do in the event of an aviation accident

or serious incident occurring in Bermuda. Representatives from BCAA were

joined by Skyport, the Bermuda Airport Authority, Airlines, CI2, Bermuda Police

Service, HM Customs, Bermuda Hospitals Board, the Bermuda Red Cross and several

other organizations and spent two days learning the latest techniques in

uncovering the causes of accidents - including those of illegal drone flying.

The AAIB is the organization appointed by the Governor of Bermuda, who is

responsible for carrying out air accident investigations, to perform these

services. Under the International Civil Aviation Organization (ICAO) Convention

on Civil Aviation, States must establish and appoint an organization responsible

for air accident investigations, which is separate and independent from the

Civil Aviation regulator, which in Bermuda is the BCAA. The aim of any air

accident investigation organization is not to apportion blame but to uncover the

root cause of any accident so lessons may be learned and improvements can be

made to prevent similar issues from recurring. The presentations invoked much

discussion and were followed by practical exercises of various scenarios in the

local area.

![]() Minister

of Finance Curtis Dickinson said tax increases included in the Pre-Budget Report

were being considered, but were not guaranteed. However, he told an

audience at a public meeting last night that if taxes on commercial and

residential rents were introduced, the threshold would be higher than the figure

floated in the report. The report proposed that the tax would not affect

properties with an annual rental value of less than $22,000. Mr Dickinson said:

“The rental tax is still under consideration. The Tax Reform Committee

suggested $22,000. It will be over $22,000.” He later said the threshold would

be more than $22,800, but emphasized that a final decision about the tax had not

been made. Mr Dickinson said: “We presented the idea to get your feedback. I

have not decided on whether to implement the rent tax or at what the threshold

rent tax will apply. My decisions will be informed by the input I get from you

and other stakeholders.” The minister also said the Government’s system of

collecting taxes owed was “antiquated”, but the ministry would continue to

look at ways to address the issue. Mr Dickinson said: “Collection and

enforcement are a priority of this government and we accept that we need to do a

better job of it. We have hired more resources to help us tackle this issue and

we are going to stay consistent on it until we collect as much of the past-due

taxes as possible.” About 1,000 people filled the Goodwin C. Smith Hall at the

Heritage Worship Centre in Hamilton last night for the meeting, intended to

receive feedback on the Pre-Budget Report.

Minister

of Finance Curtis Dickinson said tax increases included in the Pre-Budget Report

were being considered, but were not guaranteed. However, he told an

audience at a public meeting last night that if taxes on commercial and

residential rents were introduced, the threshold would be higher than the figure

floated in the report. The report proposed that the tax would not affect

properties with an annual rental value of less than $22,000. Mr Dickinson said:

“The rental tax is still under consideration. The Tax Reform Committee

suggested $22,000. It will be over $22,000.” He later said the threshold would

be more than $22,800, but emphasized that a final decision about the tax had not

been made. Mr Dickinson said: “We presented the idea to get your feedback. I

have not decided on whether to implement the rent tax or at what the threshold

rent tax will apply. My decisions will be informed by the input I get from you

and other stakeholders.” The minister also said the Government’s system of

collecting taxes owed was “antiquated”, but the ministry would continue to

look at ways to address the issue. Mr Dickinson said: “Collection and

enforcement are a priority of this government and we accept that we need to do a

better job of it. We have hired more resources to help us tackle this issue and

we are going to stay consistent on it until we collect as much of the past-due

taxes as possible.” About 1,000 people filled the Goodwin C. Smith Hall at the

Heritage Worship Centre in Hamilton last night for the meeting, intended to

receive feedback on the Pre-Budget Report.

![]() Bermuda’s shifting population demographics over the next seven years are

expected to present significant challenges for the island’s business

community. As outlined in the recently released report, Bermuda’s

Population Projections, 2016-2026, the island’s population will both

decline by 111 people by 2026 — and get appreciably older. Based on current

projections, the report says, the proportion of the population 65 or older will

rise from 16.9 per cent in 2016, to 24.9 per cent in 2026. One in nine of us

will be 75 or older; the median age will be 49. The impact of shifting population demographics has wide implications for the

business community. Population decline is expected to result in a lessening demand for the

sector’s goods and services. “For local businesspeople, it will become more and more difficult to

maintain the level of activity they have now — or grow it,” says Don Mills,

chairman and senior partner of Halifax-based Corporate Research Associates and a

partner in local firm, Total Marketing and Communications. “There’s no way

it will be different than that — it’s simply a numbers game.” Meanwhile, an increase in the number of retirees creates a corresponding

decrease in the number of people in the workforce. In combination with declining

fertility levels, businesses will have more difficulty finding enough qualified

young Bermudians to fill the positions made vacant by retiring baby-boomers. Compounding the issue, as those people retire there will be fewer of the

well-educated and skilled workers left in the workforce that make Bermuda

attractive to foreign investment. That scarcity of labour will increase costs for both local businesses as well

as potential investors in the island due to increased competition for good

employees. The expected labour shortages will occur across the economy, Mr Mills says.

Businesses in the service sector will continue to find it difficult to find

Bermudians to work in the area, and those issues will migrate to the retail

sector because younger workers are not drawn to that type of work. “There are

a lot of challenges,” Mr Mills says. On the expenditure side, healthcare costs for employers, who are legally

bound to provide a health insurance programme for their employees, are expected

to increase due to greater use of the health care system by an ageing

population. Referring to Bermuda’s unfunded pension liabilities and spiraling health

care costs, the island’s Fiscal Responsibility Panel wrote: “Government has

to be concerned that the impact on wage costs of financing the various social

insurance schemes does not jeopardize the attractiveness of Bermuda for

employers, particularly in the international business sector.” Meanwhile, businesses on-island are continuing to digest the impact on their

bottom line of the living wage legislation announced in the 2018 Budget.

Initially pegged at $12.25 an hour, it may rise to above $18 an hour by 2021. They are also awaiting news, in the 2019 Budget to be delivered on February

22, of any new or increased taxes that might impact their profitability. Among the new or increased taxes recommended to Government by the Tax Reform

