Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us).

Benefits of website linkage to Bermuda Online

|

See end of this file for all of our many History files |

Bermuda's Royal Gazette newspaper is not published on Sundays or Public Holidays.

April 29. America’s Cup chief executive officer Sir Russell Coutts expects racing in Bermuda to be even better than in San Francisco four years ago. Coutts was interacting with fans on Twitter yesterday morning and said that Swedish challenger Artemis Racing had been “dominant” on the Great Sound, while outlining some of the changes that he hopes will come about for the America’s Cup after Bermuda. Responding to a fan who asked whether America’s Cup 35 would be “even better” than AC34 in San Francisco, Coutts tweeted: “Final match in SF was brilliant. Now, nearly all the teams are competitive, so race [should] be closer and more competitive overall.” And while praising Artemis’s strong showing on the Great Sound, Coutts intimated that does not mean that their dominance will continue when the real racing starts. “Artemis Racing has been dominant in high winds,” Coutts tweeted. “Still need to see light wind performance from all teams. Variable wind is a feature of BDA.” Coutts also was confident that racing would not need to pushed back into July because of the weather. “If delays happen, regatta director Iain Murray will need to schedule more races during each day,” Coutts said. “The races are 22 minutes so we should be able to make up time. So we should be OK.” When another fan asked Coutts “if you could create one boat design related rule, effective immediately, what would it be?”, he responded: “Next version of ACC should have gennakers for very light winds — for both upwind and downwind. And a smaller wing for stronger winds.” Coutts was not convinced that the challengers would “band together” against defender Oracle Team USA. “No doubt they’ll be more worried about beating each other at this point,” he tweeted. “There’s not much time to co-operate after teams have been eliminated.” He is also not expecting a repeat of the thrilling comeback in 2013, when Oracle overturned an 8-1 deficit to Emirates Team New Zealand to win 9-8. “That was an amazing comeback,” Kiwi Coutts tweeted. “Hard to imagine we will see that again in our lifetimes.”

April 29. Ground looks set to be broken at the St Regis hotel resort in St George’s next week. The Royal Gazette understands that invitations have been sent out stating the official ground breaking ceremony will take place at St Catherine’s Beach on Thursday afternoon. The beginning of construction work would signal an end to nearly a decade of dashed hopes and false dawns for the East End community since the Club Med property was destroyed in August 2008. Mayor of St George’s, Quinell Francis, told The Royal Gazette she was very confident that progress would be made on the development in the coming week. “I have spoken with the general manager and the project engineer and it seems that the revised road alignment has been set out. I understand that the permit should be coming in the next couple of days. I am very confident that we will be moving ahead with this project in the new week and progress will be made. There is a genuine feeling of optimism in the community; we have been through this process before but now we are seeing this project move forward. The general manager and project manager have now relocated to the island and this shows again commitment to this project. We are feeling very positive that it will go ahead.” Plans to build the new St Regis hotel were approved by planners back in January The development, which will overlook Gates Bay, will feature a 122-key resort with 97 hotel rooms and 25 suites, as well as a casino, restaurant, bar, golf clubhouse and other amenities. The first phase of the project would also include two residential buildings, containing 28 condominiums. Later phases would include another three residential complexes. In March, Michael Dunkley told MPs that he had been assured by a principal of the St Regis development that the hotel would be built before the residences. The Premier was responding to repeated claims by Progressive Labour Party MP Zane DeSilva that he had heard the residences would be built first. St George’s MP Kenneth Bascome would not comment on reports that ground would be broken on the project next week. “There are a lot of rumours whirling around that something significant is going to be announced in St George’s next week. At this stage I am not in a position to make any official comment on that or verify those rumours.”

April 29. The Bermuda Casino Gaming Commission has defended the controversial appointment of One Bermuda Alliance MP Wayne Scott. The Progressive Labour Party had called for Mr Scott to resign, saying he could not hold a post in the civil service due to his position in the House of Assembly. But Alan Dunch, chairman of the Bermuda Casino Gaming Commission, said that the Casino Gaming Act 2016 did not prevent former or sitting ministers or members of Parliament from being employed by the commission. “Just like every other employee of the commission, Mr Scott is neither the holder of a casino licence nor is he affiliated with anyone that is in the process of applying for one,” Mr Dunch said. “The former education minister has not solicited or accepted any complimentary service from any entity applying for a casino licence under the Act, nor has he provided any goods or services to an applicant for any licence under the Act, other than in the ordinary course of his duties as an employee of the commission. The Act does not prohibit former or sitting ministers or members of Parliament from being employed by the commission. It also does not prohibit such persons from any involvement in the gaming industry for a specified or any period of time.” Mr Dunch said that a review panel established to interview for the position the chief technical officer unanimously ranked Mr Scott as the best candidate for the job in both rounds of interviews. He added: “While none of the candidates had gaming experience, the Bermuda Casino Gaming Commission was committed to hiring a Bermudian for the role of CTO and Mr Scott had virtually all of the technical skills and qualifications required for the job. The commissioners unanimously accepted the recommendation of the review panel that Mr Scott be appointed to the role of CTO and we look forward to working with him in our quest to create a viable, regulated casino gaming industry in Bermuda.” In a statement, an OBA spokesman said: “The Opposition’s method is always to look for the worst in everything. The OBA, however, will continue to serve the people with openness, transparency and accountability.”

April 29. Monday marks the opening of the Bermuda International Film Festival — but award-winning films are getting a complimentary screening tomorrow as well. The showing at 7pm in the Earl Cameron Theatre is courtesy of the Austria Cultural Institute and the Honorary Austrian Consulate in Bermuda, and features a selecting from the touring series, including Exomoon and Vantage Point. The festival’s 20th anniversary is being celebrated with a show of spatial art created by Biff’s art director and event manager, Nicky Gurret, along with fellow organisers, which adorns both the lawn and interior of City Hall. Biff kicks off on Monday with five short films commencing at 5pm, followed by an opening reception of 6.30pm — and the world premier of My Letter to the World. A film shows at 9.30pm on the life of the 19th century American poet Emily Dickinson. The programmes for the week of films is available at City Hall reception, as well as the visitor centre next to the Hamilton ferry terminal, and the site biff.bm Tickets are available online at the BIFF site, as well as prix.bm. — and one half-hour before each show at the City Hall box.

