Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us).

Benefits of website linkage to Bermuda Online

|

See at end of this file all our many History files |

November 30. David Burt, the Premier, said he will to cut the cost of living in Bermuda through “additional competition”. Mr Burt also announced plans for a new Cost of Living Commission at a reception for Bermudians in the UK on Monday. He said: “For some time in Bermuda we have been very protective in our mindset and I think that we have to be a little less protective and explore how to make things more efficient.” He added: “If we have more competition, we have more efficiency and that means the prices will come down”. Mr Burt tabled amendments to the Price Commission Act last Friday to change the body’s name to the Cost of Living Commission and increase the fines it can hand out. Mr Burt discussed the problem of high food prices and quoted a conversation with the head of “one of the big supermarkets”, who claimed she could lower prices by 15 to 20 per cent the next day if they cut out the middleman. Mr Burt said: “People say that might destroy employment opportunities throughout the economy. But you also have to examine the additional spending that might create inside the economy which we can have in other types of places.” The Premier also encouraged Bermudian students to return to the island after graduation and work experience. He said: “One of the best ways to make Bermuda more affordable to live in is, surprisingly, to get more Bermudians living and working in Bermuda. The more people living and working in Bermuda, the more customers you have but also more ability to spread fixed expenses across a greater number of people.” Mr Burt also discussed the island’s economic future and said the Government had worked hard to uphold Bermuda’s “sterling reputation” by continuing to be a “leader in tax transparency”. He dismissed bids to label the island as a tax haven in the wake of the Paradise Papers — millions of files hacked from international law firm Appleby. Mr Burt defended the island and said Bermuda was the opposite of “non-co-operative tax jurisdictions”. He added: “We are leading in the international requirements, we have automatic exchange of information, we are doing everything that is a requirement for international standing. You can’t hide your money in Bermuda. The money that comes to Bermuda is often taxed on its way to Bermuda and on its way out.” Katiyah Fubler, 21, said Mr Burt’s speech went “really well”. Ms Fubler, who will finish her master of science degree in clinical biochemistry next year, said she hoped to get a job in Britain. She added: “I will need experience. I think that’s another problem with Bermuda. I don’t think we have enough opportunities for people to come back.” A Sandys woman visiting her student daughter in London said she was optimistic after she heard the Premier’s speech. She added: “I’m hopeful that in due course we can see a positive move towards things like healthcare and affordable rents, so that we can pay for rent using our pension. Those sorts of things are what we are looking forward to in the future.”

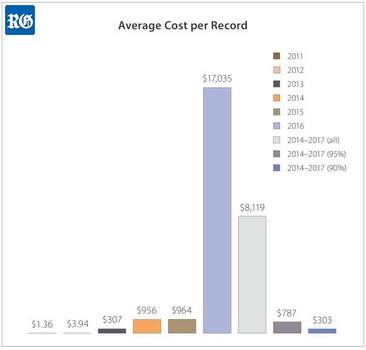

November 30. With new regulations on the horizon that will impose large fines on companies which suffer certain types of data breaches, a snapshot study of the scale of cyber incidents has been released.

November 30. Bermuda’s foreign portfolio holdings were $546.2 billion last year, an increase of 8 per cent on 2015. The increase was attributed to a growth in the insurance sector’s total assets. The insurance sub sector accounted for 84 per cent of the island’s total foreign portfolio holdings, followed by investment funds at 14 per cent, and banks. The insight comes from data released for by the Bermuda Monetary Authority. Since 2001, Bermuda has been participating in a voluntary global investment survey, under the auspices of the International Monetary Fund. The Co-ordinated Portfolio Investment Survey tracks the cross-border holdings of portfolio investment securities in 82 countries. The information shows where Bermuda’s financial services entities invest assets, and which countries are investing in Bermuda. US holdings in the United States dominated Bermuda’s foreign portfolio investment assets, accounting for 58 per cent, which was up 7 per cent the previous year. Debt securities comprised 82 per cent of the island’s foreign portfolio holdings, with the vast majority — some 93 per cent — being long-term debt securities. In a statement, the BMA said: “The CPIS is part of the International Monetary Fund’s comprehensive international survey. It measures Bermuda’s holdings of foreign portfolio investment assets, which comprise tradable financial instruments — other than direct investments or reserve assets — issued by unrelated non-residents. Bermuda’s participation in the CPIS contributes to improved understanding of the jurisdiction as an international financial centre and its impact on global financial intermediation.”

November 30. New tourism legislation is designed to create investment and employment opportunities for Bermudians, an island industry expert said last night. Andy Burrows, chief investment officer at the Bermuda Tourism Authority, said that the Tourism Investment Act looked “beyond hotel developers”. Mr Burrows added: “It’s meant to provide incentives for Bermudians who want to invest in tourism and hospitality, and not just non-Bermudians.” The Act, approved last month, aims to encourage hotel, restaurant and tourism development, including attractions, through reduced rate Customs duty, as well as other tax exemptions. Mr Burrows said that the Hotels Concession Act focused on direct investment and new hotels, but the new legislation was meant to be “inclusive of Bermudians who want to invest”. He said that the Act “is as much about job creation as it is about investment”. Mr Burrows said the potential for 1,500 new hotel rooms on the island along with investment in restaurants and attractions “ought to spur employment opportunities for Bermudians in the tourism sector”. He added he hoped the legislation “brings more Bermudians into the tourism economy through not just employment, but business ownership.” Mr Burrows said the BTA wanted to help “streamline the process” to take no more than “three to six months” from an application to when a response is received from Government. Mr Burrows said restaurants and attractions were included in the new legislation as a way to boost Bermuda’s entire tourism framework. He said: “So when you come here, the experience that you have on a wonderful hotel property is the same experience you have when you go to attractions and restaurants. People, ultimately, don’t actually think about what they spend, but want to spend.” Kevin Dallas, chief executive officer at the BTA, said the new Act opened up investment opportunities at “lower thresholds” than those for a major hotel. Mr Dallas explained: “Before, to take advantage of any of these incentives, you had to be a hotel. Under the Tourism Investment Act, there are opportunities for Bermudians to get duty and payroll relief from investing in the tourism sector beyond just hotels.”

November 30. A top island insurance executive has died suddenly in the United States. Alan Peacock, CEO and president of Colonial Group International Ltd., died on Monday aged 69 after he suffered a heart attack in Miami. Grant Gibbons, chairman of Colonial, said that Mr Peacock had provided “strong and consistent leadership” to the group of companies for more than four decades. Dr Gibbons said: “After he joined Colonial Insurance in 1974, Colonial grew from a small domestic motor insurer to one of the region’s largest insurance and financial services providers. Dr Gibbons added Mr Peacock set the “highest standards and values” and “significantly” contributed to the success of the company. He said: “We will miss Alan immensely as a colleague, a leader and a friend. Alan was very much an unsung hero in Bermuda. He shunned the limelight and any publicity, but he was a huge supporter of the local community, especially football. I would like to extend my deepest sympathies to Alan’s family in this very difficult time.” The company announced in June that Mr Peacock would retire next year. Naz Farrow, the current COO, has assumed the role of acting CEO. Mr Peacock is survived by wife Esther, and son Jonathan.