Commission are: commercial residential rental tax, general services tax,

withholding tax on managed services, withholding tax on dividends and interest

— plus reforms to a variety of existing taxes including payroll, owner-manager

declared dividend, customs duty, excise, land, financial services, foreign

currency purchase, as well as international company fees and immigration fees. “Viewed as a package, the recommendations would significantly increase the

overall tax burden, while shifting the tax system to some extent from taxes on

employment income to taxes on other forms of income and consumption, in

particular rents and services,” the panel wrote. "As with any tax increase, there will be an impact on the cost of living

and doing business in Bermuda. While we recommend that the Government accepts

and implements the package, or something like it, we also acknowledge that it

will face a major challenge in explaining the need for the measures to the

population and to business. It would clearly help if the tax increases could be matched by actions on

immigration — as also recommended by the TRC — and by equally firm actions

to improve efficiency in the public sector and to cut or at least to prevent

future increases in costs, particularly in the health sector.” It perhaps comes as no surprise that there has been a decline in private

sector business confidence, according to a recent survey. “Such surveys, while

not definitive, can be leading indicators of developments in the real

economy,” the panel wrote. John Wight, president of the Bermuda Chamber of Commerce, said: “In order

to grow, businesses need to increase revenues and without increased demand for

their products and services from more people working in Bermuda, it is difficult

to see how they will be able to generate increased revenue at a time when there

are so many increases in the costs to operate a business. “Government has rightly talked about the need to grow the economy. It is

difficult to see how we can do that without more people being based and working

here in Bermuda. Our ageing population is a concern. Economically, we lost between 6,000

and 7,000 people between 2010-14. Now, we have seen what impact those

individuals had on the economy — paying into the tax system, renting units

from Bermudians, eating at Bermudian-owned restaurants, taking Bermudian-owned

taxis. Their impact was substantial. Their departure is one of the causes of our current economic situation,

where we have a national debt of $2.5 billion and we have the challenge of

producing a balanced budget.” Mr Mills said: “After the recession, you lost people who were the

highest-spending consumers. The value of their spending was disproportionately

higher than their actual numbers. When you lose almost 10 per cent of your people, it’s going to affect

consumer spending. It’s hard to make up when the highest-spending cohort left

the island. It’s a hard part of the economy to replace.”

Bermuda’s shifting population demographics over the next seven years are

expected to present significant challenges for the island’s business

community. As outlined in the recently released report, Bermuda’s

Population Projections, 2016-2026, the island’s population will both

decline by 111 people by 2026 — and get appreciably older. Based on current

projections, the report says, the proportion of the population 65 or older will

rise from 16.9 per cent in 2016, to 24.9 per cent in 2026. One in nine of us

will be 75 or older; the median age will be 49. The impact of shifting population demographics has wide implications for the

business community. Population decline is expected to result in a lessening demand for the

sector’s goods and services. “For local businesspeople, it will become more and more difficult to

maintain the level of activity they have now — or grow it,” says Don Mills,

chairman and senior partner of Halifax-based Corporate Research Associates and a

partner in local firm, Total Marketing and Communications. “There’s no way

it will be different than that — it’s simply a numbers game.” Meanwhile, an increase in the number of retirees creates a corresponding

decrease in the number of people in the workforce. In combination with declining

fertility levels, businesses will have more difficulty finding enough qualified

young Bermudians to fill the positions made vacant by retiring baby-boomers. Compounding the issue, as those people retire there will be fewer of the

well-educated and skilled workers left in the workforce that make Bermuda

attractive to foreign investment. That scarcity of labour will increase costs for both local businesses as well

as potential investors in the island due to increased competition for good

employees. The expected labour shortages will occur across the economy, Mr Mills says.

Businesses in the service sector will continue to find it difficult to find

Bermudians to work in the area, and those issues will migrate to the retail

sector because younger workers are not drawn to that type of work. “There are

a lot of challenges,” Mr Mills says. On the expenditure side, healthcare costs for employers, who are legally

bound to provide a health insurance programme for their employees, are expected

to increase due to greater use of the health care system by an ageing

population. Referring to Bermuda’s unfunded pension liabilities and spiraling health

care costs, the island’s Fiscal Responsibility Panel wrote: “Government has

to be concerned that the impact on wage costs of financing the various social

insurance schemes does not jeopardize the attractiveness of Bermuda for

employers, particularly in the international business sector.” Meanwhile, businesses on-island are continuing to digest the impact on their

bottom line of the living wage legislation announced in the 2018 Budget.

Initially pegged at $12.25 an hour, it may rise to above $18 an hour by 2021. They are also awaiting news, in the 2019 Budget to be delivered on February

22, of any new or increased taxes that might impact their profitability. Among the new or increased taxes recommended to Government by the Tax Reform

Commission are: commercial residential rental tax, general services tax,

withholding tax on managed services, withholding tax on dividends and interest

— plus reforms to a variety of existing taxes including payroll, owner-manager

declared dividend, customs duty, excise, land, financial services, foreign

currency purchase, as well as international company fees and immigration fees. “Viewed as a package, the recommendations would significantly increase the

overall tax burden, while shifting the tax system to some extent from taxes on

employment income to taxes on other forms of income and consumption, in

particular rents and services,” the panel wrote. "As with any tax increase, there will be an impact on the cost of living

and doing business in Bermuda. While we recommend that the Government accepts

and implements the package, or something like it, we also acknowledge that it

will face a major challenge in explaining the need for the measures to the

population and to business. It would clearly help if the tax increases could be matched by actions on

immigration — as also recommended by the TRC — and by equally firm actions

to improve efficiency in the public sector and to cut or at least to prevent

future increases in costs, particularly in the health sector.” It perhaps comes as no surprise that there has been a decline in private

sector business confidence, according to a recent survey. “Such surveys, while

not definitive, can be leading indicators of developments in the real

economy,” the panel wrote. John Wight, president of the Bermuda Chamber of Commerce, said: “In order

to grow, businesses need to increase revenues and without increased demand for

their products and services from more people working in Bermuda, it is difficult

to see how they will be able to generate increased revenue at a time when there

are so many increases in the costs to operate a business. “Government has rightly talked about the need to grow the economy. It is

difficult to see how we can do that without more people being based and working

here in Bermuda. Our ageing population is a concern. Economically, we lost between 6,000

and 7,000 people between 2010-14. Now, we have seen what impact those

individuals had on the economy — paying into the tax system, renting units

from Bermudians, eating at Bermudian-owned restaurants, taking Bermudian-owned

taxis. Their impact was substantial. Their departure is one of the causes of our current economic situation,

where we have a national debt of $2.5 billion and we have the challenge of

producing a balanced budget.” Mr Mills said: “After the recession, you lost people who were the

highest-spending consumers. The value of their spending was disproportionately

higher than their actual numbers. When you lose almost 10 per cent of your people, it’s going to affect

consumer spending. It’s hard to make up when the highest-spending cohort left

the island. It’s a hard part of the economy to replace.”

![]() Blue

Capital Reinsurance Holdings Ltd made a net loss of $24.9 million, or $2.84 per

share, for the fourth quarter. The net loss for the year was $28.6 million,

or $3.27 per share. The combined ratios for the quarter and year were 308.8 per

cent and 191.6 per cent. The increase in the combined ratio was due to a

significantly higher loss and loss adjustment expense ratio. The fourth

quarter’s loss and loss adjustment expenses of $33.2 million reflected 2018

losses related to the California wildfires and Hurricane Michael and additional

estimated losses related to Typhoon Jebi, which occurred in the third quarter,

and Hurricane Irma which occurred in the third quarter of 2017. Reinsurance

premiums written for the current quarter were $9.1 million increasing by $2.4

million over the same period a year ago.