April 29. In July 2015 when the call went out for the island’s best young athletes to try out for Bermuda’s Red Bull Youth America’s Cup team, some of the members who are on that team today were at a crossroads in their lives. For them, TeamBDA was the right opportunity at the right time. Mustafa Ingham had bounced around to practically every sport offered on island and admits he was feeling “complacent”. Philip Hagen had reached a rough patch in his competitive swimming career; while Dimitri Stevens was almost at the point of giving up with sailing entirely. These were some of the powerful stories that emerged from a public meet and greet event at Liberty Theatre on Wednesday evening. Moderated by Glenn Jones, the sailors answered questions that highlighted the highs and lows of their journey so far. When asked about the sacrifices they make to compete at this level, Ingham admitted he’s had to drop “life as [he] knew it”. He, like many on the team, has put his education on hold as the team trains full-time for the June regatta. “None of us work; we don’t do anything other than sail. It takes a lot of time and dedication. [I’m training so much] I don’t spend as much time with my family as I’d hope to. I wake up early in the morning and get back home late at night. But what I’ve learnt about myself is I can actually be disciplined. Sailing has become a passion for me. Waking up and learning something new every day is great. It’s exciting doing 40mph going downwind. Plus, I like working out and I like the food.” Philip Hagen says TeamBDA has also given him a new lease on life. Asked what he’ll remember most about the TeamBDA experience, he said the friendships he’s made with his team-mates, which he hopes will last a lifetime; and the thrill that’s come from learning a new sport. Hagen said: “I was a swimmer from the age of nine and went away to university to swim. I was having a rough time in my swimming career when I left Bermuda and when this opportunity came up I had no desire to try out, but my physio kind of egged me on to go and just have fun. Now I absolutely love it — being with these guys and every aspect about what we’re doing.” For Stevens it was more about rediscovering the hunger for a sport he loves. Sailing since the age of ten, Dimitri competed in Optimist regattas in North and South America, as well as World Championships. “After that we did a Youth Olympic Campaign, however, with that I sort of got burnt out with the amount of time I was spending on sailing,” he said. “I did a little bit of fun sailing after that and then I quit. I didn’t sail that much two years before this, but with this opportunity I decided to get back into sailing and try my best at it again and I think it was a good decision.” Some attendees said they had a better understanding of what it takes to compete at this international level and left the event with even greater admiration for TeamBDA. Jess Meredith, an Alumni Development Manager at Warwick Academy, came out to support some of the school’s graduates. “It’s great to see people in Bermuda who you went through the education system with and they are representing their country in an event of this magnitude. Tonight I’ve seen the passion of the team and the community support that’s behind TeamBDA and America’s Cup in general. Zina Edwards Malcolm admitted she loved a good story and “the tale of Bermuda’s selection as host of the America’s Cup and the assembling of TeamBDA has really captured my imagination”. She found it fascinating to hear how a mix of non-sailors, and accomplished amateur sailors, including an Olympian, Ceci Wollmann, were assembled to compete against the world’s best. “I got more than I could have imagined with the fab video production telling the story of the women of TeamBDA, as well as [some of the black Bermudian sailors] Shomari [Warner] and Mustafa [Ingham]. I can’t wait to support them all in June.”

April 28. Britain’s imminent departure from the European Union should not impact Bermuda’s ability to successfully negotiate with the EU on matters of regulation and securing fair access to the EU market for the island’s insurance and financial services sector. That is the view of Jeremy Cox, chief executive officer of the Bermuda Monetary Authority. A year ago, Bermuda achieved Solvency II equivalence, with the EU recognizing that the island’s insurance regulation is at the same level as the EU’s new and enhanced insurance rules. It was the culmination of many years of effort and negotiation, led by the BMA, to ensure that commercial insurers and reinsurers based in Bermuda are not competitively disadvantaged when they do business in the EU. Mr Cox said that while Britain was not insignificant in the process of Bermuda gaining Solvency II equivalence, it was primarily Bermuda that negotiated the arrangements. Last month, Britain triggered a two-year process to leave the 28-nation EU. Mr Cox is confident that even when Britain no longer has a presence in the bloc’s decision-making mechanism, Bermuda will continue its negotiating and relationship channels with the EU. “We have never had questions about our linkage to the UK. People have always treated us as a third country, independently seeking to get equivalence,” said Mr Cox. “I don’t want to say that the UK were insignificant in the process. Every trip that I made to the UK, I always made a point of touching base with the Foreign and Commonwealth Office, and with Treasury, to give them an update on what we were doing and our progress, to pick their brain, to see if there was any intelligence they were gathering to suggest that we were not on the right track. So it was a useful process. But I believe the efforts of the BMA, the Bermuda Government, and certainly the significant efforts of organisations like Abir, won equivalence for Bermuda as opposed to anything else. They had to trust us. All along the way it was the face of Bermuda, and primarily the face of the BMA, that was needed to build trust and provide a technical overview of what we were doing in Bermuda and whether or not it was considered equivalent with Solvency II.” Mr Cox paid tribute to the team effort that secured the success, noting key roles played by the BMA’s Craig Swan, managing director of insurance supervision, and Shauna MacKenzie, director of legal policy enforcement. And Mr Cox recalled the former Governor, Sir Richard Gozney, attending a conference in 2011 with the then-Premier Paula Cox, “making it clear to the European Commission and other European regulators, that Bermuda has the ability to negotiate these type of arrangements independent of the UK”. He added that Sir Richard and Ms Cox met with “key influential people” within the EU Commission and members of the European parliament to spread that message, and had done “a very good job”. Late last year Bermuda avoided being placed on an EU blacklist after Britain blocked a French-led proposal that would have automatically branded the island a tax haven. Jurisdictions with zero per cent corporate tax rate, such as Bermuda, would have been denounced as potentially “non-co-operative” under the proposed change. While the BMA does not deal with tax policy, Mr Cox offered a personal view on how the island can stand its ground by showing its value to the EU. He said Bermuda has established its relevance to the EU through its insurance market. “We are supplying a significant contribution to Europe in the form of reinsurance coverage that has aided the European insurance market by helping them to lower costs for their consumers, and also spread and diversify risk.” As examples, Bermuda insurers and reinsurers covered half the insured losses from the sinking of the Costa Concordia cruise ship off the coast of Italy in 2012, and covered about 20 per cent of the estimated $1 billion market loss for the 2009 Air France crash in the Atlantic. Mr Cox said Bermuda would not have been able to get through even the first stage of the Solvency II equivalency assessment if it had not been able to show its relevance to Europe. “The fact that we were one of three jurisdictions that were assessed, signifies that they understood and connected with that, and recognized how important Bermuda is.” Mr Cox said that a week ago, while he was in London, an individual in Brussels mentioned to him that Bermuda has been able to distance itself from many other third-county jurisdictions because of the equivalence exercise. “People look at us very differently because of that and we will be judged favorably because of that. We are a partner and contributor to Europe’s success, not detracting from it,” Mr Cox said. And regarding possible tax changes in the US, he said it was a similar argument, with Bermuda, through the detailed work of the Association of Bermuda Insurers and Reinsurers, able to demonstrate the contribution and benefits the island’s market makes to the US. Mr Cox spoke to The Royal Gazette at the Risk and Insurance Management Society’s annual conference in Philadelphia this week. For many years the BMA has been part of the Bermuda delegation at Rims, which attracts 10,000 insurance leaders from across North America and elsewhere. Explaining why it was important for the BMA to be present, Mr Cox said: “Regulation is always going to be a critical issue to someone making decisions about whether or not to come into Bermuda. If we were to disconnect from this, there are too many questions that wouldn’t get answered. Being part of it is what we have always said about Bermuda being a one-stop shop. You have everybody here, you can touch the industry, you can touch the Government and you can touch the regulator — and that gives you a good sense of what you would expect in Bermuda. You get the questions answered as opposed to having some questions answered and some unanswered. So the decision-making process is much faster. People always get a better feeling towards a jurisdiction if they can leave something like this with their questions answered. It would be foolhardy for BMA to pull away from ‘Team Bermuda’ and decide it is not going to attend this kind of event. It’s the partnership and the team approach that has really benefited Bermuda for so long, so let’s continue and enhance it.”