November 30. Union Street in Hamilton was abuzz yesterday as thousands of bees were removed from their hive. Steven DeSilva of the Corporation of Hamilton said the hive had been in a tree in Middle Town, North Hamilton, for more than a decade, but residents in the area said the hive had been a nuisance for around 20 years. Mr DeSilva said: “It has become more and more of an issue for those who live in the area. We have people who are afraid of being stung by the bees and we have had repeated calls.” Mr DeSilva added that the city did not want to kill the bees and maintenance and beekeeping company Passion Fields had approached City Hall with a relocation plan. Spencer Field of Passion Fields spent three hours scooping up the bees with a vacuum device yesterday before placing them in a fresh hive so they could be relocated to a quieter area. Mr Field drilled holes into the hive and pumped smoke inside to dull the bees’ senses and hinder their ability to communicate. He cut bigger holes in the hive with a chainsaw before he vacuumed them out. Mr Field said: “The vacuum is just strong enough to lift the hairs on your arm, so it’s not going to hurt the bees.” He added he has been stung a lot in the past but that he is now mostly immune. He said: “I have been stung 30-40 times in an hour. It’s still painful. Most people in Bermuda get stung because they are riding on their bikes and a bee gets stuck in their helmet or their clothing. Most of the bees you see around are foragers. Foragers are not aggressive. They are just out getting food for their colony. It’s when they have a colony to protect that they get more defensive.” Mr Field added that he was stung around 20 times as he removed the Union Street hive. By yesterday afternoon the 10,000-12,000 bees were on their way to a new home in Paget. Mr Field said: “It was a pretty good-sized hive for this time of the year. Feral hives are usually smaller due to the capacity of the physical space, but they filled up that space pretty well.” He said some pieces of honeycomb inside the tree were at least three or four years old, which showed the age of the hive. One resident predicted that the bees would return but Mr Field said the space would be filled by concrete to deter other colonies from moving in. Mr Field added the island’s bee population remained fragile after a series of die-offs. He said: “Bee die-offs are still happening. Over the past decade we have lost 75 per cent of our bee population. I’m told we once had about 1,000 hives on the island. Now there’s maybe fewer than 300. That’s a large portion of the population gone.” Mr Field called on the public to learn more about bees and their environmental role. He explained bees were a food source for many species and that a variety of plant life, including half of the island’s crops, relied on bees for pollination. Mr Field warned: “The reality is if Bermuda loses all of its bees, Bermuda will not be able to survive.”

November 30. A Pembroke man is due in court tomorrow over an alleged siege with police at the former prison service headquarters in Pembroke. But for James Dallas, 68, another court battle lies ahead — a bid to claim ownership rights to the property on Happy Valley Road that he insisted was built by his family and leased. Mr Dallas is to face charges in Magistrates’ Court of threatening police during a standoff that lasted several hours. Mr Dallas was removed from the building, but he claims the derelict former prison service headquarters was built by his grandparents and that he has kept a quiet occupancy in its basement for decades. Mr Dallas said: “People didn’t even know I was staying there, but I’ve been there all my life.” He added he hoped to assert a family claim to the building, as well as squatters’ rights. Mr Dallas said: “They locked it up years ago and they never knew I was there. I’ve been looking after the place. I grew the trees, fixed up the roof. It’s like they wanted the place to fall down.” Public Works staff found Mr Dallas on the premises earlier this month, but he refused to leave and barricaded himself inside after police attempted to move him out. Cleveland Simmons, a community activist, said he would argue Mr Dallas’s case. Mr Simmons added: “He was there the whole time the prison officers used it. On top of that, he has been reconstructing it and maintaining the property. They are saying he has been trespassing on the Government’s property, but this is his home.” Mr Simmons said he hoped that the building could be turned into a community centre. He added: “There is a lot of property over the years that has been claimed, and we think this is one of those.”

November 29. Bermuda and Britain have signed a Country by Country Competent Authority Agreement that will enable the automatic reporting of corporate income for UK-related transfer pricing enforcement purposes. Transfer pricing refers to the setting of the price for goods and services traded internally between divisions or subsidiaries of a larger parent company. Such transactions can take place across multiple countries. In the past, a number of jurisdictions, including Bermuda, have faced criticism because of the practice of multinational companies transferring billions of dollars of revenue to offshore holding companies. Some of those corporations have been accused of using such mechanisms to minimize their tax liabilities elsewhere. In a statement, the Bermuda Government said the agreement will complete the Organisation for Economic Co-operation and Development Base Erosion and Profit Shifting tax transparency package between Bermuda and the UK. Similar to individuals under the Common Reporting Standard, corporations must also automatically report financial information to Bermuda authorities. Any reported UK-related income will be shared automatically with UK tax authorities. The OECD describes BEPS as tax-planning strategies that exploit gaps and mismatches in tax rules that can allow multinational enterprises to artificially shift profits to low or no-tax locations where they have little or no economic activity, resulting in little or no overall corporate tax being paid. And the OECD sees its BEPS project as providing governments with solutions for closing the gaps in existing international rules, that currently allow corporate profits to “disappear” or be artificially shifted in such a manner. Bermuda is the first UK Overseas Territory to complete a CbC Competent Authority Agreement with Britain. David Burt signed the agreement today, during his overseas trip to London which also included yesterday meeting Theresa May, the British Prime Minister. The Premier said: “I am pleased to sign this important agreement with the United Kingdom on behalf of the people of Bermuda. We are the first Overseas Territory to sign the agreement which further solidifies Bermuda’s position as a global leader in international tax transparency. Bermuda remains a jurisdiction with an excellent reputation for quality. We continue to demonstrate leadership in global tax transparency and we encourage other countries to meet the ‘Bermuda Standard’.” In June, the Government created a new online portal to meet Bermuda’s obligations under the OECD common reporting standards and CbC automatic exchange of information regimes.

November 29. Bermuda’s current account recorded a surplus of $145 million in the second quarter of the year. This was down $9 million year-over-year. The decline mostly reflected a widening of the deficit on merchandise trade due to an increase in the value of imported goods. However, the decline was offset partly by a rise in the primary income surplus due to an increase in net investment income, according to a release by the Bermuda Government’s Department of Statistics. Key points in the latest figures included a $97 million increase in the deficit on the goods account, which stood at $352 million. Goods imported from the US increased by $50 million, while goods from the Caribbean region and the UK were up $14 million and $12 million, respectively. Revenue earned from exported goods fell $1 million to $4 million during the quarter. There was a $105 million surplus in services transactions, which was an increase of $19 million. Receipts from travel services rose $27 million due to an increase in visitor arrivals and higher per-person visitor expenditure. In contrast, receipts from business services decreased $3 million due to a fall in reinsurance claims recovered. And receipts from government services decreased from $2 million to $1 million, while receipts from the provision of transportation services remained unchanged at $9 million. The surplus on Bermuda’s primary income account increased to $432 million. Payments for services received from non-residents totaled $272 million in the second quarter, $5 million above the level recorded in 2016. This reflected an $8 million increase in payments for transportation services related to freight imports. Payments for travel services also rose by $1 million. In contrast, insurance services fell by $4 million owing to a decrease in reinsurance premiums paid.

November 29. Six acts will complete for the opportunity to take part in the 2018 Bermuda Festival of the Performing Arts. The selected acts are the Bermuda School of Music Senior Ensemble, Brothers in Music and Sax duet, and solo vocalists Indigo Adamson, Shardae Lee and Skye Minors. They will compete for the spots on January 13 after being selected from a dozen acts that auditioned earlier this month. David Skinner, festival director, said: “It proved so difficult to narrow down the list to six competitors that we have decided to include performance slots for the runners-up elsewhere in the festival.” Mr Skinner said the slots would likely come as pre-show performances at either City Hall or the Fairmont Southampton. He added: “We might also be able to include singers in the choir supporting Jonathan Butler.” David and Theresa Minors, of Playlist Management, have also invited all students who auditioned to appear at next year’s AG Show. The winner and runner-up selected on January 13 will be featured in an onstage performance with international singer and songwriter Shun Ng on January 30. The performance will take place at the Earl Cameron Theatre. Mr Ng will also coach the two winners.