Blue

Capital Reinsurance Holdings Ltd made a net loss of $24.9 million, or $2.84 per

share, for the fourth quarter. The net loss for the year was $28.6 million,

or $3.27 per share. The combined ratios for the quarter and year were 308.8 per

cent and 191.6 per cent. The increase in the combined ratio was due to a

significantly higher loss and loss adjustment expense ratio. The fourth

quarter’s loss and loss adjustment expenses of $33.2 million reflected 2018

losses related to the California wildfires and Hurricane Michael and additional

estimated losses related to Typhoon Jebi, which occurred in the third quarter,

and Hurricane Irma which occurred in the third quarter of 2017. Reinsurance

premiums written for the current quarter were $9.1 million increasing by $2.4

million over the same period a year ago.

![]() RenaissanceRe

Holdings Ltd. recorded a net loss of $83.9 million, or $2.10 per diluted common

share, in the fourth quarter of 2018. That compared to a net loss a of $3.5

million, or nine cents, in the same quarter in 2017. Operating income available

to RenaissanceRe common shareholders was $1.2 million, or two cents per diluted

common share. Kevin O’Donnell, president and chief executive officer, said:

“In the quarter, we reported positive operating income, while rapidly paying

claims to customers facing significant losses from Category 4 Hurricane Michael

and a second consecutive year of record-breaking wildfires in California. “For

the year, we outperformed on multiple metrics, posting a strong operating ROE,

delivering robust top-line growth, and executing effectively on a number of key

initiatives, including the formation of our latest innovative joint venture,

Vermeer and our pending acquisition of Tokio Millennium Re. Looking ahead, at

the recent January 1 renewal we laid the foundation for a successful 2019 and

ongoing shareholder value creation.” The company reported an annualized return

on average common equity of negative 7.8 per cent and an annualized operating

return on average common equity of positive 0.1 per cent in the fourth quarter.

Book value per common share decreased $1.08, or 1 per cent, to $104.13. Tangible

book value per common share plus accumulated dividends decreased 40 cents, or

0.4 per cent, to $117.17.

RenaissanceRe

Holdings Ltd. recorded a net loss of $83.9 million, or $2.10 per diluted common

share, in the fourth quarter of 2018. That compared to a net loss a of $3.5

million, or nine cents, in the same quarter in 2017. Operating income available

to RenaissanceRe common shareholders was $1.2 million, or two cents per diluted

common share. Kevin O’Donnell, president and chief executive officer, said:

“In the quarter, we reported positive operating income, while rapidly paying

claims to customers facing significant losses from Category 4 Hurricane Michael

and a second consecutive year of record-breaking wildfires in California. “For

the year, we outperformed on multiple metrics, posting a strong operating ROE,

delivering robust top-line growth, and executing effectively on a number of key

initiatives, including the formation of our latest innovative joint venture,

Vermeer and our pending acquisition of Tokio Millennium Re. Looking ahead, at

the recent January 1 renewal we laid the foundation for a successful 2019 and

ongoing shareholder value creation.” The company reported an annualized return

on average common equity of negative 7.8 per cent and an annualized operating

return on average common equity of positive 0.1 per cent in the fourth quarter.

Book value per common share decreased $1.08, or 1 per cent, to $104.13. Tangible

book value per common share plus accumulated dividends decreased 40 cents, or

0.4 per cent, to $117.17.

![]() The

100th anniversary of the island’s first trade union is a “vital”

milestone, the organizer of an event to honour its founders said yesterday.

Glenn Fubler said that the anniversary was important “not just to the BUT, but

to the whole community”. He added: “There’s nothing more important than

education today.” Mr Fubler was speaking as the union organized to celebrate

its centennial. Several former presidents and the present head of the BUT

gathered at an event at the Bermuda National Gallery. Mr Fubler, who served as

president of the BUT from 1983 to 1985, said that creation of the union was

“fundamental to the transformation that happened in Bermuda” in the decades

after. Edith Crawford, Matilda Crawford, Adele Tucker and Rufus Stovell founded

the BUT on February 1, 1919. Mr Fubler said: “These founders brave and

unselfish action a century ago was key to strengthening the teaching profession

and providing the framework for a sustainable public system to meet the needs of

the 20th century. Their persistent and principled actions contributed

immeasurably to a Bermuda in which there was an increased access to opportunity

for all segments of the community — the black community in particular.” He

added that it was important to honour the union’s founders by “committing to

work together across our diverse interests to nurture the capacity of our whole

society”. He added: “The best way of observing this iconic anniversary would

be to commit towards fostering an open and collaborative society, which recognizes,

respects and promotes the potential of all.” Mr Fubler read a list of names

who had thanked the founders of the BUT. It included church and union leaders,

social services providers, island teachers and others. Shannon James, president

of the BUT, was happy to hear of the support. He said: “It lets me know that

the community is really involved in education and supports teachers, and in turn

supports our children. It’s a wonderful thing. It is a true community

effort.” Mr James said that to be at the event with past presidents and other

community members was “a humbling experience”. He added: “A lot of times

when you’re in the class, you feel like it’s just you. To see the faces of

the many people that support — it’s encouraging. It lets you know that

you’re not alone. We all are in it together, and we all are interested in our

children.” Ellen-Kate Horton, BUT president from 1979 to 1981, said that the

union “must have a say in education going forward”. She added: “It cannot

be just a government decision.” Ms Horton would like to seem more gatherings

of the profession. She said: “I’m hoping we can keep it going — because we

are the people who must make a difference in education. We can’t leave it to

persons who have no idea about education.” Ms Horton felt the BUT was not seen

by some as being as important today as it had been in the past. She explained:

“The fact that you can make decisions about education and not sit down at

length with the union, and educators, and teachers, is mind-boggling. I wish we

could take education away from this political football.” Ms Horton added that

former teachers could help get the island’s education system back to the top

of the class. She said: “We have a web of knowledge that we can draw upon to

try and bring us back to where we should be.”

The

100th anniversary of the island’s first trade union is a “vital”

milestone, the organizer of an event to honour its founders said yesterday.