April 28. Bermuda-based Reinsurance firm Validus reported profits of $94.6 million for the first quarter of the year. The figure, equal to $1.17 per common share, was $72.2 million down on the $166.8 million recorded for the same period last year, equivalent to $1.98 per share. Gross premiums written for the quarter amounted to $1.19 billion compared to $1.17 billion for the first quarter of 2016. Ed Noonan, CEO of Validus, said: “This was another good quarter for the Validus Group, We had $94.6 million in net income and an annualized return on average equity of 10.2 per cent in the quarter. Our combined ratio of 83.2 per cent reflects our continued commitment to underwriting profits and most importantly we grew our book value per diluted common share, including dividends, by 2.9 per cent during the quarter.” The $18.1 million increase in gross premiums written was put down an increase in the western world segment of Validus Group’s business, offset by decreases in Validus Re and Talbot segments. The company report said: “The decrease in the Validus Re segment was driven by a decline in agriculture premiums of $76.3 million due to lower crop premiums available for insurers as result of recent mergers and acquisitions in the primary insurance space, including the company announced acquisition of Crop Risk Services.” The decrease, however, was offset by an increase in agricultural premiums of $84.3 million in the western world segment, which resulted from a new quota share arrangement between CRS and Validus Re Switzerland. Managed net investment income for the quarter was up $8.3 million at $36.2 million, compared to $27.9 for the same quarter in 2016. The report said: “The increase was primarily driven by returns on the company’s portfolio of structured securities, of which $3.9 million was generated from a single fixed income fund during the three months ended March, 31, 2017, compared to a loss of $2.4 million from the same fund during the three months ended March 31, 2016, compared to a loss of $2.4 million from the same fund during the three months ended March 31, 2016.”

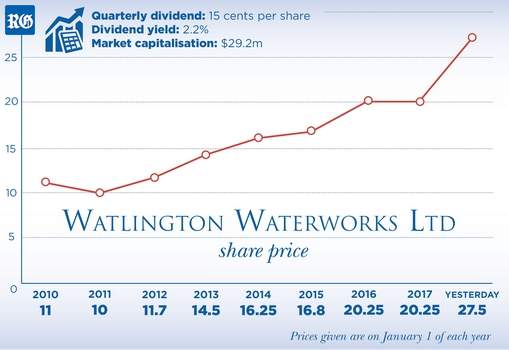

April 28. Investors looking at Watlington Waterworks Ltd will find a company with a long and steady history.

It was founded in 1932 by Sir Henry Watlington to support the island’s growing tourism sector. When it was set up, it extracted and processed brackish water from wells at Parsons Lane, Devonshire, and then piped the water to Hamilton, as far as the Hamilton Princess. Piped water also went out to Elbow Beach Hotel on South Shore. During the past 85 years, the company has expanded in terms of its reach and the services it provides. Today, the company has a market capitalisation of $29.1 million, assets of $28.7 million, and liabilities of $740,000. During the past four years, Watlington Waterworks’s quarterly dividend has steadily risen from 11 cents per share to 15 cents. Between 2012 and the end of 2016, the company’s share price rose from $11 to $20.28. The shares are currently trading at $27.50 on the Bermuda Stock Exchange. The stock saw unusual trading activity on April 5 this year when 75,000 of its shares — worth more than $2 million — changed hands. The trading spike was accompanied by a 34.1 per cent rise in Watlington’s share price that day. It appeared that someone had spotted great value in the steady earnings and reliable free cash-flow generation of this venerable company and was prepared to put their money behind their bullishness. Two years ago, the company made a change to its dividend policy. In a letter to shareholders at the time, it explained the change, saying it would “benefit shareholders more equitably by moving from basing dividends on net earnings to basing dividends on net cash generated”. Last year the company paid out 12 cents per quarter in regular dividends, plus a 14.5-cent special dividend in May, totaling 62.5 cents per share for the year, or about 2.2 per cent on yesterday’s share price. In the first quarter of 2017, Watlington raised its quarterly dividend by 25 per cent to 15 cents. Watlington Waterworks’s wholly-owned subsidiary Bermuda Waterworks is primarily involved in the production and distribution of water and purification of drinking water at retail and wholesale level. The company has pipelines supplying water across central and western parishes, and in 2010 entered a memorandum of understanding with the Bermuda Government to extend its pipeline in Southampton towards Somerset and the West End. At the end of June 2016, the expenditure on that project had reached $4.5 million. It also operates a complex on North Shore, Devonshire, that houses six reverse osmosis plants. The technology at the complex removes impurities from seawater wells to provide drinking water. Pure Water (Bermuda) was the island’s first manufacturer and distributor of bottled water. It was acquired by Watlington in the mid-1990s. The water is bottled in three- and five-gallon containers. In November, the company opened a drive-through facility at its headquarters on Parsons Road, allowing customers to collect five-gallon water bottles with assistance from staff. The company also operates The Water Depot, a retail plumbing store selling specialist products. In its most recent full-year results, to the end of 2015, the company recorded a gross profit of $7.6 million, with profit attributable to owners of $2.2 million, or $2.06 per share. In its interim financials, released in September, the company reported gross half-year profit of $3.5 million, with profit attributable to owners of $853,797, or 80 cents per share.

April 28. Internet and phone service company Fort Knox is on the move and is set to expand from a largely business-based clientele into the domestic market. And it will be offering new high-speed internet packages under the LiveNet Brand. The company, which also specializes in document management, is moving from the Rosebank Centre on Bermudiana Road to the former Link Bermuda store at the corner of Hamilton’s Burnaby Street and Church Street. Troy Symonds, chief executive officer, said: “We are excited about the relocation of our offices, which is being done to make our sales and customer support team more accessible to our clients.” He added that, in addition to traditional telecoms services, LiveNet would offer internet speeds of up to 100 Mbps to residential clients. Mr Symonds said the firm had provided corporate internet services for many years, with guaranteed service levels. He explained that the new fibre networks being laid around the island would be used to provide high-speed services to the domestic market. Mr Symonds added: “We do have some residential customers already — some have come through the corporate side.” He said the company had provided domestic services in partnership with World on Wireless, but no longer did so. “Now we’re going directly to the market and it’s the next natural stage of growth for us. We also do the telephone service. We’ve been a licensed provider for some time now." Mr Symonds, however, declined to discuss pricing in advance of the move, which will be available to clients from Monday. The official grand opening of the new storefront premises is will be May 12. “Everybody is trying to be competitive on their prices — we will be competitive and we will have some special packages and promotions from May 12,” said Mr Symonds. “Everybody is trying to get the pricing as aggressive as possible without going out of business.” Fort Knox, originally founded in 1999, also offers cloud phone systems, business continuity and cloud hosting among other ICT services.