November 29. Royal Gazette editorial. "Someone within the Bermuda Tourism Authority believes that an internal e-mail circulated by the chief executive that effectively takes The Royal Gazette to task for misleading the public is newsworthy. The leaker, whose future at the BTA must surely be in doubt, struck the jackpot by recycling the message from Kevin Dallas, which in and of itself was misleading, to the one medium with a sharpish axe to grind against The Royal Gazette, its proprietor being a former employee whose departure was acrimonious to put it mildly. This non-story was compounded by television picking it up on what apparently was, as they say, a slow news day and running with it — on the evening news and then again on the radio for morning commuters. What is to be taken from this if you are Joe Public is that the RG has, yet again, done the island a disservice simply for having the temerity to ask questions and then write a story on the basis of the responses. Which brings us to the genesis of this string of disinformation: Jamahl Simmons, the Minister of Economic Development and Tourism, holds a press conference to announce Cheryl-Ann Mapp as the new chairwoman of the Bermuda Casino Gaming Commission. We send a reporter who in our estimation stands head and shoulders as a journalist above anything that could be found on this island and whose integrity is beyond reproach. She asks searching questions, particularly about the minister’s plan to bring the casino gaming commission under ministerial control and about whether the same will happen to the BTA, the other government board whose members are appointed for fixed terms to avoid political interference. The transcript at that point goes like this: RG: “The BTA, I think, is the same. The BTA has four-year fixed terms, doesn’t it?” Minister: Yes. RG: “So are you going to change the BTA?” Minister: “And there has been change.” RG: “No, I know there has been a change of chairman but you haven’t changed the legislation. But isn’t the legislation the same — a four-year fixed term?” Minister: “At the moment, we have a mutually respectful relationship based on trust.” RG: “That wasn’t what I was asking.” Minister: “The answer is that at the moment there is a mutually respectful trustworthy relationship.” RG: “So if there wasn’t, you would change the legislation?” Minister: “You might very well think that. I think it must be understood clearly that the tail will not wag the dog in this government. We are providing funding for these entities and while we respect their independence, which should be based on their expertise in their various fields, there has to be a measure of policy direction when and if necessary.” The only context to be gleaned from this exchange is that in a hypothetical situation, should the BTA displease the minister, he would be within his right to effect change, disrupting the perceived and legislated autonomy of the organisation. For Dallas, in attempting to alleviate any concerns from within his organisation, to then accuse us of taking the minister’s comments out of context was naive at best, disingenuous at worst. Whichever explanation fits, the narrative was taken out of his hands when a supposedly trusted employee felt that this was news to be shared with the wider public via a small website with an even smaller following. Television, mischievously or not, provided the Super Mario Bros-esque power-up that was required to carry this mainstream and, voila, it was off to the races. The pertinent sections of this leaked e-mail again? “The story in question is actually about the appointment of a new Chair for the Gaming Commission, but the way in which the story was presented has created an interesting sideshow about the BTA. The Minister’s comments are taken out of context, and the reporting doesn’t match the spirit of what was actually said. The Minister’s prepared statement actually makes no mention of us. In questioning afterwards by Sam Strangeways he was asked about the BTA as the other obvious example of what she called ‘fixed- term board appointments’. Minister Simmons replied that the BTA board had already had a change [of] leadership that he felt appropriate given the change of government, and that he and the BTA ‘enjoy mutually respectful relationship based on trust’. When pushed further he said that — in the hypothetical situation where [Government] and BTA did not work as partners — ‘you could reasonably expect’ that he would look to a legislative remedy.” How the Gazette story published last Friday can be deemed to have taken the tourism minister’s comments out of context where it pertains to the BTA, when he was actually responding to a BTA-related question, is a mystery. So why the “story”? What is the motivation if not to engage or collude in an attempt to denigrate the island’s only newspaper and bravest media? It carries the same smear-campaign undertones of what could be found in the House of Assembly last week when the Minister of Education hijacked the congratulations segment of the session to criticize The Royal Gazette for not being at the Berkeley Institute’s awards night. In launching this unjustified and unprovoked attack, which David Burt later associated himself with, Diallo Rabain — in intimating that our interest in Bermuda’s youth is piqued only when they are caught up in misdeed — conveniently overlooked that in September The Royal Gazette produced five pages of bumper coverage celebrating Berkeley’s 120 years in existence, and only three days before the cheapest of cheap shots from the minister we had front-page coverage, plus more, of CedarBridge’s 20th anniversary. That is some memory lapse. A part in While You Were Sleeping 2 beckons surely. For in this amnesia of convenience he also neglected to state that no other media were present at the event in question. Nor were any media invited — a salient fact for those not of a clairvoyant disposition. Even Peter Gallagher in the original romcom had the wherewithal to first survey his surroundings after snapping out of a coma-induced loss of memory rather than launching instantly on the offensive against an easy target — and with the added shield of parliamentary privilege. In the absence of any defence coming particularly from the Berkeleyites in the House — and there are many — or from the Opposition in general, we again are left to defend ourselves or allow the poisoning of our product to seep farther into society. Which may very well happen anyway, but our entire existence is predicated on getting to the truth by way of asking the difficult questions. This can make you unpopular in some circles, but that is no reason to down tools and play dead. We dust ourselves off and we come again. And again and again."