Glenn Fubler said that the anniversary was important “not just to the BUT, but

to the whole community”. He added: “There’s nothing more important than

education today.” Mr Fubler was speaking as the union organized to celebrate

its centennial. Several former presidents and the present head of the BUT

gathered at an event at the Bermuda National Gallery. Mr Fubler, who served as

president of the BUT from 1983 to 1985, said that creation of the union was

“fundamental to the transformation that happened in Bermuda” in the decades

after. Edith Crawford, Matilda Crawford, Adele Tucker and Rufus Stovell founded

the BUT on February 1, 1919. Mr Fubler said: “These founders brave and

unselfish action a century ago was key to strengthening the teaching profession

and providing the framework for a sustainable public system to meet the needs of

the 20th century. Their persistent and principled actions contributed

immeasurably to a Bermuda in which there was an increased access to opportunity

for all segments of the community — the black community in particular.” He

added that it was important to honour the union’s founders by “committing to

work together across our diverse interests to nurture the capacity of our whole

society”. He added: “The best way of observing this iconic anniversary would

be to commit towards fostering an open and collaborative society, which recognizes,

respects and promotes the potential of all.” Mr Fubler read a list of names

who had thanked the founders of the BUT. It included church and union leaders,

social services providers, island teachers and others. Shannon James, president

of the BUT, was happy to hear of the support. He said: “It lets me know that

the community is really involved in education and supports teachers, and in turn

supports our children. It’s a wonderful thing. It is a true community

effort.” Mr James said that to be at the event with past presidents and other

community members was “a humbling experience”. He added: “A lot of times

when you’re in the class, you feel like it’s just you. To see the faces of

the many people that support — it’s encouraging. It lets you know that

you’re not alone. We all are in it together, and we all are interested in our

children.” Ellen-Kate Horton, BUT president from 1979 to 1981, said that the

union “must have a say in education going forward”. She added: “It cannot

be just a government decision.” Ms Horton would like to seem more gatherings

of the profession. She said: “I’m hoping we can keep it going — because we

are the people who must make a difference in education. We can’t leave it to

persons who have no idea about education.” Ms Horton felt the BUT was not seen

by some as being as important today as it had been in the past. She explained:

“The fact that you can make decisions about education and not sit down at

length with the union, and educators, and teachers, is mind-boggling. I wish we

could take education away from this political football.” Ms Horton added that

former teachers could help get the island’s education system back to the top

of the class. She said: “We have a web of knowledge that we can draw upon to

try and bring us back to where we should be.”

![]() The

family of a man shot dead has lost a legal attempt to recover $5,000 seized by

US Customs officers a year before he was killed. The Supreme Court heard

that Morlan Steede was stopped at the airport on January 22, 2016 as he tried to

fly to Jamaica via Miami. He showed officers a forged document that appeared to

be from the Jamaica Constabulary Force, which said he was not in the Jamaica

criminal database. But Steede, a Jamaican national, was denied permission to

enter the US after the US officials discovered he had served six months behind

bars for drug possession. Mr Steede also told officers he had $3,000 in cash on

him, but a search revealed $7,000 in US cash without any supporting documents to

explain the purpose of the money. The money was subsequently seized under the

Proceeds of Crime Act. Mr Steede later told police that his wife, Martseeyah

Jones, had given him $5,000 to make a down payment on a house in Jamaica for her

and her sisters. He said the remaining $2,000 was a gift from his father,

Richard Steede. But Puisne Judge Shade Subair Williams said in a written

judgment: “It cannot be ignored that Morlan Steede willfully attempted to

deceive the US customs officers about the sum of cash on his person when he was

at the airport. It is certainly inconceivable that he was genuinely mistaken

about the fact that he was traveling with $7,000 cash.” The judgment, released

this month, added: “The dishonest conduct of Morlan Steede did not stop there.

He clearly presented a fraudulent document to the authorities with the purpose

of making the relevant officers believe that he had not previously been

convicted of a criminal offence.” Mrs Justice Subair Williams said: “The

irresistible inference is that his efforts to conceal and deceive were

deliberate and pre-calculated.” Mr Steede, 30, from Hamilton Parish, was shot

in the Deepdale area of Pembroke on November 3, 2017. The seized money case was

considered by Magistrates’ Court six months later and prosecutors asked for

the money to be forfeited. Magistrates’ Court heard at the time that Ms Jones

told police that she and her sister, Rita Jones, had each given Steede $2,500

for “investment purposes”. Richard Steede told police he had given his son

$2,000 to give to his son’s mother to support a bus transport business.

Magistrate Khamisi Tokunbo ruled the $2,000 should be returned to Richard Steede

but that the $5,000 remainder should be forfeited. However, the family launched

a legal action in the Supreme Court in a bid to overturn the judgment. Neither

Martseeyah or Rita Jones took part in the hearing, but Richard Steede appeared

as the representative of his son’s estate. Mrs Justice Subair Williams said in

her judgment that the evidence that the $5,000 was intended for criminal conduct

was strong. She added that the conflict in stories about the $5,000 made the

claim that the money was intended for investment “unworthy of belief”. But

Mrs Justice Subair Williams said there was some doubt about the $2,000 and

upheld the magistrate’s decision to return the money to Richard Steede.

The

family of a man shot dead has lost a legal attempt to recover $5,000 seized by

US Customs officers a year before he was killed. The Supreme Court heard

that Morlan Steede was stopped at the airport on January 22, 2016 as he tried to

fly to Jamaica via Miami. He showed officers a forged document that appeared to

be from the Jamaica Constabulary Force, which said he was not in the Jamaica

criminal database. But Steede, a Jamaican national, was denied permission to

enter the US after the US officials discovered he had served six months behind

bars for drug possession. Mr Steede also told officers he had $3,000 in cash on

him, but a search revealed $7,000 in US cash without any supporting documents to

explain the purpose of the money. The money was subsequently seized under the

Proceeds of Crime Act. Mr Steede later told police that his wife, Martseeyah

Jones, had given him $5,000 to make a down payment on a house in Jamaica for her

and her sisters. He said the remaining $2,000 was a gift from his father,

Richard Steede. But Puisne Judge Shade Subair Williams said in a written

judgment: “It cannot be ignored that Morlan Steede willfully attempted to

deceive the US customs officers about the sum of cash on his person when he was

at the airport. It is certainly inconceivable that he was genuinely mistaken

about the fact that he was traveling with $7,000 cash.” The judgment, released

this month, added: “The dishonest conduct of Morlan Steede did not stop there.

He clearly presented a fraudulent document to the authorities with the purpose

of making the relevant officers believe that he had not previously been

convicted of a criminal offence.” Mrs Justice Subair Williams said: “The

irresistible inference is that his efforts to conceal and deceive were

deliberate and pre-calculated.” Mr Steede, 30, from Hamilton Parish, was shot

in the Deepdale area of Pembroke on November 3, 2017. The seized money case was

considered by Magistrates’ Court six months later and prosecutors asked for

the money to be forfeited. Magistrates’ Court heard at the time that Ms Jones

told police that she and her sister, Rita Jones, had each given Steede $2,500

for “investment purposes”. Richard Steede told police he had given his son

$2,000 to give to his son’s mother to support a bus transport business.

Magistrate Khamisi Tokunbo ruled the $2,000 should be returned to Richard Steede

but that the $5,000 remainder should be forfeited. However, the family launched

a legal action in the Supreme Court in a bid to overturn the judgment. Neither

Martseeyah or Rita Jones took part in the hearing, but Richard Steede appeared

as the representative of his son’s estate. Mrs Justice Subair Williams said in

her judgment that the evidence that the $5,000 was intended for criminal conduct

was strong. She added that the conflict in stories about the $5,000 made the

claim that the money was intended for investment “unworthy of belief”. But

Mrs Justice Subair Williams said there was some doubt about the $2,000 and

upheld the magistrate’s decision to return the money to Richard Steede.