April 28. A bid by the UK’s House of Lords to force Bermuda and other overseas territories to introduce a public record of company ownership has been dropped. Bermuda, which already has a register of beneficial owners accessible on request by overseas governments, was in line to be hit by Amendment 14 to the UK Criminal Finance Bill, aimed at clamping down on crime and money-laundering. But the proposal has been withdrawn in favour of a an amendment requiring UK authorities to report on the effectiveness of beneficial ownership sharing between the UK and its Overseas Territories by July 2019. During the Lords debate, the Scottish Earl of Kinnoull, formerly Charles Dupplin, who headed reinsurer Hiscox in Bermuda, spoke out against the move. He said: “People often do not understand how big a jurisdiction Bermuda is. Bermuda overtook London as a centre of reinsurance in 2004. London remains number two in the world. No major insurer in this country would be able to trade without the reinsurance that it purchases from Bermuda. The amount of money, capital and sophistication in Bermuda is enormous. The BMA, the chief regulator there, of which more in a second, is an extremely professional and very tough regulator. Bermuda was not responsible for even one of the revelations in the Panama papers and is a very clean jurisdiction, and it is particularly unfair that it is named in this amendment.” The Earl added that it would be wrong for Britain and Westminster to interfere in the affairs of self-governing territories. He said: “The second is a general point about shifting the problem to another jurisdiction. I agree that shifting a bad thing is a good thing in many ways, but shifting a good company is a bad thing because you are simply damaging the jurisdiction. There are many good companies, and I will explain in a second why this amendment would have the effect of shifting good companies. It would be very wrong for us to impose damage on our loyal overseas territories and possessions.” The Earl added that tax authorities, the police and regulators all looked for irregularity in financial services, with regulators wielding the most power. He said: “A person running the support business in a high-integrity environment such as Bermuda would not allow someone — one bad client — to come in and kill off their whole business. They would be very careful to make sure that that does not happen. You are scared of regulators. You are, of course, scared of tax and police authorities, and you are more than willing to give up any information that will protect your business because no one client is worth it. Your business is your business; your staff are your staff. That is how everyone feels — I hope noble Lords can hear a level of emotion in my voice. A sub point is that in our society we rely on the forces of law enforcement to deal with naughtiness on our behalf. We do not have vigilante posses running around trying to do things. I worry that if everything were publicly available people would suddenly see themselves as being promoted into some sort of enforcement environment. That is wrong. We should leave these things to the professionals — the tax authorities, the police authorities and the regulators — and trust. If they do not do a good enough job, we should bash them. We should not allow vigilante posses.” The decision to drop the amendment was welcomed by the Bermuda Government. Bob Richards, the Minister of Finance, said: “This is a good day for Bermuda. I am pleased that we have won this battle, although I expect that this issue will return again.” He added: “While the UK has indicated that it will implement its own beneficial ownership list of British companies and make it public, they are at the beginning of the process that we’ve had in place for several decades. It would have been detrimental to Bermuda’s international business to be the only country with a complete register and be forced to make it public. Few other countries have registers of any kind. Bermuda is a leader in the issue of beneficial ownership and continues to comply with global standards. The Ministry of Finance team and our office in London have been successful over several years informing UK legislators and others of the true facts related to issues that threaten our business. The Bermuda Monetary Authority and the National Anti-Money Laundering Committee have also been integral to our cross-border outreach.”

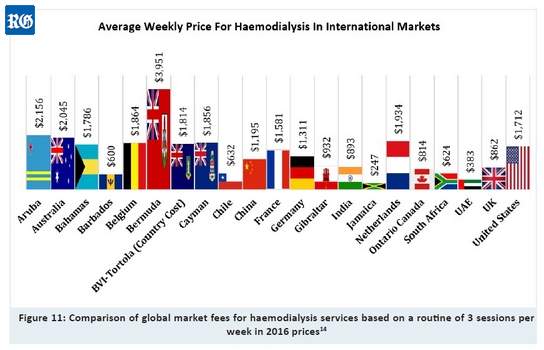

April 28. Haemodialysis prices will drop by $353 per session on June 1, reducing yearly spending by an average of $55,000.

It comes as the Ministry of Health seeks to ensure transparency and consistency in healthcare costs by basing more pricing on the relative value unit methodology. “The new dialysis fee is progressing towards RVU’s with a Bermuda conversion factor and ensures pricing that more accurately reflects the cost of providing a service,” a spokeswoman said. “This has resulted in a proposed change in haemodialysis fee from $1,317 per session to $964 per session, reducing the spend by an average $55,068 per year.” The spokeswoman said the Bermuda Health Council started using the RVU method in 2013 to price diagnostic imaging services in the community, and that it is now being applied to more services. She added: “The ministry is seeking to have more healthcare pricing based on the RVU methodology to ensure transparency and consistent pricing.” According to the Health Council’s Overseas Care: A Synopsis of Trends for the Islands of Bermuda report, 2016 haemodialysis fees for three sessions in Bermuda were more than double that of the United States and more than four-and-a-half times that of the United Kingdom. A spokeswoman for the Health Council told The Royal Gazette: “In the US, providers receive an average of $230 per session for haemodialysis, peritoneal dialysis, and in-centre in Bermuda the per-session cost of haemodialysis is $1,317. The average person requires about three sessions of haemodialysis weekly.” While she calculated that supply costs should total $126.50 per session, this does not include costs based on the supplier used, cost of the drugs, cost of shipping, duty, relevant surcharges, and costs associated with care delivery including staffing and overheads for location. She also noted that dialysis pricing on the island was historical, with no major review conducted until recently. A Bermuda Hospitals Board spokeswoman told this newspaper that the hospital’s dialysis fees also cover the purchase, upgrading and maintenance of equipment, as well as staffing and on-call coverage costs. “The fee also covers the cost of hospital space and maintenance, utilities, housekeeping, etc. Additionally, these fees help cover other services and costs associated with keeping the community’s hospital running around the clock, including the cost of providing services to those people who are uninsured and cannot pay their bills, and whom Government cannot afford to pay for through subsidy.” She stressed that any surplus was “entirely reinvested in care” and said this is increasingly being used to “cover the growing shortfall from bills charged to Government for vulnerable populations covered by subsidy (seniors, indigent populations and youth), as well as subsidizing other services for which fees are set well below the true cost, but are needed by the community. The additional cuts to the Government subsidy and fee schedule BHB faces this fiscal year will only intensify the pressure.” She added that BHB does not set or add new fees and that it cannot charge co-pays to supplement the fees covered by insurance and subsidy. In providing an update on the Bermuda Health Strategy and Action Plan to the Association of Bermuda International Companies, health minister Jeanne Atherden said strides had been made to reorganize payment systems to focus on value and outcomes, improve benefit design to reduce unnecessary trips to hospital, and to develop a healthcare workforce plan to address the needs of 21st -century Bermuda. For the “first time on record”, health spending went down by 1.1 per cent in 2015, she said. “We finally bent the cost-curve — and we’re the first country to do so, compared to the OECD.” However, she added that spending $11,102 per capita on health is still too much and there is “some way to go to achieve sustainability. Currently, there are approximately 170 patients on dialysis at the cost of $200,000 a year, each — this $34 million expenditure has been targeted in our reforms. For example, coverage is to be increased for kidney transplants, which can cost $130,000, thus helping more patients to come off dialysis. Such measures, combined with a drop in diagnostic imaging fees and the cost of long-stay hospital beds, are expected to deliver more than $20 million in savings in one year. This would represent the single, largest reduction in health costs our system has ever seen”, Ms Atherden said. Other ongoing programmes include a review of the Mental Health Act, with more details on caregivers given on the government website — while the personal home care benefit has been taken up by one private insurer, with others hoped to follow suit. With a “crisis” in bed capacity affecting the hospital, the private sector is now being courted for long-term care investment, from facilities to workforce. And while the minister said there had been “headway” in the regulation of healthcare professionals, legislation overseeing healthcare businesses had yet to be approved. “However, I remain committed to introducing the necessary regulatory controls, and hopeful that the Bermuda Health Council Amendment Act will ultimately be passed,” Ms Atherden said.

April 28. The Bermuda Underwater Exploration Institute celebrated its 20th anniversary Saturday as well as its 4th annual Underwater Extravaganza. Invited guests enjoyed watching a grind-off competition between Team BDA and 35th America’s Cup members of Artemis, Land Rover BAR and Team Japan with Artemis and Land Rover BAR tying for first place. The event on Saturday evening, under the patronage of Governor John Rankin, featured a laser Hula-Hoop performance by Ishrat Yakub, courtesy of Rockfire Productions. Della Valle Sandals was on site with a pop-up boutique creating custom handmade sandals, with part of the proceeds donated to BUEI’s education programmes.