November 29. Widening economic inequality can eventually lead to social collapse — but a mix of policy changes and private-sector initiatives can change that trajectory. That is the view of Chuck Collins, an author who has long worked to tackle the issue of a growing wealth gap between the rich and the rest, who was speaking to a business audience in Hamilton yesterday. Mr Collins is from a privileged background, having been born into the family that started the Oscar Mayer meat empire, and gave away his $500,000 inheritance to charity at the age of 26. He is the author of Born on Third Base: A One Percenter Makes the Case for Tackling Inequality, Bringing Wealth Home, and Committing to the Common Good. Speaking at a Bermuda Chamber of Commerce breakfast event at the Hamilton Princess yesterday, held in conjunction with the Bermuda Community Foundation, Mr Collins said: “If we don’t intervene in these inequalities, then a generation from now, we will be in an economic and racial apartheid society that will fundamentally lead to social collapse. That’s if we don’t intervene thoughtfully in the current trajectory.” Mr Collins gave a speech before appearing on a panel focusing on the inequality issue with Nathan Kowalski, chief financial officer of Anchor Investment Management, and Craig Simmons, senior economics lecturer at Bermuda College. Mr Collins said there was some nervousness that policies designed to narrow the wealth gap would hurt the economy, but he argued there was a “business case” to be made. “These inequalities undermine democracy, social mobility and public health,” Mr Collins said. “It exacerbates existing wealth divides and it’s bad for the economy and it undermines the cherished notion of equality of opportunity.” Responses to inequality should be about “raising the floor”, he said — ensuring a strong safety net for all and implementation of a living wage. Some businesses who had chosen to pay a “living wage”, even when competing against rivals who did not, had seen financial benefits, Mr Collins said. These included a reduction in turnover of staff and a consequent fall in training costs, as well as workers not having to take a second job, leading them to be more energetic and engaged at work to the benefit of customers. Some businesses had taken this a step further with employee ownership schemes. Yogurt maker Chobani was 20 per cent worker-owned, for example. He said there was a misleading narrative that people deserved their economic status, whether rich or poor. “Some people think the statistics are a reflection of deservedness — that some people work hard, take risks, innovate and deserve what they get. The corollary of that is that people who are struggling deserve to be where they are as well. I call that the myth of deservedness. That story gets in the way of us realizing that these inequalities are driven by inequalities largely delinked from personal effort.” He gave the example of Martin Rothenberg, a multimillionaire entrepreneur whose company developed voice recognition software, who spoke strongly in favour of estate taxes in the US. Mr Rothenberg said he had grown up poor, but went to a high school with a strong science programme. And he used to go to a public library that was open in the weekends and evenings, where he could study. His college education was fully subsidized. Mr Rothenberg pointed out that “someone else” had paid for his education, the library and the “free ride” through college, and for the college education of the computer science graduates he had hired. Quoting Mr Rothenberg, Mr Collins said: “If you abolish the tax on inheritance, you effectively say I don’t have any responsibility to pay back the society that made it almost entirely possible for me to get where I am. A good society recycles opportunity and I have the moral obligation to pay back.” Mr Collins added: “It’s about telling the story of how we got to where we are. There are plenty of ‘I did it alone’ stories. I would suggest that there is no individual wealth without a robust commonwealth.” He added that the need to act boiled down to the question: who is Bermuda for? “If it’s for everyone here, we have the imperative to wrestle with responses to inequality,” he said. “It needs policy changes and it needs private-sector innovation.” Mr Kowalski said Bermuda was on the “wrong end of the spectrum” in terms of inequality. The income of the highest decile was close to nine times that of the lowest decile — even worse inequality than Mexico on that score. Employment data show that the highest-earning group had seen their employment income rise about 2.5 per cent annualized since 2008, above the 1.7 per cent inflation rate, while the lowest earners saw their income rise at 1.6 per cent per annum, suggesting a widening wealth gap. However, he said inequality solutions, such as a living wage, should be carefully thought through. The hotel industry, one of the lower-paying sectors, employs 1,124 expats and 504 Bermudians, according to the latest employment data, he said. “In this case at least, it would not affect Bermudians, it would impact guest workers,” he said. And he warned of the danger of rising costs. “We are beholden to foreign investors in terms of funding our debt,” Mr Kowalski said. “We have a small tax base of about 15 per cent of our GDP, about $1 billion. If we start escalating costs, how do we pay for that?” He suggested looking at ways to reduce Bermuda’s high cost of living, as well as raising incomes. “We should look at both sides, rather than one side. My concern is that if costs get too high — and we’ve seen this in certain areas — that job goes away and that person doesn’t get paid at all.” Mr Simmons suggested two policy initiatives that could be implemented quickly — one of which was earned tax credits. For example, he said, someone earning under $20,000 would have their salary matched by the government. The proportion of tax credit would fall as income increased, up until $60,000, over which there would be no credit. Such a policy “could benefit thousands of people”, Mr Simmons said. Asked how it would be paid for, Mr Simmons said a more progressive payroll tax, with the $750,000 cap being raised or eliminated over time, with further support from a general services tax. Second, Mr Simmons suggested publicly funded charter schools, whose students were chosen by lottery. The schools would have autonomy and targets they would have to reach in order to get paid, giving teachers “skin in the game”, he said. Mr Simmons added: “If you go down the road of a minimum wage, please don’t let politicians decide what the minimum wage should be.” He preferred the UK model, which involves technocrats deciding the number, based on clearly defined criteria. And he added that business people should work with Bermuda College to ensure the curriculum was relevant to the modern economy.

November 29. A leading police officer has been assigned to deal with complaints of inappropriate sexual conduct by a former pastor amid concerns witnesses are reluctant to come forward. Yesterday, police said they were aware of allegations circulating on social media about a former clergy member at Cornerstone Bible Fellowship. However, they said no formal complaints had been received, meaning it is not possible for them to launch an investigation. Detective Inspector Mark Clarke, of the Vulnerable Persons Unit, has now been made the single point of contact for the matter, to give assurance to potential victims and witnesses. Police reminded members of the public of their duty to report such information. A spokesman said: “The Bermuda Police Service is aware of allegations circulating on social media about past inappropriate sexual conduct of a former Cornerstone Bible Fellowship clergy member. To date, no criminal complaints have been made to the BPS. We would like to remind the public that formal complaints are required by law in order for the police to investigate such allegations. Online statements and social media posts do not qualify as formal complaints. We appreciate that this is a sensitive subject and that witnesses and victims are sometimes reluctant to come forward. Accordingly, we have established a single point of contact so that complainants can be assured that they will be treated with dignity and that their investigation will be conducted in strict confidence.” Police pointed out it is mandatory to report cases of child abuse by those working with children in a professional or official capacity. The spokesman said: “It should also be noted that Section 20 of the Children Act 1998 makes it mandatory to report information about child abuse by anyone who performs professional or official duties with respect to a child. This includes healthcare providers, teachers, social workers, youth workers, police officers, probation officers and members of the clergy.” Former One Bermuda Alliance MP Suzann Roberts-Holshouser has persistently spoken out about sex abuse and called for a public sex offenders register. She told The Royal Gazette that she believes people need to stop making excuses and help the police to launch a proper investigation. She said: “The victim doesn’t have to make a complaint. I tried to make it clear to individuals that we as a society have a responsibility to protect our children. The police can’t do anything unless there is a charge so if someone is aware of an offence they have to speak up. Whoever put it in writing publicly and made an accusation needs to call the police and say ‘I want to press charges against this individual’. I know the police can only do so much. Everyone wants to point fingers but everyone in society is responsible. We can’t expect the police to do something because they have read something on Facebook.” She said of the police statement: “The way I saw it was that they were saying, ‘we want to do something about this but we can only do something if someone presses charges’. “It’s time to stop making excuses. We have an obligation to protect the innocent always.” Anyone with information should call Mr Clarke on 247-1086 or e-mail him at mclarke@bps.bm. Alternatively, call the independent and confidential Crime Stoppers hotline on 800-8477. The spokesman added: “The BPS works closely with the Department of Child and Family Services on these matters and we take such allegations seriously. But we caution members of the public about making unsubstantiated statements or circulating rumors on social media that may constitute slander or libel.”

November 29. The motorcyclist killed in a road accident on Tuesday has been named as Roel Flores. Mr Flores, a 52-year-old Filipino guest worker, crashed at the junction of South Road and Warwick Lane, Warwick, at 6pm. No other vehicle was involved. He was taken to King Edward VII Memorial Hospital by ambulance but later pronounced dead. Mr Flores is the 15th person to die on Bermuda’s roads in 2017. Witnesses or anyone with information should call the Roads Policing Unit on 247-1788.

November 29. A fatal motorcycle crash in Warwick yesterday evening marked the island’s fifteenth road fatality of the year. The single-vehicle crash happened at the junction of South Road and Warwick Lane at around 6pm. A police spokesman said that the male driver was taken to hospital, where he was subsequently pronounced dead. Further information was not provided by police as of press time. The accident is the third road death this month. Mendell Outerbridge, 34, of Warwick, died after colliding with a truck on Middle Road in Sandys shortly before 10pm on November 9. Police said he was being pursued by officers after he failed to stop at a speed checkpoint. Ionel Bejan, 39, was killed when his bike struck a shipping container on Church Street at around 3.45am on November 5.