![]() Kirsten

Badenduck, an insurance executive who became a champion for the disabled, has

died. Ms Badenduck was 69. She was confined to a wheelchair after she

suffered serious injuries in 2002 car crash while on holiday in Northern

California. But Ms Badenduck remained independent and became a campaigner for

others who faced similar problems. She joined the National Accessibility

Advisory Council in 2007 to push for better treatment for the disabled. MeChelle

Smith, who was one of her caregivers after she returned to the island from

medical rehabilitation, said Ms Badenduck refused to lose hope. Ms Smith said:

“She put her best foot forward and smiled through it all. It never failed.”

Ms Badenduck loved art, music and theatre, and with the help of friends she

acquired the equipment to make herself as independent as possible. Cindy Swan,

co-founder of the transportation charity Project Action, said Ms Badenduck

relied on their service to get to her job at Ace. “She was a very positive

person — I didn’t know her before her accident and can just imagine the

spirit that she had, being incapacitated with her disability. She was a

go-getter spirit, very much alive and well.” Tore Badenduck, her older

brother, said Ms Badenduck got a wheelchair that could raise her to eye level

and could fit into a car, which she could operate herself. With the help of Ms

Smith and carers Simone Trott and Apol Lo, she was also able to exercise by

swimming. Mr Badenduck said: “She had confidence and courage. Surgeons

forecast that she would live two years, a maximum of ten, but she almost made

17. She had a huge amount of friends and was lucky enough to continue to live in

her house in Smith’s with good caregivers. It all helped — it was

cumulative. Her standout features were her smile and her persistence. It goes

back to our mother, Anna Marie, who was a very determined individual, as well as

from her being an immigrant. She also had success, and success breeds more

determination.” The family were originally from the Norwegian capital, Oslo,

but moved to rural Quebec in Canada in the early 1950s. Ms Badenduck was the

youngest of three, with two older brothers. Mr Badenduck said: “She came out

not speaking English and grew up in a small town where English and French were

the ‘two solitudes’, as the expression goes.” The term, from the title of

a 1945 novel by the Canadian author Hugh MacLennan, described the divide between

the country’s English and French-speaking peoples. The family later moved to

Montreal, where Ms Badenduck studied psychology and library science at McGill

University — and met a Bermudian, Brian Luckhurst, who was studying marine

biology. They married and moved to Bermuda and Mr Luckhurst became the senior

fisheries officer at the Department of Agriculture and Fisheries. Mr Badenduck

said: “She said ‘This is my kind of place’. The couple, who had no

children, later separated. Ms Badenduck, who preferred the Norwegian version

“Shishten” for her first name, started work the Bermuda National Library.

Frances Marshall, a friend and colleague from her library days, said her former

boss was “a very intelligent, very engaging woman” who loved swimming and

sport. Ms Marshall, who befriended Ms Badenduck in 1981, added: “She didn’t

wait for things to come to her. She took lemons and made lemonade.” Ms

Badenduck moved on to become a medical librarian at the King Edward VII Memorial

Hospital. A turning point came in 1985, when she joined the insurance giant Ace

Bermuda. Mr Badenduck said his sister was “in the right place at the right

time with the right mix of talents”. Ms Badenduck started out researching

companies in the firm’s information services department and climbed the

company ranks, becoming vice-president of properties. Mr Badenduck said his

sister left behind a large selection of equipment and accessories for the

disabled, which the family wanted to pass on to others. Ms Badenduck died in her

sleep on January 14, and will be buried at the family grave in

Sainte-Agathe-des-Monts in Quebec, Canada.

Kirsten

Badenduck, an insurance executive who became a champion for the disabled, has

died. Ms Badenduck was 69. She was confined to a wheelchair after she

suffered serious injuries in 2002 car crash while on holiday in Northern

California. But Ms Badenduck remained independent and became a campaigner for

others who faced similar problems. She joined the National Accessibility

Advisory Council in 2007 to push for better treatment for the disabled. MeChelle

Smith, who was one of her caregivers after she returned to the island from

medical rehabilitation, said Ms Badenduck refused to lose hope. Ms Smith said:

“She put her best foot forward and smiled through it all. It never failed.”

Ms Badenduck loved art, music and theatre, and with the help of friends she

acquired the equipment to make herself as independent as possible. Cindy Swan,

co-founder of the transportation charity Project Action, said Ms Badenduck

relied on their service to get to her job at Ace. “She was a very positive

person — I didn’t know her before her accident and can just imagine the

spirit that she had, being incapacitated with her disability. She was a

go-getter spirit, very much alive and well.” Tore Badenduck, her older

brother, said Ms Badenduck got a wheelchair that could raise her to eye level

and could fit into a car, which she could operate herself. With the help of Ms

Smith and carers Simone Trott and Apol Lo, she was also able to exercise by

swimming. Mr Badenduck said: “She had confidence and courage. Surgeons

forecast that she would live two years, a maximum of ten, but she almost made

17. She had a huge amount of friends and was lucky enough to continue to live in

her house in Smith’s with good caregivers. It all helped — it was

cumulative. Her standout features were her smile and her persistence. It goes

back to our mother, Anna Marie, who was a very determined individual, as well as

from her being an immigrant. She also had success, and success breeds more

determination.” The family were originally from the Norwegian capital, Oslo,

but moved to rural Quebec in Canada in the early 1950s. Ms Badenduck was the

youngest of three, with two older brothers. Mr Badenduck said: “She came out

not speaking English and grew up in a small town where English and French were

the ‘two solitudes’, as the expression goes.” The term, from the title of

a 1945 novel by the Canadian author Hugh MacLennan, described the divide between

the country’s English and French-speaking peoples. The family later moved to

Montreal, where Ms Badenduck studied psychology and library science at McGill

University — and met a Bermudian, Brian Luckhurst, who was studying marine

biology. They married and moved to Bermuda and Mr Luckhurst became the senior

fisheries officer at the Department of Agriculture and Fisheries. Mr Badenduck

said: “She said ‘This is my kind of place’. The couple, who had no

children, later separated. Ms Badenduck, who preferred the Norwegian version

“Shishten” for her first name, started work the Bermuda National Library.

Frances Marshall, a friend and colleague from her library days, said her former

boss was “a very intelligent, very engaging woman” who loved swimming and

sport. Ms Marshall, who befriended Ms Badenduck in 1981, added: “She didn’t

wait for things to come to her. She took lemons and made lemonade.” Ms

Badenduck moved on to become a medical librarian at the King Edward VII Memorial

Hospital. A turning point came in 1985, when she joined the insurance giant Ace

Bermuda. Mr Badenduck said his sister was “in the right place at the right

time with the right mix of talents”. Ms Badenduck started out researching

companies in the firm’s information services department and climbed the

company ranks, becoming vice-president of properties. Mr Badenduck said his

sister left behind a large selection of equipment and accessories for the

disabled, which the family wanted to pass on to others. Ms Badenduck died in her

sleep on January 14, and will be buried at the family grave in

Sainte-Agathe-des-Monts in Quebec, Canada.