April 28. Universal, unique numbers for anyone who enters the health system will be trialed this year. A Unique Patient Identifier database is being created to reduce concerns of patient confidentiality, mistaken identity and unnecessary duplication, a Bermuda Health Council spokeswoman said. “The UPI is an alphanumeric identifier that will be assigned to each individual resident and will identify a person when they utilise healthcare services in Bermuda,” she told The Royal Gazette. “This number will only be accessed by healthcare professionals, insurers and the Bermuda Health Council and will not contain any health-related information.” The spokeswoman added that the Health Council, through partnerships with health-system stakeholders, is always looking at ways to make the health system more efficient and enhance the quality of care. “The Unique Patient Identifier database is being created to alleviate concerns of patient confidentiality, mistaken identity and unnecessary duplication.” She added that the project was a collaborative effort between the Health Council and numerous stakeholders. “The Health Council is in the process of completing the database; thereafter, there will be a period of piloting and testing. We anticipate engaging the public in early summer.” According to health minister Jeanne Atherden, this will enable providers to better co-ordinate care as part of the push to improve the island’s “poorly integrated” health-information system. Addressing the Association of Bermuda International Companies last week, she said: “For example, a Unique Patient Identifier can assist in prescribing and managing medications, monitoring and using diagnostic tests, which can help prevent hospitalization. Importantly, this Unique Patient Identifier is a necessary foundation for an integrated electronic health system, so it is a fundamental step towards this larger health-reform goal.”

April 28. A show of support is anticipated for defendants headed to court on Monday and Wednesday, in connection with the protests at the House of Assembly on December 2, 2016. In a move similar to statements issued ahead of April 4, the Bermuda Police Service outlined security measures to accommodate a peaceful gathering, and gave an advisory on court conduct. The two sessions, which will take place at the Dame Lois Browne-Evans building, are expected to be brief, a spokesman said, but “plans are in place to cater to large numbers of people attending on the days mentioned”. Entries to the building must remain clear, and a heightened police presence can be expected outside. While there are no plans for street closures, “this may change if the need arises”, the spokesman added. Standing is not allowed in the courtroom, where access will halt once seats are taken, and banners are not permitted, along with mobile phones or recording devices. Quiet must be observed. Visitors are subject to search, and helmets and other bulky items are not allowed inside. Police are available to field questions at the Operational Planning Unit, 247-1362.

April 28. Bermuda stands to reap “golden” tourism and travel opportunities via the opening of closer links with Mexico, according to consultant Leon O’Brien. Courting direct flights and Mexican tourism, along with learning directly from Mexico’s model of hospitality, are a few “win-win” ways to capitalize on the island’s agreement of co-operation with Mexico, signed last month. “As a hotelier and a person who visits Mexico tremendously, I believe the minister made a phenomenal decision,” Mr O’Brien said of the memorandum of understanding signed by Senator Michael Fahy, the Minister of Tourism, Transport and Municipalities. The forging of deeper ties between two vastly different markets caught modest attention when it was announced. but Mr O’Brien, a champion of Bermudians looking to Central America for business, said the island could learn much from the giant to its southwest. “I would encourage fostering relationships between our hoteliers, to send Bermudians to that region in the off season for further training, in areas such as the all inclusive market and residential market.” Fresh products in the region from the sprawling company AMResorts warrant a closer look, he said. Mr O’Brien, whose background in hospitality stretches to the island’s heydays, also expressed hope in the opening of direct flights between the two countries. “It would be of great benefit to our new airport, especially with our United States customs pre-clearance,” he told The Royal Gazette — suggesting the island could court the Mexican middle class for tourism, while locals used links for travel in the region. Long a proponent of Belize as a business and educational destination, Mr O’Brien pointed out that Mexico adjoins it — and “doesn’t require us to have a visa, because we have British passports. Building this relationship would be the kind of revenue generator that we need to offset the costs of our new airport terminal,” he said.

April 28. Sharing and listening in an atmosphere of mutual trust, the diverse groups in a first round of truth and reconciliation talks have found a rapport on Bermuda’s notoriously enduring and difficult subject: race. “Bermuda is a small place — we can do this if we have the will to do it,” said Cordell Riley, an activist with the group Citizens Uprooting Racism in Bermuda — and a facilitator in one of the four groups that have met over the past three months. This was very beneficial. If it can be replicated on a country basis, it would be ideal. We found it very worthwhile.” Establishing a safe space for the circles of participants to discuss race brought an “encouraging” dialogue, he said — and diverse attendance. The start this spring got an “amazing” and rapid buy-in, so much so that another round is to be held in September. Curb has its share of critics, but Mr Riley said that “whatever negative criticism people have, if they had been in the room with us, they would have a different view”. Lynne Winfield, president of Curb, has planned the community conversations over many years, but felt that the island’s time had come — especially with last year’s protests over immigration reform laying bare the racial differences. “However you categorize it, there was clearly tension in the air,” Mr Riley said, describing the upset as reminiscent of the labour standoffs that racked the island in 1981. Organised around restorative justice, with facilitators trained in its principles, the talks helped members “get into their stories without worrying about being attacked” — and there was no shortage of white participants. “One white male felt that we didn’t delve enough into racial inequality, but we were building that relationship first,” Mr Riley said. “When we got into those topics, we didn’t want people to withdraw.” Asked what the group hoped to accomplish, Mr Riley said the goal was to “continue the educational process”, with an appraisal at the close of the six-week conversation that would “determine what the next phase of it will look like”. The Royal Gazette aims to explore the stories that emerge: to begin with, we spoke with Stratton Hatfield, a member of the group that was led by Mr Riley with Suzanne Mayall as assistant facilitator. Well acquainted with restorative justice, Mr Hatfield said he felt a strong pull to “understand my position in this world as a white male — to come to terms with what that means. In order to learn, I would need to feel uncomfortable. There are so many people out there that feel uncomfortable on a daily basis. It’s not just race. Females are constantly made to feel uncomfortable. It also applies with sexual orientation.” Born in 1986, he shares the millennial view of race, where the problems and pain are less overt. “It’s unfortunate in a way that it’s being pushed on to the younger generations, but I also think our generation could be more open to these concepts, and better read. It’s like there’s more hope.” As with other groups, his circle represented a surprising variety of racial and socioeconomic backgrounds, Mr Hatfield said. Discussions stretched beyond race or the black-white dynamic. “The opening session was crucial. It set the parameters and the need to listen. Listening, especially. “Setting the safe space was what made it so good. By the second or third time, we all felt comfortable with each other.” Mr Hatfield came away reflecting on the need to “get beyond the idea of the single story” in recognition of the multiple stories that lie within. “In order for us to move forward collectively, as a community, we need to not only understand our past, but to recognise its impact. We need to be prepared to learn more, to understand other perspectives. It’s the only way we can get together and make Bermuda a better place.” He added: “People need to be reminded that they will feel uncomfortable. That’s the only way we learn. But it should never be overlooked that knowledge is power.”