November 28. Premier David Burt assured students living overseas last night that “Bermuda is a first-choice option for Bermudians”. The Premier emphasized the Progressive Labour Party government is creating new jobs for students to return home to as he delivered a speech to more than 130 people at the Bermuda Reception in The Clubhouse, Central London. He said: “We have increased job-training opportunities to help prepare Bermudians to fill jobs that are held for guest workers.” He added: “While I encourage you to gain as much experience as you can here in the UK, we do want you to come back and share your knowledge and your expertise at home.” The Premier also addressed those that have left the island because of the high cost of living, saying that the Government is working tirelessly to reverse that situation. He said: “Bermuda should not be a place to be enjoyed by visitors and guest workers alone, while many of those in the community cannot afford to live in their own country.” The Premier also said that the Price Control Commission Act, which he tabled in the House of Assembly on Friday, would give more “control and power” to the existing price control commission in Bermuda, and examine ways to reduce the cost of living. During a question-and-answer segment, Mr Burt also discussed plans to tackle the education system, racial inequality, the value of Bermudian passports and the controversial Domestic Partnership Bill. He said: “We are making sure we carry out our platform promise that same-sex couples and heterosexual couples have similar legal protection under the law. We believe that we are making the best decision we can to take into account both sides of the issue.” Mr Burt won favour with the audience, with one Sandys resident who was visiting her daughter in London, telling The Royal Gazette: “I have great confidence in the PLP and their vision and what they are doing for the country.” Alicia Kirby, a master’s student at Goldsmiths, University of London, said: “I think that the Premier’s engagement was very admirable.” She added: “I think it’s important for Bermudians of all demographics to come together and participate in conversation that affects us both abroad and at home.” Throughout this week, the Premier will be meeting with Prime Minister Theresa May and representatives from other Overseas Territories, as well as taking in meetings in Paris and Berlin.

November 28. Political observers said last night that the One Bermuda Alliance had to ditch its United Bermuda Party legacy. Former OBA minister Michael Fahy, one of the party’s founders, said it faced a painful reappraisal after it was returned to the opposition benches in July. Mr Fahy was speaking in the wake of the resignation of party chairman Nick Kempe. Mr Kempe quit after new party leader Jeanne Atherden axed him from the Senate. Mr Fahy warned that, unless the OBA was “prepared to make really tough choices, and until the new leader articulates a solid vision for Bermuda, the immediate future for the party is not good”. He added: “There are many great, hard-working and intelligent people in the OBA who want what is best for all Bermudians, and I believe it is still the better option long term for Bermuda.” The one-time Minister of Home Affairs called on the OBA to find “new energy” and refocus — and highlighted Mr Kempe’s criticism of its direction. Mr Fahy told The Royal Gazette: “Nick brought that focus to the table and showed his passion and ability in two elections, and with his leadership as chairman of the Bermuda Economic Development Corporation. However, his frustration with the direction the OBA has now taken is justified and his explanation for his resignation is clear.” Mr Kempe declared his rift with Ms Atherden’s vision for the party in a no-punches-pulled e-mail sent to OBA members last Friday. He said: “My vision for the future of the OBA relative to its rebuilding is diametrically opposed to that of the leader”. The party’s former Pembroke West candidate quit his post just five days after being elected chairman, due to “fundamental political and policy discordance”. Mr Fahy quit politics in August after the OBA’s defeat in July’s General Election. He underlined the party’s image problems and its failure to communicate its vision. Mr Fahy was backed by former Pembroke South East candidate Rodney Smith. Mr Smith criticized the OBA as out of touch after its electoral defeat and said the Opposition “definitely” had to cut its UBP links. He added: “They have to do it. It’s difficult — people grew up under the UBP and there’s a mindset that comes with that. But the public has spoken and it would do well for the OBA to listen.” Mr Smith said former UBP figures now in the OBA like Grant Gibbons, Trevor Moniz and Michael Dunkley should “realise that they have made contributions — and it’s time to move on”. He added that he had “told that to the party back in July, immediately after the defeat”. Mr Smith said: “The more striking thing is that the Progressive Labour Party has garnered the largest victory in the history of Bermuda. The OBA need to realize that as long as the race card is in play, they will never again win an election — so how do you combat that?” Mr Smith said the deadlock could be broken with “two black political parties to compete against each other. The white support can go wherever it wants. People will vote based on issues. As former finance minister, Bob Richards said, ‘no good deed goes unpunished. He worked very hard to turn the economy around, but there were other things that the black community and the majority of Bermudians felt that the OBA was not addressing.” Mr Smith praised Mr Kempe as “very positive, a hard worker. It’s sad to see him take a back seat but, like him, others are trying to encourage the party to take a step forward.” Mr Smith added the Opposition had to work with the PLP, saying the OBA needed to move past “the continuous fight. We must support the new Opposition leader Ms Atherden — but I’d hoped that she would have shown herself prepared to break from the past.” Ms Atherden was not available for comment yesterday and Mr Kempe declined to comment further.

November 28. Prince Harry is engaged to marry American actress Meghan Markle and will wed in spring 2018, the royal palace announced yesterday morning, ending days of feverish speculation in the tabloids over when their nuptial plans would be revealed. The 33-year-old ginger-bearded prince is fifth in line to the throne. The 36-year-old Markle is a well-regarded actress who was born and raised in California. The couple will live at Harry’s snug two-bedroom bachelor pad, Nottingham Cottage — known as Not Cot — on the Kensington Palace grounds in London. The announcement said the couple had become engaged this month in London. More details to come, the palace promised. After the announcement, the couple appeared briefly before news photographers at the sunken gardens at Kensington, where they stood beside a pond and answered a few shouted questions. He wore a trim blue suit; she was in a black dress beneath a belted white coat. When Harry was asked how he proposed, Markle turned to him and said, “Save that.” Harry added, “That will come later.” The couple were scheduled for a sit-down interview with the BBC later yesterday. “When did I know she was the one?” Harry said. “Very first time we met.” A pair of statements were issued by Harry’s father, Charles, Prince of Wales, and the Queen, whom Harry’s mother, Diana, Princess of Wales, liked to call “the top lady”. Harry said he was “delighted” and had received the blessing of Markle’s parents. The last time an American married into the Royal Family, Britain and the monarchy were plunged into crisis. In 1936, King Edward VIII abdicated the throne to marry Wallis Simpson, an American socialite and divorcée. Harry confirmed he was dating the actress in November 2016, when he blasted the tabloid press for subjecting Markle to a “wave of abuse and harassment”. The palace condemned “the smear on the front page of a national newspaper, the racial undertones of comment pieces, and the outright sexism and racism of social-media trolls and web article comments”. Markle’s mother is African-American, and her father is white. She is divorced, without children from her previous marriage. The British media quickly raised the issue of Markle’s race, marital status and nationality yesterday. A BBC News alert read: “American, divorced, an actress and mixed race — Meghan Markle will bring something different to the Royal Family.” The Daily Mail’s headline said that “the Queen says she is ‘delighted’ the divorced American actress is to join the royal family.” The press seemed unsure of the British public’s gut reaction to the engagement news, even as most stories asserted that the bride-to-be’s race and nationality were either a good thing or irrelevant. Stephen Bates, former royal correspondent at the Guardian newspaper, told the BBC: “It’s not entirely unknown that royals have married people of mixed race before. I think people in this country, certainly, are very comfortable with that these days.” Bates added, “Fifty years ago ... it would have been an issue then, but today I would have thought people would take it as not only absolutely commonplace, but rather welcome that the Royal Family has moved into that generation as well.” But the Guardian’s website started one of its live blogs with the tease: “Joy or disdain? Follow the reactions to the royal engagement.” The pair made their first public appearance together in September at the Invictus Games, a sporting event founded by the prince for disabled veterans. She was dressed casually in white shirt and ripped jeans, he in a sports polo and wraparound sunglasses, and so they resembled many young Londoners out for a day of sport and fun. The couple also held hands and canoodled — and the photographers ate it up. They were also snapped standing alongside Markle’s mother, Doria Ragland. In her career, Markle is best known for playing Rachel Zane in the popular New York City legal drama Suits, which is filmed in Toronto, where Markle has been living. London’s Evening Standard wondered aloud, what should Markle be called? “The most likely situation,” the newspaper guessed, “is that Harry and Meghan will actually become known as the Duke and Duchess of Sussex, but this depends on the Queen. The Queen must grant the couple a royal dukedom on their wedding day in order for them to be allowed these titles. This is the way that wives of royals can be known on an equal level to their husbands, otherwise Markle will have to get used to being known as Princess Henry of Wales.” The Royal Family have a long and fraught relationship with the issue of divorce — just ask the Queen’s uncle, Edward, who abdicated the throne so he could marry Simpson. Markle was previously married to Trevor Engelson, a film producer. They wed in 2011 and split after two years. When Harry’s father, Charles, married Camilla — they were both divorcees — the couple opted for a civil ceremony. But divorce is not the big deal it once was — three of the Queen’s four children are divorced — and there is no reason to think that Harry and Meghan could not be married in a Church of England ceremony, especially after the church clarified its position on the subject of divorce. In 2002, the Church of England’s governing body said that “there are exceptional circumstances in which a divorced person may be married in church during the lifetime of a former spouse”. Whether to perform the marriage in a church is a decision that “rests with the minister”, it said. If that minister was the Most Reverend Justin Welby, the Archbishop of Canterbury — the most senior post in the Church of England — it seems likely that he would happily oblige. “I’m absolutely delighted to hear the news that Prince Harry and Meghan Markle are now engaged,” he tweeted. “I wish them many years of love, happiness and fulfillment — and ask that God blesses them throughout their married life together.” Within seconds of the announcement of the royal engagement, Twitter erupted in celebration. “Harry and Meghan” and #Royalengagement quickly began trending in Britain and worldwide as people offered their congratulations. “They look so in love and make such a lovely couple. This is great for Britain as a whole. Next year is going to be all about #harryandmeghan,” tweeted one. Others were just as excited about the tantalizing prospect of a day off work. When Prince William and Kate Middleton, tied the knot on April 29, 2011, becoming the Duke and Duchess of Cambridge, the Government declared it a public, or “bank”, holiday. “Is Harry important enough for us to get a Bank Holiday????” queried one Twitter user. Kensington Palace said, “Ms Markle’s parents, Mr Thomas Markle and Doria Ragland, have wished the couple ‘a lifetime of happiness’“. Prime Minister Theresa May, perhaps relieved to put aside for an hour the drudgery of Britain’s exit from the European Union, added her voice: “This is a time of huge celebration for two people in love. On behalf of myself, the Government and the country, I wish them great happiness for the future.” Even Jeremy Corbyn, leader of the Labour Party and long-time republican, offered his well wishes. Corbyn told reporters in Glasgow: “I hope they have a great time and great fun together, and having met Harry a couple of times, I’m sure they are going to have a great deal of fun together.” The Labour leader added: “I really do admire the way that Harry and his brother have drawn attention to mental health conditions all across the country.” Harry and William have become known for their campaigning work that aims to alleviate the stigma surrounding mental health. They have spoken openly and candidly about their own struggles with loss after their mother, who died in a car crash in Paris in 1997.