![]() A

social inquiry report was ordered on a teenager caught in possession of cannabis

with intent to supply. Jah’Dimon Parkes, 17, admitted the offence at

Magistrates’ Court this week. The court heard that Parkes, from Pembroke, was

arrested in the parish on a separate matter on July 25 last year and searched.

Police found a plastic bag with 18 twist bags inside that contained a gum-like

substance, later found to be cannabis. Senior magistrate Juan Wolffe adjourned

the case until March 15.

A

social inquiry report was ordered on a teenager caught in possession of cannabis

with intent to supply. Jah’Dimon Parkes, 17, admitted the offence at

Magistrates’ Court this week. The court heard that Parkes, from Pembroke, was

arrested in the parish on a separate matter on July 25 last year and searched.

Police found a plastic bag with 18 twist bags inside that contained a gum-like

substance, later found to be cannabis. Senior magistrate Juan Wolffe adjourned

the case until March 15.

![]()

![]() The

insurance-linked securities market is seeing “convergence of convergence”,

according to Willis Towers Watson. The reinsurance broker and risk adviser

said in its ILS Market Update that the market had reached $93 billion of

outstanding non-life capital by the end of 2018, despite a slowdown during the

fourth quarter. The report stated that lines of demarcation within the ILS space

were blurring, as ceding companies and intermediaries look to the range of

catastrophe bonds, sidecars, and other collateralized ILS, to identify the best

tools to meet specific challenges, continue to develop new solutions, and refine

existing structures. This blurring of categories should help the ILS market to

overcome concerns including prompt loss reporting, valuation accuracy,

collateral release and rollover, and increasing volatility, the report contends.

Two-way transparency both for ceding companies and investors is key, and

solutions to many specific challenges seem close at hand. “We are seeing the

convergence of convergence,” says William Dubinsky, managing director and head

of ILS at Willis Towers Watson Securities. “The overall ILS figure is today a

much more meaningful measurement of market size than focusing on cat bond and

sidecar issuance alone. ILS capacity and products are growing organically and

dynamically as gaps between different products and subsectors fill in, and

innovation and market necessity create new capacity and products. Our confidence

in the speed that new solutions will emerge gives us a favourable outlook for

ILS in 2019.” The report said that in the face of multiple smaller

catastrophic events in 2018 and a meaningful series of catastrophes in 2017,

non-life cat bond issuance remained strong. About $9.2 billion of new capital

was delivered, marking the second most active calendar year ever. Of $535

million in bonds issued during the fourth quarter, $125 million provides

protection from California wildfire liability, $200 million grants peak multi-peril

protection, and $210 million covers US earthquake (workers’ compensation).

The

insurance-linked securities market is seeing “convergence of convergence”,

according to Willis Towers Watson. The reinsurance broker and risk adviser

said in its ILS Market Update that the market had reached $93 billion of

outstanding non-life capital by the end of 2018, despite a slowdown during the

fourth quarter. The report stated that lines of demarcation within the ILS space

were blurring, as ceding companies and intermediaries look to the range of

catastrophe bonds, sidecars, and other collateralized ILS, to identify the best

tools to meet specific challenges, continue to develop new solutions, and refine

existing structures. This blurring of categories should help the ILS market to

overcome concerns including prompt loss reporting, valuation accuracy,

collateral release and rollover, and increasing volatility, the report contends.

Two-way transparency both for ceding companies and investors is key, and

solutions to many specific challenges seem close at hand. “We are seeing the

convergence of convergence,” says William Dubinsky, managing director and head

of ILS at Willis Towers Watson Securities. “The overall ILS figure is today a

much more meaningful measurement of market size than focusing on cat bond and

sidecar issuance alone. ILS capacity and products are growing organically and

dynamically as gaps between different products and subsectors fill in, and

innovation and market necessity create new capacity and products. Our confidence

in the speed that new solutions will emerge gives us a favourable outlook for

ILS in 2019.” The report said that in the face of multiple smaller

catastrophic events in 2018 and a meaningful series of catastrophes in 2017,

non-life cat bond issuance remained strong. About $9.2 billion of new capital

was delivered, marking the second most active calendar year ever. Of $535

million in bonds issued during the fourth quarter, $125 million provides

protection from California wildfire liability, $200 million grants peak multi-peril

protection, and $210 million covers US earthquake (workers’ compensation).

![]() Preparations

for the 22nd Bermuda International Film Festival [BIFF] are well under way,

promising to make it event to remember with a spectacular array of films, with

the BIFF Academy again set to hold two programs aimed at students. Nicky

Gurret Artistic Director of BIFF and in charge of the BIFF Academy said, “BIFF

will take place from 10 March to 17 March, 2019, and it has an important

education purpose. As part of the festival delivers two programmes designed to

inform and inspire the Island’s younger generation through the imagination and

attention-grabbing medium of film. The BIFF Academy is comprised of the Books to

Film initiative targeted at primary school children and the Reel Talk

documentary screening aimed at middle and senior school students. The programme

is free to students and their teachers. Book to Film for P1- P4 students will

take place on Wednesday, 13 March and Thursday, 14 March from 8:30am to 10:15am

and Thursday, 14th March from 8:30am to 10:15 and 10:30am to 12:15pm. The

screening takes place at The Earl Cameron Theatre. The Wednesday and Thursday

program are full however Tuesday has a few seats left. The Books to Film

programme is the Festival’s initiative focusing on visual literacy learning in

primary schools. Classes from Primary 1-4 are invited to come experience an

exciting programme of reading and film. Story books are read to primary school

children followed by the screening of a film adaptation. The format is designed

to encourage enthusiasm for both reading and high-quality films. BIFF introduces

the films and leads discussions. Reel Talk for middle and high school students

will take place on Friday, 15th March from 8:30am to 10:30am. The screenings

take place at The Earl Cameron Theatre. Reel Talk offers an exclusive

opportunity for middle and high school students to attend the screening of a

socially relevant documentary film during the Festival. Reel Talk aims to stir

students’ interest in film making, to encourage creative expression, provide a

new perspective, and develop interpersonal skills. There are over 500 student

and teachers signed up thus far with 1,000 expected for both programmes. All

public and private school are invited. Any home schools that would like to

attend can e-mail director@biif.bm

or call the BIFF office at 293-3456. Artistic Director Nicky Gurret said, “We

are pleased with all the schools that have signed up so early and if there are

any home schools that would like to attend please contact us at the email

address or telephone number shown above.