April 28. “Crazy and unforgivable” — that was the damning indictment of the level of drink-driving in Bermuda yesterday by Police Commissioner Michael DeSilva as he provided the crime statistics for 2016. Lamenting that 11 people lost their lives on the island’s road last year, Mr DeSilva said that police would back an initiative to provide officers with handheld breathalyzers provided they are used as a “deterrent. When it comes to the level of impaired driving, we are in the top half of the global numbers; that is crazy and unforgivable,” he added as he spoke of the “severe limitations” that present legislation presented to officers. It is time to take a real hard look at all the measures.” Meanwhile, Mr DeSilva announced that total crime for 2016 was down, while serious offences — including murder, assaults, and robberies — were up. Notably, last year’s 31 confirmed firearms incidents — up from 12 in 2015 — represented the highest subtotal for the last five years. Similarly, the 14 firearms fatalities and injuries recorded in 2016 make it the highest year since 2011. Mr DeSilva acknowledged that an increase in the police’s budget and the hiring of 30 new officers this year would help put more boots on the ground and increase the police footprint in the community. But he maintained: “I do not want us to ever think that simply throwing more police resources at a problem is the answer. Tackling crimes, gangs and antisocial behaviour requires law enforcement and that is our job but it also requires the community to keep their foot on the gas. We need more joined up solutions that continue through Government and the community.” According to the report the total number of crimes recorded was 3,587 in 2016, down from 3,751 in 2015. The report classified offences into three categories: crimes against the person, crimes against property, and crimes against the community. While property and community crimes were down, crimes against the person — including murder, assaults, sexual assaults, robbery, and offences against children — were all up. Discussing the rise in robberies, Mr DeSilva said that while it was worrying, he cautioned against being “alarmist. Almost all robberies are crimes of opportunity to acquire money or other property, or they result from tensions and clashes between rival gang members. In all cases, we continue to advocate crime prevention tactics to reduce the opportunities for robberies to occur, and we encourage anyone to call in with information about suspicious activity to help catch and convict the offenders.” Previously, crime statics reports were published on a quarterly basis, and included drug seizure information. The 2016 report, and future reports, will be produced annually, with a separate report on drug seizures and enforcement likewise produced annually. Release of the data was delayed by “technical issues” created by moving from one system of crime recording to another, the Commissioner said. “The exercise of migrating data from one system to another was a lengthy one, and we took care to ensure that the numbers in this report are completely accurate,” Mr DeSilva said.

April 28. Government House Gardens will be open on Sunday afternoons throughout the next four months. Governor John Rankin said of the initiative, which begins on Sunday for the fourth summer: “I am looking forward to seeing families — particularly those living near Government House — make use of this wonderful area and have a chance to enjoy the grounds, the historic trees and wonderful views.” Entry and exit will be via the North Gate on North Shore Road. Visitors are encouraged to come on foot, by pedal bike or use the No 11 bus, which stops near the gate. Parking will not be available in the grounds. The gardens will be open from noon to 5pm each Sunday until September 3, but will not be open over the Cup Match weekend. Families are encouraged to come, relax and enjoy the grounds and to picnic. Visitors are asked to respect the grounds, especially the vegetable gardens being run by students from the three Victor Scott, West Pembroke and Northlands primary schools. They are also asked not to bring dogs.

April 28. The Bermuda Karting Club will serve up a high-speed appetizer for the America’s Cup when the Dockyard Grand Prix roars into action tomorrow. International drivers will compete in a Bermuda street race for the first time as the club sets up in the West End for the fourth time in four years. A total of 31 karts and eight bikes will race around the Clocktower, with around 2,000 spectators expected over the course of the two-day event. “We are only three weeks out from the America’s Cup,” club president Scott “Skitchy” Barnes said. “There’s some mega yachts here and some tourists as well, so we’re hoping we pull some of them in too. I think the biggest thing, though, is we have international people involved in the racing. It’s the first time we’ve had a street race with international drivers. That’s a huge deal. We also have international announcers and an international race co-director too. Marco Oldhafer, he runs the F Series, from New Jersey — he’s coming down for the first time so it will be cool to show him what we’ll all about. Canadian Rob Howden, from eKartingNews.com, will be announcing and racing in the LO206 class. And there’s Austin Riley, also from Canada, who is bringing his motoring with him. He’s got a nice chassis so has some good equipment. He’s racing in the Shifter class, and will be one of the favorites for that.” Riley, 17, who is autistic, is also scheduled to visit schools to raise awareness of the condition, something he has done before in Bermuda. A growing star and poster boy for autism, Barnes expects him to be quick. “He’s had a whole year of practice time in the Shifter, so he’s definitely going to be fast. I’m not sure if he’s done any street races but he’s definitely going to be a favourite and it’s cool to have him back on island. We like to show him a good time and help get the word out there for autism.” He added: “In that class I guess the favorites will be myself, Shannon Caisey is fast, while Austin, who has a modified ICC, will have one of the fastest engines out there. Him and Caisey have a little more horsepower than me but we’ll see.” Elsewhere, there will be full-throttle action in the Cadet class, TAG Senior and TAG Junior, as well the masters LO206 closed-engine class. In the Cadets, Jamie Newton, son of Oracle Team USA sailor Joey Newton, is the one to watch as he tackles a street race for the first time. “It will be interesting to see how he adapts to the street,” Barnes said. “Jacob Hines has been coming on strong, while Nile Bean has been going away with Jamie to race. So those will be the three to look out for.” He added: “In the TAG Senior, myself, David Barbosa and David Selley will be the front-runners, while the LO206s is up for grabs — that’s anyone’s race. You’ve got 12 in that class and any 12 can win. There’s no weak links so it will interesting to watch, and with this track and how tight it is, that class is going to be fun to watch. It should be bumper to bumper.” For the kart classes, points from three heat races will decide starting positions for the trophy final on the Sunday. The schedule also features Super Mini Bikes and rental kart races, with America’s Cup sailors, politicians and big-name Bermudians getting behind the wheel. There will be five rental races on Sunday with five drivers competing in each. The winner of each race goes through to a final. All drivers and riders will have to embrace the thrill and difficulty of the tight Dockyard track. “It requires patience,” Barnes said. “You have to decide when you’re going to make a pass and how you’re going to do it. You have got to plan it, set it up. But you have to be aggressive too, which is the opposite of being patient. They kind of go together when you’re racing. When you make a pass you have to decide to do it. You can’t hesitate. The margin for error in a street race, there is none. If you make one little mistake you’re into the curb, bending stuff up. And when you have a couple of thousand people watching you and you see them, they’re only 20 feet off the track, that adds to the adrenalin and the excitement. Plus, like with any street race, the roads are different from a normal track so with Dockyard, between turns three and four, there’s a little hump in the road, which gets you some air, which is interesting and fun as you have to control the kart. Every time we do one of these races, we always get people coming up to us saying, ‘I never knew go-karts were like this on the island’. When people think of go-karts, people think of the fun things you go on at Disney; they don’t think of what we do. So it’s pretty cool to showcase this to Bermuda and show everyone what we’re all about.” The family friendly event features food vendors, bake sales stalls and a fun castle. Ferries and buses are running. The action takes place from 9.10am tomorrow and 9.45am Sunday. Dockyard Grand Prix schedule. Tomorrow 8.45am: Mandatory drivers’ meeting. 9.10: Practice session 1. 10.10: Practice session 2. 11.10: Practice session 3. Heat Race 1. 1.20: Cadet. 1.40: TAG Senior and Junior. 2.00: Super Mini Bikes. 2.20: LO206. 2.40: 125cc Shifter. Heat Race 2. 3.10: Cadet. 3.30: Tag Senior and Junior. 3.50: Super Mini Bikes 4.10: LO206. 4.30: 125cc Shifter. Sunday. 9.15: Mandatory drivers’ meeting. 9.45: Practice session. 10.35 - 11.50: Rental races. Heat 3. 1.10: Cadet. 1.25: TAG Senior and Junior. 1.40: Super Mini Bikes. 1.55: LO206. 2.10: 125cc Shifters. Finals. 2.35: Opening ceremony. 2.55: Rental race. 3.15: Cadet. 3.40: TAG Senior and Junior. 4.05: Super Mini Bikes. 4.30: LO206. 4.55: 125cc Shifters.