• The Washington Post’s Jennifer Hassan contributed to this report.

November 28. Chubb Ltd has entered into a ten-year strategic co-operation agreement with China’s largest property and casualty insurance company. In a statement, Chubb said the agreement would allow the leveraging of Chubb’s global capabilities in support of PICC Property & Casualty Company’s customers and other Chinese-affiliated companies around the world. It added that this would be in line with the Chinese Government’s drive to promote the country’s “Going Out” and “One Belt One Road” initiatives. Evan Greenberg, chairman and CEO of Chubb, said: “For Chubb, this strategic co-operation agreement is a substantial opportunity to bring the full breadth of our capabilities and global network to bear in meeting the complex insurance needs of China’s largest and most successful companies. “With this agreement, PICC now has the ability to offer its clients access to our industry-leading capabilities in countries beyond China. We greatly look forward to working with our new partners.” PICC P&C had total assets of approximately $72.2 billion and gross written premiums of approximately $47.3 billion reported in 2016. PICC’s commercial customers include some of China’s largest enterprises, many of which have complex operations in multiple foreign jurisdictions.

November 28. Markel Catco Investment Management Ltd has raised $543 million of new capital from a share offering. The successful raise follows last month’s raising of $1.8 billion by the Bermudian-based company, which offers collateralized reinsurance products and invests in insurance-linked securities. Tony Belisle, chief executive of Markel Catco, said: “We are delighted with the tremendous support shown by existing and new investors for Markel Catco’s specialized ILS investment opportunity. “The fundraise will ensure the company continues to meet the growing demand from our buyers for our unique reinsurance protections.” The company was hit hard by catastrophes in the third quarter. Last month Markel Catco said its CatCo Reinsurance Opportunities Fund had implemented loss reserves for hurricanes Harvey, Maria and Irma amounting to 20 per cent of the fund’s net asset value. Large industry losses had also “resulted in increased pricing within the retrocessional reinsurance market and, in addition, a requirement by the company for new capital”, Markel Catco said on October 2.

November 28. More than 3,000 trips to the island were cancelled in September due to international media hurricane coverage confusing Bermuda and Barbuda. Glenn Jones, director of public and stakeholder relations with the Bermuda Tourism Authority, said that approximately 3,100 trips were scrapped. Mr Jones said the 3,100 figure was determined by taking the expected amount of tourists for September based on the August 31 hotel pace report and subtracting the number of visitors that actually came to the island that month. He added: “You might recall September 2017 was pacing ahead of September 2016 by 12 per cent but finished up only 1 per cent on hotel occupancy. “So basically 3,100 is the difference between pace and actual.” According to Q3 2017 visitor arrival statistics, each air leisure visitor to Bermuda spent an estimated $1,500-plus on average per person, Mr Jones said. Kevin Dallas, CEO at the BTA, said earlier this month that the ramifications of the media mix-up were “quick and immediate”. He added: “People cancelled.”

November 28. A 37-year-old Pembroke man was jailed for a year yesterday for growing cannabis. David Burnell Adams pleaded guilty in Magistrates’ Court to the cultivation of the plants before February 27 last year. Prosecutor Carrington Mahoney told the court that 57 plants were discovered in a St Monica’s Road home after police obtained a search warrant. He added that Adams, who was charged with another man who was not in court, turned himself in and admitted operating a grow house when interviewed by police. In court, Adams said only two of the plants were “big”. But magistrate Khamisi Tokunbo said even the “small” plants were still cannabis and he sentenced Adams to 12 months behind bars.

November 28. Bermuda were victorious in the team and individual categories at the Caribbean Equestrian Association’s Regional Jumping Challenge on Sunday. In addition to retaining the team division title, Bermuda’s Kirista Rabain riding Just Pete and Kelsey Amos on Wiratoro were the overall individual winners in the .70m and 1.00m divisions, respectively. Cody Rego, riding Happy Feet, narrowly missed the overall top spot for the .85m division by a mere .03 seconds. Also competing for Bermuda at the National Equestrian Centre were Tyler James, Ariane Willmott and Courtney Bromby. The challenge provides competitors of all ages an opportunity to measure their skills against riders within the Caribbean. Riders compete in their own countries over two rounds of a predetermined jumping course at heights of .70m, .85m or 1.00m. The top two scores from each division form the country’s team. The show was rescheduled from Saturday to Sunday because of bad weather.