Preparations

for the 22nd Bermuda International Film Festival [BIFF] are well under way,

promising to make it event to remember with a spectacular array of films, with

the BIFF Academy again set to hold two programs aimed at students. Nicky

Gurret Artistic Director of BIFF and in charge of the BIFF Academy said, “BIFF

will take place from 10 March to 17 March, 2019, and it has an important

education purpose. As part of the festival delivers two programmes designed to

inform and inspire the Island’s younger generation through the imagination and

attention-grabbing medium of film. The BIFF Academy is comprised of the Books to

Film initiative targeted at primary school children and the Reel Talk

documentary screening aimed at middle and senior school students. The programme

is free to students and their teachers. Book to Film for P1- P4 students will

take place on Wednesday, 13 March and Thursday, 14 March from 8:30am to 10:15am

and Thursday, 14th March from 8:30am to 10:15 and 10:30am to 12:15pm. The

screening takes place at The Earl Cameron Theatre. The Wednesday and Thursday

program are full however Tuesday has a few seats left. The Books to Film

programme is the Festival’s initiative focusing on visual literacy learning in

primary schools. Classes from Primary 1-4 are invited to come experience an

exciting programme of reading and film. Story books are read to primary school

children followed by the screening of a film adaptation. The format is designed

to encourage enthusiasm for both reading and high-quality films. BIFF introduces

the films and leads discussions. Reel Talk for middle and high school students

will take place on Friday, 15th March from 8:30am to 10:30am. The screenings

take place at The Earl Cameron Theatre. Reel Talk offers an exclusive

opportunity for middle and high school students to attend the screening of a

socially relevant documentary film during the Festival. Reel Talk aims to stir

students’ interest in film making, to encourage creative expression, provide a

new perspective, and develop interpersonal skills. There are over 500 student

and teachers signed up thus far with 1,000 expected for both programmes. All

public and private school are invited. Any home schools that would like to

attend can e-mail director@biif.bm

or call the BIFF office at 293-3456. Artistic Director Nicky Gurret said, “We

are pleased with all the schools that have signed up so early and if there are

any home schools that would like to attend please contact us at the email

address or telephone number shown above.

![]() The

Women’s Resource Centre and BELCO recently partnered to host a workshop

entitled ‘Use Less, Save More’: How to Reduce your Electricity Bill. The one

hour Free Lunch & Learn was sponsored by BELCO. The objective was for

women to gain tools to lead energy efficient households and learn new methods to

reduce their electricity costs. BELCO delivered a comprehensive understanding,

in very understandable terms, of the kinds of electricity that we utilize in our

households every day. The presentation included how to dry clothes more

efficiently and how to lower your electricity bill by utilizing appliances such

as heaters, microwaves, refrigerators, light bulbs and computers more

efficiently. Other topics included how to make our homes energy efficient by

simply cleaning and checking our appliances regularly. Elaine Butterfield,

Executive Director of the Women’s Resource Centre, said, “It was a

tremendous workshop. Attendees, including myself, learned how to make

sustainable life choices while reducing our electricity bills in a safe and

practical way. Considering the high cost of living in Bermuda, every chair

should have been filled. This workshop was for everyone. We are excited to be

partnering with BELCO and will definitely be repeating this soon.” BELCO’s

Energy Efficiency and Conservation Manager, Jamil Rahemtula, remarked, “We are

grateful to the Women’s Resource Centre for the opportunity to share energy

efficiency tips with its members. BELCO makes a concerted effort to promote

energy efficiency throughout the community and one of our favorite ways to do

this is by speaking directly to people about how simple changes can lead to big

savings. The ladies in attendance were very attentive and asked excellent

questions. We look forward to returning to the Women’s Resource Centre in the

near future. In the meantime, anyone interested in energy efficiency tips can

visit belco.bm or search #BELCOefficiencytips on Facebook.” All attendees were

treated with takeaways on tips that were shared and a delicious light lunch

compliments of BELCO. For further information about the Women’s Resource

Centre’s Awareness & Education quarterly Calendar of workshops, please

visit our Facebook page at Women’s Resource Centre Bermuda or contact us at wrc@wrcbermuda.com

or call us at 295-3882.

The

Women’s Resource Centre and BELCO recently partnered to host a workshop

entitled ‘Use Less, Save More’: How to Reduce your Electricity Bill. The one

hour Free Lunch & Learn was sponsored by BELCO. The objective was for

women to gain tools to lead energy efficient households and learn new methods to

reduce their electricity costs. BELCO delivered a comprehensive understanding,

in very understandable terms, of the kinds of electricity that we utilize in our

households every day. The presentation included how to dry clothes more

efficiently and how to lower your electricity bill by utilizing appliances such

as heaters, microwaves, refrigerators, light bulbs and computers more

efficiently. Other topics included how to make our homes energy efficient by

simply cleaning and checking our appliances regularly. Elaine Butterfield,

Executive Director of the Women’s Resource Centre, said, “It was a

tremendous workshop. Attendees, including myself, learned how to make

sustainable life choices while reducing our electricity bills in a safe and

practical way. Considering the high cost of living in Bermuda, every chair

should have been filled. This workshop was for everyone. We are excited to be

partnering with BELCO and will definitely be repeating this soon.” BELCO’s

Energy Efficiency and Conservation Manager, Jamil Rahemtula, remarked, “We are

grateful to the Women’s Resource Centre for the opportunity to share energy

efficiency tips with its members. BELCO makes a concerted effort to promote

energy efficiency throughout the community and one of our favorite ways to do

this is by speaking directly to people about how simple changes can lead to big

savings. The ladies in attendance were very attentive and asked excellent

questions. We look forward to returning to the Women’s Resource Centre in the

near future. In the meantime, anyone interested in energy efficiency tips can

visit belco.bm or search #BELCOefficiencytips on Facebook.” All attendees were

treated with takeaways on tips that were shared and a delicious light lunch

compliments of BELCO. For further information about the Women’s Resource

Centre’s Awareness & Education quarterly Calendar of workshops, please

visit our Facebook page at Women’s Resource Centre Bermuda or contact us at wrc@wrcbermuda.com

or call us at 295-3882.

![]() A

burst pipe at the Fairmont Southampton caused flooding over the weekend. A

hotel spokesman said the incident happened overnight on Saturday in the kitchen

of the Jasmine Lounge restaurant. He said: “The resort experienced a burst

water pipe which resulted in some flooding that was immediately handled. Jasmine

Cocktail Bar and Lounge did not experience any disruption in service and we look

forward to welcoming all our local clientele.”

A

burst pipe at the Fairmont Southampton caused flooding over the weekend. A

hotel spokesman said the incident happened overnight on Saturday in the kitchen

of the Jasmine Lounge restaurant. He said: “The resort experienced a burst

water pipe which resulted in some flooding that was immediately handled. Jasmine

Cocktail Bar and Lounge did not experience any disruption in service and we look

forward to welcoming all our local clientele.”