April 27. A judge has partially denied an attempt by the Lahey Clinic to stop the disclosure of evidence in the civil case brought against it by the Bermuda Government. The Massachusetts-based hospital filed a motion for a “brief stay of discovery” in the matter, arguing that it would ensure time and resources were not “needlessly expended” while the court considered a separate motion for the entire suit to be dismissed. “The court’s ruling on the motion [to dismiss] may well dispose of the matter in its entirety,” lawyers for the hospital said. But after an initial scheduling conference on Monday at the United States District Court in Massachusetts, Judge Indira Talwani denied Lahey’s motion to stay discovery in relation to initial disclosures, and imposed a May 24 deadline for both parties to complete those disclosures. That means Lahey and the Bermuda Government will have to share information on individuals likely to have discoverable information — and the nature of that information — that could be used to support their claim or defence. They will also have to disclose copies of relevant documents they have in their possession. The order released after Monday’s conference said the judge was still considering whether to halt written discovery, the formal investigation which takes place in the United States before a civil trial and which allows each side to obtain evidence from the other party. But she granted the motion in relation to halting the taking of depositions, where witnesses are questioned by attorneys. The Bermuda Government filed its suit against Lahey on February 14, alleging that the hospital conspired with Ewart Brown, the former premier, on a “wildly successful” and “unlawful” enterprise that profited both “at the expense of the Bermudian government and people”. One of the main thrusts of the claim is that Lahey paid elected official Dr Brown as a consultant to promote its interests on the island in breach of the United States’s Racketeer Influence and Corrupt Organisations Act. Lahey has disclosed to the court the contract it had with Dr Brown, which prohibited him from taking any action on behalf of Lahey’s competitors for the provision of healthcare services to Bermuda’s residents. The hospital says the civil suit attempts to “transform this consulting relationship into a bribery scheme, without alleging what, if any, official acts Dr Brown performed in his official capacity for the benefit of Lahey”. Dr Brown is not a party to the lawsuit and has said it contains “countless lies and ridiculous allegations”. Lahey is defending the action. In recent weeks, the hospital has taken out full-page adverts in The Royal Gazette, signed by 19 of its specialists doctors, to reassure patients that it will continue to work in Bermuda. “Our mission isn’t political, economic or social,” say the adverts. “It’s medical.” Hospital spokesman Chris Murphy said last night: “Lahey Hospital & Medical Center continues to provide the care and support our patients in Bermuda need and deserve. The allegations against LHMC are baseless and disappointing and we are committed to defending this lawsuit through every step of the legal process.”

April 27. Allied World made a total of profit of $80.3 million in the first three months of this year. The figure was up $6.2 million on the $74.1 million recorded in the first quarter of last year and equal to 90 cents per share, compared to 81 cents per share for the same period in 2016. Scott Carmilani, president and CEO of Allied World, said: “Despite a challenging market environment, I am pleased with our ability to produce an annualized net income return on average shareholders’ equity of 8.9 per cent this quarter, while growing diluted book value per share by 2.8 per cent from year end 2016. “Additionally, we have made great strides within the global markets insurance segment which generated a 14.4 percentage point improvement over the prior year period as we are beginning to reap the benefits of the strategic re-underwriting of this segment. “Looking ahead, I feel that we are well-positioned for continued growth in our core specialty business.” The company, in line to be taken over by Fairfax Financial Holdings, notched up gross premiums written of $860.9 million, a decrease of 0.3 per cent on the $863.5 million for the first quarter of 2016. The company report said that was driven by growth in the North American insurance segment, partially offset by decline in the reinsurance segment, which saw a 5.6 per cent decrease, caused mostly by the reduction in property casualty risk, as well as the non-renewal of some property and casualty treaties. The quarter saw $11 million in catastrophe losses related to Cyclone Debbie, compared to no major catastrophe losses in the same period of 2016. The $11 million total represented $7.5 million in the reinsurance segment and $3.5 million in the global markets insurance segment. The firm recorded net investment income of $52.3 million, $1 million down on quarter one last year.

April 27. Global insurer and reinsurer XL Catlin last night posted profits of $152.8 million for the first quarter of the year. The figure is nearly $140 million up on the same period last year and equal to 57 cents per share, compared to 7 cents in the first quarter of 2016. Mike McGavick, XL’s chief executive officer, said: “We are pleased to start off 2017 with solid performance, focused growth and the continuation of lower operating expenses. “As we approach the two-year anniversary of the Catlin acquisition, we see the benefits of our increased market presence, or focus on underwriting discipline, our strong culture of innovation and continuous improvement and a more efficient operating platform. Additionally, our realigned operating model seamlessly went live at the beginning of the year and with it we remained steadfast on superior client experience. As a result, our performance included an accident year combined ratio, excluding catastrophes, of 89.5 per cent — an improvement of 2.6 points compared to the first quarter of 2016. 2017 is all about delivering on what we have built.” Net income from company affiliates totaled $51.9 million for the year, compared to $8.1 million in the prior year quarter. XL Catlin said the increase was driven mostly by its hedge fund affiliates, as well as strong performance by its strategic operating affiliates and “investments within our value investing strategy.” Net investment income for the quarter was $200.5 million, compared to $205.9 million in the first quarter of last year. The company posted natural catastrophe pre-tax losses net of reinsurance and reinstatement premiums in the quarter of $96.1 million, compared to $52.8 million in the prior year quarter. Integration costs related to the combination of XL and Catlin totaled $33.9 million for the first quarter, compared to $55 million in the first quarter of last year. Gross premiums written in property and casualty in the first three months of the year amounted to $4.62 million, 6 per cent up on the first quarter of 2016. Property and casualty net premiums earned were $2.5 billion, made up of $1.6 billion from the insurance segment and $0.9 billion from the reinsurance segment.