November 27. Three joint select committees designed to boost government efficiency are to be set up. The committees — a recommendation of the Sage report on good government — got the green light after MPs backed a change to standing orders of the House of Assembly. A report also proposed the introduction of a regular period where members can quiz the Premier. Michael Weeks, the PLP MP, who opened the debate, said the Premier’s question time would last up to 30 minutes and be held on the second Friday of each month. Patricia Gordon-Pamplin, One Bermuda Alliance MP, said some of the recommendations, including that members’ detail travel expenditures inside 21 days, should be standard practice. But she added that the Government’s back bench could potentially monopolize the time with prepared questions. Ms Gordon-Pamplin said: “There could be a value to the Premier’s question time. It’s something that needs to be clarified as we go forward.” Kim Swan, Progressive Labour Party MP, said he could not believe that there could be any objections from the Opposition for the opportunity to hear the Premier. He added: “It runs afoul of democracy to suggest that." Scott Simmons, PLP MP, said he felt the Premier’s question period was “absolutely needed”. Mr Simmons said that the period allowed for the public to be kept informed on Government business. Grant Gibbons, OBA MP, questioned if it was the Government’s intention to refer a “significant number” of Bills to the three committees. He added: “That could potentially slow down the process of the House quite a bit.” Diallo Rabain, Minister of Education, slammed the Opposition for failing to exist as a strong voice. Mr Rabain said: “We are now two-and-a-half months into this session, and I can count on one hand the amount of Parliamentary questions that have come from that side. “Don’t ask what the Premier’s question session is going to be like if you are in an Opposition that can’t figure out one question to ask the Premier of this country, about this country, every two weeks.” Michael Dunkley, the former premier, said he had no problem with the Premier’s question period “as long as it’s set up to be productive”. Mr Dunkley added that any new committees must be effective. He said: “We’re asking to form committees to assume responsibility we have to meet. If we’re going to do it, then we have to set up in the right way.” Mr Dunkley added that recent Parliamentary committees — including one established on sexual predators — had not done the work they were created to do. Jean Atherden, Opposition leader, said the Premier’s question period is a good thing. She explained: “It means that going forward I will have the opportunity to ask the questions.” Ms Atherden added that she did not think anyone could object to members having to submit travel expenses within three weeks. She said: “The people’s monies have been spent, and therefore it’s important to hear about it.” David Burt, the Premier, said that he was surprised by the length of the debate. Mr Burt added that he was interested to hear former OBA premier Mr Dunkley remind the House that Randy Horton, former Speaker of the House, wanted to implement the Premier’s question period three years ago. He said: “Some may argue that maybe that Premier did not want to be questioned during question time, and that’s the reason it didn’t move forward.” Mr Burt added that the Government was not afraid of the Premier’s question time “because we have nothing to hide”.

November 27. Legislation to bring the Land Title Registry into effect was passed in the House of Assembly without objection. Lieutenant-Colonel David Burch, the Minister of Public Works, said the registry was created by legislation passed in 2011 but it had yet to be brought into operation. However with the passing of the new legislation, Colonel Burch said Friday’s move meant the regime come into force at the start of next April and make information about land ownership easily accessible to any interested party. Colonel Burch said: “Bermuda is one of the very few developed countries in the world without a system for land title registry. The current system of deeds-based conveyance needs to be modernized.” Colonel Burch said that deeds of title can be copied or forged but the registry would prevent such actions and help to settle property disputes. He added that all Government properties owned by deed have already been entered into the system which allowed staff at the registry to test check for problems. Colonel Burch said: “In a word, this legislation provides safety and security for those who own land in this country.” But Trevor Moniz, the Shadow Attorney-General, raised concerns about people attempting to register land that does not belong to them. He said: “We don’t want people to have the responsibility to go to the Land Title Registry every day to make sure no one registered something that they should not have registered.” He also questioned the decision to use an indicative boundary for the registry instead of more accurate surveyed boundaries. Mr Moniz said that because of the island’s small size disputes can arise over very small amounts of space. He added: “People fight about inches in Bermuda. Oftentimes their most valuable possession is the property that they own. Indicative borders are not the best way to proceed.” Colonel Burch said that the registry used indicative boundaries because surveys “don’t always work correctly in this country”. Kim Wilson, the Minister of Health, however said that as a lawyer she is aware that the existing system of deeds is problematic and expensive — especially when the deeds are lost or damaged. She added: “The cost associated with recreating a deed are huge. A system such as this will minimalism the burden.” Walter Roban, the Deputy Premier, said historical abuses of the deed system had also allowed people to steal land.

November 27. Amendments to modernize National Parks legislation — and related fees — have been approved by MPs. Both the National Parks Amendment Act 1 and 2, tabled by Lieutenant-Colonel David Burch, the Minister of Public Works, were passed without opposition on Friday. Colonel Burch said the bills would formalize the position of a variety of fees in the legislation. He added: “The Department of Parks currently offers a variety of goods and services that have been provided to the public for a nominal fee since the inception of the Bermuda National Parks Act 1986. These include the provision of venues for social events and weddings, the rental of buildings and admission into attractions. After a review of the act, with the exception of the $14 per day camping fee, it was discovered that the collection of all other fees over the years had not been authorized as under the parent act there is no provision for the numerous fees for services and related goods. This discrepancy was detected in November 2016 and as a result, all fees were suspended until they could be formalized.” The amendments also gave the minister the power to waive fees under certain conditions and made changes to the composition of the Parks Commission. The commission will now include representatives from the Bermuda National Trust, the Bermuda Audubon Society, the Bermuda Zoological Society, the Bermuda Tourism Authority and the National Museum of Bermuda. The commission would also include two “users” of the park system and four people selected for their knowledge of environmental protection, conservation and economic and commercial affairs. Cole Simons, the Shadow Minister of Education, stressed the need for “balance”, and said it was important that commercial entities had some representation on the commission. He also asked for an update on the maintenance of the Botanical Gardens. Colonel Burch said that was not related to the amendments, but that there has been some progress made. Progressive Labour Party MP Kim Swan added that the interests of business should not be forgotten but the amendments should “err on the side of protecting the environment”. Shadow Minister for Economic Development Grant Gibbons asked for a better understanding of the marine buffer areas in the legislation. Jeanne Atherden, Opposition leader, highlighted the need for the proposed fee structure for national parks to be used for their maintenance and “not for making a profit.” PLP backbencher Dennis Lister III welcomed the legislation and said he was “a child of nature”. He said the preservation and maintenance of our national parks was “the utmost priority”. Mr Lister added: “We must protect them at all costs. I support this amendment with all my heart.” Mr Lister said he had worked for the department and it had been a tough task, especially during the summer. One Bermuda Alliance MP Sylvan Richards said there had been discussions about the level of fees during his time as minister and that those proposed are in line with what the previous administration had discussed. He added: “My hope is that some of the funds will be allocated to the upkeep and maintenance of our parks and beaches.” The condition of public bathrooms at the island parks was also raised. Colonel Burch said he was aware of the problem and that it was at the top of the Ministry’s agenda.