![]()

![]() An

“insulting nickname” led to the knife murder of a 17-year-old Bermudian in

Britain, an English judge has said. Lyrico Steede, a Bermudian student

living with his family in Nottingham, was targeted by a rival group of teenagers

who had been dubbed “the Athlete Gang” as a taunt that they ran away from

confrontation. Mr Justice Lavender, who sentenced the five last Friday, added

that “drill rap videos” had also played a “prominent role” in the attack

on Mr Steede in February 13 last year. He told the group: “You and your

associates were given an insulting nickname. You were called the Athlete Gang.

You were called athletes by people who suggested that you ran away from fights.

The people who made that suggestion included Lyrico Steede.” Kasharn Campbell,

19, was sentenced to 20 years for murder, and Christian Jameson, 18, was jailed

for 16 years. Three others were sentenced for manslaughter for their part in the

attack. Remmell Miller-Campbell, 18, was jailed for nine years and a 17-year-old

boy, who cannot be named for legal reasons, was sentenced to 7½ years. A

16-year-old girl, who also cannot be identified, was jailed for six years.

Nottingham Crown Court was told that Campbell, Jameson and Miller-Campbell

wanted revenge after they were mocked by Mr Steede and his friends. Campbell

appeared in a rap music video filmed two days after the attack, with lyrics that

included “anyone screaming Athlete Gang gonna get rambled up” — a

reference to stabbing. The judge told them it was “a case about stabbing, and

so much of that music is about stabbing”. Mr Justice Lavender told Campbell he

was “sure” that CCTV footage from the night of the attack showed him

“putting on rubber gloves to keep Lyrico Steede’s blood off your hands”.

He added the three who accompanied him were there to add “strength of numbers.

He ran and you all chased him, running past the homes of people who had no idea

that there were killers on the loose just outside their front doors.” The

judge told Campbell, the oldest, that he had stabbed Mr Steede with the

intention of killing him and that Jameson was his “right-hand man”.

Miller-Campbell was said to have played a smaller role and Mr Justice Lavender

said he believed he and the 17-year-old did not take part in the stabbing. The

girl was told she had played a “crucial role” at Campbell’s instigation.

Mr Justice Lavender said: “With remarkable cynicism, you then sent Snapchat

messages to Mr Steede pretending you knew nothing about the ambush and claiming

that you were yourself a victim, in that your iPad had been stolen, when in fact

you were a party to the crime. The jury were not sure that you intended that Mr

Steede should be caused really serious harm, but they were sure that you

intended that he should be stabbed.” Mr Steede died in hospital on February

18, five days after being lured to a park in the Bulwell suburb of Nottingham to

meet the 16-year-old girl. He was chased and stabbed after he arrived for the

meeting. Mr Justice Lavender said the victim’s injuries included stab wounds

to his lungs. He added a stab to Mr Steede’s right leg damaged the victim’s

femoral artery and caused “significant bleeding”. The court heard that Mr

Steede had a heart attack, which deprived his brain of oxygen, as he was rushed

to hospital. Mr Justice Lavender added that his mother, Keishaye Steede, had

given a “very moving statement”. He told the five: “What you have

inflicted on her is, as she has said, a mother’s worst nightmare.”

An

“insulting nickname” led to the knife murder of a 17-year-old Bermudian in

Britain, an English judge has said. Lyrico Steede, a Bermudian student

living with his family in Nottingham, was targeted by a rival group of teenagers

who had been dubbed “the Athlete Gang” as a taunt that they ran away from

confrontation. Mr Justice Lavender, who sentenced the five last Friday, added

that “drill rap videos” had also played a “prominent role” in the attack

on Mr Steede in February 13 last year. He told the group: “You and your

associates were given an insulting nickname. You were called the Athlete Gang.

You were called athletes by people who suggested that you ran away from fights.

The people who made that suggestion included Lyrico Steede.” Kasharn Campbell,

19, was sentenced to 20 years for murder, and Christian Jameson, 18, was jailed

for 16 years. Three others were sentenced for manslaughter for their part in the

attack. Remmell Miller-Campbell, 18, was jailed for nine years and a 17-year-old

boy, who cannot be named for legal reasons, was sentenced to 7½ years. A

16-year-old girl, who also cannot be identified, was jailed for six years.

Nottingham Crown Court was told that Campbell, Jameson and Miller-Campbell

wanted revenge after they were mocked by Mr Steede and his friends. Campbell

appeared in a rap music video filmed two days after the attack, with lyrics that

included “anyone screaming Athlete Gang gonna get rambled up” — a

reference to stabbing. The judge told them it was “a case about stabbing, and

so much of that music is about stabbing”. Mr Justice Lavender told Campbell he

was “sure” that CCTV footage from the night of the attack showed him

“putting on rubber gloves to keep Lyrico Steede’s blood off your hands”.

He added the three who accompanied him were there to add “strength of numbers.

He ran and you all chased him, running past the homes of people who had no idea

that there were killers on the loose just outside their front doors.” The

judge told Campbell, the oldest, that he had stabbed Mr Steede with the

intention of killing him and that Jameson was his “right-hand man”.

Miller-Campbell was said to have played a smaller role and Mr Justice Lavender

said he believed he and the 17-year-old did not take part in the stabbing. The

girl was told she had played a “crucial role” at Campbell’s instigation.

Mr Justice Lavender said: “With remarkable cynicism, you then sent Snapchat

messages to Mr Steede pretending you knew nothing about the ambush and claiming

that you were yourself a victim, in that your iPad had been stolen, when in fact

you were a party to the crime. The jury were not sure that you intended that Mr

Steede should be caused really serious harm, but they were sure that you

intended that he should be stabbed.” Mr Steede died in hospital on February

18, five days after being lured to a park in the Bulwell suburb of Nottingham to

meet the 16-year-old girl. He was chased and stabbed after he arrived for the

meeting. Mr Justice Lavender said the victim’s injuries included stab wounds

to his lungs. He added a stab to Mr Steede’s right leg damaged the victim’s

femoral artery and caused “significant bleeding”. The court heard that Mr

Steede had a heart attack, which deprived his brain of oxygen, as he was rushed

to hospital. Mr Justice Lavender added that his mother, Keishaye Steede, had

given a “very moving statement”. He told the five: “What you have

inflicted on her is, as she has said, a mother’s worst nightmare.”

![]() Deloitte

Bermuda has been confirmed as a Platinum Sponsor of the AXA End-to-End event. This

will be the third year in a row that Deloitte has participated in the

fundraising event, which will take place on May 4. The company previously hosted

a water stop next to the Somerset Bridge. John Johnston, CEO at Bermuda and

Caribbean Region, said: “We are delighted to be one of two Platinum Sponsors

for the AXA End-to-End 2019. This sponsorship provides us with the opportunity

to express our commitment to making a positive contribution in the communities

where we live and work. The charities that have been selected by the End-to-End

over the years align to Deloitte’s Corporate Social Responsibility pillars —

children, education, elderly, and environment. This event brings out the best in

Bermuda, and Deloitte professionals put their passion, determination, and skills

to use for the benefit of others.” Anne Mello, chairwoman of the End-to-End