April 27. Bermuda’s impact at this year’s Risk and Insurance Management Society’s conference in Philadelphia has been hailed a success by Michael Dunkley, the Premier. The four-day conference concluded yesterday with a closing keynote speech from Michael J. Fox, star of the film The Secret of My Success. The evening before, Mr Dunkley summed up the secret of Bermuda’s success as the combined efforts and energy of “Team Bermuda”. He made the observation at the Bermuda reception, an annual networking event hosted by the island during Rims. The reception attracts industry leaders winding down at the end of the day, and offers them a taste of Bermudian hospitality. The reception was held on board the historic, four-masted windjammer Moshulu, which appeared in a number of films, including Rocky. As rain lashed the sides of the 114-year-old ship, and grey clouds filled the skies, Mr Dunkley welcomed guests and joked that the “dark and stormy weather” had been specially arranged to complement the Dark ’n’ Stormies being served at the bar by Gosling’s Rum. The reception was hosted by the Bermuda Business Development Agency, in partnership with Gosling’s Rum and the Bermuda Tourism Authority. Rims 2017 attracted 10,000 insurance industry leaders, and more than 400 exhibitors. Bermuda maintained its prominent position at the event with its two-storey exhibit hall booth, and a large delegation who met with clients, appeared on discussion panels, and networked for future business for the island. “Rims has gone well. It’s a critical part of the calendar,” Mr Dunkley told The Royal Gazette. “We continue to fly the Bermuda flag and answer any questions that people might have.” During a busy four days, Mr Dunkley and other members of the Bermuda group were interviewed by media, including Bloomberg News, The Philadelphia Inquirer, reinsurance magazine Reactions, AM Best TV, and Rims TV. They also held side meetings with other groups, including members of the Philadelphia Chamber of Commerce and business leaders. “As the Premier, I take on a very aggressive schedule. We have also been well served by ministers Grant Gibbons and Bob Richards, by Jeremy Cox and the Bermuda Monetary Authority, the BDA, the BTA, and industry representatives. They know that it is a team that works well.” David Burt, leader of the Progressive Labour Party, also visited the Bermuda booth and attended the reception event. Mr Dunkley said: “I’m glad that the opposition leader came, because it shows that when we leave Bermuda’s shores we put politics aside and we work together for the island.” Senator Kim Wilkerson, the shadow economic development minister also attended Rims. In a statement, the PLP said the opposition wanted to present “a unified front to promote Bermuda business in what is sure to be an election year”. Mr Burt said: “It is important that lawmakers join together to advance Bermuda’s interests within the international investment community. While we may spar here at home, when we are abroad our priority must be to promote Bermuda as economic growth is important for the prosperity of our country.” Senator Wilkerson said the PLP had “always advocated for bipartisan approaches to major issues of the day such as immigration and tax reform”, an approach that would continue if the party wins power at the election. Mr Dunkley was officially welcomed to the event by Mary Roth, chief executive officer of Rims. In a speech at the conference on Monday, the first by a Bermuda Premier at Rims, Mr Dunkley gave an overview of the island’s history, its links with the US, and its ability to innovate and have a “supersized” impact in the world of insurance and reinsurance. He also highlighted the island’s hosting of the America’s Cup, something that together with Brexit and possible US tax changes, was a big talking point for Bermuda at Rims. Mr Dunkley’s executive leadership speech was recorded and is expected to be used in the future on “many channels”. Regarding the meeting with the marketing and business arm of the Philadelphia Chamber of Commerce and business leaders from the area, the Premier said it had gone well, adding: “The potential there is significant.” He and Mr Richards, the finance minister, also visited Temple University’s Fox School of Business, which currently has two students from Bermuda in its risk management and insurance programme. Lady Carmela Robinson and Quaejah Cox will graduate next year. The ministers toured the school and met its insurance students. Temple has a long association with Bermuda. Moshe Porat, dean of the school of risk management, played a role in drafting the legislative and financial framework for setting up captive companies in Bermuda. The university has two captive insurance companies in Bermuda, one was formed in 1989, the other in 1998. Now the students want to create their own captive in Bermuda, which would make them only the second-known student-run captive industry company. It was announced at the start of the week that risk management and insurance programme students at Butler University’s Lacy School of Business, in Indianapolis, have been granted licensing approval from the Bermuda Monetary Authority to launch a captive that will insure a variety of risks for the university, including its fine art collection. The students visited Bermuda this month and met service providers Aon, KPMG and Conyers. This week at Rims, representatives of Butler University dropped by at the Bermuda booth.

April 27. Bermuda’s A+ credit rating and stable outlook have been affirmed by ratings agency Standard & Poor’s. The island report said: “The ratings reflect our view of Bermuda’s effective and predictable policymaking, very high gross domestic product per capita, small and improving fiscal deficits, moderate debt burden, net external creditor status, and lack of monetary flexibility. The stable outlook reflects our expectations that fiscal deficits will continue to improve, resulting in no significant increase in debt. Real GDP annual growth will be about one per cent in 2017 and the territory will remain a net external creditor in the next two years. We expect broad continuity in economic policies following elections in 2017.” The report also contained projections based on best and worst-case scenarios. It said: “A sustained return to more robust real GDP growth and greater economic diversification, balanced fiscal results that persist leading to declining debt and interest burdens, or an improvement in our external assessment could lead to a positive rating action.” But the report warned: “A return to economic contraction that leads to a resumption of large Government deficits and increasing debt and interest burdens or negative banking-sector outcomes could cause us to lower our ratings.” News of the maintained ratings was welcomed by Bob Richards, the Minister of Finance. Mr Richards said: “Key drivers stated as the reasons for the affirmation are effective and predictable policymaking and a high gross domestic product per capita. The Ministry of Finance and the Government as a whole has been working diligently to communicate and implement credible fiscal plans and it is pleasing that S&P has recognized this and affirmed Bermuda’s ratings. It is rewarding to see our sovereign rating affirmed at A+, especially when ratings agencies have been extremely cautious, as evidenced by the ongoing downgrades of several countries.” Mr Richards said the stable outlook reflected the agency’s expectation that the island’s economy would grow over the next two years and help to reduce the deficit, in line with the 2016/17 Budget projections. He added “The S&P affirmation reflects its confidence in the Government to grow Bermuda’s economy and put us back on the road to success. The S&P ratings update report is very positive news as the Government remains on track to eliminate the deficit by 2019/20. This report is further evidence that our policies are bearing fruit. With our practical and measured approach, the future of Bermuda is looking much brighter for all.”

April 27. Three Bermudian Supreme Court judges are now eligible to sit part-time in the Cayman Islands. Chief Justice Ian Kawaley has been appointed as a judge of the Grand Court Financial Services Division, and Puisne Judges Carlisle Greaves and Stephen Hellman have been appointed to the Grand Court General Division Panel of Acting Judges. The manner of the announcement sparked controversy as Mr Justice Kawaley’s salary information and other personal details were accidentally released to Cayman media, leading to an editorial in the Cayman Compass. Commenting on his appointment, Mr Kawaley said in a Bermuda Supreme Court press release: “I am honored to have been afforded the opportunity to assist the Financial Services Division of the Cayman Islands Grand Court in an acting capacity from time to time and insofar as my other judicial commitments permit. The legal system in the Cayman Islands has much in common with Bermuda’s legal system. It is not inconceivable that we may in the future need to supplement our own judicial ranks and may in turn seek assistance from the Caymanian Bench.” The controversy in the Caymans happened after commissions secretariat manager Deborah Bodden disseminated an e-mail announcing the appointment of Mr Justice Kawaley and British attorney Raj Parker in the Financial Services Division. Her message also included confidential employment applications filled out by the two judges, sharing their home, cell and work phone numbers, e-mail addresses, home addresses, work history, academic records and other key personal details. The Cayman Compass wrote in an editorial: “We at the Compass won’t be publishing any of the above information because it has limited value to the public interest, not nearly enough to justify the concomitant invasion of privacy of the two men. But if we wanted to publish the details, we certainly could. The government sent us the information, so we are under no legal obligation not to use it. We are voluntarily refraining from publishing the judges’ personal information, but that’s just us. We presume the e-mail was also sent to other media organisations (perhaps not just in Cayman), who may not adhere to the same ethical and news standards as the Compass. We have no idea, and no control over, what they might do.” The editorial described its government’s history of accidental leaks as a “huge problem in a country whose financial services sector (and the greater economy) is predicated on the assumption that we understand how to maintain appropriate levels of confidentiality”.