November 27. A top island police officer has warned of “unintended consequences” from the circulation of videos and photos of crimes being committed. Detective Superintendent Sean Field-Lament said officers were aware of CCTV footage seen on social media last week of two burglary suspects outside a Paget house. Mr Field-Lament added police were sympathetic to the “emotional reaction” of the victims of crime. He said: “In particular, we empathize with the often visceral response surrounding burglary — which in essence is an invasion of privacy — and can be very traumatic.” But Mr Field-Lament said people should have a “measured response” and “report such matters to police immediately”. The 30-second video shot from a porch-mounted camera at the Paget home showed two men in motorcycle helmets. One of the men was filmed removing a window screen while the second stands on the lawn. Pictures showing two men — along with their names — were also shared. Two men have since been arrested in connection with the investigation. Mr Field-Lament explained: “Whenever CCTV captures evidence of a crime, such as a burglary, then the video footage itself becomes an exhibit that may be used in court. The police do not support the circulation of evidence on social media and such exhibits should instead be turned over to the police.” He said that members of the public with camera evidence should contact police and turn over the potential evidence for examination. Members who want advice on crime prevention can attend meetings held by Community Action Team officers. An event for St David’s residents regarding recent burglaries will be held tomorrow evening at Clearwater Middle School from 6.30pm to 7.30pm. Information can also be obtained by calling the police at 295-0011 or visiting www.bermudapolice.bm

November 27. Ascot Group has launched a new reinsurance company in Bermuda and hired industry veteran John Berger as chief executive officer. Ascot Reinsurance Company Ltd, which received its Class 3B insurance licence from the Bermuda Monetary Authority earlier this month, will start life with $1 billion of capital and an A rating from AM Best. Mr Berger is a well-known executive in the Bermuda marketplace, having previously led Harbour Point and, most recently, Third Point Re, where he remains chairman until December 22, having stepped down as CEO nine months ago. Ascot Group is a Bermudian-based company, which owns Ascot Underwriting and related businesses. It is owned by the Canada Pension Plan Investment Board, who acquired the company from AIG in a $1.1 billion deal announced last year. “Ascot Re is an important development in the growth of the Ascot Group and the culmination of a long held strategy to strengthen Ascot’s global footprint by building a reinsurance company in a key marketplace,” said Andre Brooks, chief executive officer of Ascot Group. Neill Currie, the former RenaissanceRe CEO who is Ascot Group’s executive chairman, said: “Through Ascot Re, we look forward to becoming a leading reinsurer in the Bermuda market, which will enhance our ability to build meaningful, long-term relationships with brokers and their clients, and positions us well to service any demand for new cover.” Mr Berger will start as Ascot Re’s CEO in January 2018, pending approval by the Bermuda Immigration Department, and will work with the existing Ascot Group team on the island. “I have known and admired the Ascot team for a long time,” Mr Berger said. “I am very excited about joining the group and building out the Bermuda operation.” Mr Brooks added that Mr Berger’s “exceptional market knowledge, experience and reputation within our industry will play a huge role in building out the platform we aspire to”. Ascot Group added that the reinsurance capacity provided by Ascot Re would “enhance the leadership and servicing of business already established within the Ascot Group”. AM Best assigned a financial strength rating of A (excellent) and a long-term issuer credit rating of “a” to Ascot Re, with a stable outlook. Best said its ratings reflected Ascot Re’s “very strong” balance sheet strength, adequate operating performance, limited business profile and appropriate enterprise risk management, as well as backing from its parent, Ascot Group, and ultimate owner, CPPIB. According to Ascot Re’s business plan, it will start writing quota-share reinsurance for Lloyd’s Syndicate 1414, which is managed by Ascot Underwriting, next year. The rating agency expects the firm to also write some non-affiliated business.

November 27. This year’s US Atlantic hurricane season is officially the most expensive ever, racking up $202.6 billion in damages since the formal start on June 1. The costs tallied by disaster modelers Chuck Watson and Mark Johnson surpass anything they’ve seen in previous years. That shouldn’t come as a complete surprise: In late August, Hurricane Harvey slammed into the Gulf Coast, wreaking havoc upon the heart of America’s energy sector. Then Irma struck Florida, devastating the Caribbean islands on the way. Hurricane Maria followed shortly after, wiping out power to all of Puerto Rico. And the season’s not over yet: it officially ends on November 30. “Given our infrastructure today, the question is: was 2017 unusual? I think we answered that pretty well,” said Watson, a modeler at Enki Research. “2017 wins no matter what you do. At one point I was working disasters in Asia, Central America, the US, and Ireland. It felt like I had jet lag even though I never left the office.” As this devastating season draws to a close, here are a few statistics that show the extraordinary strength of this year’s storms. The season delivered 17 named storms, ten of which became hurricanes that altogether killed hundreds across the Atlantic basin. While 2005 still holds the record, with 28 storms, the intensity and dangerous paths of this year’s tropical systems caught even seasoned forecasters off guard. For the first time in records, three Category 4 storms hit US shores, with Hurricane Harvey becoming the first major hurricane to slam the country since 2005. Harvey also set a new tropical rainfall record with just over 60 inches in Texas, according to Michael Bell, a professor of atmospheric science at Colorado State University. Hurricane Irma, which bowled over the Florida Keys in September before threatening Tampa, set a record by maintaining Category 5 strength for 37 hours. That broke the old mark of 24 hours set by Typhoon Haiyan, Bell said. Accumulated cyclone energy, a measure of storm power and longevity, also set a record in September, according to the US National Hurricane Centre. Worldwide, storms caused $369.6 billion of damage, the second-most costly year since 1960. This hurricane season is “in the top ten in most of the metrics we use to measure hurricane activity”, Bell said. And we haven’t even mentioned Ophelia, a “crazy storm” that maintained hurricane strength within 12 hours of nearing Ireland, said Jeff Masters, co-founder of Weather Underground in Ann Arbor, Michigan. It was the worst tropical system to threaten Ireland since 1961. A construction boom along US shores in recent years acted as a damage multiplier this year, when nature threw its worst at beach homes, waterfront resorts, power grids and Gulf Coast refineries. Watson’s storm costs are based on physical damages, clean-up expenses and lost business activity that isn’t recovered within a year. To account for buildings, homes and factories that weren’t around 150 years ago, his models look at storms dating back to 1871 in the US and 1960 globally, and project the damages they would inflict had they occurred today. If every hurricane that hit the US in 1893 were to strike now, the cost would be $185.6 billion. The US hasn’t been the only country to feel the pain this year. Typhoons and hurricanes struck countries including China and Japan, Watson said. The totals are a testament to the damage storms that hit major cities can do. “Megacities such as New York City, Houston, or Miami in the US, Tokyo in Japan, or the incredible dense infrastructure around Hong Kong in China, are susceptible to a single event causing in excess of $100 billion in damages,” Watson and Johnson, a professor of statistics at the University of Central Florida, wrote in a study.

November 27. A Somerset home goods store is marking its fifth anniversary by adding electric bikes to its offerings. Jody Place, owner of Exim Home Goods, on East Shore Road, Sandys. said: “Exim stands for export and import, we import everything that has to do with home goods such as furniture, appliances, kitchen cabinets and now electric bikes.” Mr Place believes that battery-operated vehicles are a growing trend and decided to introduce four styles of Nakada electric bikes to enhance sales and diversify the business. Besides not needing a driver’s licence to ride these cycles, there are other major benefits for people of all ages who want to work out, as its motor can assist when going up hills if the rider chooses to stop pedaling when tired. The bikes, which are assembled in Bermuda, come equipped with a 500-watt electric motor and a 48-volt battery. Electric bikes can be a safer alternative for teenagers about to turn the legal age to ride mopeds as it can help to get them comfortable on the road and used to riding before they obtain a licence. Newcomers to the island can benefit from the vehicle if they need transport right away without having to worry about licensing and insurance. Mr Place has tested the bikes himself riding from Somerset to Hamilton, showing they have a considerable range. “I went from Somerset Village to East Broadway, Hamilton and back to Somerset with an average speed of 32 kilometers per hour. I only peddled when I went up hills to help extend the life of the battery,” Mr Place said. The store aims to keep the cost at a minimum as they are not located in the city. Packing the bikes away is very easy as they fold in half and can be locked for safety. They offer four different styles of the bike: Nakada Men, Nakada Ladies, and Nakada Electric 1 and 2. Just for today, Cyber Monday, Exim is offering 20 per cent off. Regular prices for the bikes range from $1,495 to $3,495. Today’s sale prices range from $1,196 to $2,796. “Please come along and test drive the bikes before you purchase,” Mr Place added.